The book "Latin America's Open Veins" reveals that for five hundred years, both old and new colonialism have transformed Latin America into a periphery, specialized in blood transfusions. The richer its resources, the more its veins have been cut. Today, blockchain's autonomous nodes, open source code, and distributed ledgers offer Latin America the technological potential to rebuild its "blood circulation system." Developers in Argentina, Brazil, and Mexico are issuing local stablecoins denominated in pesos and reals, using smart contracts to reduce cross-border fees to a fraction, eliminating the need for dollar settlement for remittances and trade financing.

As with any technological revolution, some people quickly embrace the new, while the majority either fail to understand or fear change. In Latin America, the words "cryptocurrency" or "stablecoin" still evoke mixed emotions. While more and more people are becoming exposed to the technology and a romantic narrative is spreading, only a small minority truly understand blockchain technology and its application in daily life. Furthermore, USDT and USDC still hold a 90% market share in Latin America. With the Federal Reserve's interest rates and US regulations tightening the screws with a single word, a new "currency colonization" looms.

Following a previous article outlining the on-chain landscape of the Latin American crypto financial payment ecosystem , this article, based on the article Frontera, LATAM crypto ecosystem: Leading the New Digital Economy, provides an in-depth and objective analysis of Latin America’s emerging crypto industry.

This article will explore the panorama of the Latin American crypto ecosystem and examine the use cases of cryptocurrencies and stablecoins within it: how and for what purposes is Latin America adopting cryptocurrencies, as well as the crypto projects, communities, and investors behind these use cases. We will then explore the evolution of stablecoin payment projects in Latin America by examining key Latin American countries (Argentina, Brazil, Colombia, Mexico, and Peru).

An additional question for everyone to think about is: Is the difference between the historical facts detailed in Eduardo Galeano's book and reality only that, in the past, it was the silver mines and plantations of the colonies, but today it is everyone's digital wallet; in the past, it relied on guns and merchant ships, but today it relies on codes and nodes - but the angle at which the "blood vessels" are cut still points to the same north.

