Original Author: Prathik Desai

Original Translation: Luffy, Foresight News

Original Title: Profiting Over $200 Million in 2 Months, ARK Invest's Crypto Market Timing

Over the past few months, I have been tracking ARK Invest's daily trading of crypto companies. This American fund company manages assets across several ETFs and a venture fund. Their buying and selling strategy reveals an interesting phenomenon: how they precisely time their moves in a seemingly difficult-to-time field.

One operation might be a coincidence, twice perhaps intuition, but ARK's crypto trades demonstrate an unusual sense of timing. This is deliberate, not a passive reaction. Evidence shows that by trading Coinbase and Circle stocks in June and July alone, they gained over $265 million in profits.

A closer look reveals that ARK is withdrawing funds from exchanges and trading platforms, shifting towards infrastructure, asset reserves, and other areas.

ARK's recent trades provide insight into how one of the most watched institutional investors optimizes returns for crypto investors through quick and often precise entry and exit timing. This is drastically different from the crypto realm's "diamond hands" (long-term holding) narrative and far more nuanced.

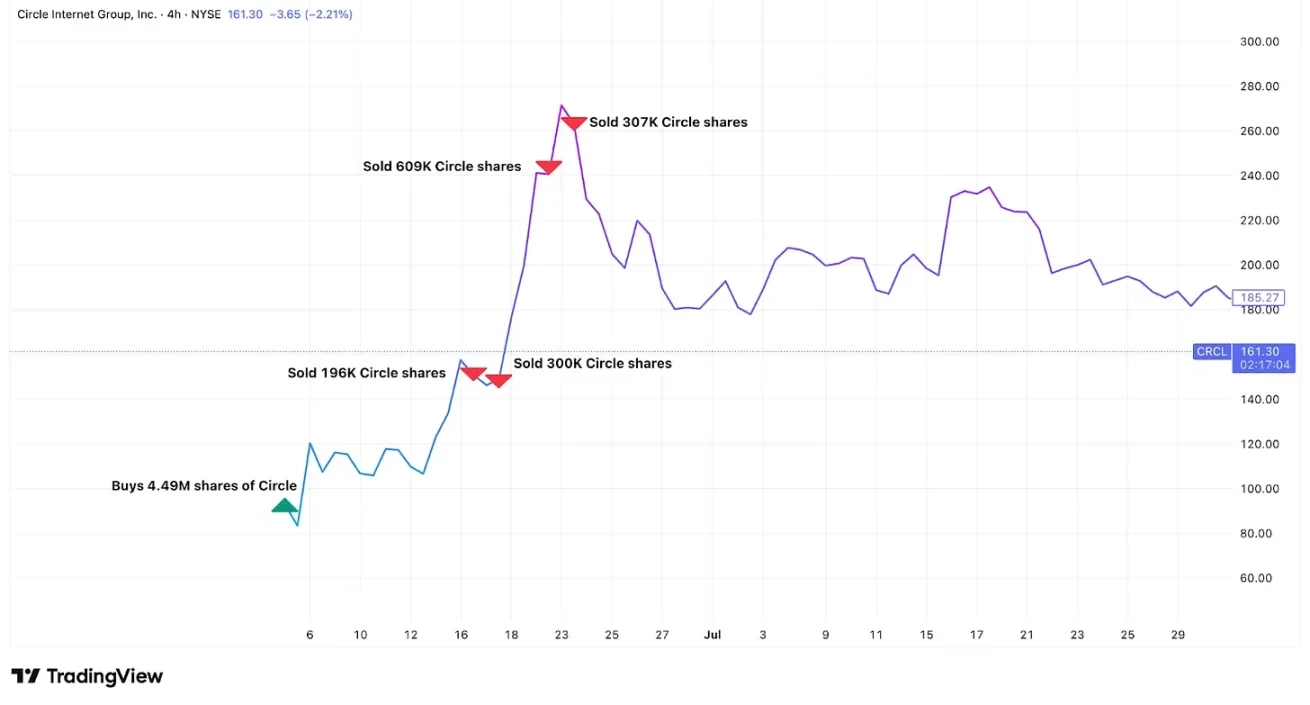

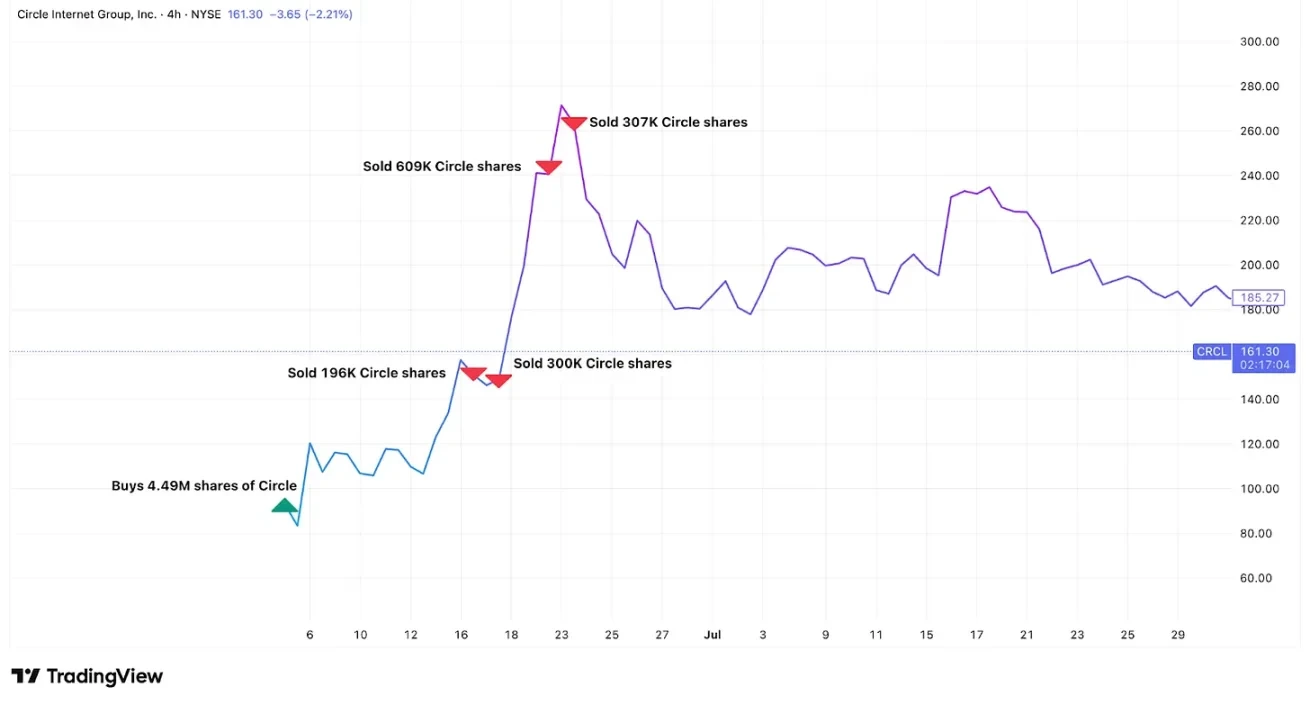

On June 5, 2025, Circle, the largest compliant stablecoin issuer, went public on the NYSE at $69 per share. ARK, as an anchor investor, purchased 4.49 million shares through its funds, with a total value of approximately $373 million.

On June 23, Circle's stock reached its peak at $263.45, meaning the company's market value was around $60 billion, equivalent to 100% of its assets under management at the time. This might be due to market optimism about stablecoins and attempts to estimate Circle's forward revenue at 10 times its current AUM. However, compared to traditional asset management companies, this seems exaggerated. For reference: BlackRock manages $12.5 trillion in assets, yet its market value is only slightly over $180 billion, about 1.4% of its AUM. This was a signal for ARK.

Daily trading documents show that as Circle's stock price soared, ARK systematically sold its shares across multiple funds.

ARK began selling a week before Circle's stock price peaked, selling approximately 1.5 million shares (33% of total holdings) and cashing out around $333 million during the stock's parabolic rise. Compared to their initial investment, this realized over $200 million in profits, a 160% return.

ARK's interest in hot IPOs didn't stop there.

Last week, they purchased 60,000 shares on Figma's first day of listing. This San Francisco-based design software company revealed in SEC filings that it holds $70 million in Bitcoin ETF and is approved to purchase an additional $30 million.

Figma's stock price surged over 200% on its first trading day, closing at $115.50, a 250% increase. The next day, Figma's stock rose another 5.8%.

ARK's recent trades with Coinbase further reveal its systematic profit-taking approach.

