Get the best data-driven crypto insights and analysis every week:

Shake Up in the Stablecoin Sector

Key Takeaways

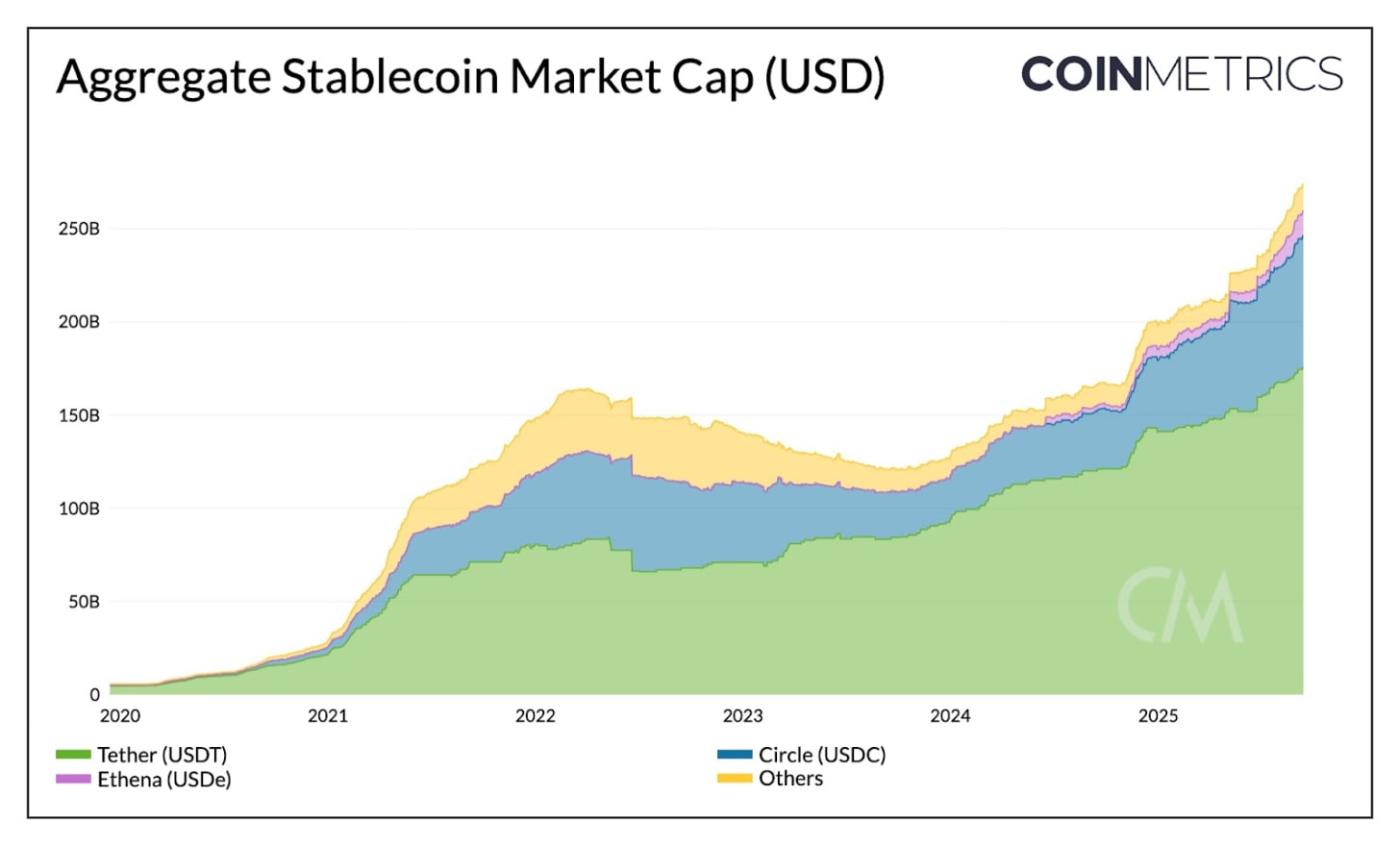

The stablecoin market cap stands at $280B, up 40% year-to-date. USDT (64%) and USDC (25%) continue to hold the largest market shares, while USDe expanded 133% post-GENIUS Act, becoming the third-largest stablecoin.

