MetaEra CEO Jessica and Manny discussed the core logic of the DeFi Treasury (DAT) model, the strategic value of the TON ecosystem, and the potential profound impact of this business model on the entire cryptocurrency industry.

Article author: Lesley

Article Source: MetaEra

The Web 3.0 strategies and plans of listed companies have become a hot topic of increasing public interest. Against this backdrop, MetaEra has officially launched its "Crypto Stock Executive Interviews" series. We will speak with leaders at the forefront of digital transformation. Through the perspective of decision-makers, we will delve into their strategic plans, business innovations, and financial innovations, providing forward-looking insights for industry participants.

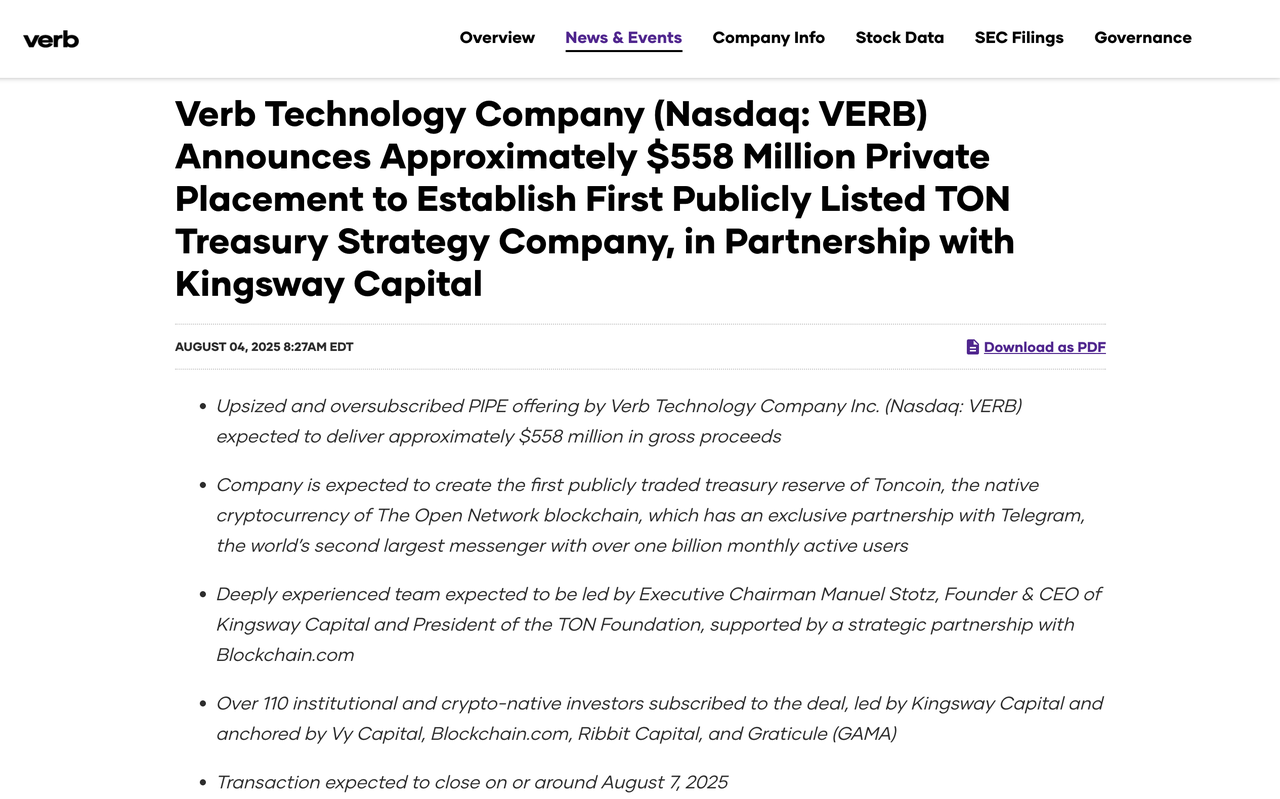

On August 4th, Verb Technology Company (Nasdaq: VERB) announced the completion of approximately $558 million in private placement financing through a private equity initiative (PIPE). The company plans to partner with Kingsway Capital to establish the first publicly listed Toncoin ($TON) treasury company, renamed TON Strategy Company. Following Strategy's pioneering Bitcoin treasury strategy, the Decrypted Asset Treasury (DAT) model has been systematically expanded to the emerging public blockchain ecosystem for the first time, providing institutional investors with a compliant channel into the TON ecosystem.