1. Panorama of the Crypto Ecosystem in Latin America

1.1 Overall Overview

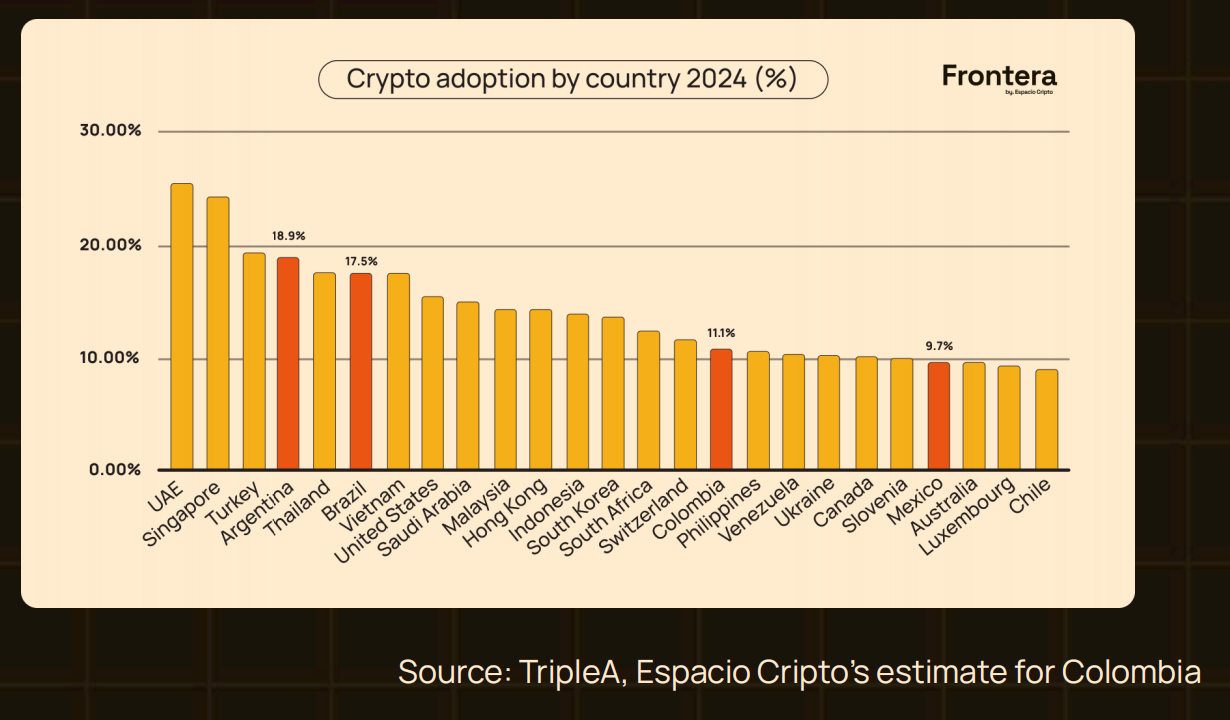

Over the past 15 years, cryptocurrencies have evolved from a niche toy for libertarian geeks to a key component of the global financial landscape, fundamentally changing how we understand and use money and value. According to TripleA data, the number of people holding virtual assets worldwide has grown to 562 million (420 million in 2023), representing 6.8% of the world's total population.

While the majority of users remain in Asia, South America saw the fastest growth last year, with user numbers nearly doubling, making it the third-largest market for global crypto adoption, surpassing Europe. Within Latin America, Argentina and Brazil lead the way, each fueled by distinct yet complementary socioeconomic factors, creating twin engines of stablecoin adoption.

Argentina 's ongoing economic turmoil—years of hyperinflation and strict exchange controls—has forced many citizens to turn to cryptocurrencies like Bitcoin and stablecoins for a safe haven. Despite government austerity measures, inflation remains lurking: in October 2024, consumer prices soared 193% year-on-year. While this was the lowest increase of the year (209% in September), it marked the sixth consecutive month of slowdown. Despite this, purchasing power continues to erode, turning cryptocurrencies into a lifeline and solidifying their position within Argentina's financial ecosystem. High internet and mobile device penetration provide the technological foundation for this process, making them a reliable alternative to traditional finance. Despite the economic turmoil, DeFi, tokenization, and payment projects are flourishing.

Brazil , Latin America's most populous and diverse country, is experiencing a surge in crypto adoption, fueled by strong interest in the tech community and a fertile environment for startups and fintech. With mobile penetration rates among the highest in Latin America, crypto applications and digital wallets are readily available, and a young, tech-savvy population is highly receptive to new innovations. Central bank digital currencies (CBDCs) are on the horizon, regulatory frameworks are rapidly evolving, and the investment environment is becoming increasingly friendly. Universities and innovation centers are offering blockchain and crypto courses to cultivate local talent. Coupled with Brazil's leading position in Latin America's financial services sector, crypto assets are gradually being integrated into traditional financial products, further accelerating their adoption.

Crypto adoption in Mexico is primarily driven by remittances. As one of the world's largest recipients of remittances, with billions of dollars flowing back from the United States annually, the massive flow of funds between the US and Mexico highlights the high costs and slow speeds of traditional remittance channels. Crypto offers a faster and cheaper alternative. Compared to Argentina, Mexico enjoys macroeconomic stability, and crypto is viewed more as a convenient tool and investment target than as an inflation hedge. While fintech is robust and driving adoption, it's less diverse and the ecosystem still needs to mature.

Colombia , despite high adoption levels, presents a different picture. While its economy isn't as volatile as Argentina's, the crypto community is growing, driven by the need for financial inclusion and the benefits of remittances. With a large number of Colombians working abroad and remittances accounting for a significant portion of GDP, crypto is naturally popular as a faster and cheaper way to send money. The government is also gradually introducing regulations, which is expected to pave the way for future adoption.