The GENIUS Act standardized reserve backing with U.S. Treasuries, shifting competitive differentiation towards distribution, ecosystem reach and ability to scale market adoption.

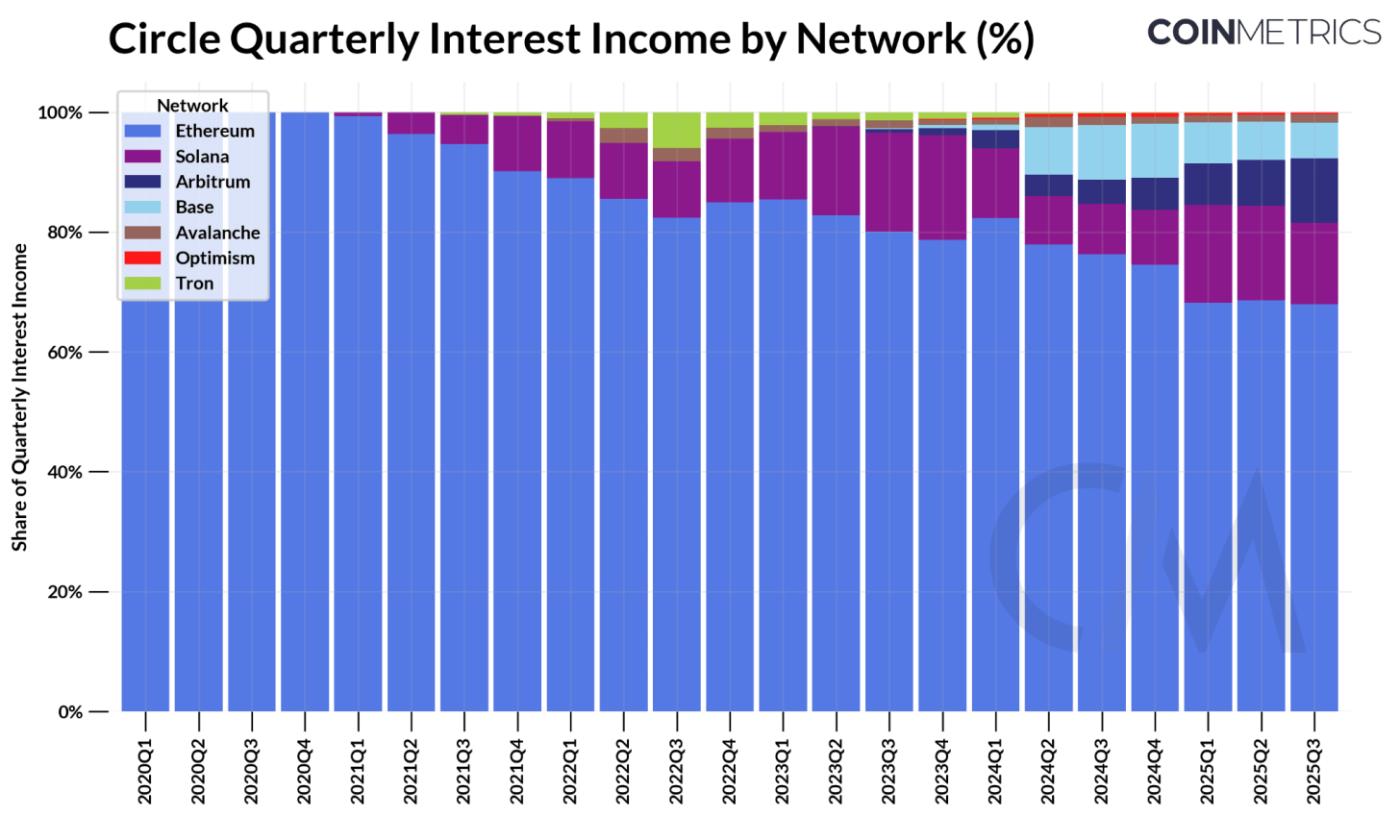

Circle’s revenues are driven by interest income on USDC reserves, mainly from Ethereum and Solana. However, the majority of USDC transaction activity accrues to Coinbase (through sequencing revenue on Base) and to Ethereum & Solana through fees & MEV.