Verb Technology announces $558 million private placement, plans to establish the first listed TON treasury company

A key figure in this transaction is Manny Stotz (also known as Manuel Stotz, hereinafter referred to as Manny). As the founder of Kingsway Capital, Manny manages approximately $5 billion in assets, focusing on frontier market investments. Three and a half years ago, he became one of the largest investors in the TON token and has served on the board of directors of the TON Foundation since its inception. He served as Chairman of the Foundation from the beginning of this year until yesterday. He currently serves as Executive Chairman of TON Strategy Company (Nasdaq: VERB).

In this online conversation, MetaEra CEO Jessica and Manny discussed the core logic of the Decentralized Access Treasury (DAT) model, the strategic value of the TON ecosystem, and the potential profound impact this business model will have on the entire cryptocurrency industry. Below is a summary of the conversation.

Theoretical Basis and Practical Logic of the Cryptoasset Treasury Model

With Trump's initiation of the Bitcoin National Strategic Reserve and Michael Saylor's spurring of a surge in public companies hoarding cryptocurrency, the crypto asset treasury model is gaining popularity among publicly listed companies. A growing number of Web 3.0 builders are joining or collaborating with public companies to advance this emerging model. As the first TON treasury company, TON Strategy Company's strategy is deeply inspired by pioneering cryptocurrency treasury strategies like Strategy, resulting in its own unique business model.

The three core logics of the successful crypto asset treasury model

Manny pointed out that Michael Saylor and his strategy have played a significant role in the Bitcoin market, even changing the trajectory of this crypto market cycle. Bitcoin's exceptionally strong performance is driven by an influx of institutional capital—including the Bitcoin ETF launched last year and the Bitcoin Treasury strategy led by Saylor. Without this institutional funding, Bitcoin would have struggled to maintain its current strong performance.

He also mentioned that Ethereum's treasury companies have also had a profound impact on Ethereum's market trends, driving up spot prices and boosting the ecosystem. Manny believes that analyzing this phenomenon is crucial. Here are three reasons Manny outlines for the success of the crypto asset treasury model.

1. The crypto asset treasury model bridges the significant disparity in capital access. Manny pointed out that the global capital available for investment in US stocks far exceeds the capital available for entry into the crypto market. "There is likely over 100 times more capital available globally to flow into US stocks than into cryptocurrencies. Even blue-chip tokens like Bitcoin and Ethereum face similar limitations," Manny said.

He further pointed out that, using TON as an example, this gap could be magnified 1,000-fold. "TON tokens are not yet listed on any major US spot exchanges—not Coinbase, Robinhood, Gemini, or even South Korea's largest exchange, Upbit."

As a result, TON’s market liquidity and access to institutional funds have been limited, which also explains why many related companies have long traded at a premium to their book value and net asset value (NAV).

2. The Crypto Treasury Model is the Holy Grail of Investing

Manny further analyzed that the core of so-called "perpetual capital" lies in long-term investment and long-term compounding, which is the "holy grail" of investment and fundamentally different from the traditional ETF structure. He explained, "If an investor sells an ETF, the ETF must also sell the tokens it holds. However, if an investor sells Strategy or VERB shares, the stock price may fall, but the tokens remain securely in the company's treasury."

In his view, this structural advantage not only avoids the risk of passive selling but also provides investors with room to capitalize on market fluctuations. "By issuing shares at a premium and repurchasing tokens at a discount, the company can continuously increase its book value per share (BVPS)." He calls this model "volatility harvesting," essentially leveraging market fluctuations to create value, a long-standing approach to capital management for Michael Saylor.

