Author: Jaleel Jialiu

Original title: Deep Players’ EdgeX Practical Experience: A New DeFi Strategy for “Cost Reduction and Efficiency Improvement”

The next big airdrop project will most likely come from the Perp DEX space. According to incomplete BlockBeats, there are at least ten Perp DEXs currently operating without issuing tokens: edgeX, Lighter, Paradex, Variational, Pacifica, Aster, and more. We want to know: what can ordinary people do in this space to avoid being too aggressive while also not missing out on the alpha potential?

To answer this question, BlockBeats found a deep player of Perp DEX, anymose ( @anymose96 ), who is the author of two books, "Understanding Web3 from Scratch" and "NFT Minimalist Introduction", and is also a player who has conducted in-depth research on early alpha projects.

Among these most promising players, anymose chose edgeX as his current home base based on comprehensive factors such as trading depth, mobile experience, API experience, project background, and airdrop profit and loss ratio.

Next, we will analyze in detail anymose's practical experience on edgeX - from point acquisition strategies to weight amplification techniques, from TGE time prediction to point value assessment, to provide readers with a set of replicable practical paths.

"Cost Reduction and Efficiency Improvement" Points Strategy

During this cycle, the "points system" has become the mainstream method for calculating early-stage airdrop shares. Points are used to track actual contributions, and rewards are distributed according to the ledger during TGEs or airdrops. The advantages of this mechanism are obvious: greater compliance, controllable timing, precise incentives, and enhanced anti-scamming effectiveness. Hyperliquid has successfully validated this logic in the Perp DEX space, and edgeX also employs the same mechanism.