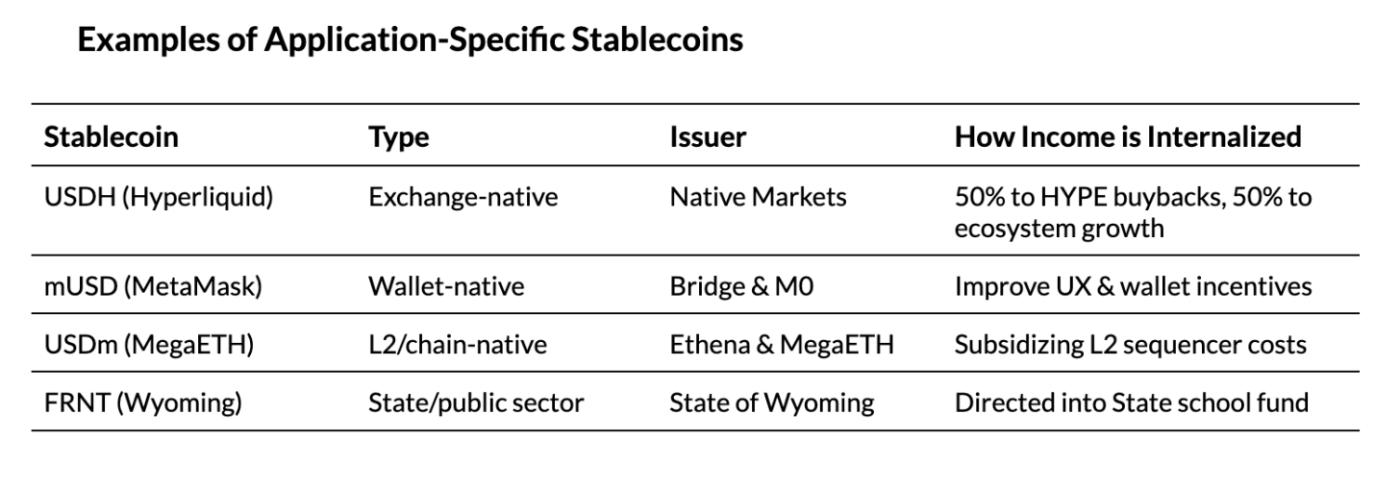

These dynamics point to the emergence of application-specific stablecoins and stablecoin-focused chains, aiming to capture and internalize more value from the stack.

Introduction

The whirlwind of activity in the stablecoin sector shows no signs of slowing. In May, we published our Stablecoin Sector report, analyzing the diverse types of stablecoins, reserve models, and issuers across networks. In recent months, we’ve seen the passage of U.S. stablecoin regulation through the GENIUS Act, while Circle’s IPO brought the stablecoin business model into the mainstream. The competitive landscape has intensified and appears in flux, with Tether announcing its entrance into the U.S. market through USAT, a heated battle for Hyperliquid’s USDH ticker, and a wave of payments-focused chain launches from firms like Stripe and Circle.

Against this backdrop, this issue of Coin Metrics’ State of the Network explores the shifting seas of the stablecoin sector in a changing regulatory and interest-rate environment. With the GENIUS Act standardizing reserve backing for payment stablecoins, competition is increasingly moving to those who own and capture the distribution. We map Circle’s revenue from USDC across blockchains to understand the dynamics prompting the push for proprietary stablecoins and the emergence of purpose-built networks.

Competitive Backdrop: Post GENIUS Act Market

Current Market Landscape

The GENIUS Act was signed into law on July 18th, creating a regulatory framework for dollar-backed payment stablecoin issuers. Key requirements of the legislation included 100% reserve backing in safe, liquid assets (cash and short-term U.S. treasury bills and money market funds) with issuers prohibited from offering yield or interest on issued stablecoins. This has created a new environment where the collateralization of stablecoins is more standardized across issuers.

Before considering the impact of this, it’s worth taking stock of where the market stands today. The aggregate market cap of stablecoins is now over $275B, up 40% year-to-date. Tether’s USDT leads with a 64% market share ($177B), split primarily between Ethereum (50%) and Tron (47%), while Circle’s USDC holds second place with 25% ($71B) across Ethereum, Solana, Arbitrum, and other networks.

