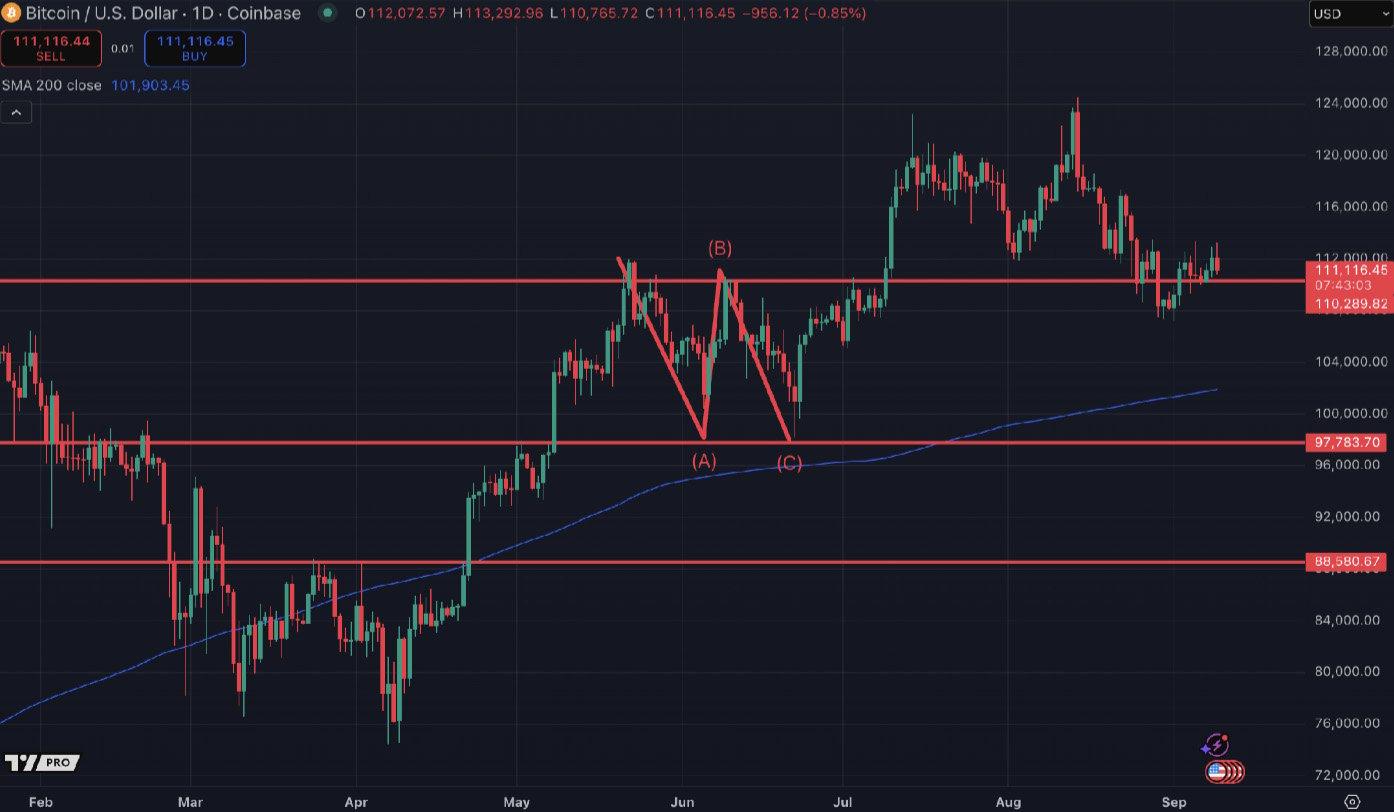

Bitcoin Consolidates as Macro and Institutions Drive the Cycle

Markets head into September with macro firmly in control. Weak payrolls, a sub-1 vacancy-to- unemployment ratio for the first time since 2021, and dovish Fed rhetoric have made September rate cuts almost certain. The yield curve steepens as short-end rates fall, a backdrop that reflects confidence in growth rather than stress.

Equities and gold have rallied, but crypto has held steady. Bitcoin remains above 110k despite ETF outflows, and Ethereum trades above 4,250. Options positioning shows caution, with put demand ahead of Thursday’s inflation report, while elevated short-dated vol signals traders are braced for data without panic.

Meanwhile, institutions continue to expand: U.S. Bancorp has resumed Bitcoin custody, BlackRock is now the second-largest BTC holder after Satoshi, and $440M in venture capital has flowed into crypto in just two weeks. Policy is also evolving, with moves like the U.S. Strategic Bitcoin Reserve and the GENIUS Act for stablecoin regulation.

Bottom line: retail noise about “Red September” is missing the point. Bitcoin is consolidating at historic levels while the institutional and policy foundation for the next cycle is being cemented.

