Since the beginning of this year, the stock tokenization track has suddenly become lively.

Projects such as Robinhood, xStocks, Backed, and Swarm have entered the market, each trying different paths.

Why are giants eyeing stock tokenization?

The market size is indeed attractive. The US stock market has a market value of $60 trillion, but global crypto users, especially non-US users, have never had the opportunity to invest in US stocks conveniently.

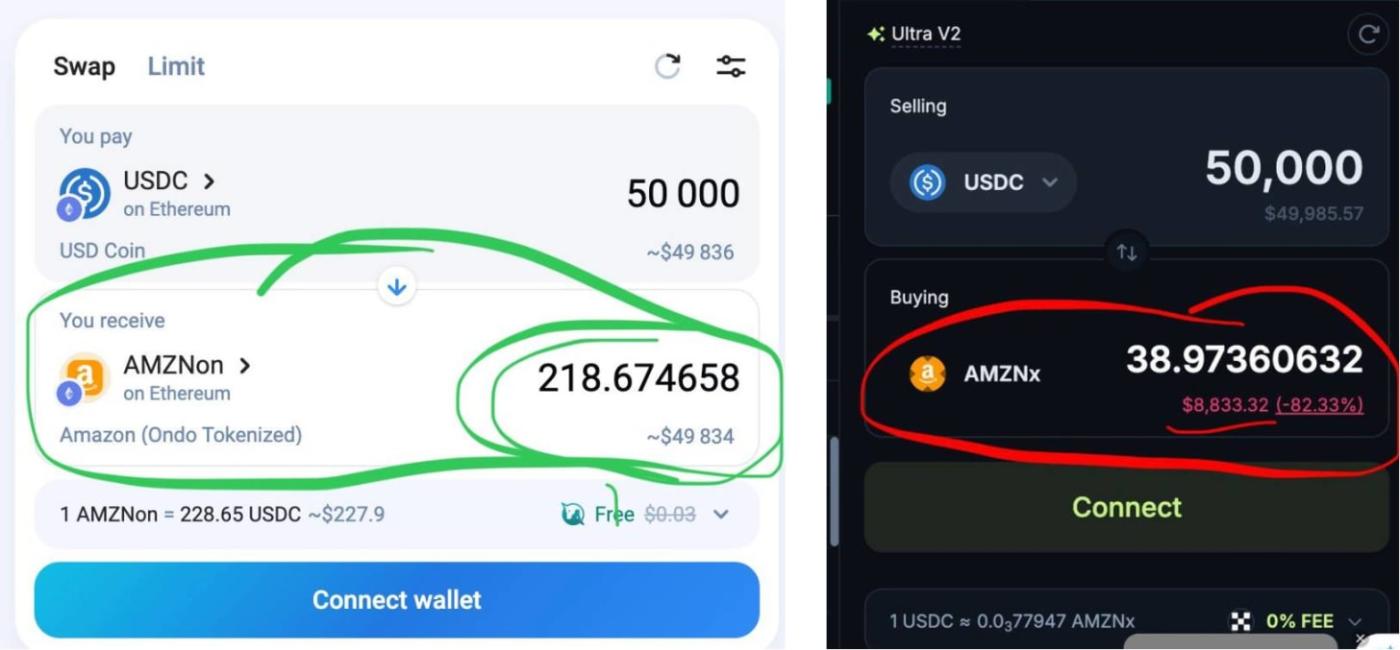

The opportunity is huge, and there are many players. However, problems always exist: either tokens are locked in the platform and cannot be withdrawn, or there is a serious lack of liquidity resulting in huge slippage, or the coverage of assets is too limited to achieve scale.

"Free circulation" and "liquidity depth" are still key issues that need to be urgently addressed in this field.

On September 3, Ondo Finance, a leading project in the RWA sector, launched Global Markets, which may be a powerful solution to these problems and a challenger to the current market landscape.

When introducing this new product, its Official Twitter said something meaningful:

" Not all tokenized stocks are born equal."

On the first day of the product launch, Ondo demonstrated extraordinary scale.

This reminds people of stablecoins.

The "stablecoin moment" of stock tokenization may really be coming.

