Berachain's PoL (Proof of Liquidity) mechanism is one of its most recognizable innovations. By deeply embedding DeFi's incentive logic into the consensus layer, it not only injects sufficient liquidity into the underlying network and ensures security, but also effectively drives the growth of ecosystem applications and creates diverse and lucrative profit opportunities for users.

In particular, the recently launched PoL v2 upgrade introduced a new native economic model: users can stake BERA natively in Berahub. At the same time, 33% of the original bribe income will be repurchased as WBERA and redistributed to BERA stakers, forming a continuous reinvestment mechanism. This mechanism significantly improves the sustainability of staking returns and allows Berachain users to obtain more diversified income paths while participating in network governance.

Because of this native DeFi design, currently holding and using BERA assets on Berachain can already achieve highly composable income strategies, truly achieving "killing two birds with one stone".

Composability return path

In fact, many CEXs have already launched wealth management staking products. Gate and Bitget have already integrated Berachain native staking, offering yields of approximately 73.2%, and top CEXs will soon be integrating this week. CEX staking is suitable for users who only trade on CEXs and are unfamiliar with on-chain operations. However, this approach eliminates some of the opportunities for native, combinable, and re-earning strategies on the chain.

Therefore, if you hold BERA and choose to capture multi-layered profit opportunities on the chain yourself, you can often obtain more advantageous compound returns.

The following are examples of combinable income ideas:

Idea 1:

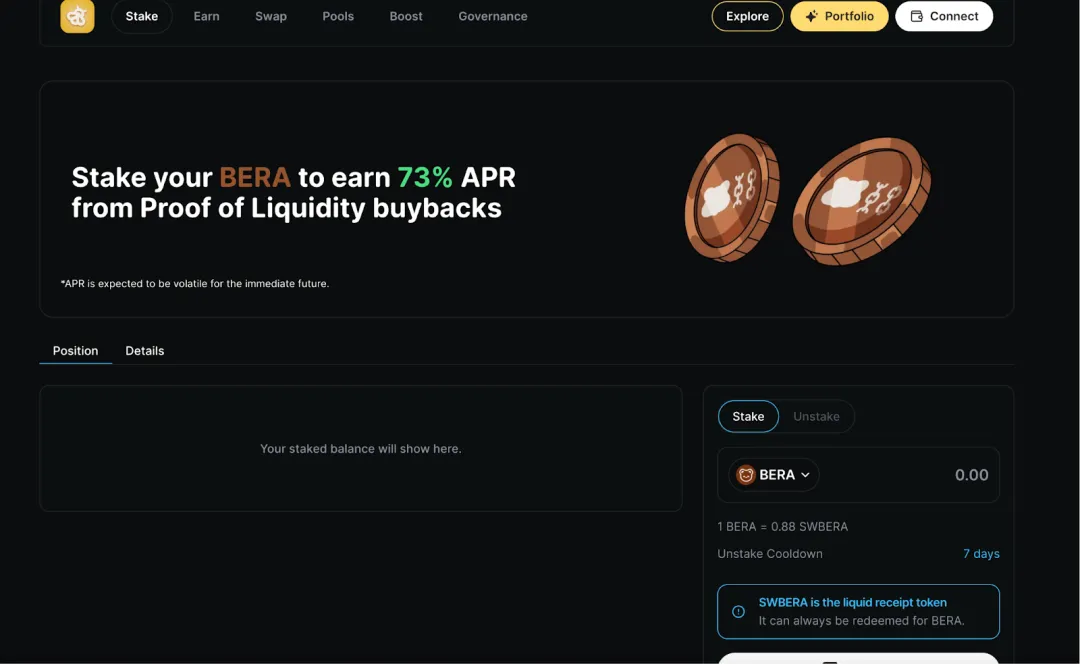

Currently in Berachain's PoL v2, its BeraHub supports native staking of BERA assets. The current yield is about 73% (automatic reinvestment), and after completing the staking, we will obtain the staking certificate sWBERA asset.

After completing the pledge and obtaining the sWBERA certificate, we can combine sWBERA with other assets in other DeFi protocols on Berachain to form LPs to obtain a new layer of income.

