This article is machine translated

Show original

Dinari and the Plan to Launch a Layer 1 Blockchain for Tokenized Securities

A specialized blockchain focused on tokenizing stocks, bonds, and securities compliant with US securities laws. A missing piece of RWA that has not been well addressed 👇

1. What is Dinari?

- @DinariGlobal, a San Francisco-based company specializing in tokenizing US securities through dShares products, is preparing to launch its own Layer 1 blockchain called Dinari Financial Network.

=> The network's goal is to serve as a payment and clearing infrastructure for tokenized stocks, similar to DTCC's role in the traditional securities market.

2. Technology Platform

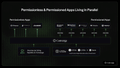

- The blockchain is developed on @avax through AvaCloud, allowing customization of transaction fees and network parameters.

- Aims to coordinate liquidity between multiple blockchains, including Arbitrum, Base, Plume, Solana… to reduce liquidity fragmentation in securities token trading.

3. Deployment Status

- Testnet is currently operational.

- Public launch expected in the coming weeks.

- Initial governance structure: Managed by a validator alliance including Gemini, BitGo, VanEck, and other organizations.

4. dShares Product

- Each token is backed 1:1 by real stocks or ETFs, maintaining benefits like dividends and voting rights (when legally permitted).

=> Currently supports over 150 US stocks and ETFs. Users in over 85 countries can trade through partner networks.

5. Legal Aspects

- Dinari is registered as a broker-dealer and transfer agent in the US.

=> Building a proprietary blockchain is considered necessary to meet strict legal requirements related to tokenized securities issuance and trading.

6. Impressive Backers with Appropriate Capabilities

- Series A Round: Raised $12.7 million, bringing total funding to approximately $22.65 million.

- Investors: Hack VC, Blockchange Ventures, @vaneck_us Ventures, F-Prime Capital, Avalanche Foundation.

- Seed investors: Balaji Srinivasan, Alchemy, 500 Global, Version One, Susquehanna International Group.

7. Long-term Objectives

- Become a neutral payment infrastructure for the tokenized securities market.

- Moving towards decentralized governance through future governance token issuance.

=> If successfully implemented, it could help global investors access US assets without traditional brokerage accounts.

=> This is a step forward in "Real-World Assets" (RWA), transforming blockchain into a legal securities payment and custody channel.

Steven | Crypto Research

@Steven_Research

05-13

TƯƠNG LAI CỦA DEFI - BẢN NÂNG CẤP CỦA TRADFI - CONVERGE ĐÁNG CHÚ Ý KHÔNG?

RWA và Defi đang là thứ được lợi cho chính sách tài chính mới của Mỹ, dưới đây là một số insight các bác tham khảo nhé 👇

1. DeFi liệu có là tương lai của TradFi (theo dòng chảy thời x.com/Steven_Researc…

Please note... (VanEck)

VanEck

@vaneck_us

08-14

Please note that VanEck is an investor in @DinariGlobal and may hold positions in Avalanche (AVAX). 🔺 x.com/CoinDesk/statu…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content