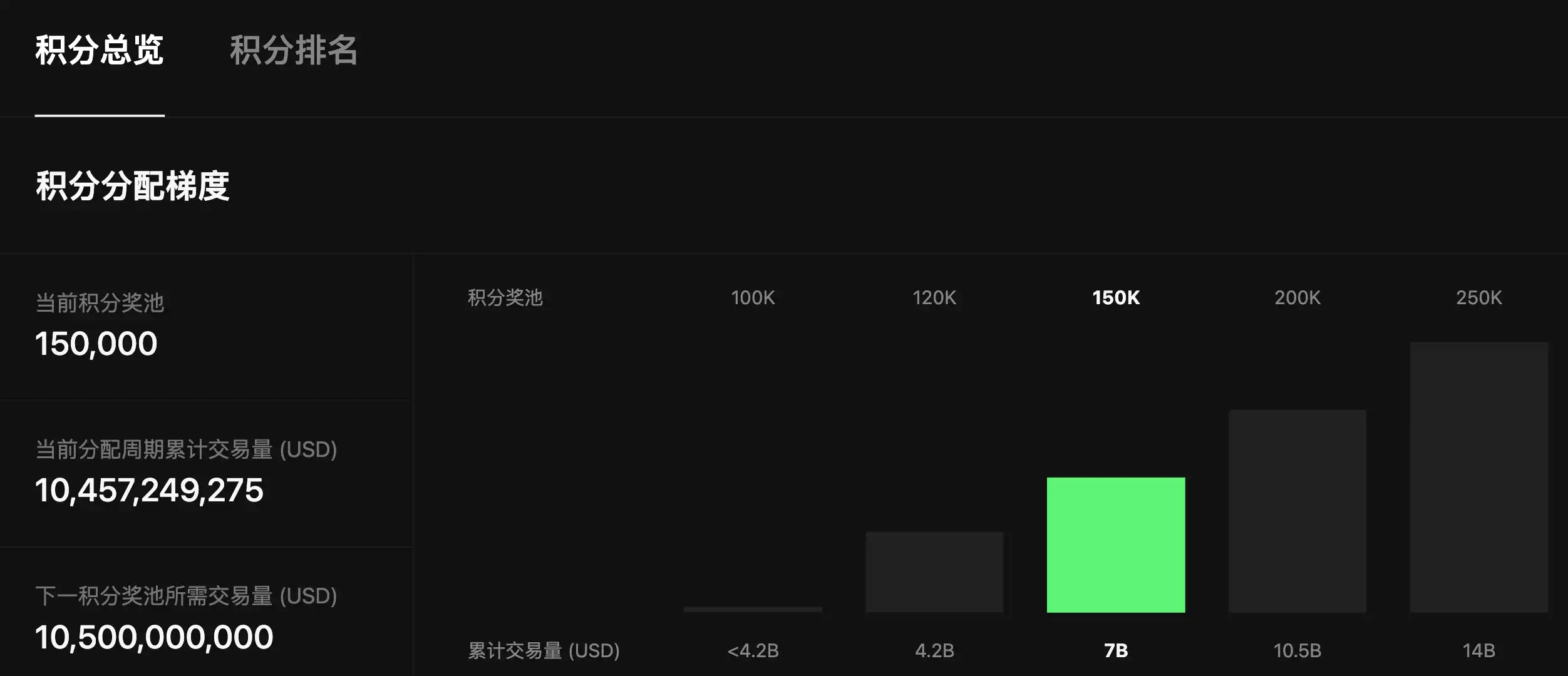

edgeX distributes points weekly, in a tiered system, based on contribution. The specific mechanism is as follows: points are distributed every Wednesday, with a total reward pool divided into five tiers based on the total weekly transaction volume of all users. For example, if the weekly transaction volume is less than $4.2 billion, the reward pool is 100,000 points; if it reaches $4.2 billion, the reward pool is 120,000 points, and so on, for a total of five reward pools. According to BlockBeats, in recent weeks, the reward pools have mostly fallen into the third tier (150,000 points) and the fourth tier (200,000 points).

Schematic diagram of the points prize pool ladder

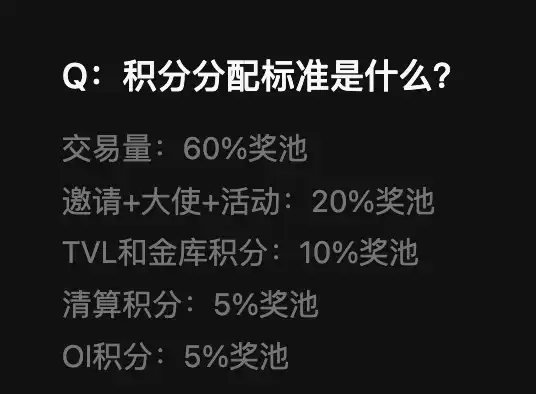

After the total amount of the prize pool is determined, users can obtain points through the following 5 ways, each with different weights.

The largest source of the points pool is trading volume, which aligns with anymose's observation: "If we were to rank the points weights, we calculated: order amount (contribution fee) > position > profit and loss."

This also means that trading volume is the main factor in earning points. So how much trading volume is needed to earn one point, and what is the approximate cost of earning points? This is probably one of the most pressing questions for users. Anymose provides his own answers based on the practical experience of a front-line user.

"Our team contributed approximately $200,000 in fees to edegX transactions." Combining this with the edgeX fee ratio, we can roughly infer that anymose's total trading volume is between $830 million and $1.54 billion. Since edegX's current points distribution system is dynamic and the difficulty of earning them fluctuates weekly, it's difficult to pinpoint the exact amount of trading volume required to earn one point. However, anymose estimates that the average cost of one point is around $10.

Because of early and deep participation, the cost of anymose is relatively low. For ordinary users, the cost is higher. According to community discussions, one point is currently earned for every $50,000 to $70,000 in trading volume, which costs around $15.

This is also why Anymose no longer recommends users create "premium accounts" instead of multiple accounts: "Lowering costs is the best and most important strategy for playing edgex."

By concentrating your funds on a single "premium account," and once your trading volume and referrals reach a certain level, you can upgrade to a VIP tier. This reduces transaction fees and significantly lowers the cost of earning points. With the same amount of funds, you can earn more points at a lower cost. As shown in the figure below, different VIP tiers offer lower transaction fee discounts.

In addition to upgrading to VIP, other ways to minimize costs include offering bonus points during new coin launch events. Furthermore, Anymose added, "Participating in community events, trading competitions, referral rebates, becoming an ambassador, and other activities can all earn you bonus points and lower your average cost."

Running API + full treasury

"Looking at historical data, the average weekly wallet points earned have dropped to a historic low of 24 points for two consecutive weeks, and the number of transactions has hit new highs, so it's getting more difficult overall," said Anymose.

Some early "tricky" methods, such as opening multiple accounts to complete beginner tasks or exchanging margin calls for points, have become increasingly expensive as edgeX has gained popularity, making many of these methods no longer viable. Therefore, actual trading volume has become the core factor in earning points.

"Ultimately, it's all about your trading volume." Therefore, Anymose strongly recommends high-frequency traders or quantitative traders to connect to APIs for automated trading. "Our strategy is relatively simple. We just look at funding rates and connect to the edgeX API for unilateral trading. The experience is excellent and very smooth. The API application process was suspended for over a month, but it's now open."