In short, the dynamics of the Latin American crypto ecosystem are shaped by distinct economic, technological, and social factors. Argentina and Brazil remain the dominant players, the former driven by economic risk aversion and the latter by technological advantages. Mexico and Colombia, on the other hand, have remained relatively low-key, focusing on remittances and financial inclusion.

1.2 Latin American users favor stablecoins

Before deconstructing the current state of the ecosystem, we must return to its origin: users. Users are at the epicenter of this new crypto storm, and any narrative must first address their needs and use cases. Despite Bitcoin's mission to hedge against fiat currency devaluation, the vast majority of users in Latin America still choose stablecoins. Recent research from Kaiko Research shows that over 40% of transactions in Latin America are settled in USDT; of transactions denominated in the Brazilian real (BRL), nearly half are completed using stablecoins.

Because accurate statistics on off-chain cryptocurrency trading volumes are difficult to obtain, Brazilian government data is crucial for verifying trends. Since 2019, the Brazilian Federal Tax Agency (Receita Federal) has implemented a comprehensive reporting system, requiring all operating exchanges and large individual users to submit monthly reports. Official data confirms a surge in stablecoin usage: USDT's cumulative trading volume exceeded 271 billion reais, while Bitcoin's was 151 billion reais during the same period, nearly double that.

Compared to the global market, stablecoins play a far more central role in Latin America. While Bitcoin still accounts for the majority of trading volume globally, as measured by Binance, the largest centralized exchange, users' preference for stablecoins in Latin America reflects regional characteristics: volatile local currencies, a lack of confidence, and the difficulty of obtaining US dollars through traditional channels make stability a scarce financial attribute.

Specific Use Cases of Cryptocurrency in Latin America

Cryptocurrency users in Latin America are diverse, encompassing individuals, businesses, and even government agencies from diverse socioeconomic backgrounds. Understanding this diversity is key to assessing the regional impact of crypto assets.

2.1 Individual Users

A. Economic risk aversion

In Argentina, Venezuela, and, to a lesser extent, Brazil, citizens are turning to cryptocurrencies as a shield against hyperinflation. With inflation in Argentina at one point exceeding 200%, millions of residents are turning to stablecoins like USDC and USDT to protect themselves from the devaluation of the peso. For ordinary people, crypto assets are a "digital dollar"—a stable store of value previously unavailable under capital controls. Seizing the opportunity, the Argentinian platform Lemon Cash launched a crypto card, allowing users to spend in local currency, settle crypto assets in the backend, and receive Bitcoin Cash rewards, which has proven extremely popular.

B. Faster and cheaper remittances

Remittances are a lifeline for families in countries like El Salvador, Mexico, and Guatemala. Traditional remittances are expensive and slow to arrive. Cryptocurrency eliminates intermediaries, offers low fees, and arrives within minutes. This is particularly crucial for low-income families who rely on every dollar sent by relatives abroad. Bitso, a leading Mexican exchange, already accounts for at least 10% of remittance flows in the Mexico-US corridor.

C. Access to financial services

Large swathes of Latin America's population, particularly in rural areas, are unbanked or underbanked. Crypto wallets allow them to save, make payments, and even take out loans without traditional accounts. DeFi offers a decentralized alternative to banking, making it more attractive in areas with limited infrastructure and empowering individuals to take control of their financial future.

D. Investment and Wealth Growth

In addition to hedging against inflation, some Latin Americans are considering cryptocurrencies as investment targets. Digital assets like Bitcoin and Ethereum, with their high volatility, high returns, and low barriers to entry, have become part of their wealth growth strategies.

2.2 Enterprises and Entrepreneurs

A. Encrypted Payments

To avoid the high fees and delays of traditional banks, small and medium-sized businesses in Latin America are beginning to accept Bitcoin and stablecoins as payments. Some Brazilian merchants are using crypto settlements to hedge against local currency fluctuations while also connecting with Asian customers already familiar with crypto payments and expanding their global market share.

