On this day, August 5, 2025, a brief statement posted by Yat Siu, co-founder and executive chairman of Animoca Brands, on the X platform was like a stone thrown into a calm lake, creating ripples in the Web3 gaming field. He announced that Animoca Brands will "publicly commit to supporting the Tower ecosystem" and will initiate a secondary market buyback of the TOWER token.

The market's reaction was quite subtle: Who is TOWER? A token seemingly stuck in the depths of 2021 memories, why is it being dusted off and prominently displayed by this Web3 giant in 2025? Is this merely a routine support for an "in-house favorite," or a carefully considered strategic signal against the backdrop of GameFi seemingly missing the previous bull market?

The answer is far more complex than a simple token buyback.

Deconstructing TOWER: A "Living Fossil" of Web3

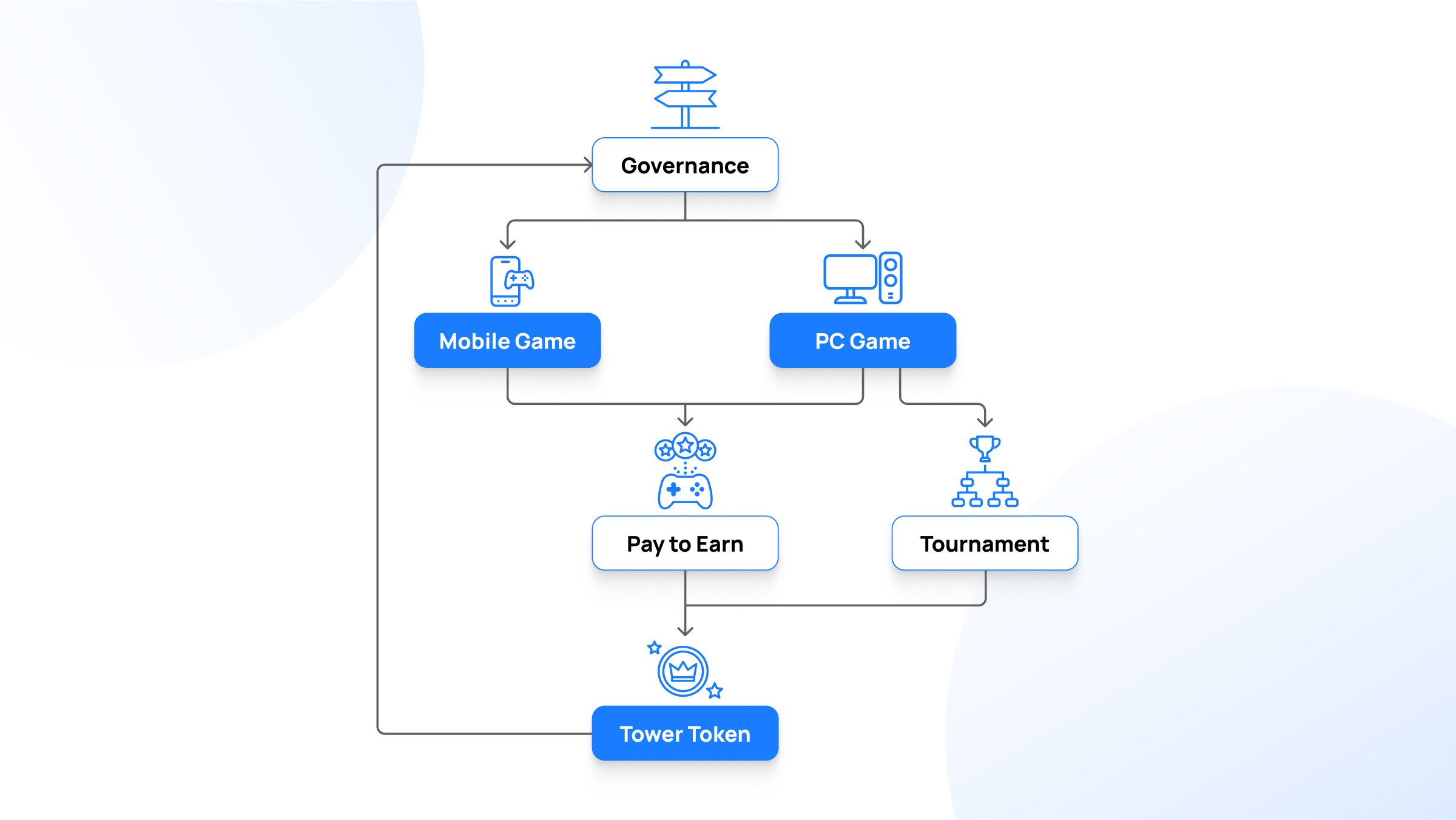

To understand Yat Siu's motives, we must first turn back the clock. The TOWER token and its ecosystem are themselves a mirror of GameFi's evolution, and can even be called a "living fossil". It was born in early 2021, the hottest era of the Play-to-Earn (P2E) concept. Animoca Brands' vision was highly forward-looking: bridging their already market-validated free-to-play mobile games with millions of downloads, such as 'Crazy Kings' and 'Crazy Defense Heroes', with Web3 token economics.

The core of this model was not creating an entirely new on-chain game focused solely on "earning", but "adding" a value layer to an already successful game experience. Players battling in 'Crazy Defense Heroes' would no longer just earn virtual points and badges, but could earn real ERC-20 tokens circulating on-chain - TOWER - by achieving certain monthly in-game experience (XP) goals. These tokens could be exchanged for exclusive game Non-Fungible Tokens or participate in special events, forming a complete "play-earn-use" economic closed loop.

[Translation continues in the same manner for the entire text]Interestingly, in our research on the TOWER ecosystem, we did not find a clear, forward-looking long-term development roadmap. This seems somewhat unique in the crypto world that pursues the ability to "draw a big picture". However, this might be part of Animoca's new strategy: bidding farewell to rigid, grand long-term commitments, and instead adopting more agile, opportunistic tactical interventions. A token buyback, a collaboration with new partners, or a carefully designed in-game event might bring more actual value than a fancy PDF document.

In summary, Yat Siu's statement about TOWER goes far beyond a simple financial operation. It is a profound response to the current development challenges of GameFi, an inevitable reflection of the market's transition from enthusiasm to maturity, and a meaningful move by Animoca Brands, a Web3 player, in the mid-game stage.

GameFi might have missed the last grand dance, but leaders like Animoca Brands have clearly not abandoned ship. What they are doing is returning to the cabin, carefully inspecting each engine component, polishing those dusty "family heirlooms" to prepare for a completely different voyage. This new journey will no longer rely on speculative bubbles, but will be built on sustainable economic models and market-verified real value. Yat Siu's signal is not just about TOWER's future, but is quietly and firmly telling the entire industry: the game is far from over.