Manny also highlighted the additional advantages of using a PoS protocol: "For all Proof-of-Stake (PoS) networks, you can stake and be included in an index, which is something that ETFs cannot do. ETFs cannot trade at a premium or discount, cannot be perpetual capital, and are forced to sell assets when redeemed."

3. The crypto asset treasury model has a winner-takes-all scale effect

Saylor has consistently emphasized that the reserve of crypto assets is a "winner-takes-all" competition, with the winner ultimately securing the majority of market share. Manny agrees, stating that the key to success lies in access to low-cost capital—a capital advantage that not only generates economies of scale but also, like network effects, is self-reinforcing.

He gave an example: "Saylor's company is 30 times larger than the second-largest Bitcoin treasury company. Although the second-largest company may perform well, the competitive advantage of low-cost capital enables Saylor to consolidate its dominant position through economies of scale, making it difficult for others to catch up."

Facts have proven this. Through efficient capital allocation, Saylor indirectly drove a tenfold increase in Bitcoin's price over the past five years, while also causing Strategy's stock price to soar 30-fold, even outperforming Nvidia during the AI boom. This performance is driven by the leverage effect between capital efficiency and market volatility.

As for TON Strategy Company, Manny believes that through the same "strategic capital allocation," the company has the potential to outperform the market in the future, especially as crypto assets mature. "Of course, everything depends on the performance of the underlying assets themselves," he added. "If you don't have confidence in these underlying assets, such as doubts about TON's prospects, then don't buy our stock. But if you are bullish on TON, we are confident that through smart capital allocation, we can outperform Strategy."

Building an Unkillable Crypto Treasury: Three Golden Rules

“Crypto asset treasury strategies require very detailed and thoughtful structural design,” Manny emphasized. “The market is flooded with crypto asset treasury companies with loose structures and lack of deep thinking,” Manny bluntly pointed out, “and some low-quality projects may ultimately fail.”

Golden Rule 1: Stay Away from Leverage, Maintain Equity Financing

Manny quoted Charlie Munger's famous quote: "Three things drive smart people bankrupt: women, alcohol, and leverage. Even if you think the first two are not a big deal, absolutely avoid leverage." Manny emphasized, "Our strategy is 100% common equity financing, and we never use hard financial leverage."

The importance of this principle is particularly evident during the extreme volatility of the crypto market. Not using leverage means that the company is not at risk of forced liquidation even during the most severe market declines.

Golden Rule 2: Ensure positive cash flow and leverage economies of scale

"It may sound a bit old-fashioned, but I always adhere to one principle: revenue minus expenses must be greater than zero, at least in terms of cash flow profitability," Manny firmly believes. He uses his investment management business at Kingsway as an example: "We only need five or six people to manage $5 billion in assets. When you scale from $100 million to $10 billion, the capital increases a hundredfold, but the costs don't increase a hundredfold at the same time. Of course, we have more sophisticated operations and back-end support, but overall expenses remain manageable."

In the crypto treasury model, staking becomes a stable revenue engine. "The biggest expense is personnel costs, but you can easily pay for this with stock, and it doesn't count as a cash outflow. If all revenue comes from staking, you can either build your own staking infrastructure or earn income through delegated staking—instantly creating a massive revenue stream. Even if you only charge a tiny percentage of staking fees, once the base is large enough, the end result is still a substantial revenue stream." This strategy of building its own infrastructure avoids over-reliance on external revenue while effectively controlling costs through economies of scale.

Golden Rule 3: Maintain a cash buffer and build a solid safety margin

“In the crypto world, fiat currencies are often undervalued, but holding cash reserves is always a wise move,” Manny emphasized.

He recommends that companies maintain at least two years of operating expenses as cash reserves to weather market bubbles or sudden downturns. "A cash buffer prevents you from being left swimming naked during a market downturn—remember, never leave yourself without a backup."

