Last week, the cryptocurrency market showed significant volatility based on macroeconomic indicators and statements from Federal Reserve officials.

Bitcoin, which recorded a new high by surpassing $124,000, was once pushed below $117,000. This was because recent inflation and other macroeconomic indicators were worse than expected, weakening expectations of consecutive US interest rate cuts.

One of the most important indicators last week was the July US Consumer Price Index (CPI). The headline CPI was announced lower than Wall Street's expectations, causing a positive market reaction, but a closer look revealed a less favorable situation.

Tariff Effects on Inflation... Will It Hinder Interest Rate Cuts?

The CPI indicator showed a notable rise in Core CPI and Super Core CPI, excluding food and energy. Particularly, the sharp increase in Super Core CPI since April suggests that US service prices are rising very rapidly.

The US July Producer Price Index (PPI) significantly exceeded expectations, having an even greater market impact. The PPI had not shown significant increases during the initial months of the US 'trade war' in May and June. However, in July, it recorded a record-breaking monthly increase of 0.9%. This is the first time PPI has risen 0.9% month-on-month in three years.

This is closely related to US tariff policies. While the trade war starting in April seemed to temporarily stabilize producer prices as companies stockpiled inventory, the significant July increase signals that companies can no longer absorb the cost increases from tariffs. Particularly, service sector price increases were prominently reflected in the PPI.

Surprisingly, the July US import prices seriously impacted the market. Logically, import prices should rise due to tariff effects. However, US prices in May and June did not move this way. The Trump administration argued that tariff policies do not cause price increases.

However, July's import prices recorded a significant increase. This means import and export companies can no longer bear the tariff effects internally and have started passing these costs to consumers.

The Federal Reserve has recently shown serious concerns about potential price increases triggered by tariffs in two Open Market Committee (FOMC) meetings. If import prices continue to rise significantly in August due to US tariff policies, the possibility of Fed rate cuts may become even more difficult.

Year-End Rate Cut Forecast Reduced from 3 to 2 Times

I explained the changing macroeconomic atmosphere last week for good reasons. Recent Bitcoin prices have been significantly influenced by expectations of US interest rate cuts.

On Thursday the 14th, when Treasury Secretary Scott Bessent mentioned the possibility of a 50bp rate cut in September during a media interview, it exceeded $124,000. However, this price immediately collapsed when Bessent changed his stance to 25bp after the PPI announcement.

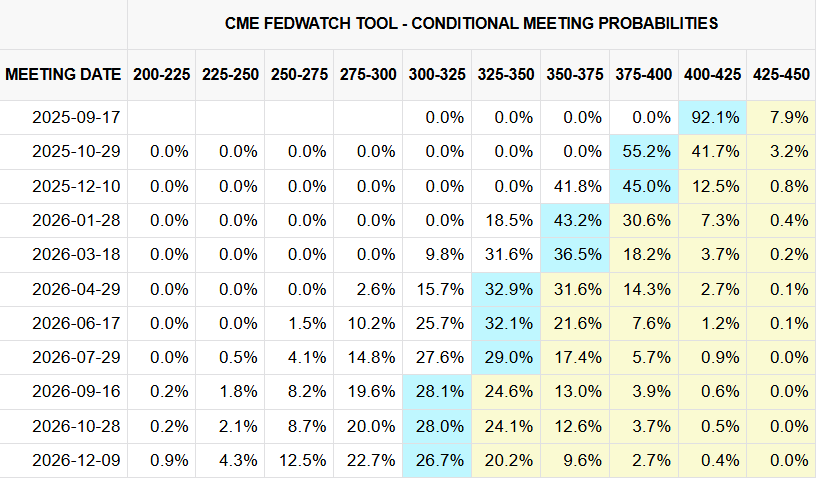

According to the CME's FedWatch rate prediction service, the year-end rate cut forecast has been reduced to two times since Friday the 15th. Major cryptocurrency exchanges and US spot ETF fund inflows and outflows are also significantly affected by these macroeconomic data.

Bitcoin deposits on Binance surged around July 15th when import prices were announced. The Bitcoin and Ethereum spot ETF market, which had maintained net inflows for a week, recorded net outflows that day like a receding tide.

Altcoin prices are similar. The second-largest cryptocurrency, Ethereum, renewed its all-time high in Korea and Japan on the 11th, raising additional rise expectations. However, it failed to break through the previous all-time high of $4,860 against the dollar, unable to overcome macroeconomic variables. As of 12 PM on the 18th, Ethereum is fluctuating around $4,540.

Inflation or Employment... Powell's 'Hint' Will Emerge at Jackson Hole Meeting

The previously certain Fed's three rate cuts this year have now entered the realm of uncertainty.

While strong arguments for rate cuts emerged due to July's US employment deterioration, the Fed cannot easily accept those claims because inflation has been reconfirmed. The steering wheel of rate decisions has effectively been handed back to Fed Chair Jerome Powell.

In this context, the Fed's Jackson Hole Meeting from the 21st to 23rd is receiving significant attention. The Jackson Hole Meeting is an authoritative monetary symposium hosted by the Kansas City Fed, attended by central bank governors from around the world.

Fed Chair Jerome Powell is scheduled to deliver a speech about US monetary policy direction at Jackson Hole at 11 PM Korean time on Friday, the 22nd.

Powell previously made hint-like statements during the Jackson Hole Meeting before cutting rates by 50bp in September last year, which is why his remarks are drawing attention.

According to the Fed's official schedule, Fed Vice Chair Michelle Bowman and Board Member Christopher Waller, who strongly advocated for rate cuts at the July FOMC, will also give public speeches on August 20th and 21st respectively. They have been arguing for preemptive rate cuts due to employment deterioration and economic recession concerns.

Considering the recently intensified inflation issue, the market is focusing on whether the existing stance will be withdrawn or whether the strong interest rate cut cycle will continue to be advocated.

There are no significant macroeconomic indicators to be announced next week. However, the Federal Reserve's July FOMC minutes to be released in the early morning of the 21st are expected to have a significant impact on the market depending on their contents. The market's expectation of interest rate cuts and Bitcoin prices could fluctuate greatly depending on whether there were other committee members besides Bowman and Waller who advocated for interest rate cuts. We wish our readers a successful investment this week as well.