Original article | Kyle ( @0xkyle__ )

Compiled by Odaily Odaily( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

Editor's Note: One of the hottest and most intriguing stories in the crypto industry recently has been Collector Crypt's attempt to bring the collectible card game (TCG) to blockchain. Its native token, CARDS, has seen a near tenfold increase in value in a short period of time, prompting renewed thinking about the potential of integrating crypto with real-world collectibles. In this article, author Kyle focuses on Collector Crypt's core competitive advantage, arguing that it represents a project with far greater depth and fortifications than the typical RWA narrative. Due to the length of the original article, Odaily Odaily has edited and condensed the content. It should also be noted that the author personally holds CARDS, so readers are advised to exercise independent judgment.

Anyone who thinks CARDS is “just a crypto RWA” is seriously underestimating the value of this project. While this isn’t entirely wrong, it oversimplifies the business model that Collector Crypt has built.

I believe Collector Crypt actually has multiple moats, which can be summarized as follows:

- Token Barrier

- Strong distribution and logistics capabilities

- The interests of the founder and the project are highly aligned

- Unique supply-side advantages

- A highly resilient business model

The importance of these factors cannot be underestimated. The explosion of the TCG (Trading Card Game) narrative over the past few days has exemplified a classic crypto phenomenon: everyone is eager to dig for gold and replicate existing successes. However, many fail to realize that this isn't a product that can be easily replicated.

In fact, I'd argue that, unlike SaaS-driven AI Agents (which inherently offer advantages in scalability and replication), replicating a TCG RWA is 1,000 times more difficult than imagined. This is because it involves a vast logistics network and deep real-world connections, which is completely different from most "purely digital" crypto projects. Simply writing a few lines of code and forking a feature won't get a TCG business off the ground.

In my opinion, a strong business model coupled with a high-growth market creates a compounding advantage that becomes increasingly difficult for competitors to replicate over time. Collector Crypt's defenses far surpass those of most crypto projects, and it also has a time advantage that others don't possess: they've spent years building the tedious yet crucial infrastructure—the procurement network, the authentication process, the logistics system. More importantly, their experience handling $75 million in transactions has earned them market trust and reputation.

TCG Market Opportunities

Before we delve into Collector Crypt, let's first examine the TCG market opportunity. While I'm no industry expert, and my personal experience is limited to playing Duel Masters as a child, I see immense potential. Here, we'll focus on Pokémon cards—the current core product of CARDS and the cornerstone of the entire TCG industry.

Pokémon cards have seen a cumulative increase of 3,261% over the past 20 years, the highest growth rate among all card categories. More broadly, the art, automotive, and collectibles markets are even larger than the gold market. The TCG market is projected to reach $7.43 billion by 2024 and is expected to continue expanding at a compound annual growth rate of 7.86%.

However, more important than the cold numbers are the social trends and logic behind these data. Based on my observations, there are three key trends that are reshaping this market:

Wealth Transfer between Millennials and Generation Z

Over the next decade, global wealth will experience the largest intergenerational transfer, with Millennials and Generation Z gradually taking control of asset allocation. This group is far more receptive to collectibles, trendy toys, and digital assets than previous generations, and they are more willing to invest in them for emotional value and identity. Collector Crypt's presence in the TCG (trading card game) market aligns perfectly with this generational shift in preferences .

A “Labubu-ized” society

Driven by social media and consumerism, young people are embracing items with symbolic meaning, such as Labubu, blind boxes, and limited-edition sneakers. Collecting has become more than just a hobby; it's become an outward expression of social identity and cultural identity. Collector Crypt taps into this wave of "symbolic consumption" by combining cards and tokens, enabling collectibles to satisfy both emotional value and financialization and liquidity.

Growth continues after the bubble

The NFT market frenzy has faded, but the demand for collectibles like trading cards remains. Instead, players, having weathered the bubble, prioritize scarcity, true value, and long-term returns. Collector Crypt has emerged as a new platform within this context: fulfilling the financialization needs of digital asset players while capitalizing on the steadily growing collectibles market.

Collector Crypt's Moat

1. Token Moat

CARDS is the native token of Collector Crypt. Here, the existence of the token is justified:

- This is a high-growth business in a high-growth industry with strong thematic intersection with the crypto industry;

- It provides highly liquid exposure and is a unique offering in the space, which is exactly what everyone wants to be in.

Pokémon card players, crypto traders, and sneaker collectors are often closer than one might think. Those who understand the value of a PSA 10 Charizard are practically the same people who understand the value of digital tokens. Crypto traders are inherently speculative, and when speculation is combined with TCGs, tokens can naturally unlock previously unmet demand. Not everyone wants to buy Pokémon cards directly, but if a token could somehow represent the entire TCG market, it would be extremely attractive.

