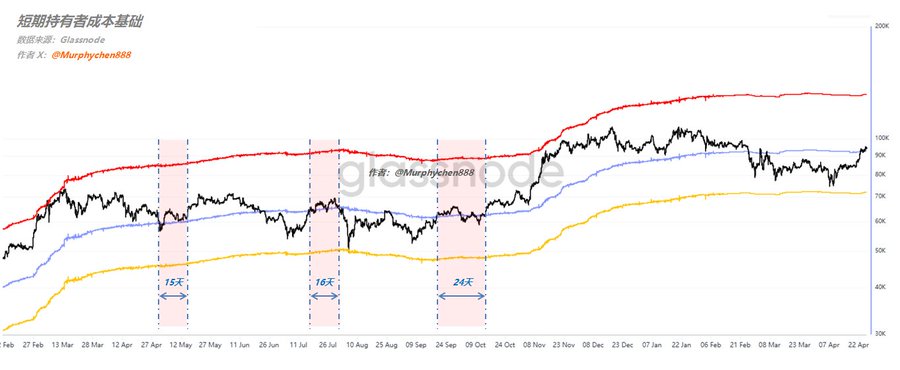

Previously, we mentioned that BTC has been hovering around the STH-RP level for 7 days since the 26th. This is due to a combination of factors: market liquidity, the tug-of-war between buyers and sellers, and shifting macro sentiment. But BTC obviously can’t stay stuck at this sensitive level forever. Historically, from an on-chain perspective, similar situations tend to resolve within 10-20 days (see Chart 1)—either with a strong rebound or even a reversal, or with a prolonged downtrend or accelerated correction. (Chart 1) When emotions are compressed to the extreme, we often see some minor bounces during this period. The key is whether BTC can break through the nearest resistance level. Right now, the average cost basis for short-term holders (<1 month and <3 months) has converged (see Chart 2), creating a double resistance zone at $112,700. (Chart 2) Short-term investors are more easily swayed by market sentiment compared to long-term holders. When their unrealized losses turn back to breakeven, they're more likely to add sell pressure to the market. That's why $112,700–$113,400 is the most critical level for any rebound. If BTC fails to break through, it’s likely to retest the STH-RP support. On the flip side, a smooth breakout would signal that these trapped holders still have confidence in the future and aren’t in a rush to sell. That would give us more reasons to be optimistic. 👇 👇 ‼️ This is for educational sharing only and not financial advice. ‼️ ------------------------------------------------- This post is sponsored by #Bitget | @Bitget_zh

This article is machine translated

Show original

Murphy

@Murphychen888

09-02

从8/29日开始算的话,BTC在STH-RP这根“短期筹码平均成本线”附近已经徘徊了7天了。从表面上看,似乎像是狗庄故意将价格控制在成本线上下等我们下注,但实际上是分歧让多空双方在这个敏感位置产生了激烈博弈。

这种现象在“投资者趋势信心指数”同样得以体现: x.com/Murphychen888/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content