Source: Coin Metrics Network Data Pro

Tether’s Entrance into the U.S. Market

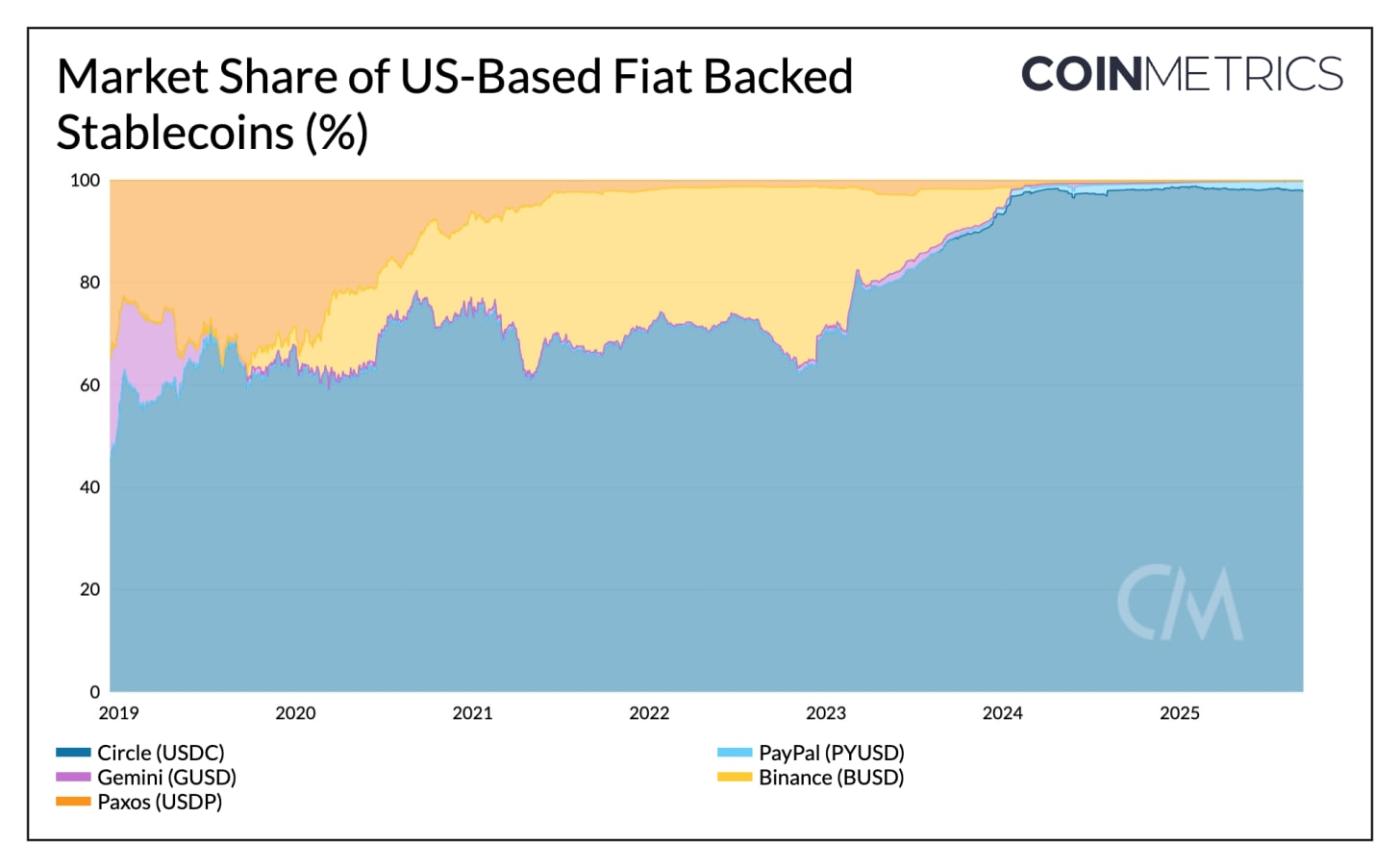

So far, Tether has operated as an offshore issuer headquartered in El Salvador with USDT primarily serving demand in emerging markets. On the other hand, Circle’s USDC has benefitted from strong regulatory positioning in the onshore market, where it now accounts for 97% of U.S.-domiciled stablecoin supply.

In 2025, USDC gained roughly 6% in market share, while USDT lost about 7%. However, Tether’s launch of USAT, a U.S.-compliant stablecoin, threatens to erode USDC’s onshore dominance. With Anchorage Digital as the issuer and reserves managed by Cantor Fitzgerald, USAT will need to make inroads into exchange listings and liquidity to match USDC’s multi-chain footprint and distribution through partners like Coinbase.