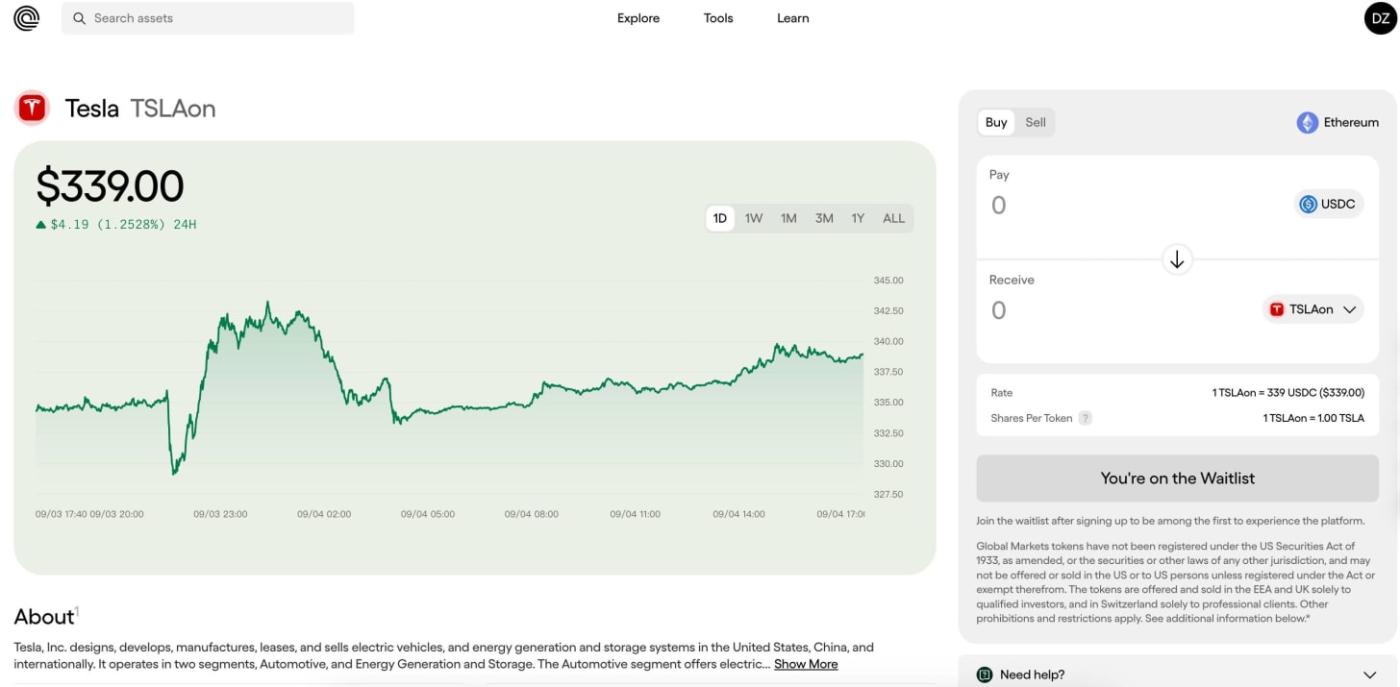

Buy stocks like buying coins

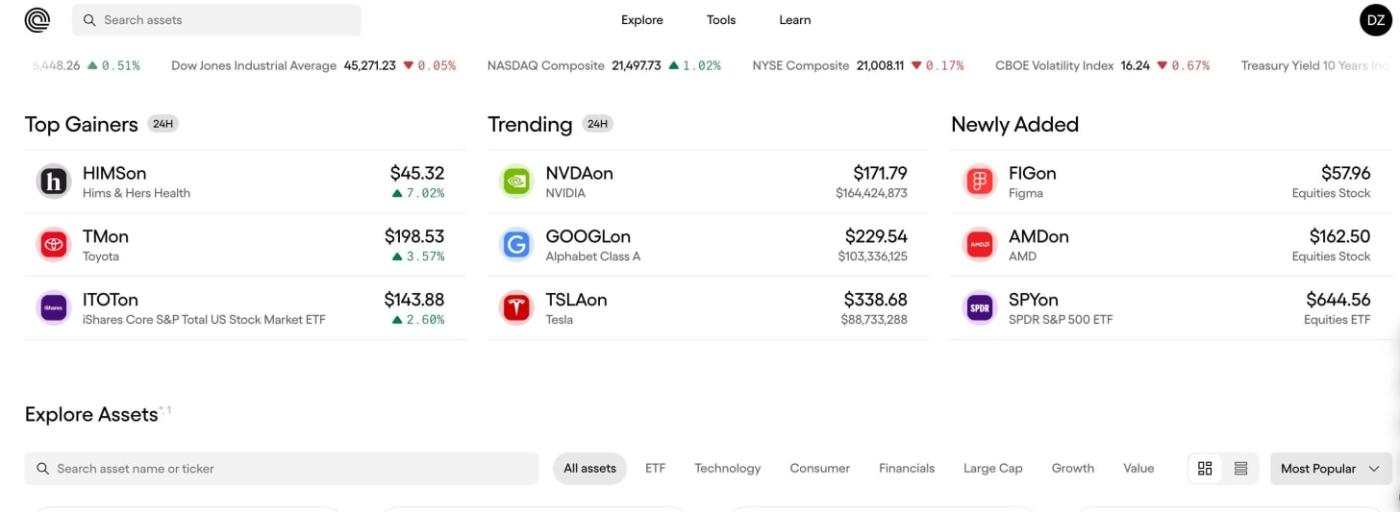

When you open the Ondo Global Markets interface, the first feeling is familiarity and simplicity.

According to Ondo Finance’s official documentation , Ondo’s tokens not only track stock prices but also include dividends.

In layman's terms, if Apple pays a $1 dividend, the system will automatically use that $1 (after taxes) to purchase more Apple stock. So, over time, one AAPL share might equal 1.05 actual Apple shares, naturally resulting in a higher price. This is more like automatically enabling a "dividend reinvestment" feature.

How are deep liquidity and 24x5 trading achieved?

Instant casting, embracing Nasdaq's trading depth

Let’s first look at the issue of liquidity.