In addition to Perp trading, the eLP treasury is another key feature of edgeX. According to official documentation, edgeX eLP APY income is derived from passive market making profits, liquidation fees, and a portion of platform transaction fees. The eLP treasury quota allocated to each user increases gradually with the growth of Perp trading. The current treasury quota allocation rules are: Individuals receive $30 for every $50,000 in trading volume; invited users receive $30 for every $300,000 in trading volume; and the maximum quota is 50% of the $100,000 deposit limit.

Although the eLP vault only accounts for 10% of the prize pool, it offers a high APR, with an APR of around 13.65% over the past month. Therefore, the Anymose team's strategy is to "keep the vault full and increase the amount at any time to capture points and high APR returns."

As of the time of publication, the TVL of the eLP treasury is $196 million; data source: edgeX

As for the "witch rules" that the community is very concerned about, anymose said that the edgeX team's statement on witches is: "As long as you get the points, there is no such thing as witches."

"That means: if there's a witch, you don't get any points," said Anymose.

However, one thing to note is that one of edegX's trading rules states that self-trading does not count towards points. "Self-trading means placing your own order and then taking it yourself, which is easy to identify," explained Anymose. Furthermore, BlockBeats to information obtained by BlockBeats in the community, ultra-short-term scalping (immediately closing a position after opening it) is weighted lower, while holding a position longer for the same amount of trading volume will result in a higher point weight.

Therefore, the most reliable approach is to first concentrate your funds on a premium account to increase your VIP level, prioritize limit orders to reduce fees, trade live to avoid self-trading, combine promotions with ambassador rebates, and increase your eLP vault to its full capacity or in batches. This approach optimizes your cost per penny while simultaneously increasing both real trading and stable returns.

1 point is $30, is it overestimated or underestimated?

Recently, we have seen community discussions on edgeX credit prices on social media. Although the over-the-counter trading volume is not large, the price of $30 per credit seems reasonable to anymose.