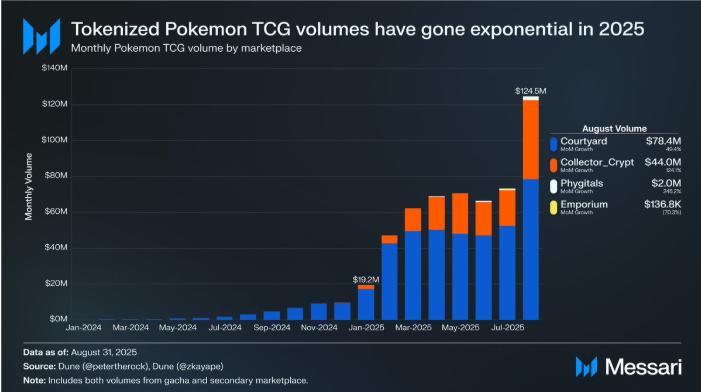

Data has confirmed this trend - by 2025, the volume of card tokenization transactions will grow exponentially.

CARDS provides liquidity exposure to this vertical, a crucial component of the "hyperfinancialization" narrative. Crypto's most successful products are all centered around financialization: whether it's DeFi, perpetual contract DEXs, or prediction markets. Today, the Pokémon market has become one of the hottest alternative assets in the world.

At the same time, CARDS is backed by a fast-growing business with solid fundamentals. Other tokens often only bet on a specific theme without fundamental support, offering only beta exposure at best and failing to capture alpha. Currently, CARDS is the only asset in the market that individual investors can liquidly bet on: Courtyard lacks a token, and Phygitals' trading volume is insufficient, making any token issuance lack investment value.

Therefore, when “growth fundamentals” are combined with “huge market size”, CARDS becomes a “golden egg” - a fundamentally sound, continuously growing token located in an industry with a large and expanding TAM (total addressable market).

2. Deep distribution and logistics moat

Many people overlook this point. The core reason why Collector Crypt is difficult to copy is its advantages in distribution and logistics .

First, Collector Crypt is one of the largest buyers of cards on eBay, purchasing approximately $500,000 worth of cards per week. They developed the world's first end-to-end eBay auction crawler, capable of monitoring thousands of auctions daily, setting prices using proprietary algorithms, and simultaneously bidding on hundreds to thousands of cards. No other team in the world has this capability.

Furthermore, Collector Crypt is already the largest buyer at most auction houses they participate in. The relationships and reputation built through long-term, large-scale purchases are a barrier that is extremely difficult for newcomers to replicate.

More importantly, they are highly efficient throughout the entire process of procurement, logistics, and on-chain minting. This isn't just about writing code; it's about extreme operational efficiency: inventory is received, authenticated, scanned, and uploaded to the blockchain in the shortest possible time. This in itself is an insurmountable moat.

Collector Crypt employs professional authenticators to oversee the verification process and has established a comprehensive after-sales service. For example, CEO Tuom Holmberg mentioned in a podcast that if a card sold is found to be counterfeit, Collector Crypt will provide a 100% refund. In an industry rife with fraud, this kind of integrity is particularly valuable.

These abilities are not acquired overnight, but are the result of years of accumulation.

3. Founder Moat

Collector Crypt's success is inseparable from its CEO, Tuom Holmberg. With decades of experience in the TCG industry, he is a man of unwavering principles and a deep passion for cards. A former biotech executive, he ultimately chose to pursue TCGs, a lifelong passion.

Even more remarkable is that he used all of the raised funds to purchase cards, rather than enjoy them for personal use. He still drives a used 2021 Prius, yet he has led Collector Crypt to $75 million in revenue. He locked up his tokens for over 12 months, and despite numerous private acquisition offers, he remained steadfast in his integrity and long-term vision.

This kind of founder-market fit is extremely rare, impossible to fake, and difficult to compete with. When a founder truly loves their business and reinvests every dollar back into building it, competitors aren’t just competing against the company; they’re competing against their life’s work.

4. Resource Acquisition Moat

Collector Crypt has a clear advantage in card resource acquisition, particularly in offering high-value prize pools. Many users report that Collector Crypt's card draw rewards are more cost-effective than those on platforms like Phygitals and Grailed. This is crucial for a card draw system that relies on the "80/20 rule": 20% of rare rewards drive 80% of trading volume. The ability to source the best cards and contribute to the prize pool directly determines the platform's trading activity.

This is especially important for core players. Heavy users tend to avoid platforms that stock low-quality or ungraded cards. Collector Crypt excels in this regard, allowing it to attract "whale" users and drive the majority of trading volume, just like top exchanges or perpetual DEXs.

