Author: imToken; Source: X, @imTokenOfficial; Translated by Shaw Jinse Finance

From a macro perspective, stablecoins are undergoing a major shake-up.

In July, US President Trump signed the GENIUS Act, marking the official introduction of the country's first federal stablecoin law. In August, Hong Kong's Stablecoin Ordinance officially came into effect, becoming the first regulatory framework of its kind in the region. Meanwhile, Japan, South Korea, and other major economies are also accelerating the development of rules allowing licensed issuers to bring stablecoins to market.

In short, the market has entered a true "regulatory window." Stablecoins are evolving from gray area liquidity tools to financial infrastructure, achieving parallel development between compliance and innovation.

1. Why focus on regulated stablecoins?

Within this broader classification, regulated stablecoins occupy a unique and critical position.

Today, demand extends far beyond on-chain transactions. For cryptocurrency native users, they remain essential for hedging and liquidity. For traditional institutions, they are increasingly seen as tools for cross-border settlement, fund management, and payments.

Historically, tokens like USDT have grown organically in response to demand. However, despite their scale, they operate in a regulatory gray area and have faced questions about transparency and compliance risks.

In contrast, regulated stablecoins are built with compliance first: they are issued by regulated entities, licensed in their jurisdictions, and backed by clear reserves and legal obligations.

In simple terms: a regulated issuer + the right license + transparent reserves and enforceable liabilities. Every token is associated with an identifiable regulator and custody arrangement that can be verified by users and institutions.

This is why these assets can circulate on-chain and appear in corporate documents and compliance reports - becoming the "official bridge" between traditional finance (TradFi) and cryptocurrencies.

We view stablecoins from the perspective of user needs—there is no longer a single narrative. In our framework, we classify stablecoins into several user-oriented, practical categories.

Within this framework, regulated stablecoins (such as USDC, FDUSD, PYUSD, GUSD, USD1, etc.) are not intended to replace USDT; they operate in parallel - providing compliant, lower-risk channels for cross-border payments, institutional workflows, and other regulated use cases.

If USDT’s role is to provide “global cryptocurrency liquidity,” the goal of regulated stablecoins is to embed stablecoins into the fabric of the financial system and daily life.

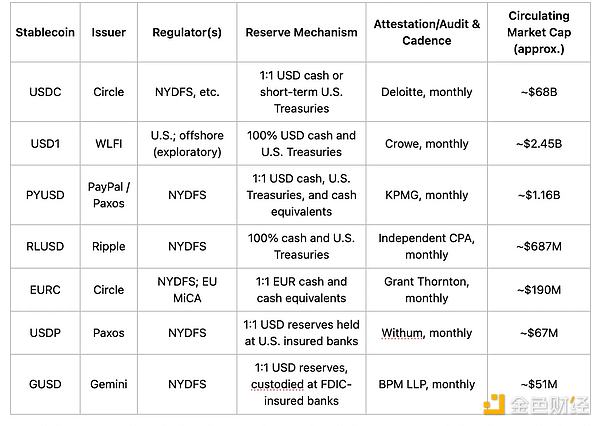

II. Overview of Major Regulated Stablecoins

While the paths may differ across regions, the direction is converging: a shift from gray-area liquidity to compliant financial interfaces. Its use is no longer limited to exchange matching and arbitrage, but has expanded to cross-border payments, corporate treasury management, and even daily consumption.

Globally, regulated stablecoins are evolving along several clear development tracks.

USA

USDC (Circle) : Backed by cash and short-term U.S. Treasury bonds, regularly audited, and 1:1 redeemable. Widely adopted by institutions, it's one of the few tokens that appear in audited financial statements.

USDP (Paxos) : Issued under the supervision of the New York Department of Financial Services (NYDFS). Its circulation volume is smaller than USDC, but it is clearly positioned for institutional payments and settlements.

PYUSD (PayPal) : Primarily used for retail payments rather than transactions, it aims to introduce stablecoins into daily consumption and cross-border transfers.

Hongkong

With the entry into force of the Stablecoin Ordinance in August 2025, Hong Kong becomes the first jurisdiction to establish a comprehensive regulatory framework covering issuance, reserves, and custody. Stablecoins issued under this regime are considered regulated financial instruments rather than gray area assets. FDUSD (First Digital) is a prime example of this.