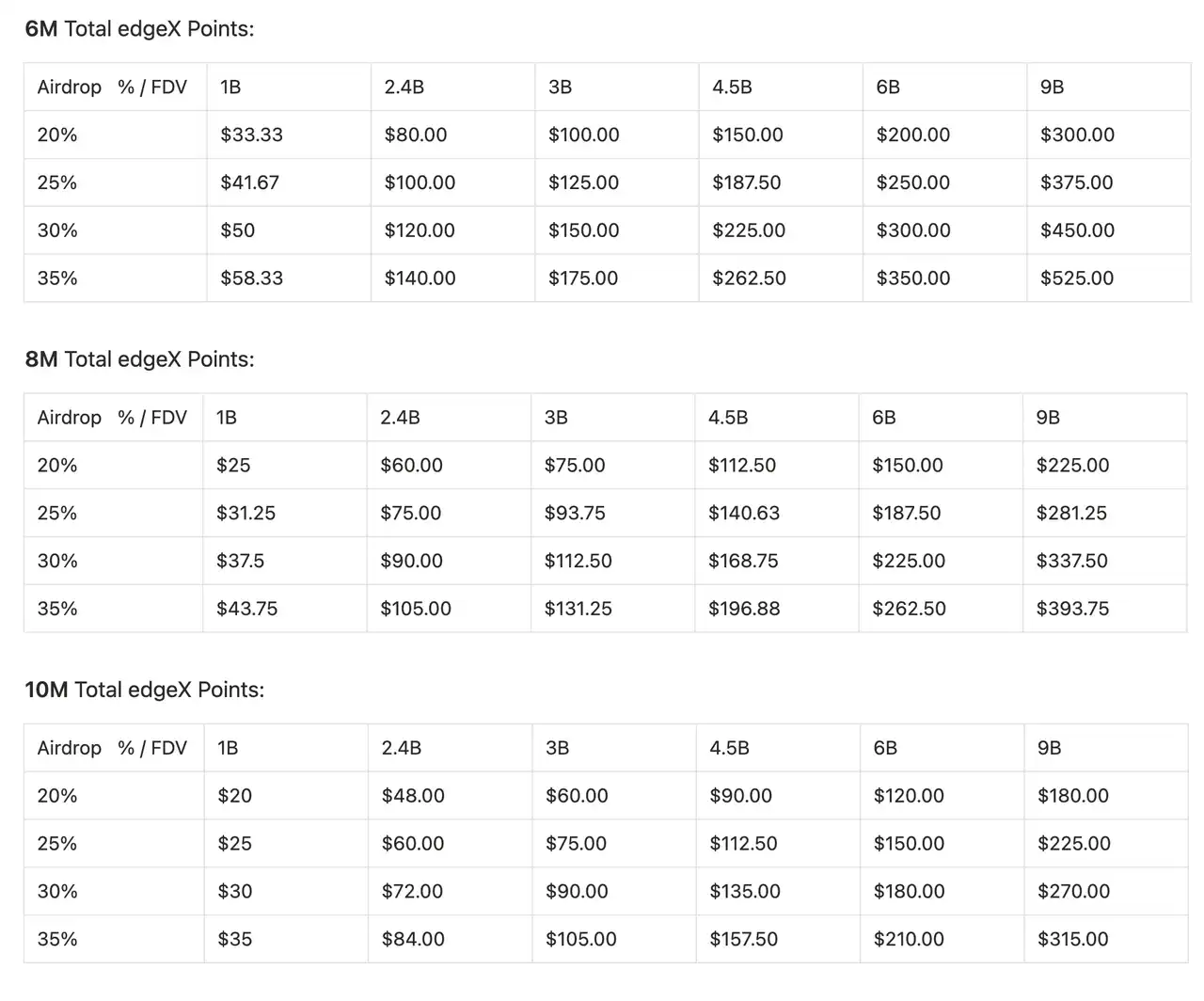

"I conservatively estimate edgeX's FDV to be around 2 billion, with an airdrop ratio of 20%. Based on a total of 6 million points, the price of one point is $67. However, considering the 50% elasticity in valuation, we ultimately calculate the price of one point to be between $30 and $50. Therefore, the current OTC price is not outrageous."

According to BlockBeats from BlockBeats, edgeX has already distributed a total of 2.83 million points, including those issued in the first Alpha Season and the current Open Season. If the full 250,000 points are distributed each week for the next seven weeks, the total number of points will be 4.83 million.

Let's consider the calculation model of another community member, akonresearch : If, when edgeX launches its token, its daily transaction volume reaches 1.5 billion, the number of daily trading users reaches 8,000, and its TVL reaches 500 million, then the FDV can be reasonably estimated to be 1/20 of hype, or 2.4 billion. Based on a 20%-35% airdrop share of 6 million points, the value of the points could reach $80-$140, which is significantly higher than anymose's estimate.

Of course, this estimate assumes the second season also lasts 21 weeks. If market performance is poor and the season is extended, the estimated value of the points will be adjusted downward. However, from another perspective, while the number of points may continue to grow, causing dilution, the maturity of the product, healthier liquidity, and user structure will likely lead to more stable price performance after the TGE. "After all, edgeX still has a lot of products under development, and optimizing the depth of trading pairs outside of mainstream trading pairs and system stability will take time," Anymose stated candidly.

Regarding the official timeline, the goal is to hold a TGE in the fourth quarter of this year, assuming market conditions and product progress continue smoothly. Anymose provided more specific observation points: "So, the first key date is seven weeks from now, which is the end of October. The open season is already in its 14th week, and by the 21st week, the season will likely be over."

In addition to paying attention to the product situation and market environment 7 weeks later, anymose also recommends paying attention to several signals as TGE approaches: whether trading volume will surge again, the joining of partners, and the progress of products such as the vault and V2 testnet, etc.

Among its competitors, anymose bluntly stated that Lighter might get a head start in TGE: "Lighter's model and pace are faster, and VCs may provide more resources, and its products are more single. However, from a perp perspective, it is far behind edgex. If Lighter goes first, our marginal investment in edgeX will decrease, and we will switch to a defensive strategy." But in the long run, anymose is still more optimistic about edgeX's growth potential. "In terms of the team, after interacting with the people at edgex, I can feel that they are very focused on their business and not so exaggerated or radical."