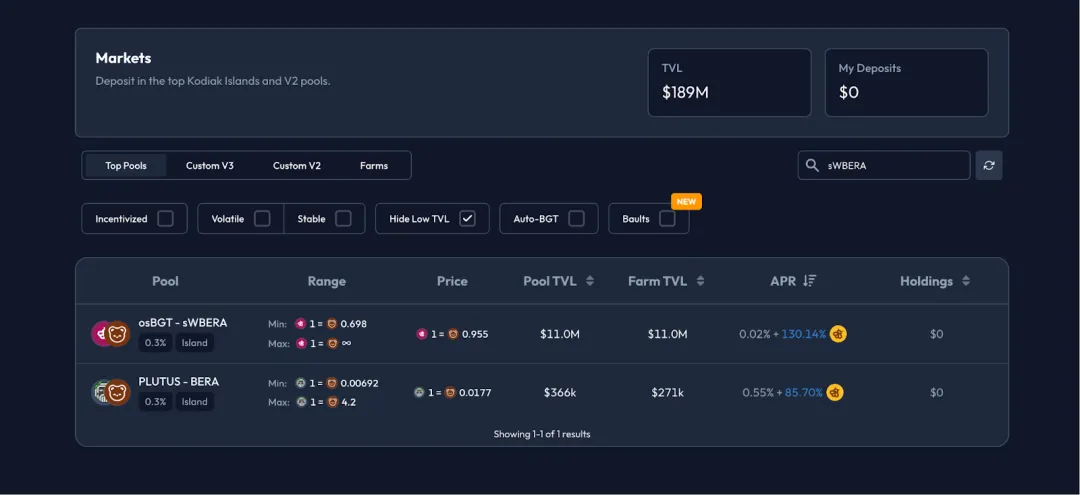

For example, there is the osBGT/sWBERA LP pool on Kodiak, and the overall APR is 129% (this includes transaction fee distribution, Farming, and the comprehensive incentives of the governance token BGT).