B. Supply Chain Traceability

Blockchain's transparency is being leveraged across various industries. Costaflores Winery in Mendoza, Argentina, launched the "OpenVino" project, creating one of the world's first open-source wineries. From grape growing to bottling, all data is uploaded to the blockchain, allowing consumers to verify authenticity and understand sustainable practices. The winery also issued "wine-backed tokens," each corresponding to one physical bottle of wine.

C. Freelancers and self-employed individuals

The rise of remote work has led to a significant increase in freelancers receiving payments from overseas. The Argentinian platform Takenos has seen a surge in usage, with many freelancers opting for Bitcoin or stablecoins to avoid fluctuations in their local currency.

2.3 Government and institutional adoption

A. Blockchain Optimizes Government Affairs

In addition to individuals and businesses, some Latin American governments are exploring blockchain to improve transparency and efficiency. For example, Guatemala is using blockchain to record votes, creating an immutable election ledger and reducing the risk of fraud.

B. Central Bank Digital Currency (CBDC)

Brazil is at the forefront of the region, piloting the "Digital Real" (DREX) to modernize the financial system, reduce costs, and improve transaction efficiency, especially for the unbanked population.

The Latin American crypto landscape is rapidly evolving, with growing user numbers and use cases highlighting the region's unique needs and challenges. From remittances and everyday payments to inflation hedging and government transparency, cryptocurrencies are reshaping Latin America in every way. Driven by both necessity and innovation, Latin America is poised to take a leading position in the global crypto market and provide valuable practical examples for the world to learn from.

3. Latin American Crypto Projects, Communities, and Investors

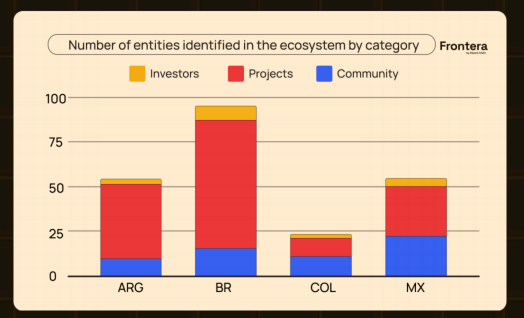

A comparison of the four countries shows that the Latin American crypto ecosystem presents a differentiated pattern:

Brazil leads the way with 71 projects, 15 active communities, and strong institutional interest, showing a complete and diverse structure.

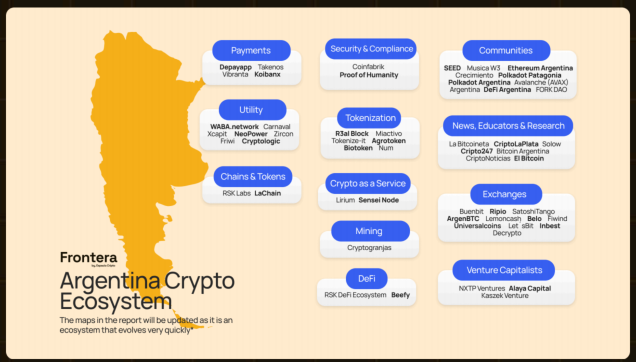

Argentina (42 projects) has leveraged its economic difficulties to become a hotbed of innovation, particularly in the areas of asset tokenization and DeFi. Despite its small scale, it has produced solutions that are highly tailored to local needs through resilience and creativity.

Mexico has 21 crypto communities, the most of the four countries, indicating a rapid increase in adoption, but the number of projects (29) is still relatively small.

Colombia has only 10 projects and 11 communities, which are still in their infancy and urgently need more capital and time to unleash their potential.