Source: Coin Metrics Network Data Pro

Interest Rates and Yield Dynamics

The GENIUS Act’s ban on paying yield and the changing interest rate environment could also carry important implications on competitive dynamics. With stablecoin holders prohibited from being compensated directly, interest income from U.S. Treasury reserves continues to accrue to issuers. Tether and Circle already hold more than $145B in Treasuries, with Tether keeping the proceeds and Coinbase indirectly passing interest from USDC reserves to holders.

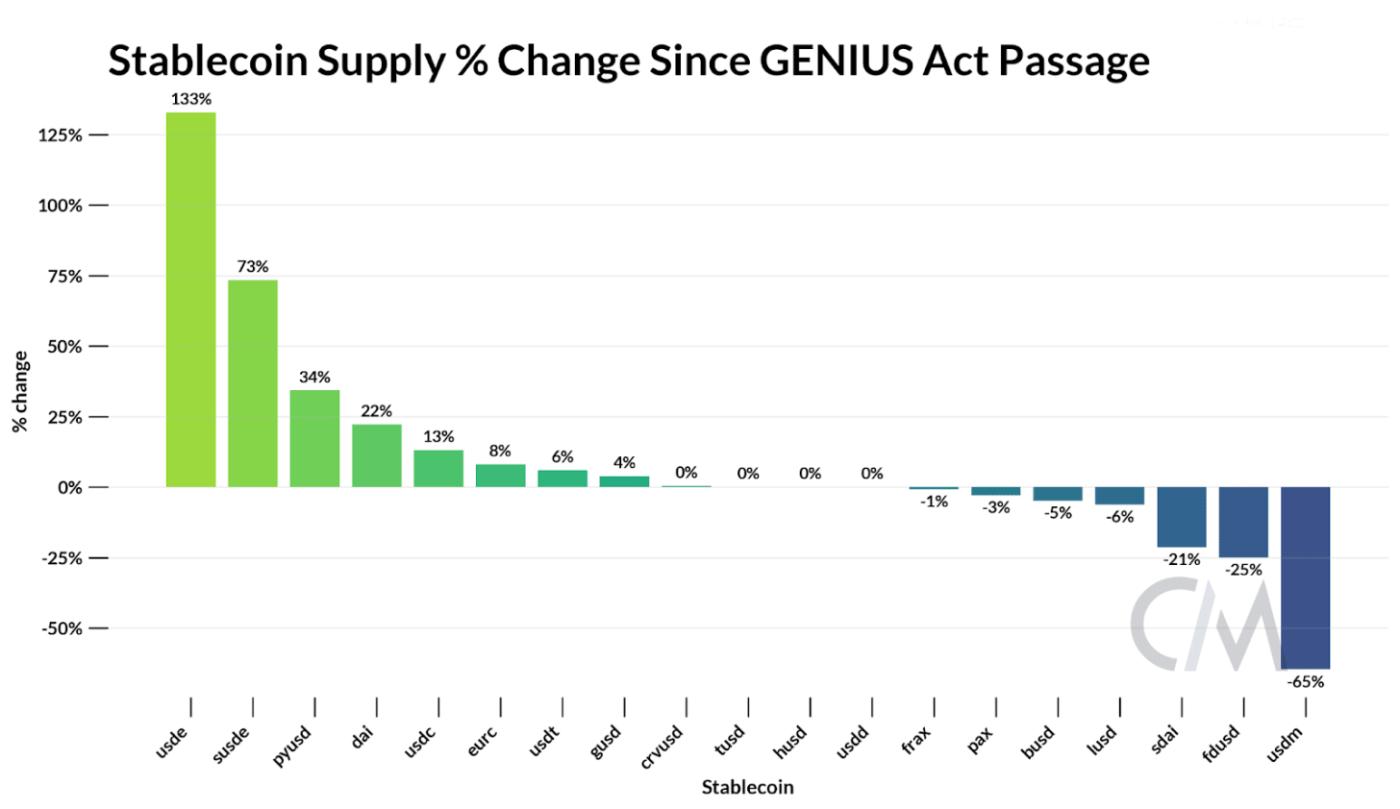

This gap could make yield-bearing alternatives and on-chain sources of yield through staking or lending, more attractive. Ethena’s USDe has grown 133% while sUSDe, its staked version, has risen by 73% since the GENIUS Act’s passage, lifting USDe to the third-largest stablecoin with a market cap of $13.6B. By tokenizing the basis trade, through delta-neutral strategies using staked ETH and perpetual futures, Ethena is able to offer yields that remain competitive even as interest rates decline.

