Fisher Yu’s ambition is simple: to make Bitcoin no longer a “digital gold” that just lies flat, but a productive asset that can actively create value.

Article author: Lesley

Article Source: MetaEra

Just past the halfway point of 2025, it's widely considered the year cryptocurrency enters the global mainstream. Governments around the world are adding Bitcoin to their national reserves, and businesses and institutions are accelerating their allocations. According to bitcointreasuries.net, nearly 200 publicly listed companies and more than a dozen governments worldwide hold over 1.5 million Bitcoins. At this juncture, the Bitcoin staking protocol Babylon has been making significant investments, once again garnering market attention.

In January 2022, cryptographer and former Dolby Laboratories senior engineer Dr. Fisher Yu co-founded Babylon with Stanford University engineering professor David Tse, a member of the U.S. National Academy of Engineering, and an expert in information theory. Their entrepreneurial journey was driven by a profound insight into the industry landscape following the 2021 "DeFi Summer." "At the time, there were thousands of chains and tens of thousands of DeFi applications, and the entire blockchain world was highly fragmented," Fisher Yu recalls. "We believed that one day, the long-standing divide would eventually converge, and that unifying foundation would be Bitcoin."

In this interview, MetaEra will speak with Dr. Fisher Yu, co-founder and CTO of Babylon Labs, to deeply analyze Babylon's technological innovations and the changes that Babylon has brought to the Bitcoin ecosystem.

Babylon: Cracking the $2 Trillion Productivity Paradox

Currently, the core pain point facing the Bitcoin ecosystem is that Bitcoin holders can only passively hoard their coins, unable to earn returns through staking or mortgaging. "Everyone is buying Bitcoin now: public companies, even sovereign nations, institutions, and retail investors. But what happens after they buy?" Fisher Yu asked this blunt question, capturing the core dilemma of the Bitcoin ecosystem.

Bitcoin's market capitalization has exceeded $2 trillion (Source: Coingecko)

This situation is almost unimaginable in traditional asset management. Fisher Yu explained: "If the treasury assets are cash, they can be used to buy government bonds or fixed-income securities to generate returns. If they are non-cash assets such as real estate and factories, they can be used as collateral to obtain loans from banks or credit institutions for investment or reproduction. But Bitcoin cannot do this - it is not programmable like Ethereum, so it can't do anything and can only be left there as a means of storing value."

Fisher Yu defines this problem as the blockchain world's greatest resource mismatch: "While Bitcoin is the largest blockchain asset, it has yet to generate synergistic effects on other chains." How can Bitcoin be upgraded from mere "digital gold" to a "productive asset"? This is precisely the problem Babylon is dedicated to solving.

Currently, Babylon focuses on solving two problems:

1. Expanding Bitcoin's Usage: Babylon achieves this goal through two protocols: the Bitcoin Staking Protocol, which allows native Bitcoin to generate staking returns through multi-staking. The Bitcoin Treasury Protocol, which allows native Bitcoin to participate in any DeFi product, including staking, lending, stablecoin issuance, and even perpetual contracts.

2. Bringing Bitcoin liquidity to other blockchains: Allowing other chains to benefit from Bitcoin's liquidity. "This not only solves Bitcoin's own liquidity problem, but also addresses the blockchain world's lack of Bitcoin as a major asset," Fisher Yu concluded.

Why did Babylon choose the Bitcoin ecosystem? The answer lies in security. Fisher Yu and Professor Sreeram, founder of EigenLayer, have previously researched the concept of "shared security," whereby a blockchain exports its own security (computing power, consensus mechanism, staked assets, etc.) to other chains for use. Both Babylon and EigenLayer are based on this concept, but have chosen different paths: Babylon chose Bitcoin, the most secure blockchain, while EigenLayer is based on the more flexible Ethereum.

Fisher Yu believes Bitcoin is the most solid foundation for the future. "Professor David Tse and I are both staunch supporters of Satoshi Nakamoto. Bitcoin is the most secure, and everything in the world should be based on it." However, due to Bitcoin's immutability and other characteristics, this choice also brings greater technical challenges.