5. Stress-Resistant Business Model

Ultimately, these advantages converge into Collector Crypt's dominance in the market.

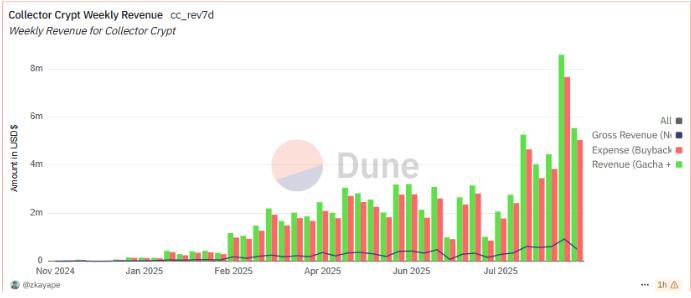

Image source: dune.com

Compared to its competitor Courtyard, which raised $43 million, Collector Crypt has raised less than $3 million, yet has already achieved two-thirds of its revenue, relying solely on Pokémon cards.

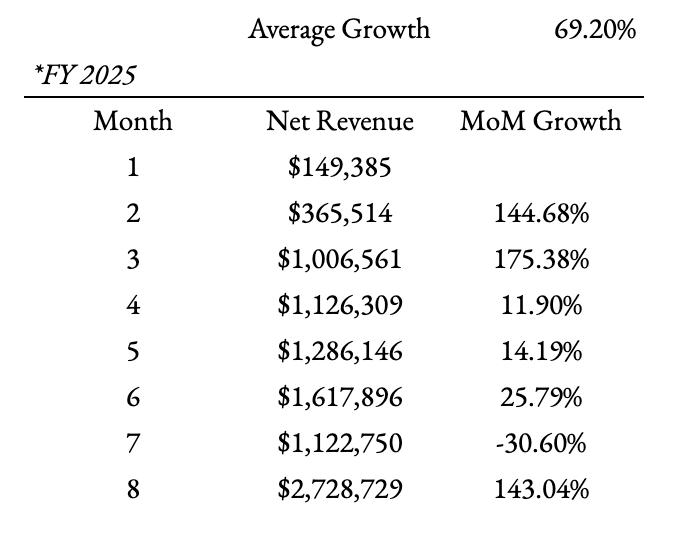

All of this happened in the past eight months, with Collector Crypt's average monthly net revenue increasing by 69% month-over-month, and this was achieved in a bear market environment.

Collector Crypt is profitable: with $75 million in revenue, it has generated $7–10 million in profit , making it a truly cash-generating product.

Most importantly, the unit economics are excellent, especially for Gacha. For every $50 a user spends, their expected return is $53.50. Collector Crypt's profit comes from buying back unwanted cards at a 15% discount. This ensures positive expected returns for users while also allowing the platform to generate sustainable profits.

With the launch of sports cards , Collector Crypt's total addressable market (TAM) will further expand. More importantly, this model is highly scalable: they've gone from zero to $75 million in revenue in less than two years, with a lean team.

In summary, Collector Crypt is a high-quality business with strong barriers to entry.

catalyst

Beyond these barriers, Collector Crypt has clear growth catalysts:

Horizontal expansion to other IPs

The biggest growth driver in the future will be expansion into more categories, such as NBA and Magic: The Gathering (MTG).

- MTG accounts for approximately 20% of the TCG market (Pokémon accounts for approximately 65%). A successful introduction to MTG would not only allow Collector's Crypt to capture a new audience but also strengthen its position as a "bridge between card digitization." The user spillover effect between different IPs would further enhance overall liquidity.

- NBA cards can reach a wider range of mainstream sports fans and attract a mass audience beyond the core TCG circle.

Risk resistance brought by audience diversity

Currently, Collector Crypt is still highly dependent on Pokémon (~65% market share). By expanding into areas such as MTG and NBA, Collector Crypt is no longer just a "Pokémon platform," but a comprehensive collectibles platform with a more resilient user and revenue structure, and its network effect will continue to grow.

risk

Inventory risk

The biggest issue right now is insufficient inventory supply—cards are sold out as soon as they're released, with demand far outstripping supply. While this is a "good problem," it will still limit growth. The market has full confidence in CEO Tuom Holmberg's execution and believes he can find a solution.

Valuation risk

The current valuation of approximately $400 million FDV seems high.

On the other hand, if the inventory issue is resolved and the platform successfully expands into larger markets such as sports, a valuation of $400 million is not outrageous. More importantly, only about 3.5% of the tokens will be unlocked in the next year, and the actual circulating market value accounts for only 8.11% of FDV.

in conclusion

Collector Crypt is a business that combines high growth, strong fundamentals, a moat, and a clear expansion path.