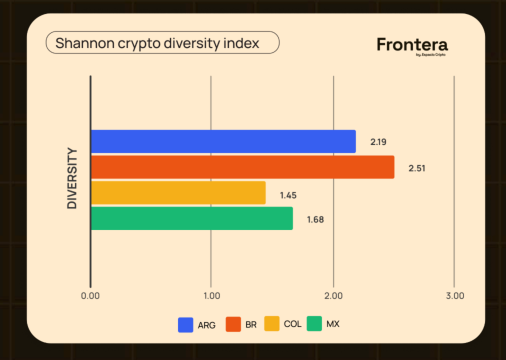

Diversity is a core indicator of the strength and potential of the crypto ecosystem. The more diverse the ecosystem, the wider the range of projects, participants, and technology paths it encompasses, and the greater its resilience to regulatory, economic, or technological shocks. Diversity fosters continuous innovation, reduces reliance on a single sector or giant, and disperses risk, making the system more robust. The opposite leads to fragility and slows transformation.

The Shannon diversity index, borrowed from biology, quantifies this characteristic. This index considers both the number of categories and the number of individuals within each category, with higher values indicating greater balance and diversity. The index typically ranges from 1–3, with values greater than 2 considered healthy and well-distributed.

Calculation results of the crypto ecosystems of four countries:

Brazil 2.51 — Highest in the region, with projects, communities, and investors evenly distributed across all categories and the strongest resilience.

Argentina 2.19 - Good diversity, slightly lower than Brazil, but rich and active ecological dimensions.

Mexico 1.68 - Moderate diversity, with some tracks highly concentrated and a risk of single reliance.

Colombia 1.45 — Lowest diversity, with ecosystems concentrated in a few areas. In the early stages of development, it has the greatest room for expansion and diversification.

In summary, Brazil and Argentina have formed a balanced and diverse ecosystem with greater adaptability and risk resistance; Mexico and Colombia have relatively low diversity and face both challenges and huge opportunities for improvement in subsequent expansion.

3.1 Crypto Projects: Developing Products Users Need

Latin American crypto projects are unique in their extreme adaptability and local innovation . They often directly address local socioeconomic pain points: opaque supply chains, high financing barriers, and inflation eroding savings. Entrepreneurs are using blockchain as a "patch," rapidly filling gaps in traditional systems. From traceable logistics to compliant DeFi, from community tokens to cross-border payments, the use cases extend far beyond the single financial sector.

Beyond innovation, collaboration and community are another lifeline. Developers, investors, and users form a close network, iterating ideas weekly and upgrading products monthly. If the market trend shifts, the team shifts gears overnight. It's precisely because of this collaborative effort that the Latin American project can maintain rapid evolution amidst turbulence.

They are also looking overseas, actively connecting with international capital and global nodes, leveraging external resources to transform local experiments into scalable business models. Many of these projects now appear on slides in global roadshows, no longer simply "Latin American stories" but essential examples for the global arena .

Of course, regulatory gray rhinos are still on the way. As long as the regulations are not finalized, the compliance costs will hang over your head. But most teams have learned to "repair the ship while sailing": leave interfaces before the provisions are updated, and switch quickly when the policies are implemented. Who will eventually come out on top depends on the clarity of the regulatory frameworks of each country. Brazil is an example of the dividends brought by "clarity". Clear superior laws and predictable compliance lists have brought together nearly half of the region's projects across the country, and capital and talent continue to flow south. On the contrary, in Mexico, where regulations are changeable or absent, teams spend a lot of energy on "guessing policies", the pace of innovation is forced to slow down, and the ecological ceiling is welded in advance.

In short: Latin American crypto projects have transformed their regional disadvantages into experimental advantages thanks to a trifecta of "pain point-driven development, community acceleration, and global integration." Next, whether they can transform regulatory uncertainty into institutional dividends will determine whether they remain regional stars or global mainstream. As regulatory frameworks mature across countries, compliant projects will have greater room to grow. The winners after the era of "Regulatory Arbitrage" will undoubtedly be those native Latin American projects that understand global regulations while addressing local pain points.

3.2 Community: Accelerating the Ecosystem

Communities are at the heart of Latin America's crypto growth and play a fundamental role. Far from being a collection of casual blockchain enthusiasts, they form a vibrant ecosystem deeply intertwined with the region's diverse socioeconomic landscape. Here, passion and necessity converge to create a unique chemistry. Community members include users, developers, entrepreneurs, investors, educators, and enthusiasts, working together to push technology to its limits and drive social change.

