Amid a downward trend in the altcoin market, selective buying sentiment was detected with only a few sectors showing a rebound.

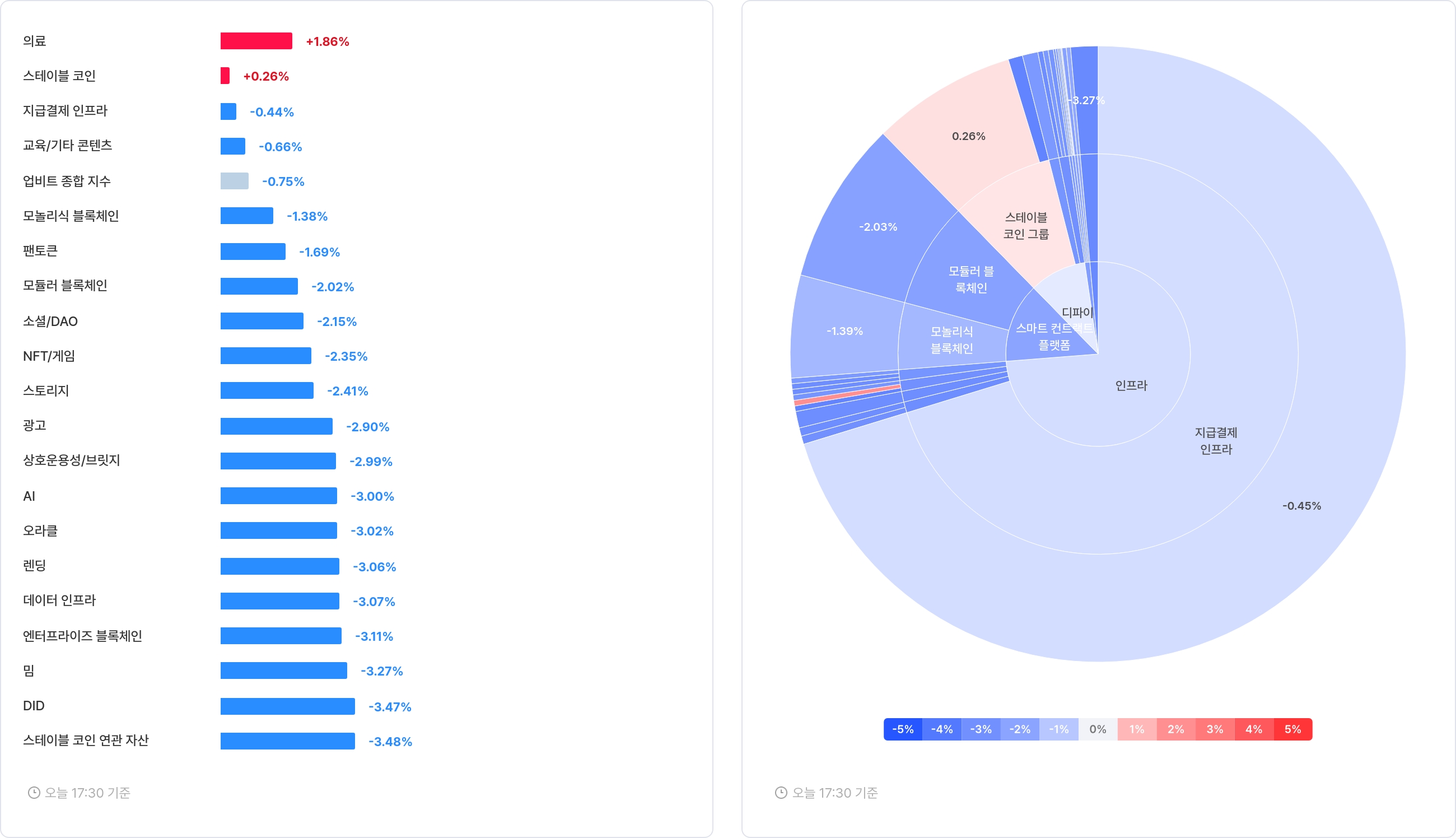

According to Upbit DataLab as of 5:08 PM, out of a total of 23 sectors, only 2 sectors were rising, with the overall market showing a predominant downward trend. The medical (+1.86%) and stablecoin (+0.26%) sectors showed an upward movement.

In the medical sector, Hippo Protocol recorded the largest increase at +5.93%. In the stablecoin sector, USDC (+0.28%) and USDT (+0.28%) maintained a slight upward trend, leading the entire sector.

In contrast, the top sectors with declines were: ▲Stablecoin-related assets (–3.55%) ▲DID (–3.57%) ▲Meme (–3.21%) ▲Enterprise Blockchain (–3.11%) ▲Data Infrastructure (–3.10%). Five themes exceeded a decline of -3%.

In the stablecoin-related assets sector, Ethena (–3.79%), Sky Protocol (–3.22%), and Just (–1.29%) all declined. In the DID sector, Ethereum Name Service (ENS, –3.57%), Space ID (ID, –3.52%), and Civic (CVC, –2.25%) experienced adjustments.

In the meme sector, Pengy Penguin (–4.55%), BONK (–4.32%), and BRETT (–3.85%) sharply dropped. In enterprise blockchain, Altlayer (–3.67%), Hedera (HBAR, –3.14%), and Stratis (–1.96%) led the decline. In the data infrastructure theme, The Graph (GRT, –3.81%), Akam (AKAM, –3.62%), and Sign (SIGN, –2.91%) notably fell.

Large sectors such as infrastructure (–0.44%), DeFi, and smart contract platforms also could not escape the downward trend. The infrastructure sector showed an overall decline with a slight drop, DeFi displayed volatility with mixed performance across different tokens, and in smart contract platforms, while some tokens slightly increased, most showed weakness.

Overall, the decline in tokens was broader than the rise, and successful themes were limited. Apart from the restricted rebound in medical and stablecoin sectors, most themes experienced adjustments, and the market atmosphere was even more cooled compared to the previous day. In the overall weak trend, a directionless wait-and-see attitude continues.

For real-time news...Go to Token Post Telegram

<Copyright ⓒ TokenPost, Unauthorized Reproduction and Redistribution Prohibited>