Fisher Yu explained, "Because of Bitcoin's non-programmability, all current Bitcoin-related protocols require users to hand over their Bitcoin to a third party, which is fundamentally unacceptable." Although security is a prerequisite for blockchain, the real challenge lies in how to eliminate dependence on third parties on a secure basis and achieve true "trustlessness."

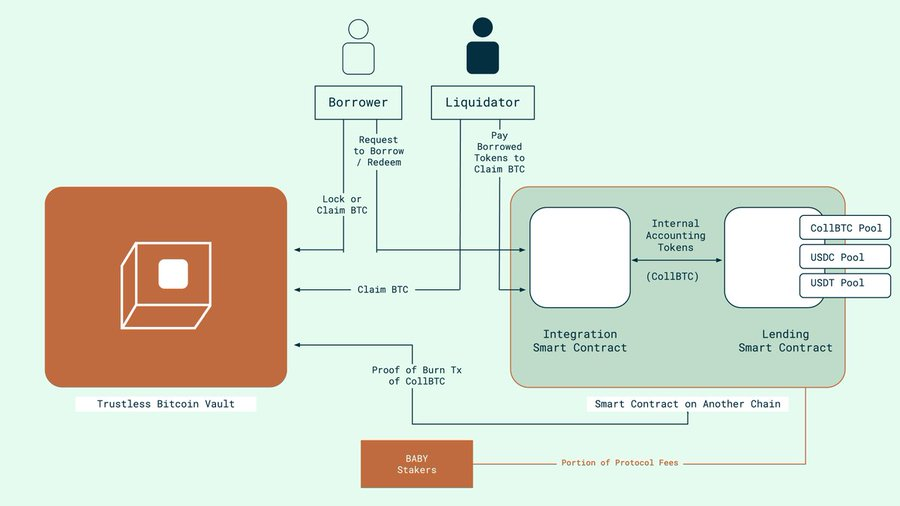

Trustless Bitcoin Vault

To address this challenge, Babylon recently launched a "Trustless Bitcoin Vault," which interacts with DeFi protocols on other chains through BitVM3 (a Bitcoin-native verification scheme based on zero-knowledge proofs and garbled circuits). This solution allows Bitcoin to remain on the Bitcoin network while functioning as native DeFi collateral on multiple chains, including Ethereum and Cosmos. "This way, no one can steal your Bitcoin," Fisher Yu explained.

Looking ahead, Babylon's roadmap is divided into three phases:

1. Completed the Bitcoin staking protocol - expanding from single staking to multi-staking, allowing one Bitcoin to be staked in multiple scenarios simultaneously, thereby generating multiple income streams;

2. Launching the Babylon Genesis EVM — Deploying the EVM on the Babylon chain will enable Ethereum’s DeFi protocols to run seamlessly on the Bitcoin network, further shaping the BTCFi ecosystem.

3. Launch innovative products such as BTC Vault to build a complete BTCFi ecosystem - launch the test network at the end of the year and officially release the following year, providing more abundant financial tools for the Bitcoin ecosystem.

Fisher Yu firmly believes that a clear roadmap will help Babylon build a complete BTCFi financial system. "We want to make Bitcoin as easy to use as Ethereum, or even better and more powerful," Dr. Fisher Yu said.

Collaboration with listed companies: A two-way journey between traditional capital and the crypto world

After clarifying its technical path, Babylon began exploring deep integration with traditional finance, with its first collaboration being a strategic partnership with ATA. In August 2025, Nasdaq-listed ATA Creativity Global (Nasdaq: AACG) signed a $100 million controlling stake agreement with Baby BTC Strategic Capital (a special purpose fund used to control listed companies, led by the Babylon Foundation as a lead limited partner). This transaction structure differs from the common coin hoarding model of listed companies and signals a shift in how traditional financial institutions are engaging with the Bitcoin ecosystem, moving from simple asset purchases to deeper ecosystem integration.

Baby BTC Strategic Capital Signs Term Sheet with Nasdaq-Listed ATA Creativity Global

Baby BTC Strategic Capital partner Gigi further explained that the strategic partnership between ATA Creativity Global and Baby BTC Strategic Capital has established an innovative business model of "listed holding platform + token asset acquisition + staking ecosystem income". Specific details include:

• Completed the restructuring of the holding structure through a $100 million capital injection from Baby BTC Strategic Capital;

• Deeply integrate the listed company platform with the Babylon ecosystem;

• Focus on BTC staking income and BTCFi ecosystem construction;

• Dynamically optimize the asset allocation ratio of Baby tokens and BTC.