Manny concluded, “If you follow these three golden rules, you can operate without leverage, remain profitable, and maintain a cash buffer. Even if the external environment fluctuates drastically, the company can maintain a basic margin of safety.”

The true power of these strategies often emerges during market cycles. In the next bear market, market premiums will first shrink to zero, and then potentially turn into discounts. "What if the stock price is at a 20%, 30%, or even 50% discount?" Manny's answer is straightforward:

"First, wait and see. Following the Golden Rule means the company is debt-free and profitable, and management can even go fishing in Alaska and come back a year or two later with nothing wrong.

Second, proactive share repurchases. Using cash buffers to repurchase shares at a discount not only stabilizes market confidence but also effectively increases book value per share.

Third, flexibility. In extreme cases, you can choose—but not be forced—to sell some tokens and then repurchase shares, further increasing the book value per share.”

He emphasized that the key lies in seizing the initiative. "Avoiding becoming a forced seller is the true bottom line for survival." In his view, this set of principles enables companies to be both offensive and defensive amidst cyclical fluctuations, enabling them to flexibly respond to short-term shocks while also forging ahead steadily in the long term.

TON Strategy Company's strategic positioning and ecological value

Manny divides VERB's value into two core dimensions: the capital flywheel and the narrative flywheel. He believes that VERB is not only the capital hub of TON, but also an amplifier that drives the globalization of ecological narratives.

Capital Flywheel: Building a Compliance Channel for Institutional Investment

Manny's tone radiated confidence when discussing the strategic significance of a Nasdaq listing. "In March, we announced TON's $400 million funding round, and the funds raised by VERB for TON in just one month exceeded the total raised by the TON ecosystem over the past two years," he said. "We were able to grow from zero to a Nasdaq-listed company with a market capitalization of $1 billion in just one month. This is due to the unique scale advantages and deep liquidity of the US capital market."

This difference in capital access has opened up VERB to a new investor base. He explained, "We have both existing shareholders who have invested in TON, as well as new funds, including Telegram bondholders and large traditional financial institutions. They are familiar with Telegram, hold convertible bonds, and have already analyzed and underwritten the relevant equity."

In his view, the scale of these investors' capital determines the market's potential. Some institutions place orders as large as $30 million to $50 million, but for funds managing $30 billion, this represents a mere "small investment." Manny concluded, "These hedge funds and institutional investors can't buy tokens directly, but they can easily buy stocks."

When asked if buying VERB is equivalent to buying "Telegram shares", Manny responded cautiously: "Of course not. Telegram is a private company, but if you want to get exposure to Telegram through equity, VERB should be the only choice in the world."

This is the value of the crypto asset treasury strategy - it transforms capital that was originally unable to enter the crypto market into a flywheel that drives the TON ecosystem.

Narrative Flywheel: Reshaping the Global Voice of the TON Ecosystem

In Manny's view, VERB's significance goes far beyond being a capital allocation tool; it serves as an amplifier for the TON ecosystem's narrative. He frankly admits that TON's storytelling efforts are far from adequate. He says, "A crypto asset treasury not only drives the capital flywheel—continuously raising funds and buying more TON, making the flywheel spin faster and faster—it also propels the narrative flywheel, telling the TON story even louder."

He particularly emphasized the perceived strength of TON's "super app" narrative in Asia. "Tencent became Asia's first trillion-dollar company thanks to WeChat, its gateway, and the integration of its payment, finance, money market, and gaming ecosystems. Today, WeChat Pay and Alipay are larger than Visa and Mastercard."

In his view, Telegram's true competitors aren't Ethereum or Solana, but super platforms like Meta (market cap $1.9 trillion), Tencent, ByteDance, and Snap. "Telegram may not make it into the 'Big Seven' of the US Stock Market, but it's likely to be in the top 15 or 20. After all, it's the world's largest open distribution platform, with 1 billion active users and growing." Therefore, VERB's presence in the capital markets serves not only as a financing channel but also as an "amplifier" for TON's narrative to reach global investors.