The true uniqueness of Latin American crypto communities lies in their origins: most originated from a group of passionate individuals who firmly believed that cryptocurrency could solve local problems . From small, spontaneous groups, they eventually grew into movements that influenced regional discourse. They went beyond mere evangelism and became engines of regional adoption. In Latin America, where traditional financial systems are limited or inaccessible, communities act as catalysts: they spread knowledge, organize events, hackathons, and workshops to accelerate blockchain adoption, and even connect emerging companies with potential investors, truly democratizing opportunity. Educators and influencers share knowledge for free through YouTube, Twitter, and Telegram, transforming previously private information into accessible, accessible Spanish and Portuguese versions, thereby promoting knowledge equality.

The driving forces behind cryptocurrencies vary from country to country. For the Argentinian community, escaping inflation is the core goal—crypto is a survival tool, not a trend. For the Brazilian community, innovation and the implementation of DeFi technologies are the primary drivers. For the Mexican and Colombian communities, remittances and financial inclusion are key drivers. Buenos Aires, São Paulo, Mexico City, and Bogotá have become regional hubs, hosting regular meetups, conferences, and hackathons to foster networking and collaboration.

What truly keeps communities together is "use," not "speculation." In Mexico and El Salvador, remittances are the lifeline of household finances. Cryptocurrency has reduced cross-border transfers from days to minutes, slashing fees to a fraction of traditional channels. In remote areas where banks haven't yet reached them, communities are not only promoting digital assets but also using them as a tool to bridge the gap between financial inclusion and financial inclusion.

Collaboration is another key element. These communities not only cultivate their own national communities but also actively connect with global projects, bringing new technologies, capital, and knowledge to Latin America. Furthermore, cross-border collaborations are frequent within the region, with Argentinian developers, Mexican entrepreneurs, and Colombian designers collaborating on code and token creation, forming a "borderless" innovation belt and making the local ecosystem more resilient through interconnectedness.

The social impact is equally significant. In regions facing significant gaps in traditional finance, cryptocurrencies are seen as a tool for empowerment: saving, investing, and making payments can bypass banks. Numerous community projects are leveraging on-chain transparency for charitable donations and supporting small local businesses with crypto payments, bringing the benefits of technology directly to corner groceries and rural schools.

Conferences and hackathons serve as offline fuel for the community. Established conferences like LABITCONF (Latin America Bitcoin and Blockchain Conference) annually attract developers, funds, and regulators from around the world, bringing Latin America from a marginal market to the mainstream agenda. Monthly meetups and hackathons in various countries continue to incubate new teams and use cases, keeping the innovation cycle chugging along.

Of course, this enthusiasm has its dark side. Regulatory uncertainty is the biggest obstacle—policy lines vary from country to country, and community initiatives are often interrupted by sudden changes in regulations. However, in countries with hyperinflation, such as Argentina and Venezuela, economic collapse has become a perfect demonstration platform: communities, using vivid examples like "Exchange your salary today for USDT immediately," have transformed crises into public lessons on the practicality of crypto, demonstrating its resilience.

Ultimately, the Latin American crypto community is deeply embedded in the local socioeconomic fabric. More than just a club of enthusiasts, it serves as a catalyst for technological implementation, a bridge to financial gaps, and a driver of regional innovation. As the community continues to expand, it will play an even more significant role in the next chapter of the global crypto industry.

3.3 Investors: Investing in the Future

Venture capital (VC) firms and various funds are decisively shaping the evolution of the crypto ecosystem, funding the most innovative and disruptive startups. These investors not only inject capital into early-stage projects but also leverage their strategic expertise and critical resources to help them scale operations. They are collectively targeting Latin America: unique economic pain points, the rapid penetration of crypto and blockchain, and the innovative solutions offered by local startups all combine to create compelling reasons to invest. Over the past few years, top global institutions such as a16z, SoftBank, and Sequoia have invested heavily in local crypto projects, betting they can not only disrupt traditional finance but also rewrite the rules of the game in other pillars of the industry.