Source: Coin Metrics Network Data Pro

Together, these dynamics highlight how the competitive landscape is moving beyond reserve models toward distribution, yield and ecosystem growth.

Mapping Circle’s Income Across Blockchains

As a publicly traded company, Circle provides a clear blueprint for understanding the stablecoin business model. The primary driver of its revenue today is straightforward: interest income on the reserves backing USDC’s outstanding supply.

In Q2 2025, Circle earned roughly $634M in interest income, a function of its ~$61B in USDC supply (at the time) and short-term U.S. treasury yields backing it. Breaking this down by chain, we see that the largest contributors are Ethereum with $423M (68%) of revenue and Solana with $97M (15%), with Arbitrum emerging as the fastest-growing source of supply and revenue (+24% since Q1).

Source: Coin Metrics Network Data Pro

While USDC supply generates interest income for Circle, the movement of USDC across chains does not. When breaking down the share of USDC transfers and transfer volume across networks, we see that Solana dominates in frequency, while Base (64%) and Ethereum (23%) account for the bulk of aggregate transaction volumes. This transaction activity of USDC therefore accrues to Coinbase (via sequencing revenue on Base) and validators on Ethereum and Solana, rather than Circle itself.

Source: Coin Metrics Network Data Pro

This underscores how Circle’s revenues are tied to outstanding USDC supply, while blockchains capture the value of transfer activity through sequencing, fees, and MEV. The emergence of application-specific stablecoins like Hyperliquid’s USDH (covered in the next section) illustrates how platforms are moving to internalize reserve income within their ecosystems. Meanwhile, Circle’s launch of its Layer-1 chain, Arc, points to an effort to capture transaction-based revenue from payments and FX related use-cases, which may not fully overlap with the kind of activity currently occurring on networks.