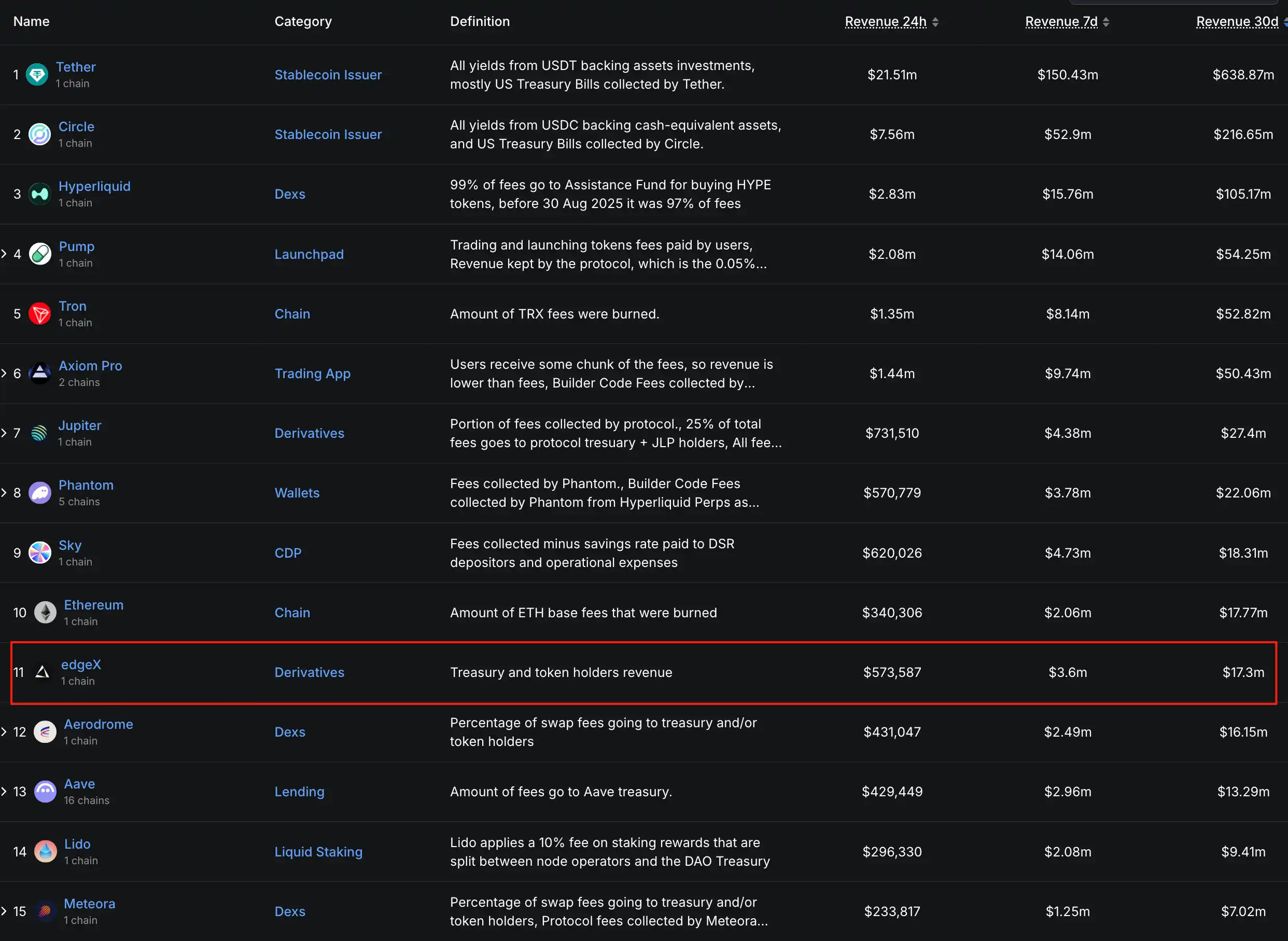

In fact, revenue data supports anymose's assessment. As of the time of writing, edgeX's 30-day revenue ranks 11th among all crypto protocols. Of the top 15 protocols (excluding stablecoin issuers USDT and USDC and Axiom, a trading bot that has repeatedly stated it has no plans to issue a new coin), edgeX is the only one that hasn't issued a coin. For more information on edgeX's revenue, read: " This DEX, Without a Coin, Surpasses Uniswap in Revenue ."

In terms of liquidity depth, within a 0.01% spread, edgeX's order book can handle up to approximately $6 million in BTC orders, exceeding Hyperliquid (approximately $5 million), Aster (approximately $4 million), and Lighter (approximately $1 million). While its overall depth is still slightly lower than Hyperliquid, edgeX boasts the deepest Perp DEX besides Hyperliquid for most currencies. In terms of transaction volume, edgeX is second only to Hyperliquid and Lighter. This means that in terms of product completeness and various metrics, edgeX is striving for a top-two or top-three position among Perp DEXs.

So, is $30/point expensive? The answer depends on your expectations for FDV, airdrop ratio, and the denominator of the points. More importantly, your participation method determines your marginal cost. Focus on trading volume for "premium accounts," increase your tier to reduce fees, and stack ambassador/event/invitation/eLP vaults to minimize the cost per point, then wait for the TGE window.

The most important of the eight methods may be to reduce costs and increase efficiency, and simplicity is the ultimate truth.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush