Article source: Words Beyond Words

Time is the fairest existence, everyone has time, but many people only realize that time is their greatest wealth when they are about to lose it.

At the beginning of the year (January 3rd), we published an article about the 16th anniversary of Bitcoin, which listed the price changes of Bitcoin over the past decade along a timeline, as shown in the image below.

I remember some friends leaving comments at the time, lamenting that they missed the golden period of Bitcoin's surge, saying that if they had bought just a few dozen Bitcoins ten years ago, they would have at least a 300-fold return now.

Theoretically, this can be said, but buying Bitcoin ten years ago and holding it until now is very difficult, because for most people, it is impossible to have such extreme patience.

1. Market is an Expression of Emotion

Time is everyone's greatest advantage, but this advantage needs sufficient patience to be fully utilized.

Especially in investment, never harbor any luck, do not think you can always beat the market with your intelligence and talent. The market fundamentally does not care how smart you are. At its core, the market is an expression of emotion. Only by overcoming our own emotions and rationally hedging our rash actions can we have the opportunity to maximize the advantage of time.

In the previous article (August 5th), we mainly discussed the topic of "opportunities" and mentioned that the market never lacks opportunities. From my own experience, I believe waiting for opportunities is a good thing because the market provides us with compound opportunities, that is, opportunities for continuous accumulation and superimposed growth.

Let's take a simple example with Bitcoin. As long as we can utilize the advantages and laws of cycles, identify extreme market situations, always remain calm and patiently wait for some opportunities, avoid frequent trading, avoid using leverage recklessly, and persist through several cycles, we will likely achieve good results.

Of course, there's a premise here that choosing the right target and system is more important than short-term effort. To put it more bluntly, if you find an investment opportunity with an average annual return of 10% and persist long-term, the returns through compound interest after decades will definitely be considerable. Assets like Bitcoin remain one of the best choices.

[The translation continues in the same professional and accurate manner for the entire text, maintaining the original structure and meaning while translating to English.]- Fantasizing that the Federal Reserve will quickly cut interest rates, thereby bringing more liquidity to the market and thus ushering in a comprehensive Altcoin season.

- Fantasizing that the Altcoin king Ethereum will quickly break through its historical high in price, thereby triggering a new round of comprehensive Altcoin season.

But there is another issue to face: Have you prepared for the worst-case scenario (i.e., creating a Plan B)? Specifically, if the Federal Reserve cuts rates as expected this year, and ETH also breaks its historical high, but the market still doesn't welcome the comprehensive Altcoin season you hoped for, and your full Altcoin position fails to break even or make money, what would you do then?

Regarding the interest rate cut, I've recently seen many arguments claiming: Rate cut = big bull market. Strictly speaking, I believe this statement is debatable.

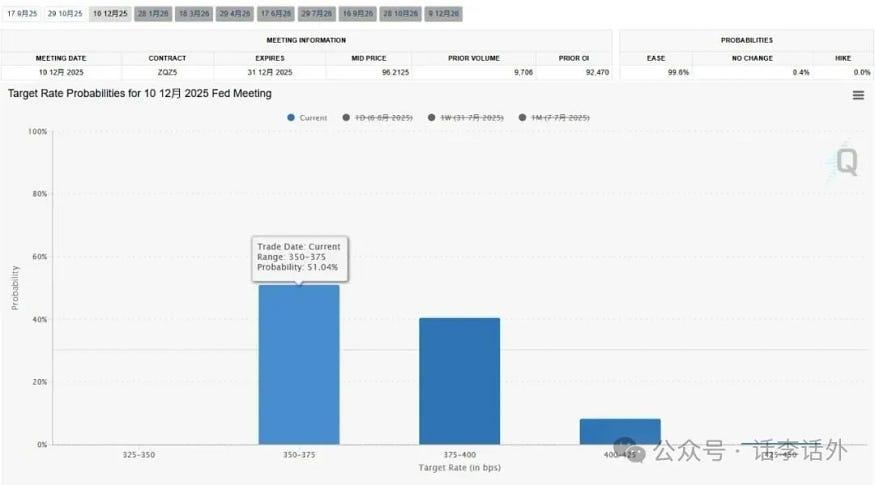

Through the Federal Reserve observation tool, we can find that the probability of interest rate cuts to 3.5%-3.75% this year is 51%. As shown in the figure below.

In other words, this seems far from the market-neutral rate of 3%–3.5%, and this result should not be considered an optimistic signal, meaning that rate cuts do not necessarily directly prompt a new bull market to arrive immediately.

Remember in the article on March 2nd, we also mentioned when discussing rate cuts: Since last year (2024), the market has been focusing on rate cut expectations, but honestly, at the current stage of the crypto market itself, it is at most a small market. We will receive spillover liquidity from stock and other financial markets due to rate cuts, but don't expect liquidity to primarily flood into the crypto market.

In the article on March 16th, we further added regarding rate cuts: In the previous bull market, it was precisely because of the extreme rate cuts in 2020 that extremely low borrowing costs and larger-scale liquidity nurtured the process of a new bull market. However, if we look back at historical price trends, we can also find that the effect of rate cuts was not immediately apparent in the crypto market, with the big bull market not erupting until 2021. At the current stage, the crypto market is mainly enjoying "excess liquidity" - the large-scale liquidity from rate cuts will first flow into traditional markets like US stocks, and then the excess liquidity will flow into the crypto market, a secondary high-risk market. But this situation will gradually improve, as more and more large institutions have begun to deeply participate in the crypto market in recent years, making the crypto market increasingly synchronized with US stocks. Once there is large-scale liquidity in the market, some funds may choose to flow into the crypto market in advance.

At the time, we also mentioned in the article: The 2020 rate cut differs from the 2025 rate cut, with the biggest difference being the rate cut speed, besides the starting interest rate. The previous round of rate cuts had a relatively large speed and magnitude, while the current round (2025) currently appears to be a slow and gradual process. Therefore, the current crypto market situation may also continue to be gradual.

Additionally, in the article on April 14th, we again mentioned the rate cut topic and noted: Do not simply assume that the market will continue to rise as long as the Federal Reserve cuts rates. The relationship between rate cuts and market rises is not as simple as we imagine. For example, once the market clarifies rate cut expectations, even before the rate cut officially lands, the market will likely have a short-term speculative rise. Moreover, when the official rate cut arrives, although the policy is releasing water, the market may still experience a new round of decline or a rise followed by a pullback in the early stages of the rate cut. Rate cuts are certainly beneficial to the market, but do not directly equate rate cuts with price increases, because the market is always dynamic and volatile.

Many people always like to look at issues from a single perspective. They hope the Federal Reserve will quickly cut rates because rate cuts will bring new liquidity, and new liquidity can drive the prices of risk assets up. But from another angle, if the probability of rate cuts increases, it also means that the economic situation in the United States (and even globally) is becoming more severe. If someone pays attention to macroeconomic data, they would know that the current US employment data is not optimistic, the real estate market is struggling, PMI is below the boom-bust line (50), fiscal deficit continues to expand... These data and phenomena all indicate signs of economic contraction.

If we combine market trends with these macroeconomic conditions, it can be said without exaggeration that this is the important reason for recent market volatility, but these conditions currently seem unlikely to change in the short term.

Of course, precisely because the market is volatile and contains various uncertain factors, some special demands or speculation can still bring short-term price increases for some assets. For example, recently some listed companies have begun to frantically accumulate and reserve ETH, directly causing a stage of rapid rebound and rise in ETH prices. However, for the market in the long term, if the macroeconomic situation cannot significantly change, the overall market may still remain in a relatively chaotic and volatile state, and we can hardly directly welcome the kind of comprehensive and universal surge (the crazy bull market people idealize).

In summary, for risk assets, rate cuts are indeed something people should look forward to, because rate cuts mean more liquidity. However, do not become overly optimistic just because we will see rate cuts. It's important to know that rate cuts themselves are only a key condition for catalyzing price increases of some risk assets, not the result. From a long-term perspective, the market will not continuously rise directly due to rate cuts, but should rise continuously as economic recovery signs begin to appear.

Rate cuts occur because economic conditions are deteriorating, not improving. The market may cheer and experience a short-term peak due to rate cuts, and smart money might use rate cuts for short-term speculation to push up asset prices. But in the long term, smart money will certainly not take excessive risks. Rate cuts are not just a blessing for rises, but could also be a warning. If the economic situation becomes more severe behind the rate cuts, this problem might be more serious than it appears on the surface.

Therefore, we must maintain calm thinking. Besides steadfastly holding BTC, we should try to reserve sufficient liquidity positions (cash/USDT) for ourselves.