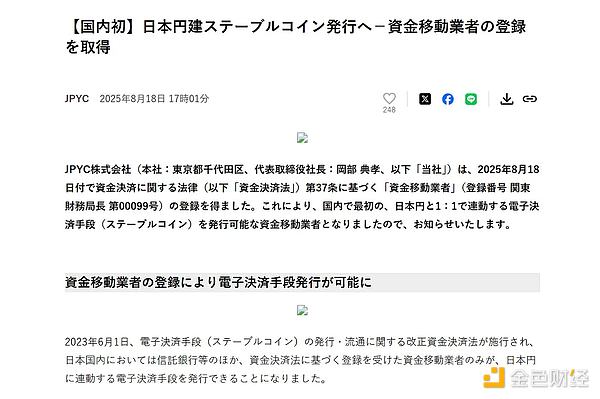

Japan

JPYC, the first approved Japanese yen stablecoin from JPYC Inc., is issued under a money transmitter license and backed by liquid assets such as government bonds. Japan's Financial Services Agency (FSA) plans to approve more such projects as early as this fall. JPYC has completed remittance business registration and plans to issue it on the Ethereum, Avalanche, and Polygon networks.

South Korea

A regulatory sandbox in South Korea is testing the use of a Korean won stablecoin in cross-border payments and B2B settlements.

The commonality is clear: regulated stablecoins aren't designed to replace USDT or USDC. Instead, they target scenarios where compliance and transparency are crucial. Their narrative is shifting from "gray liquidity for transactions" to "legitimate interface for global finance."

Different paths, same destination: Regulated stablecoins are becoming a parallel track to USDT - not to seize liquidity dominance, but to provide legal, auditable and regulator-friendly options for institutions, cross-border capital flows and daily applications.

What’s next?

By 2025, the biggest structural shift in traditional finance (TradFi) will be the widespread adoption of regulated stablecoins. Competition will shift from scale and trading volume to regulatory depth and real-world adoption.

Whether it is the regulations first introduced in Hong Kong or the stricter supervision of USDC and PYUSD in the United States, the signal they convey is the same: stablecoins that can truly serve global users and traditional capital are those that integrate off-chain compliance with on-chain architecture.

The basis of competition is shifting from “who holds the most dollar reserves” to “who can enter real-world use cases the fastest”: cross-border settlement, corporate treasury management, and retail payments. A group of compliance-first players is emerging.

For example: USD1

Relying on strong traditional capital and policy ties, USD1 has emphasized compliance and global applicability from the outset. With the political support of the Trump family, it achieved an astonishing "from zero to one" breakthrough in just six months.

Since March, its supply has surged to $2.1 billion, surpassing FDUSD and PYUSD to become the fifth-largest stablecoin in the world (CoinMarketCap).

USD1 is now listed on major CEXs including HTX, Bitget, and Binance, while PYUSD, despite being backed by PayPal’s brand, is still struggling for market acceptance.

At the same time, liquidity-as-a-service infrastructure is emerging, aiming to make stablecoins not only on-chain transaction tokens, but also globally callable settlement APIs.

In the near future, cross-border payments, corporate fund management and even personal consumption may find a new balance between USDT’s gray market liquidity and the whitelist system of regulated stablecoins.

From a broader perspective, this architecture is evolving towards a diversified, parallel structure:

USDT remains the liquidity engine of the global cryptocurrency market.

Yielding stablecoins satisfy capital growth needs.

Non-USD stablecoins introduce a multipolar narrative.

Regulated stablecoins are increasingly integrated into the real-world financial system.

Over the past decade, USDT has embodied organic, gray-zone growth, driving global cryptocurrency liquidity. Products like USDC have bridged the gap between gray and white. Now, with the enactment of the US GENIUS Act, relevant regulations in Hong Kong, and pilot programs in Japan and South Korea, regulated stablecoins are entering a genuine window of opportunity.

This time, stablecoins will no longer only serve on-chain users, they will appear in cross-border settlement, corporate fund management and daily consumption.

This is the essence of regulated stablecoins: transcending the cryptocurrency bubble and integrating into the routines of finance and daily life .