Driven by both capital and narrative, Manny pushed the topic further into the future. He not only positioned VERB as TON's capital hub and narrative amplifier, but also demonstrated his ambition to surpass previous experience.

Driven by both capital and narrative, Manny pushes the topic further into the future.

He stated frankly that he not only wanted to replicate the path of his predecessors, but also to move faster and more aggressively. He pointed out that Michael Saylor spent a full five years, using almost every possible means—appearing on every Bitcoin podcast, navigating the bear market, and issuing unprecedented financial instruments—to accrue 3.5% of the Bitcoin supply. In the Ethereum space, Bitwise, a leader in treasury strategies, has only the most ambitious goal of one day acquiring 5% of the Ethereum supply. Manny said, "But the proportion of TON token supply owned by TON Strategy Company already exceeds Strategy's proportion of Bitcoin, and far exceeds Bitwise's current proportion of Ethereum."

He firmly believes that “we can become the most aggressive DAT, aiming for 4%, 5%, 6%, 7%, or even 8% of the supply. If we do it right, it will have a profound impact on the market landscape.”

What excites Manny even more is the enormous opportunity presented by stablecoins. He keenly grasps Circle's high valuation on the Nasdaq and Tether's profits surpassing Goldman Sachs. "The core question is, who truly holds the power? Who owns the distribution channels? The answer is Telegram."

Based on this, he proposed his "100 billion scenario": assuming that Telegram's 1 billion users each deposited $1,000 in stablecoins, this would generate $1 trillion in assets under management. Calculating at a 3% net interest margin, this translates to $30 billion in annual cash flow. Even if half were allocated to Telegram, the remaining $15 billion, valued at 20 times the price-to-earnings ratio in the capital market, would still correspond to a market capitalization of $300 billion.

"The numbers may be even bigger than we imagine," Manny concluded. "The story of crypto treasury has two chapters: the first is the initial stage, increasing book value per share through financing and asset allocation; the second is more complex, involving staking, more diverse income opportunities, stablecoin business, and even listing in Hong Kong or the UAE to attract sovereign capital. The truly grander next step has just begun."

Risks and Challenges: Hidden Concerns and Responses in the Expansion of Cryptoasset Treasury Models

While the crypto-asset treasury model has brought unprecedented capital and narrative dividends to TON, this emerging model is not without its hidden dangers. Behind the capital surge, there are still multiple risks and challenges such as liquidity, governance, and compliance.

Risk 1: Will excessive concentration of TON token holdings trigger selling pressure?

The excessive concentration of TON tokens is often viewed as a potential risk, with concerns that it could cause a sell-off in the market. In response, Manny, Executive Chairman of the TON Strategy Company, stated: "Any TON token holder who wants to sell a large number of tokens can contact me now. I am the largest buyer in the market."

His confidence stems from TON Strategy Company's capital market fundraising capabilities as a Nasdaq-listed company. Manny admitted, "Raising another $100 million, $200 million, or even $500 million is no problem for us." Compared to traditional crypto players who rely on internal funding, VERB's advantage lies in its compliant financing channels and the professional team's experience in capital operations.

More importantly, he revealed the profound impact of the crypto asset treasury model on market psychology: "When the market believes that prices will rise, even if someone originally planned to sell $50 million worth of tokens, after I promise to take over, they may choose to hold on."

This "buying exists and selling is reluctant" effect makes the crypto asset treasury model have a dual function in the market: it not only provides liquidity support, but also reshapes investors' expectation structure.

Alameda previously promised to "cover" FTT before the FTX collapse, but due to a massive funding shortfall, these promises became empty promises, becoming a classic example of false promises in crypto history. Manny pointed out the difference with VERB: "Alameda's promise was fundamentally false—it had no capital backing and violated liquidity and leverage principles. We are a publicly listed company and must deliver with real money." These compliant promises by crypto asset treasury companies stand in stark contrast to the "empty-handed" schemes of the crypto industry in the past.