Local funds are also essential. Early-stage investors like Kaszek Ventures and Monashees continue to provide seed funding, helping teams transform prototypes into scalable products across regions. However, after experiencing explosive growth in 2021, Latin American VCs entered a period of consolidation in 2023 amidst global interest rate hikes and tightening liquidity. While total investment remains on par with pre-pandemic levels, it has fallen significantly from its 2021 peak. Institutions are becoming increasingly selective, investing only in solid projects with clear profitability paths and the ability to generate cash flow during subsequent funding freezes.

This pace is in line with global trends: after peaking in 2021, global VC investment has fallen for two consecutive years, reaching less than half of 2021's level in 2023 and remaining on par with 2020. However, the decline in Latin America was even more dramatic, with investment in 2023 reaching only 25% of 2021's level. This is due to the market's smaller size and greater sensitivity to global macroeconomic fluctuations. Despite this, capital continues to flow in, albeit more cautiously. The resilience of sectors with "essential demand" such as fintech and e-commerce demonstrates the region's continued appeal to venture capital.

As the global VC market gradually stabilizes, Latin America is poised for a new wave of funding. Projects that address social and economic pain points, demonstrate robust compliance, and possess scalable models will be particularly sought after. In this increasingly selective capital landscape, only teams with the strongest value propositions, the lowest regulatory risks, and the most stress-tested business models will secure a spot on the next wave.

Finally, we also found that a group of traditional companies are integrating cryptocurrencies and blockchain technology into their own operations, marking an important step in digital transformation. This category includes mature institutions such as banks and e-commerce companies, which have integrated crypto services into their existing businesses to meet the market demand for more agile and decentralized solutions. For example:

The bank launched a crypto asset custody service, allowing customers to securely store and manage digital assets;

The e-commerce platform directly opens the functions of purchasing, custody and selling cryptocurrencies, realizing a "one-stop" encryption experience.

4. Cryptocurrency Adoption in Latin American Countries

4.1 Argentina

It's no coincidence that Argentina has become the epicenter of cryptocurrency adoption in Latin America. Multiple economic factors, including hyperinflation, the continued devaluation of the peso, and a collapse of trust in the traditional financial system, have forced millions of Argentines to seek digital assets as a safe haven. In this context, cryptocurrencies are not only an investment tool but also a means of preserving value amidst extreme volatility. Simultaneously, the local crypto community is thriving, providing fertile ground for the innovation and implementation of decentralized solutions. This diverse and rapidly expanding ecosystem, comprised of an active community, innovative projects, and bold investors, presents both numerous challenges and immense opportunities.

Why Argentina? As the undisputed leader in crypto adoption, Argentina boasts the highest transaction volume in the region, despite having only one-fifth the population of Brazil. With a mature market, the largest active user base for real-time testing, and a globally influential community of blockchain application developers, the country possesses immense entrepreneurial potential. Now is the time to capitalize on this momentum, position Argentina as a hub for blockchain technology and innovation, produce internationally competitive products, and further solidify its leadership in the crypto ecosystem.

A. Community

The growth of the crypto community is a defining force in Argentina's ecosystem. It not only promotes education but also fosters collaborative networks for exchanging ideas and launching disruptive projects. The most influential groups include:

Crecimiento: Through its focus on education and co-creation spaces, Crecimiento has become a hub connecting innovators and blockchain enthusiasts nationwide. Its recent large-scale events have attracted industry leaders and helped connect startups with investors.

Ethereum Argentina: A local branch of the global Ethereum network, promoting the adoption of smart contracts and DApps through hackathons and events.

Polkadot Patagonia & Polkadot Argentina: Focus on promoting the Polkadot ecosystem, organizing interoperability and parachain development activities, and consolidating the national technological infrastructure.

FORK DAO: An emerging DeFi community dedicated to developing decentralized applications and presenting DeFi as a viable alternative to traditional finance.

