After watching the parade, as a non-military spectator, I can only describe it in two words: Awesome! What about the market perspective? It's simple: strong power deters others from resorting to force. Only with world peace does everyone have the opportunity to prosper together.

Speaking of peace of mind, Trump finally showed up last night. After a week-long absence, many in the crypto were uneasy, wondering if something serious had happened. After all, he's a chatterbox, so a week of silence was certainly odd. Fortunately, it turned out to be a false alarm. Polymarket has slashed the probability of Trump stepping down this year to 7%. In other words, the path of vigorously developing cryptocurrencies over the next four years is secure!

Another big news: The SEC and CFTC have made a rare joint appearance, launching "Project Crypto" and "Crypto Sprint," respectively. What does this mean? It suggests that the US dollar is once again welcoming crypto companies back to the US. At this rate, US-based cryptocurrencies may see a collective rally.

WLFI starts off cold, but political resources are the real winner

When the US stock market opened last night, the WLFI treasury was completely ripped apart by the DWF market manipulation. US stock traders are accustomed to Circle's "three-day rally followed by a gradual decline," but DWF's initial performance was a complete letdown. Who could handle this? Despite destroying 50 million WLFI tokens on the first day, the market still couldn't hold up. Eric could only grit his teeth and claim, "It's up 20 times the public offering price," but unfortunately, those who held long positions in Heyue and spot markets were still trapped.

But I'm not panicking at all. The market right now is all about resources, especially political resources, and WLFI has no rivals in this area. Not to mention, it's navigating two top sectors: stablecoins and lending . I also participated in the public offering and haven't sold a single unit. My target price is at least 0.5U.

Market Share + V: Mixm5688

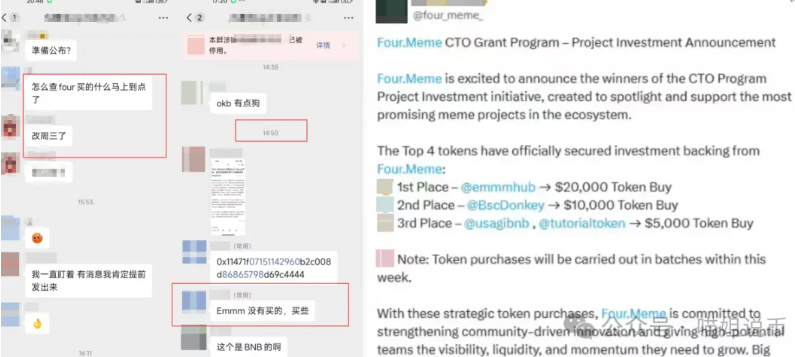

#emmm, from the moment Four announced their funding project to their first-place finish, I witnessed it all. I've been waiting in ambush for a month now, and the price has been rising steadily, with Four supporting it multiple times. Now approaching 20 million in market capitalization, with significant trading volume, it's likely to head straight for 30 to 50 million, perhaps even challenging the "large MC memecoin" position. I just added to my position. I haven't seen such a strong performer on the BSC chain in ages. I'm counting on it to continue its surge!

🥶 ETH is too weak, BTC is attracting money again

ETH's performance has been truly dismal over the past two days. ETFs, having just reopened after a three-day hiatus, saw a direct outflow of $130 million. Institutional buying has slowed, with BMNR increasing its holdings by 70,000, bringing its total holdings to 1.87 million. SBET also saw a surge to 837,000, but the overall momentum is far less pronounced than before. Market expectations have clearly cooled, with even renowned bull Tom Lee backing off, predicting only "5,500 in September, 9,000 in January," with no mention of a break above 10,000. There was a bit of good news yesterday: Yunfeng Financial purchased 10,000 ETH for its reserves.

Then the ETH Foundation immediately sold 10,000 coins, claiming it was "paying salaries." Hey, your R&D team doesn't need $50 million a year in salaries, does it? Wouldn't it be nice to raise more money and issue a new coin? What a terrible teammate! Now ETH/BTC has fallen below 0.039, while the BTC ETF has seen a net inflow of $300 million in a single day. Clearly, institutional funds have shifted to BTC, and ETH's one-man show is coming to an end.

Altcoin don’t have a treasury, don’t brag about their quality.

Recently, there has been a wave of "treasury wind" in the copycat circle:

- The Conflux Foundation is exploring collaboration with listed companies to establish a CFX treasury with a lock-up period starting from 4 years.

- Injective announced a financing of 100 million INJ reserves;

- Sonic Strategy secured $40 million in investment;

- Tron Inc's treasury received 110 million in new funds, with holdings exceeding 220 million;

- The BNB treasury also increased its holdings, increasing by 38,888 coins, or approximately US$33 million.

The reality is harsh: without a treasury and an ETF in the pipeline, you can't even call yourself a high-quality project, let alone a billion-dollar FDV. Furthermore, ETHZilla plans to deploy $100 million in ETH to EtherFi, which is a huge boon for the staking sector. Especially since Peter Thiel-related companies have already started putting ETH on-chain. If all of BMNR's 1.87 million ETH were staked, the staking protocol would take off immediately. In the short term, I'll be focusing on the staking sector.

Next, funds will pay more attention to the logic of "resources + policies". Everyone should either hold on to the leader or keep an eye on the track, and don't be blinded by the false excitement.

That’s all for now! If you’re still unsure about your direction in the crypto, why not join me in making a plan? I’ll wait for you to come. Otherwise, in the next wave of market, you may be the one standing on the other side again.