Risk 2: Is VERB just a financialization attempt by TON insiders?

Faced with external doubts that VERB is just an "over-financialization" experiment promoted by TON insiders, Manny gave a systematic response from an economic perspective.

“Financialization itself is not a derogatory term,” he said. “Money plays an important role in every transaction. Just because you buy a work of art with cash doesn’t mean the art itself is financialized.”

In his view, the real issue isn't whether it's financialized, but whether the monetary system is sufficiently credible. He cited data, noting, "The annual inflation rate of the US dollar is about 7%, while the Zimbabwean dollar is as high as 1,000%. However, TON's inflation rate is only 45–50 basis points (0.45%-0.50%), making it more stable."

Manny's core point is that financialization isn't synonymous with speculation, but rather a means of value creation and resource allocation. The key to the success or failure of a cryptoasset treasury strategy isn't whether it's financialized, but rather whether its structure is robust and whether it can generate long-term positive impact for the ecosystem.

Challenge: The rapid expansion of the crypto asset treasury model will trigger the survival of the fittest in the industry

Manny elaborated on how the crypto asset treasury strategy is injecting positive energy into the TON ecosystem. He stated that the TON Strategy Company will sponsor industry events such as Korea Blockchain Week and TO KEN2049, fund developer projects, and explore how to better invest tokens in TVL and DeFi protocols to enhance the ecosystem's vitality.

He used the metaphor of urban development to explain this logic: "People prefer to move to a city where there is a constant influx of new residents, new commercial facilities opening, and rising real estate prices, because there is a lot of growth momentum there. Crypto asset treasury companies play the role of this growth engine in the blockchain ecosystem."

In his view, financialization isn't synonymous with speculation, but rather a tool for value creation and optimal resource allocation. The real risk lies in the robustness of the cryptoasset treasury structure. Manny warned, "If an inexperienced team uses high leverage to shoehorn an experimental token ranked 75th by market capitalization into a Nasdaq shell company, problems are bound to arise."

In terms of operational approaches, he particularly emphasized efficiency and compliance: "Many teams have chosen SPACs, but they are too slow in securitizing crypto assets. We prefer the PIPE+reverse merger model, which can go from zero to a $1 billion market capitalization within a month and further expand in the public market."

This perspective reveals the inherent market logic of the cryptoasset treasury model: early winners inevitably attract a large number of followers, but ultimately only teams with solid fundamentals and risk management capabilities can survive the cycle. As financial history has repeatedly demonstrated, every wave of innovation is accompanied by bubbles, reshuffles, and restructuring. DATs will also follow this evolutionary law—the market will naturally eliminate projects that lack value support or rely too much on leverage, leaving behind high-quality targets with true long-term investment value.

Summary: A watershed moment in reshaping crypto finance

TON Strategy Company's TON Treasury strategy represents a critical turning point in the cryptocurrency industry. From Michael Saylor's pioneering of the Bitcoin treasury model to the current systematic expansion of crypto asset treasury strategies into the emerging public blockchain ecosystem, we are witnessing the further dissolution of barriers between traditional financial capital and crypto-native assets. This is not only an innovative experiment in capital allocation, but also a deep exploration of how crypto assets can be integrated into the mainstream financial system.

As institutional investors gain access to TON tokens through regulated, publicly listed companies, and as the "perpetual capital" operating model begins to be replicated across the broader blockchain ecosystem, a more mature crypto-financial infrastructure is taking shape. However, as Manny warns, the rapid expansion of this model will inevitably lead to an industry shake-up—those who follow suit, lacking real value and relying too heavily on leverage, will ultimately be eliminated by the market.

For the TON ecosystem, VERB serves as both a channel for capital injection and a platform for narrative amplification. In this grand experiment combining traditional internet giants with crypto-native innovation, VERB may just be the beginning. In this grand experiment combining traditional internet giants with crypto-native innovation, VERB may just be the beginning.