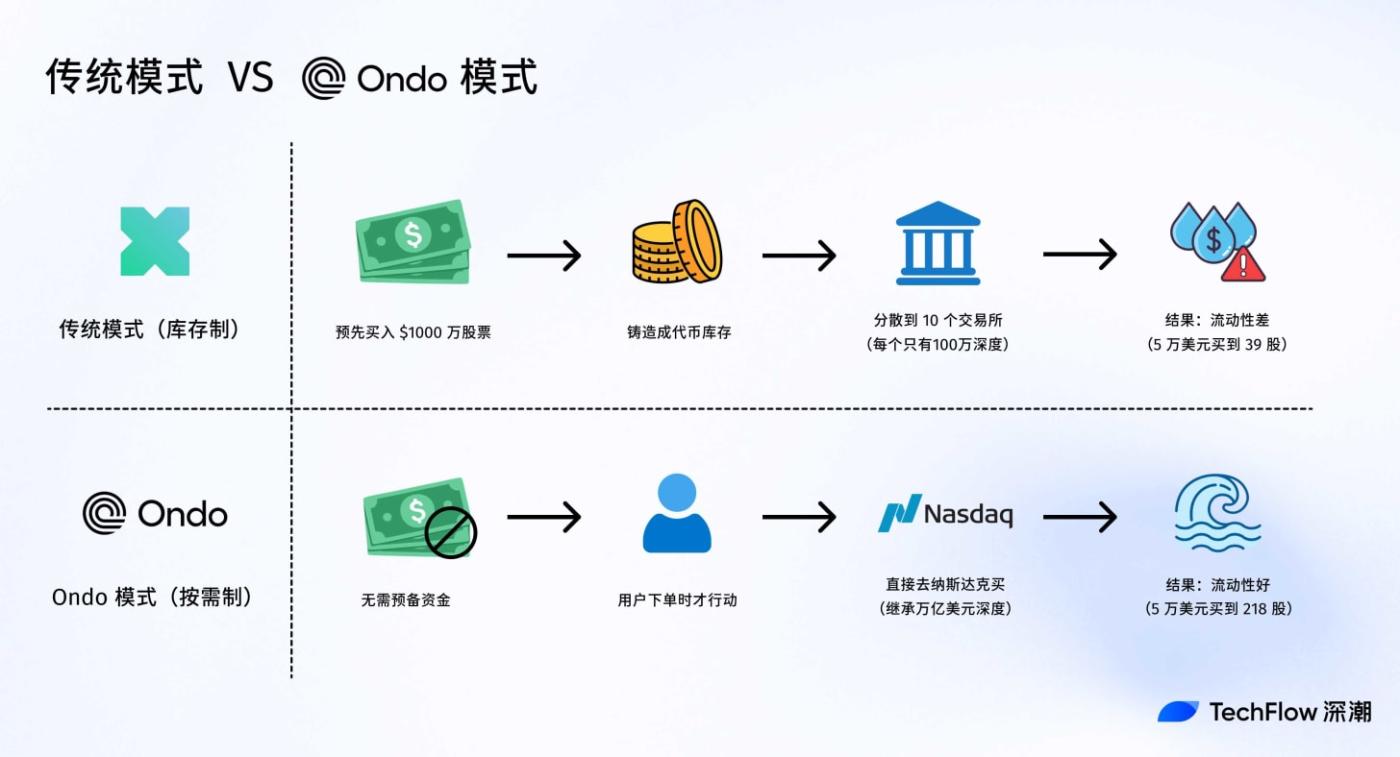

Ondo CEO Nathan Allman’s tweet at the time of the product launch actually explained this problem very well. The key lies in two completely different tokenization operating models.

Existing platforms operate like a supermarket model : they require pre-orders. Market makers pre-buy stocks, mint tokens, and then distribute them to various exchanges. The problem is that supermarkets have limited shelf space and capital. If someone wants to buy $50,000 worth of Amazon stock, but there's only $10,000 in stock on the shelf, they're either unable to buy it or the price will be inflated to an exorbitant level.

Ondo Global Market operates similarly to a food delivery service: When a user orders Amazon stock, the platform "sources" the actual stock from Nasdaq and mints tokens. When the user wants to sell, the tokens are immediately destroyed and the stock is sold on Nasdaq. With no inventory restrictions or shelf space requirements, Ondo Global Market inherits Nasdaq's daily trading volume of hundreds of billions of dollars.

Nathan calls this model "instant, atomic minting and burning." More importantly, this model can be easily expanded to hundreds or even thousands of stocks because there is no need to prepare a pool of funds for each stock in advance.

