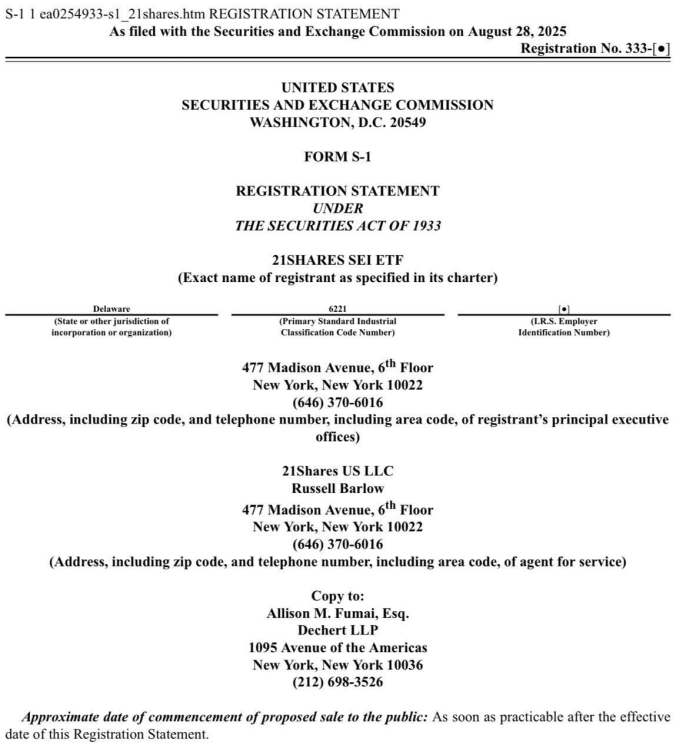

August 28, 2025 - 21Shares, a leading global issuer of crypto asset investment products, today officially submitted an application to the U.S. Securities and Exchange Commission (SEC) to issue $SEI Exchange-Traded Fund (ETF).

If the application is approved, $SEI will become one of the few blockchain assets, following Bitcoin and Ethereum, to be recognized by mainstream US financial markets. This progress not only signals the further maturity and expansion of the $SEI ecosystem globally, but also represents the accelerating integration of crypto assets with traditional capital markets.

ETFs, one of the most important investment tools in traditional financial markets, offer advantages such as high liquidity, low costs, and transparency. Through ETFs, institutional and accredited investors can conveniently access and allocate $SEI assets in a compliant environment without having to directly trade or manage cryptocurrencies. This significantly lowers the barrier to entry and is expected to attract more institutional capital into the $SEI ecosystem.

21Shares is one of the world's earliest and largest issuers of crypto-asset ETPs and ETFs, having successfully launched investment products covering a variety of mainstream assets, including Bitcoin and Ethereum, in multiple jurisdictions. Leveraging its extensive experience in product design, regulatory compliance, and market development, 21Shares' launch of the $SEI ETF is considered a significant milestone in the crypto capital market.

As the crypto industry gradually enters a new phase of regulatory compliance and institutional development, the successful launch of $SEI's ETF could have a profound impact on market liquidity, price discovery, and investor confidence. This will not only enhance $SEI's brand value among global investors but also potentially encourage more blockchain projects to pursue similar regulatory compliance paths.