Hedera 's price appears to have reached saturation point, and the altcoin is showing signs of a potential recovery.

At $0.216, HBAR is trying to stabilize after recent declines. This recovery could trigger large liquidations in the market, creating both opportunities and risks for traders.

Hedera Traders Should Be Worried

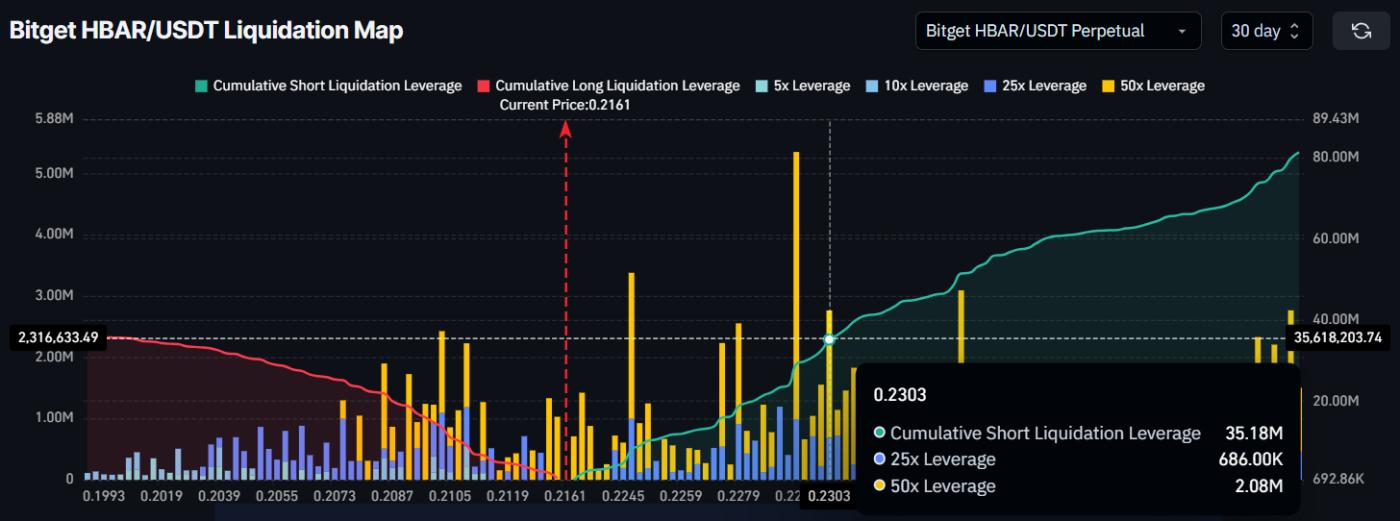

The liquidation map shows that over $35 million in short positions could be liquidated if HBAR rises to $0.230. This development could create a major short squeeze, potentially fueling bullish momentum across the market. This would give HBAR an opportunity to extend its rally.

For traders, this means that a move above $0.230 could bring higher volatility. While liquidations would add momentum to the uptrend, they also represent a key price zone.

A successful push above this level could increase Capital as bullish investors try to capture the upside opportunity.

Want more information on Token like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

HBAR Liquidation Map. Source: Coinglass

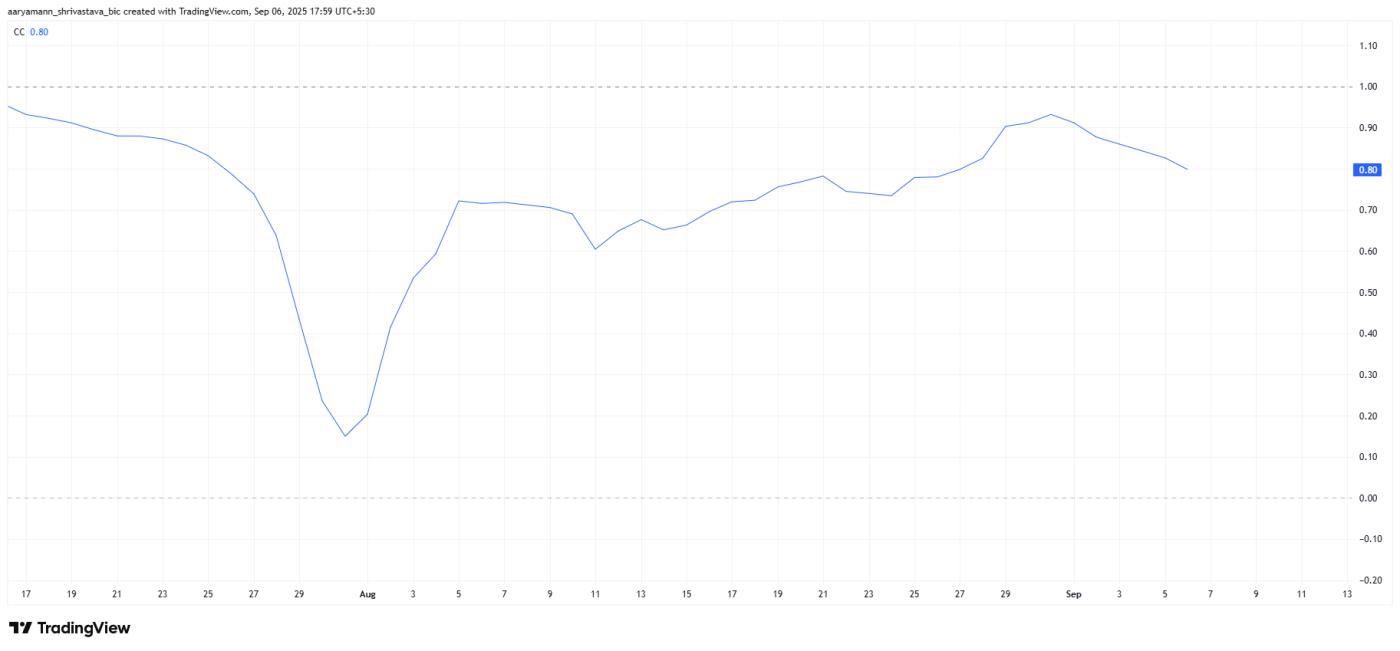

HBAR Liquidation Map. Source: CoinglassOn a broader scale, Hedera 's trajectory is closely tied to Bitcoin. The altcoin has a 0.80 correlation with BTC, indicating a strong price relationship.

As long as Bitcoin maintains support above $110,000, the price of HBAR is likely to benefit from positive spillover effects.

This correlation gives HBAR some protection against downside risk. With Bitcoin stabilizing in the six-figure range, Hedera could use this momentum to test higher resistance levels. BTC ’s trend will be Vai in determining whether HBAR can sustain the rally or remain range-bound.

HBAR 's correlation with Bitcoin. Source: TradingView

HBAR 's correlation with Bitcoin. Source: TradingViewHBAR price is facing resistance

HBAR is trading at $0.216, just below the $0.218 resistance level. This barrier has proven difficult to overcome in recent days, but a breakout could allow HBAR to build momentum towards higher targets.

The next important resistance level is at $0.230. If HBAR reaches this level, the liquidation of over $35 million worth of short positions could occur. This short squeeze scenario is likely to push the altcoin higher towards $0.244.

HBAR Price Analysis. Source: TradingView

HBAR Price Analysis. Source: TradingViewHowever, if the bullish momentum stalls, HBAR could consolidate in the $0.218 to $0.205 range. This sideways move would invalidate the immediate bullish outlook and delay the breakout, leaving HBAR vulnerable to further stalling.