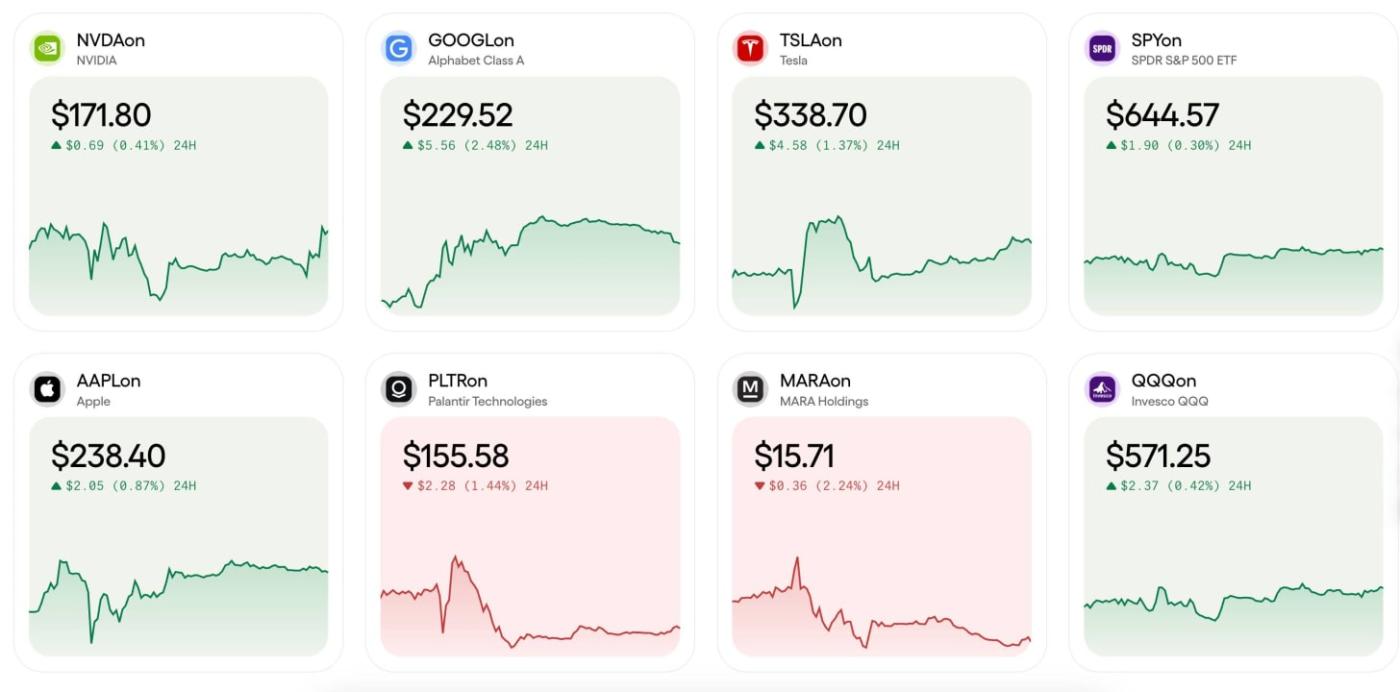

24/5 trading, 24/7 transfers

Official documents show that trading hours are from 8:05 PM Sunday to 7:59 PM Friday (EST), covering almost the entire week. How is this possible?

The answer is a two-tier mechanism. The first tier is the minting and redemption tier, which relies on the traditional market.

Ondo not only integrates the regular trading hours of the NYSE and Nasdaq (9:30-16:00), but also the pre-market hours (4:00-9:30), after-market hours (16:00-20:00), and the overnight hours (20:00-4:00) offered by alternative trading systems like Blue Ocean. Together, these provide 24-hour coverage on weekdays.

The second layer is the token transfer layer. For example, TSLAon, the tokenized version of Tesla's stock, is a standard ERC-20 token once minted. It can be transferred between users 24/7, just like USDT. Even on weekends when traditional markets are completely closed, users can still trade tokens with each other.

Of course, the document also mentions that liquidity during the overnight period is relatively low and large orders may need to be split.

Price difference: transparent profit model

"We do not charge any minting, redemption or management fees."

This sentence in the FAQ document already makes it clear that Ondo doesn't make money from these aspects, but the second half of the sentence is equally important: "The price may differ slightly from the price at which we buy and sell the underlying shares."

This "slight difference" is Ondo's source of income.

In financial markets, there's always a slight difference between the bid and ask price, representing the cost and reward of providing liquidity. Traditional brokerages also have a spread, but they also charge an additional $5-10 commission. Ondo only collects the spread, not the commission.

Specifically, when Tesla's stock price is $100, you might pay $100.01 to buy through Ondo and receive $99.99 for selling. This $0.02 (0.02%) difference is far lower than the total cost of "spread + commission" (typically 0.5-1%) at traditional brokerages.

This pricing model is common in markets like foreign exchange and gold. Ondo keeps the spread extremely low while eliminating all other fees.

For users, this means that the total cost of trading $1,000 worth of stocks may be only about $1, which was unimaginable in the era of traditional brokerages.

Comparison with current competitors

Stock tokenization is nothing new. From Mirror Protocol in early 2021 to Ondo Global Markets today, you can see that this sector has undergone a clear evolution.

The most conservative approach is for the platform to build its own "wall", with tokens circulating within the platform and unable to be withdrawn to personal wallets. A typical example is Robinhood.

This model essentially just moves traditional brokerages onto the blockchain. Beyond the potential cost savings, it doesn't truly leverage the advantages of blockchain. The user experience is similar to trading on a brokerage app, except that blockchain technology may be used in the background.

The second category is xStocks. Tokenized US stocks can be freely transferred on the chain, but the liquidity is too poor, and large slippage makes large transactions a problem.

Ondo may represent the third generation of thinking: not to build a trading platform, but to build infrastructure.

Ondo solves the core pain point of liquidity through its instant minting mechanism. More importantly, it has been designed from the outset to integrate deeply with DeFi, such as accepting Morpho as collateral and aggregating transactions with 1inch.

