There are three core drivers driving the Bitcoin market:

VX:TZ7971

1) Expanding global liquidity,

2) Accelerated institutional capital inflows,

3) A cryptocurrency-friendly regulatory environment.

These three factors are working together to create the strongest upward momentum since the bull run of 2021. Bitcoin is up about 80% year-on-year, and I believe that in the short to medium term, there are limited factors that could disrupt this upward momentum.

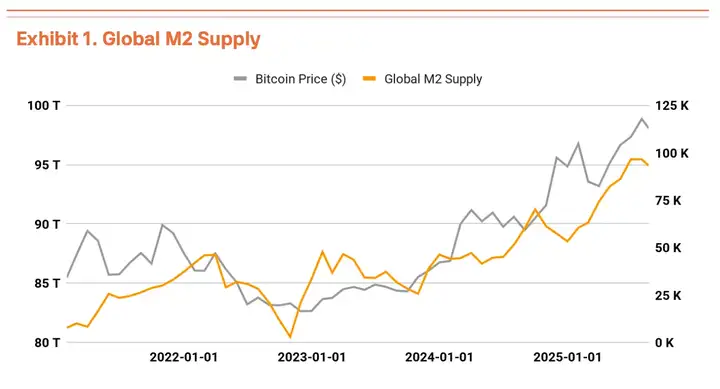

In terms of global liquidity, a key point of note is that the M2 money supply across major economies has surpassed $90 trillion, reaching a new all-time high. Historically, M2 growth rates and Bitcoin prices have shown similar directional patterns, suggesting significant room for further appreciation if the current monetary expansion continues.

In addition, Trump's pressure for interest rate cuts and the Federal Reserve's dovish stance have paved the way for excess liquidity to flow into alternative assets, with Bitcoin becoming the main beneficiary.

Meanwhile, institutional accumulation of Bitcoin is proceeding at an unprecedented pace. US spot ETFs hold 1.3 million BTC, approximately 6% of the total supply, with MicroStrategy (MSTR) alone holding 629,376 BTC (worth $71.2 billion). Crucially, these purchases represent a structured strategy, not a one-off trade. MicroStrategy's continued purchases, particularly through convertible bond issuance, signal the formation of a new layer of demand.

Furthermore, opening up 401(k) retirement accounts to Bitcoin investment creates potential access to an $8.9 trillion pool of capital. Even a conservative 1% allocation would represent $89 billion—roughly 4% of Bitcoin's current market capitalization. Given the long-term nature of 401(k) funds, this development should not only contribute to price appreciation but also reduce volatility. This is a clear sign that Bitcoin is transitioning from a speculative asset to a core institutional holding.

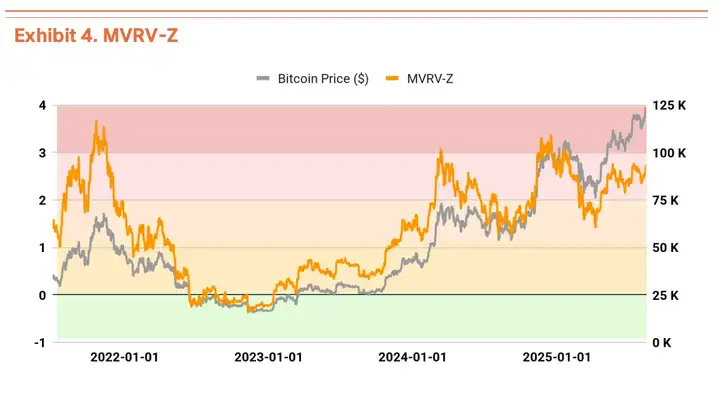

Although overbought, institutions provide bottom support

On-chain indicators show some signs of overheating, but significant downside risk remains limited. The MVRV-Z indicator, which measures current prices relative to investors' average cost basis, is at 2.49, placing it in overheated territory. It recently spiked to 2.7, warning of a possible near-term pullback.

However, aSOPR (1.019), which tracks investors' realized profits/losses, and NUPL (0.558), which measures the overall unrealized profits/losses of the market, remained in stable territory, indicating the overall health of the market.

In short, while current prices are high relative to the average cost basis (MVRV-Z), actual selling is occurring at modest profit-taking levels (aSOPR), and the market as a whole has not yet reached excessive profit-taking territory (NUPL).

This dynamic is supported by institutional buying power outstripping retail buying. Continued accumulation from ETFs and MicroStrategy-type entities is providing solid price support. A short-term pullback is possible, but a trend reversal seems unlikely.

Today's panic index is 53, falling to neutral.

On August 15th, ETH's share of total trading volume reached 48%, the highest point so far in this cycle. This ratio indicates that almost half of all funds flowing into and out of trading platforms are in ETH, on par with BTC, and indirectly confirms the current market's strong interest in ETH.

As more investors begin to focus on ETH, the exchange rate will strengthen, and ETH will begin to outperform BTC. The current ETH/BTC exchange rate is only around 0.04, far from its peak of 0.08 in 2021. This suggests that the ETH/BTC exchange rate is still undervalued. As long as investors continue to pay attention, the current exchange rate theoretically has room to rise.