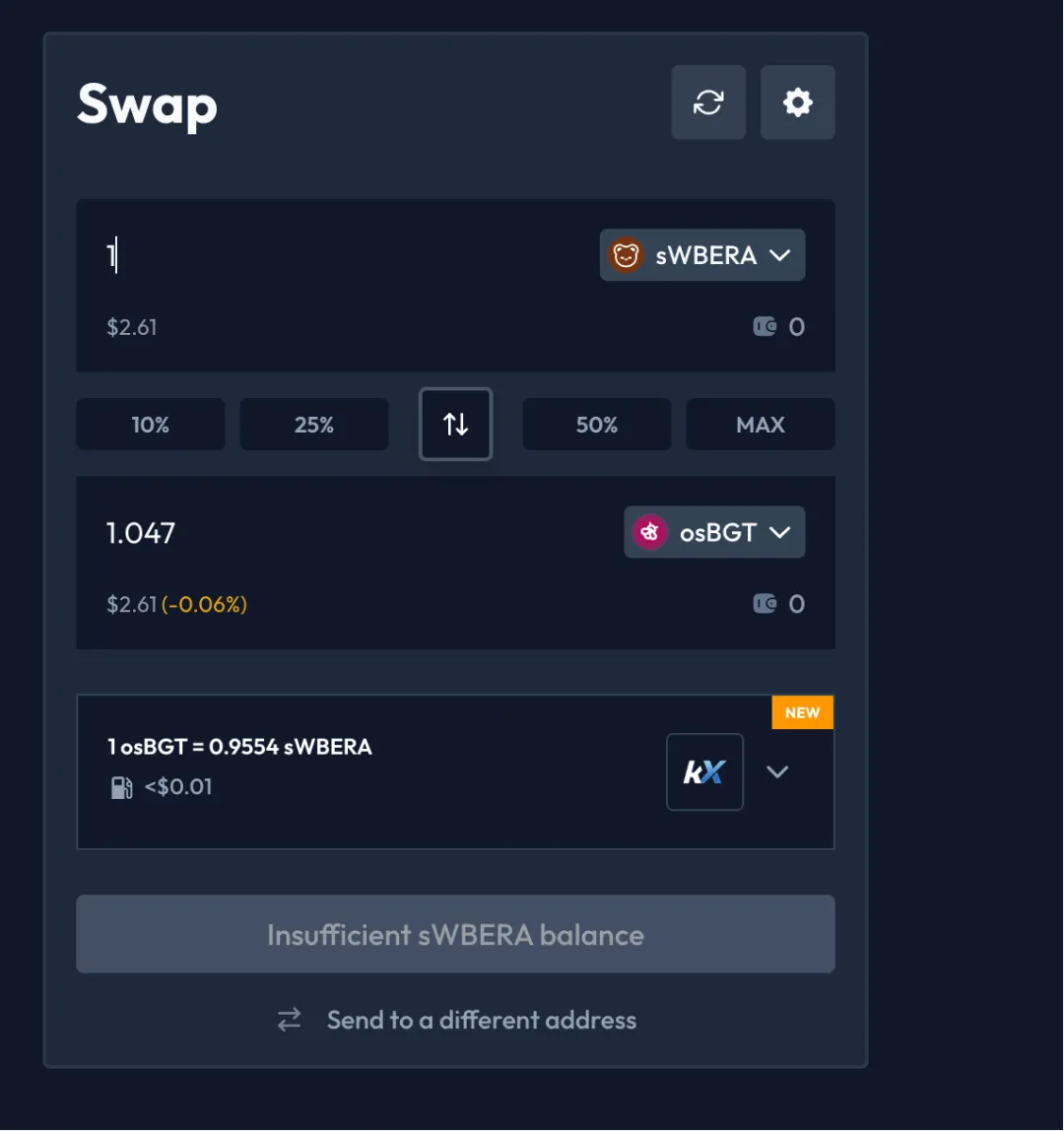

We can swap part of sWBERA to osBGT via Swap on Kodiak.

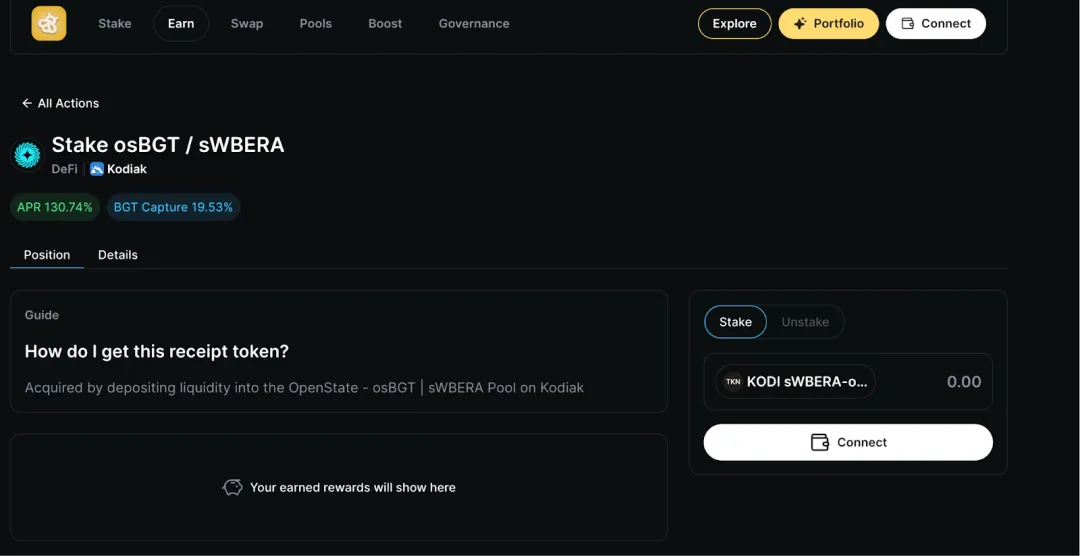

After acquiring osBGT assets, we can provide LPs in proportion to the osBGT/sWBERA assets in the Liquidity section of Kodiak. However, after we obtain osBGT/sWBERA assets, we need to further pledge the LP on Berahub, after which we can fully receive the benefits.

In fact, in the above profit path, we have achieved multiple benefits:

- BERA assets are staked in Berahub, with an APR of approximately 73%

- osBGT/sWBERA LP income and BGT governance rewards, the yield is about 130%

- Kodiak does not have a TGE yet, but using Kodiak may result in potential airdrops in the future.

Idea 2:

We can stake BERA in the protocol on Berachain and continue to form LPs in pools with considerable returns (similar to the above idea). Infrared Finance is recommended here.

First, we can pledge BERA on Infrared Finance to obtain iBERA, which has a basic APR of about 3.2%.