Robinhood-like : Prioritizing compliance at the expense of openness

xStocks : Pursuing openness first, but constrained by liquidity

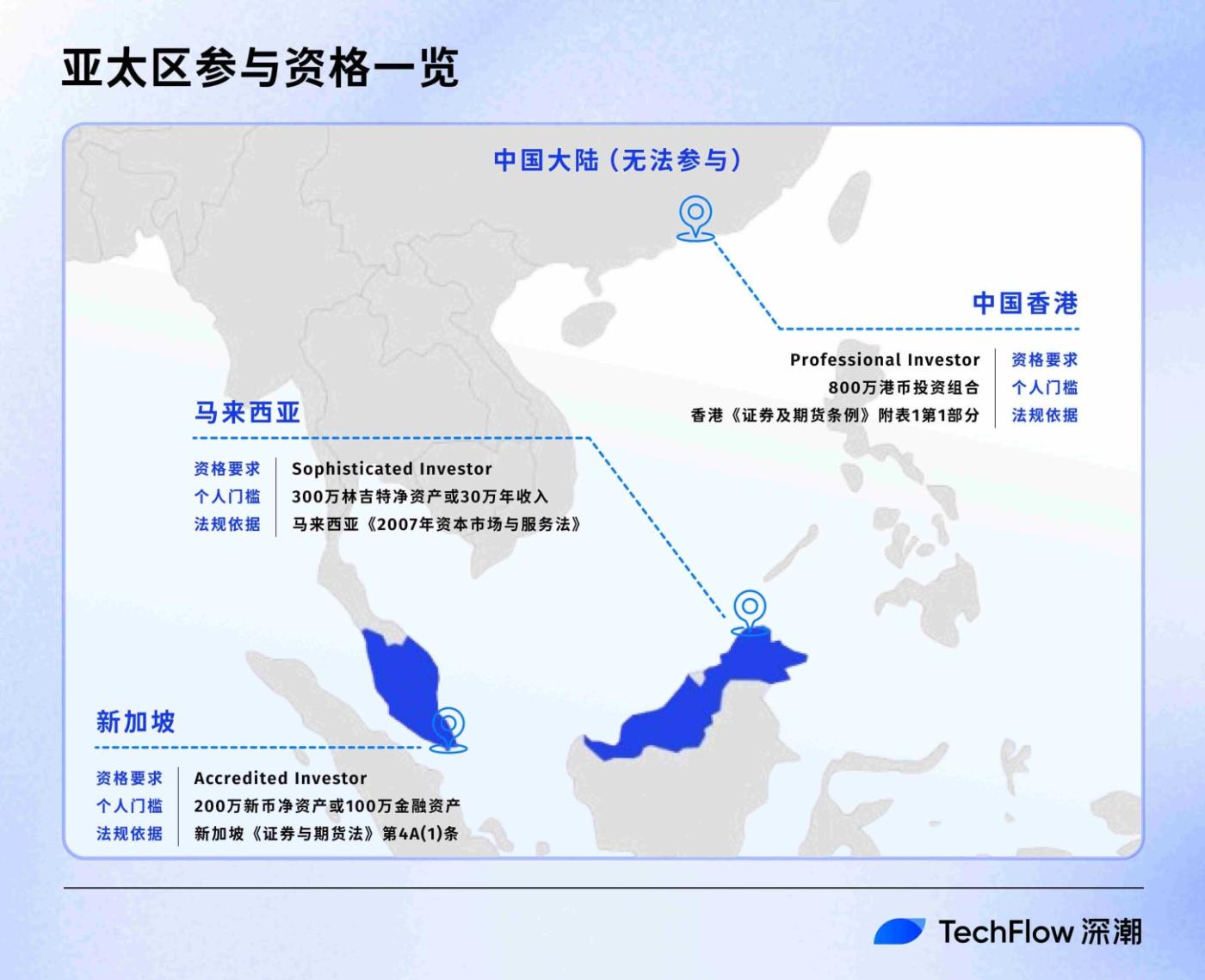

Asia Pacific Participation Eligibility List

The on-chain revolution is happening

If you look at the list of partners of Ondo Global Markets, you will find even greater ambitions.

Subscribe to the channel: https://t.me/TechFlowDaily

Telegram: https://t.me/TechFlowPost

Twitter: @TechFlowPost

Join the WeChat group and add the assistant WeChat: blocktheworld

Donate to TechFlow to receive blessings and permanent records

ETH: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A

BSC: 0x0E58bB9795a9D0F065e3a8Cc2aed2A63D6977d8A