This collaborative model aligns closely with Babylon's original intention. "Our team hopes to collaborate with listed companies to help them develop and implement advanced Bitcoin treasury strategies, rather than simply buying and hoarding Bitcoin." Fisher Yu believes that the collaboration with ATA is a prime example, and that more similar collaborations will follow. "ATA is the first, but it won't be the last. Our goal is to help more listed companies design and implement more advanced Bitcoin treasury strategies."

Fisher Yu pointed out that this partnership will provide significant assistance to listed companies. "Currently, hundreds of listed companies with total assets exceeding $100 billion are buying Bitcoin, but they urgently need a secure, reliable solution without third-party custody risks to deploy these Bitcoins. Otherwise, these assets will only passively lie in the financial statements, unable to generate additional value."

The logic behind this promotional model is clear: Babylon will focus on technology development and crypto-native user growth, while expansion into traditional industries will be achieved through the listed company's platform. "Babylon will focus solely on crypto application development, while Web2 adoption will be facilitated by the listed company," said Fisher Yu.

Industry Reshaping Effect: A Two-Way Journey Between the Mainstream and Crypto Worlds

With traditional capital entering the crypto space en masse, questions are being raised about whether the spirit of decentralization will be diluted. Fisher Yu responded explicitly, stating, "I don't believe the large-scale entry of centralized institutions into the blockchain space violates the spirit of decentralization."

He divides the decentralization of the Bitcoin ecosystem into two dimensions: "Decentralization has two aspects. The first is that the maintainers of the chain are decentralized, and the second is that the more widely distributed the coin holders are, the better."

• From the perspective of chain maintainers, institutional participation has not changed the blockchain's operational structure. "There are now nearly 200 companies buying Bitcoin, but Bitcoin miners are still the same as before."

• From the perspective of the distribution of coin holders, traditional capital has actually promoted the decentralization of the holder distribution: "A listed company holds a coin, but in reality, this coin belongs to all its shareholders, not the company itself. Therefore, the effective number of Bitcoin holders is actually increasing."

Fisher Yu believes that Bitcoin's move into the mainstream is a natural evolution: "Bitcoin will inevitably be gradually recognized and adopted by the mainstream world." He emphasizes that this progress wasn't driven by the crypto industry, but rather by the mainstream world's proactive approach. "The Bitcoin system is truly decentralized; there's no foundation or operator driving its adoption. It's the mainstream that actively recognized and accepted Bitcoin." As the mainstream world came to understand the concept of decentralization through Bitcoin, their attitude became more open and inclusive. "Coincidentally, the crypto community also wanted to break out of its own box, resulting in this two-way push."

Gigi, a partner of Baby BTC Strategic Capital, also clarified the historical mission of this cooperation with ATA from another perspective: "Building a bridge connecting traditional finance and the crypto ecosystem, and releasing the new value of Bitcoin assets through innovative financial tools." In the future, Babylon will also bring more surprises to the mainstream world through comprehensive solutions.

Summary: The moment when the value of Bitcoin ecology is released

As the world's attention turns to Bitcoin, Babylon is redefining the game with technology. Fisher Yu's ambition is simple: to transform Bitcoin from a passive "digital gold" into a productive asset that actively creates value.

The influx of traditional capital is no accident. Beginning with Babylon's strategic partnerships with listed companies, these companies are shifting from simply buying and hoarding coins to deeply participating in the development of the crypto ecosystem. This isn't a betrayal of decentralization, but rather its true victory. When the mainstream world actively embraces Bitcoin, the concept of decentralization is actually gaining wider adoption.

From Satoshi Nakamoto's white paper to today's thriving ecosystem, Bitcoin has spent sixteen years proving the possibility of decentralized finance. Now, it's embarking on the next sixteen years—from value storage to value creation, from marginalized revolution to mainstream infrastructure. This is not only a triumph of technology, but also a legacy of philosophy.