Follow the Incentives, Own the Distribution

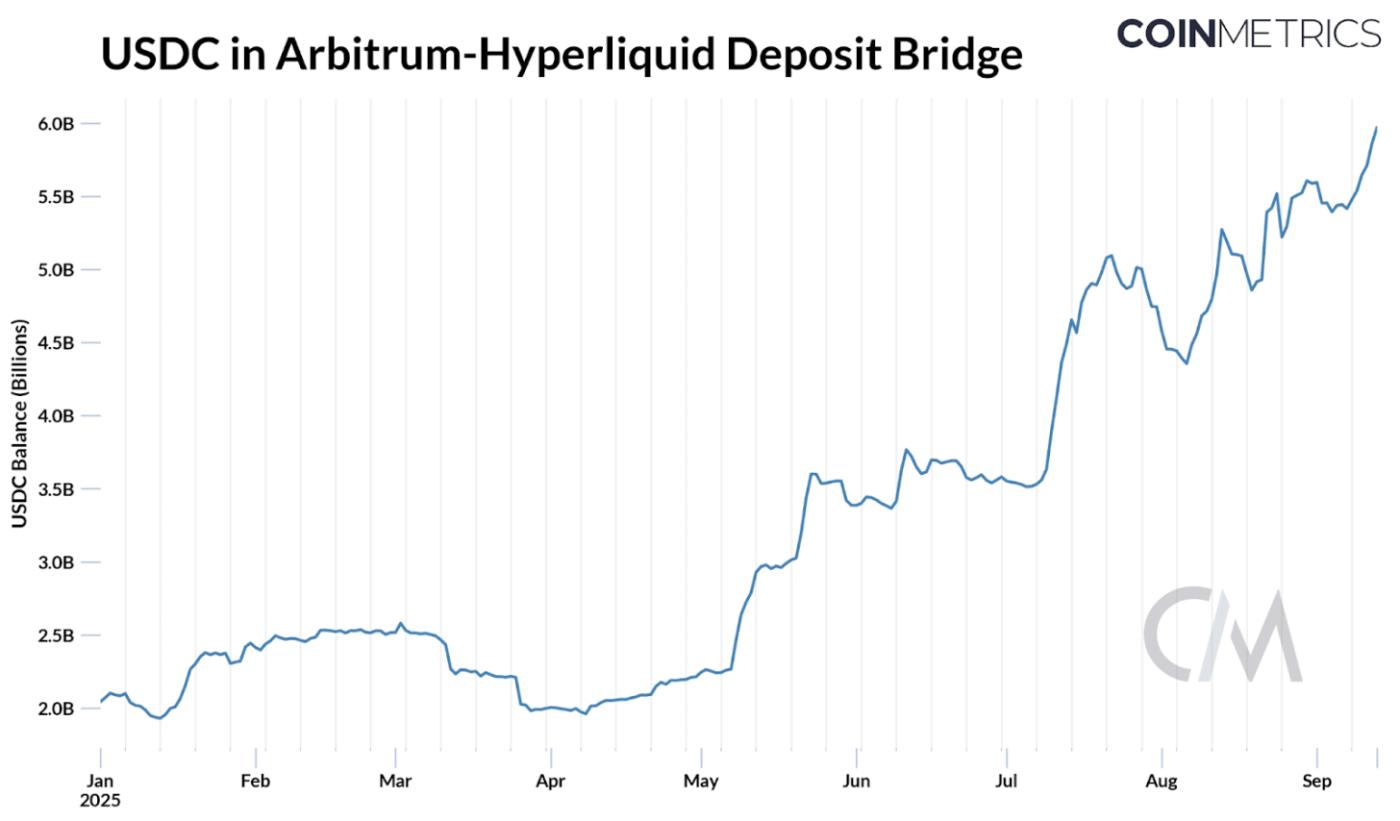

The recent battle for Hyperliquid’s USDH ticker highlights why platforms want to reduce reliance on external sources and internalize the economics themselves. Last week, Hyperliquid opened a governance vote to award the USDH ticker to a “Hyperliquid-first, Hyperliquid-aligned, and compliant” issuer. With roughly 8% of all USDC supply (~$5.9B) in Hyperliquid’s Arbitrum bridge, this represents ~$247M in interest income (at a 4.1% reserve return rate) that's flowing to Circle (and Coinbase via the revenue sharing agreement).

This sparked a bidding war, attracting proposals from major issuers such as Paxos, Ethena, Agora, and Sky, alongside newer entrants like Native Markets. Issuers proposed terms to make USDH compelling for Hyperliquid’s ecosystem, offering to return as much as 95% of interest income, provide attractive revenue-sharing models, or strengthen compliance alignment and distribution.

In the end, Native Markets secured the USDH ticker via an on-chain vote. Native Markets' USDH will be fully backed by cash and US treasury equivalents with off-chain reserves initially managed by BlackRock and on-chain reserves by Superstate through Stripe-owned Bridge. In response, Circle is also preparing to launch native USDC on Hyperliquid’s HyperEVM, suggesting how distribution across growing platforms remains critical in the competition for stablecoin dominance.

Other recent stablecoin launches also show why applications, wallets, networks, and even States are moving in the same direction: issuing their own proprietary stablecoins to capture interest income and recycle it into ecosystem growth.

Conclusion

The stablecoin sector appears to be going through a phase of reshaping simultaneously from the top down and the bottom up. At the macro level, the GENIUS Act has standardized requirements, tethering stablecoin reserves to U.S. treasuries and making distribution critical. The battle between the incumbents Tether & Circle is entering a new phase, with USAT set to challenge USDC in its home turf. With issuers prohibited from passing on yield, declining rates may elevate the role of alternatives like Ethena’s USDe as demand for yield persists.At the micro level, the economics of reserve income and transaction activity are prompting platforms to internalize more value.

From Hyperliquid’s USDH saga to Circle’s Arc chain, the trend points toward controlling more of the stack, whether through internalizing reserve income or capturing transaction-based revenues. These efforts also reflect a broader push to anchor stablecoins in payments and settlement. But the path forward raises important questions. Will the wave of new proprietary stablecoins fragment liquidity, or will distribution advantages consolidate demand around a few winners? And as purpose-built payment chains emerge with more centralized architectures, will they complement general-purpose L1s or compete with them for activity? The sector’s evolution is far from settled, and how these forces play out will define the next chapter of stablecoin adoption.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.