As of April 30, 2025, ARK held 2.88 million shares of the largest US crypto exchange. Subsequently, they systematically took profits before the end of July.

Meanwhile, as Bitcoin hit a historic high of over $112,000, Coinbase's stock also rose, briefly breaking $440 and reaching its own historical peak. On July 1, ARK sold stocks worth $43.8 million; on July 21 (Coinbase's peak stock price day), ARK reduced holdings by $93.1 million through three funds. Between June 27 and July 31, ARK sold a total of 528,779 shares (about 20% of total holdings), valued over $200 million, with an average selling price of $385 per share. In comparison, ARK's weighted average cost of buying Coinbase over four years was around $260, generating profits of over $66 million from these trades.

Over the past two months, Coinbase is no longer the top holding in ARK's fund portfolio.

After the market closed on July 31, Coinbase's second-quarter earnings disappointed investors, causing the stock to plummet 17% the next day, from around $379 to $314. On August 1 (the day of the crash), ARK bought Coinbase stocks worth $30.7 million.

These trades are not isolated incidents but part of a strategic shift, moving funds from the overheated crypto exchange ecosystem to areas just beginning to attract widespread attention.

While selling Coinbase stocks, ARK also reduced holdings in its competitor Robinhood. These divestments coincide with ARK's significant investment in BitMine Immersion Technologies, dubbed the "Ethereum version of MicroStrategy". Led by Wall Street veteran Tom Lee, BitMine is building an Ethereum reserve with the goal of holding and staking 5% of total Ethereum.

On July 22, ARK invested $182 million in BitMine through a block trade. But they didn't stop there, systematically buying during significant pullbacks and accumulating over $235 million in just two weeks.

These trades indicate that ARK is moving from crypto exchanges and payment companies towards the so-called crypto infrastructure sector. Coinbase and Robinhood profit from people's crypto trading, while BitMine profits by directly holding cryptocurrencies. Both can benefit from crypto adoption, but with different risk profiles.

Exchanges benefit from market volatility and speculative behavior. When crypto prices fluctuate dramatically, trading activity increases, and exchange revenues rise, but this is cyclical. Companies like BitMine directly benefit from cryptocurrency price increases. If Ethereum rises 50%, BitMine's assets would also rise 50%, independent of trading volume or user behavior. Even without significant capital appreciation, staking Ethereum on the network can generate stable income.

But high returns come with high risks: reserve companies face direct downside risks. When Ethereum's price drops, BitMine's asset value would proportionally shrink, making the reserve strategy's beta (risk factor) higher.

ARK's trades reflect its belief in cryptocurrencies: moving from a speculative trading market towards a more mature, permanent financial infrastructure. In such a world, holding underlying assets might be more valuable than holding platforms that trade these assets.

The fascinating aspect of these trades is their precise timing. They sold throughout Circle's dream rally until its peak; they captured Figma's IPO 250% surge; they sold Coinbase at its peak and then added positions after its performance-related crash; they bought BitMine during multiple pullbacks.

ARK's methodology combines traditional value investment principles with precise market timing: when Circle's market value reaches 100% of its managed assets, it might be overvalued; when Coinbase drops 17% in a day due to underwhelming performance, it might be undervalued. ARK seems to time trades around predictable events like financial reports, regulatory decisions, and market fluctuations.

There's an even more critical question: why do these stocks have such massive premiums relative to their underlying assets? Circle's market value once matched its managed asset size, and BitMine's stock price exists at a multiple premium to its held Ethereum value. This premium largely exists because most investors can't easily buy cryptocurrencies directly; even if they can, the onboarding and offboarding experience for retail investors isn't smooth. If you want to allocate Ethereum in your retirement fund to capture its appreciation, buying stocks of companies holding Ethereum is far easier than directly purchasing Ethereum.

This creates a structural advantage for companies holding crypto assets. ARK's trading indicates that they are well aware of this situation: buying when the premium is reasonable and selling when the premium is too high.

ARK's strategy proves that investing in crypto stocks is not simply a buy-and-hold approach, especially when you want to optimize returns. For anyone trying to track ARK's crypto trades, knowing what they bought is not enough; you also need to understand the reasons behind their purchases, potential selling points, and what targets they might turn to next.

Twitter: https://twitter.com/BitpushNewsCN

Bitpush TG Community: https://t.me/BitPushCommunity

Bitpush TG Subscription: https://t.me/bitpush