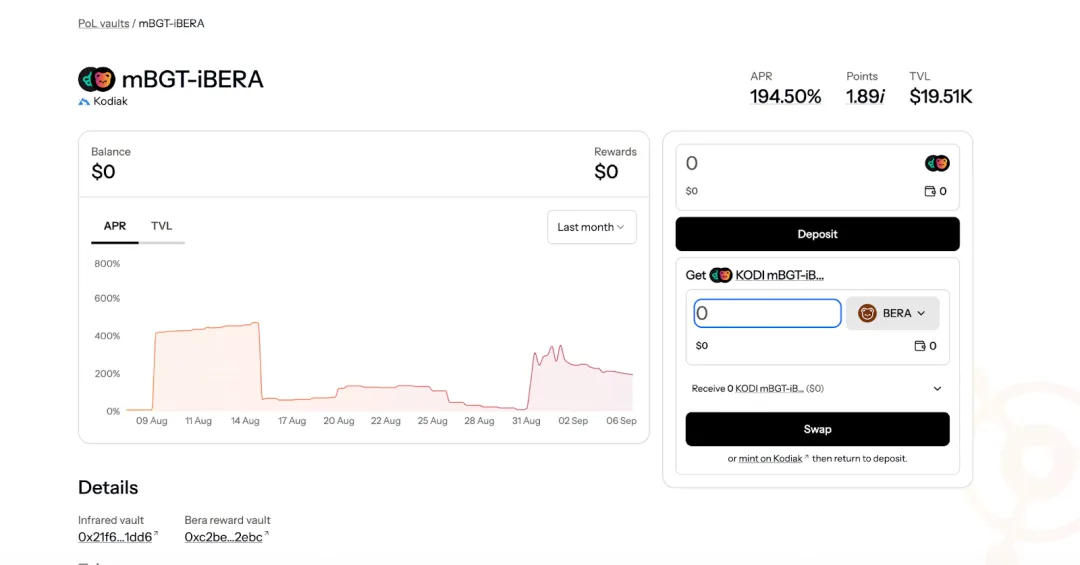

After obtaining iBERA, we can further form LP with iBERA and other assets. Infrared's PoL Vaults section shows some PoL pools that currently support IBERA. We can choose one with a relatively high yield, such as the mBGT-iBERA pool, which has a good APR overall of about 194%.

Currently, Infrared Finance directly supports exchanging iBERA assets for mBGT-iBERA LP. After the exchange, you can directly pledge the LP on this page.

In the above profit path, multiple rounds of profits can also be obtained:

- Stake BERA on Infrared to get iBERA, which has a 3% APR.

- After staking iBERA/mBGT as an LP, you can get an APR of approximately 194% (including Farming income, handling fee sharing, BGT rewards, and other comprehensive income).

- Infrared Finance has launched a points system, where users earn points for using Infrared Finance. Airdrops are expected after the protocol's TGE, which is currently relatively clear. The iBERA/mBGT LP points weight is 1.89, which is relatively high, making earning points more cost-effective.

Of course, we can also exchange iBERA for weiBERA, and further pledge weiBERA on this page to obtain an APR of 90%+ and earn Infared points (currently the point weight is not high, only 0.86). This method is currently not as cost-effective as the iBERA/mBGT solution.

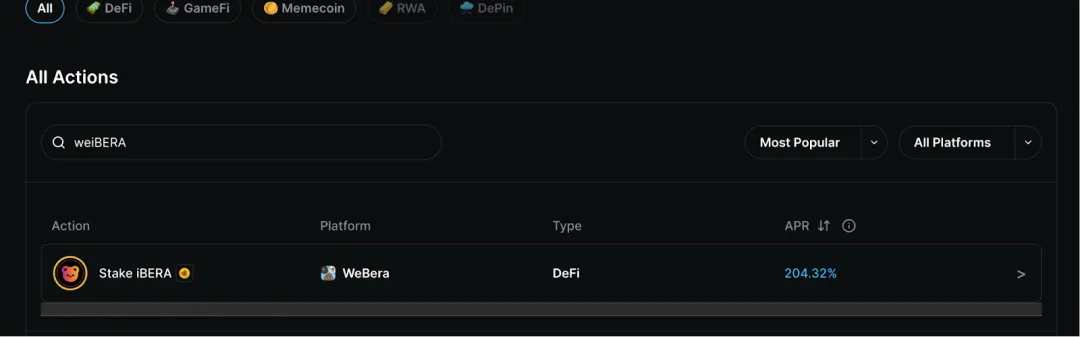

Similarly, after obtaining weiBERA, we can also further stake it on Berahub and obtain 200%+ APY.

Of course, the yield of each pool changes dynamically, and we need to adjust the strategy according to the APR of the pool to achieve the optimal return.