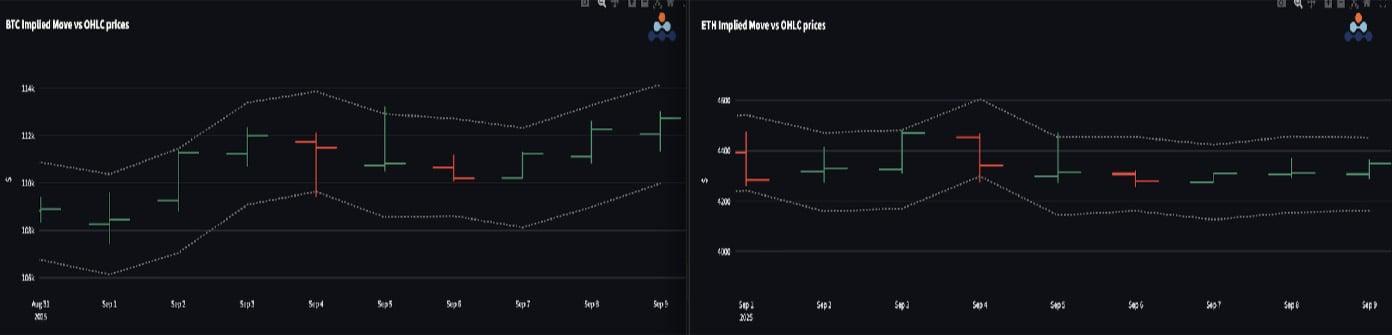

Volatility Fades as Crypto Finds a Range

Realized vol is drifting lower as spot holds steady. Bitcoin sits in the low 30s while Ethereum hovers near 55.

Front-end BTC vol is down about 3 points; ETH has dropped 7.

Carry is flat on BTC but positive again on ETH, attracting gamma sellers.

OHLC charts show tight ranges this week, with quick reversions whenever implied moves were tested.

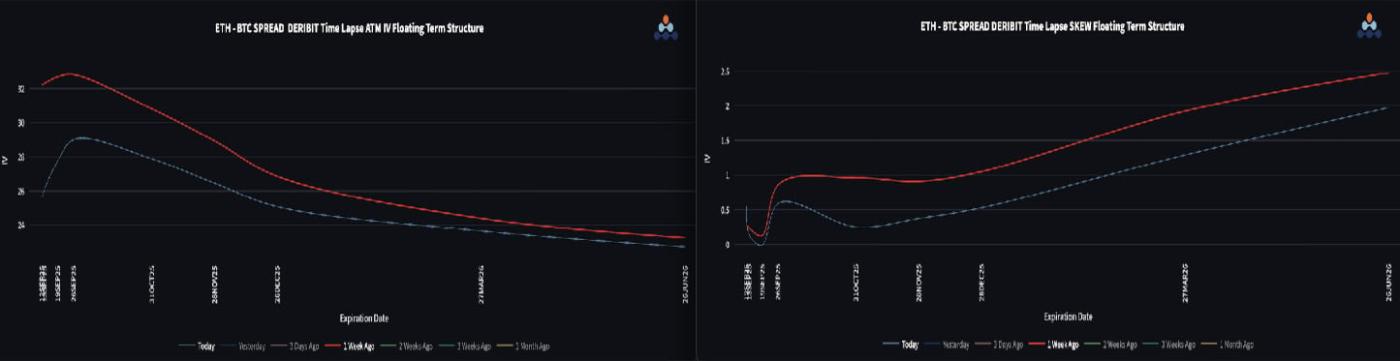

Skew Tilts Bearish Despite Macro Tailwinds

Skew continues to shift into put premium: BTC is deeper by 0.5 vols and ETH by over 1 vol.

The entire BTC skew curve is now in put premium, even June 2026. This looks more like institutional hedging in long-dated options than a broad bearish shift.

ETH front-end skew shows 3 vols of put premium, while the far end of the curve still holds call premium into 2026.

Overall, sentiment in options remains cautious, even with supportive macro conditions.

ETH/BTC Consolidates with Vol Spread Reset

ETH/BTC spot consolidation continues with low volatility, holding above 0.038—a key level.

The ETH vol spread was slammed sharply compressed as realized vol collapsed, though the entire curve remains above 20 vols.

Front-end skew differential has normalized, with ETH losing its call bias until expiries beyond December 2025.

To get full access to Options Insight Research including our proprietary crypto volatility and skew dashboards, options flows, crypto stocks screener, visit the Alpha Pod. We also run Crypto Vaults, a smarter, safer, and more profitable crypto trading approach. Whether you want to hedge risk, earn steady yields, or create a long-term income stream, there’s a vault for you. All our products are purely for educational purposes and should not be considered financial advice.

Disclaimer

This article reflects the personal views of its author, not Deribit or its affiliates. Deribit has neither reviewed nor endorsed its content.

Deribit does not offer investment advice or endorsements. The information herein is informational and shouldn’t be seen as financial advice. Always do your own research and consult professionals before investing.

Financial investments carry risks, including capital loss. Neither Deribit nor the article’s author assumes liability for decisions based on this content.

AUTHOR(S)

Imran Lakha is an expert at using institutional options strategies to capitalize on investment opportunities across global macro asset classes. Learn more here.

RECENT ARTICLES

Options Dynamics: Macro Tailwinds, Institutional Flows, and Shifting Skew

Imran Lakha2025-09-11T07:18:32+00:00September 11, 2025|Industry|

Options Dynamics: Reading the Signals in BTC and ETH

Imran Lakha2025-09-03T09:01:04+00:00September 3, 2025|Industry|

Crypto Derivatives: Analytics Report – Week 36

Block Scholes2025-09-03T08:13:26+00:00September 3, 2025|Industry|

The post Options Dynamics: Macro Tailwinds, Institutional Flows, and Shifting Skew appeared first on Deribit Insights.