On August 26th, the market ultimately failed to hold above $110,000. Following Fed Chair Jerome Powell's dovish stance, BTC briefly rallied to $117,000, but soon suffered four consecutive daily declines, even dipping to $108,666.66 this morning. After hitting a record high, Ethereum quickly plummeted to $4,334, a 24-hour drop of over 6%. Altcoin also experienced a sharp correction due to the broader market.

VX:TZ7971

Coinglass data shows that the entire network has seen $935 million in liquidations over the past 24 hours, with $821 million in long positions liquidated, severely damaging long positions once again. On August 24th, glassnode data showed that over $150 million in long positions were quickly liquidated, making it one of the largest BTC long liquidations since December 2024.

Discussions on bull and bear markets surge, is the bull market really over?

Trump ousts Fed Governor Cook

On August 26, Trump signed a document dismissing Federal Reserve Board member Tim Cook, effective immediately. This sudden move disrupted market investors' judgment and expectations.

The nature of Trump's dismissal of Cook is clear: it is blatant blackmail and an attempt to pressure policymakers to cut interest rates.

The Federal Reserve declined to comment on Trump's dismissal of Governor Cook. However, Fed Governor Cook said Trump did not have the authority to fire him and that he would continue to perform his duties.

Financial markets hate uncertainty, and Trump's actions against the Federal Reserve have undoubtedly cast a shadow over subsequent market sentiment.

Futures speculative positions surge, whales take profits

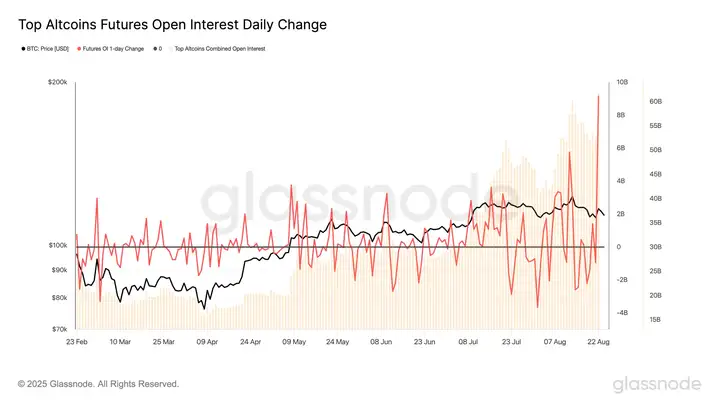

After the Federal Reserve's Powell's dovish stance last Friday, the open interest in Altcoin futures surged by $9.2 billion in a single day, pushing the total open interest to a new historical high of $61.7 billion.

Such rapid capital inflows highlight that Altcoin are increasingly becoming a key factor driving higher leverage, increased volatility and greater vulnerability in the digital asset market.

When market participants consistently believe that the outlook will continue to be bullish and sentiment is high, price movements tend to go against expectations and lead to margin calls.

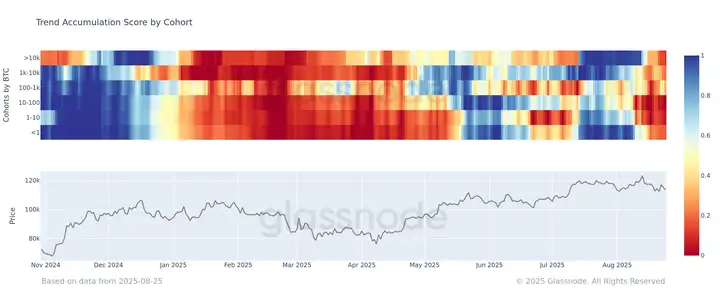

Another key chart shows that market-sensitive and smart whales are starting to take profits.

Glassnode data shows that all Bitcoin holding groups have clearly entered a phase of selling and cashing out, led by those holding 10 to 100 Bitcoins. This consistency in behavior across all groups highlights the widespread selling pressure emerging in the market.

BTC and ETH show abnormal trends

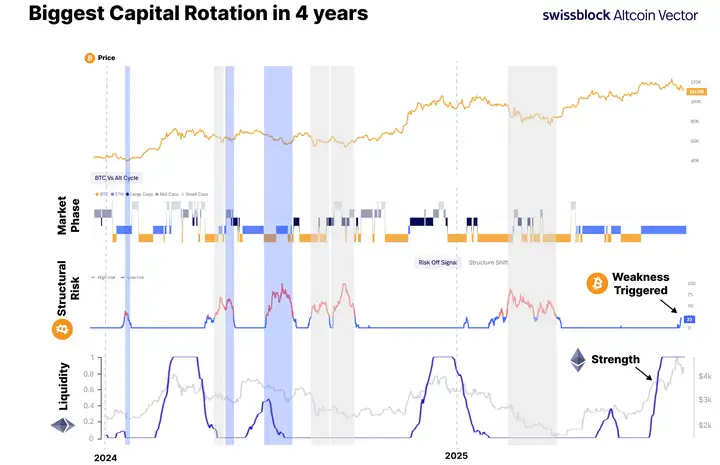

For the first time in this three-year cycle, a rare phenomenon emerged: ETH showed its strong momentum.

Ethereum is performing strongly → positive (attracting inflows)

Bitcoin Performance → Neutral (fluctuating within a range)

Risk-averse sentiment: Large Bitcoin wallets take profits and transfer positions to Ethereum

If Ethereum is to lead the market, Bitcoin must hold its key position – capital rotation is pushing Ethereum towards cyclical leadership. This feels like the last major test before the final stage of this cycle.

$110,800 represents the average holding cost for investors who entered the market during the period of the all-time high from May to July and held positions for one to three months. This level represents strong support at the moment. Historically, if Bitcoin fails to hold this level, the market often experiences months of weakness and potentially a larger correction.

Today's panic index is 48, remaining neutral.

Despite the market's decline, no institutions or companies seem to be selling; instead, everyone is scooping up bargains. There's growing evidence that current market inflows and outflows are driven by retail investors, not just institutions as in earlier periods. When retail traders believe the market has peaked, many may make emotional decisions and withdraw funds from ETFs. This can temporarily cause a market decline, but it often signals an eventual bottom. From a longer-term perspective, this purge may also be a necessary step for the bull market to continue. Clearing out overheated positions in the market creates room for the next leg of the rally. Cherish every dip.