B. Project

Argentina’s project landscape is extremely diverse, ranging from established exchanges to asset tokenization and DeFi platforms, reflecting the vitality of local entrepreneurs in adapting blockchain to various industries.

Exchange

Ripio: A veteran in the Argentinian crypto industry, Ripio not only facilitates transactions but also provides loans and crypto credit cards, bringing digital assets into daily consumption.

Lemon Cash: It quickly became popular with its "BTC return on every purchase", bringing crypto payments into thousands of households.

Asset Tokenization

Agrotoken: Putting agricultural products such as soybeans, corn, and wheat on the blockchain allows farmers to use tokens for financing or cashing out, opening up new channels for agricultural finance.

R3al Block: Focuses on real estate tokenization, allowing high-value properties to be split and traded, improving liquidity and lowering investment barriers.

Financial Solutions and DeFi

RSK Labs: Implementing smart contracts on top of Bitcoin, with an ecosystem covering lending, stablecoins, and more, contributing to financial inclusion.

Beefy: A yield aggregator that helps users obtain higher returns in DeFi through automated strategies, becoming a new alternative to traditional investments.

Infrastructure

Coinfabrik: Provides blockchain development, security audits, and platform construction, serving as the "construction team + security team" of the local ecosystem.

Sensei Node: Operates blockchain nodes to enhance network decentralization and security.

C. Investors

Despite the complex economic environment, local and international funds still see Argentina as fertile ground for technological innovation.

Alaya Capital: Betting on crypto infrastructure and DeFi startups to help the financial system evolve towards greater inclusiveness and resilience.

Kaszek Ventures: One of the largest VCs in Latin America, focusing on fintech and crypto products to promote regional ecosystem expansion.

NXTP Ventures: Investing in Latin American technology startups, NXTP has invested in several companies that use blockchain to solve local pain points, helping projects scale and transform the financial industry.

D. Dilemma of Traditional Companies

Regulatory and economic uncertainty are making it difficult for traditional businesses to operate. Banco Galicia, one of the largest private banks, attempted to launch crypto services but was forced to halt its efforts due to direct intervention from the central bank, highlighting the lack of a regulatory framework and authorities' reluctance to allow financial institutions to engage in crypto.

E. Regulatory Developments in Argentina

2024 Regulatory Implementation

2024 is a pivotal year for Argentina's cryptoasset industry regulation. In March, Law No. 27,739 came into effect, amending Law No. 25,246 (Preventing Money Laundering, Terrorist Financing, and the Proliferation of Weapons of Mass Destruction). The new law formally defines "virtual assets" for the first time and establishes a national registry of Virtual Asset Service Providers (VASPs) overseen by the Argentine National Securities Commission (CNV), allowing them to operate in compliance with the anti-money laundering/counter-terrorist financing framework. VASPs are also incorporated into the national anti-money laundering and counter-terrorist financing system and are subject to oversight by the Financial Intelligence Unit (UIF).

This institutional shift paved the way for a series of regulatory measures, opened the door for the implementation of encryption and blockchain technologies in traditional scenarios, and brought about the following milestones:

Establishing a company with crypto-asset capital. According to Law No. 27,739, VASPs play a key role in Argentina's anti-money laundering system. It clarifies that virtual assets (VAs) can be used as paid-in capital contributions and designates VASPs as "crypto-equity" verification agencies. Key points: Bitcoin and USDC are officially recognized by the IGJ for the first time as legal capital contributions for company registration in Argentina; transparent valuation: the number of shares is calculated based on the market value of the crypto-asset in pesos on the date of the contribution.

Argentina has included crypto assets in a tax amnesty for the first time. Law No. 27,743, passed on July 8, 2024, explicitly and legally designated cryptocurrencies as declarable taxable assets for the first time, forming part of a one-time tax regulation and asset externalization system. This system allows Argentine citizens to launder undeclared assets up to $100,000: any excess amount is taxed at a preferential one-time rate within a specified period. To participate, the relevant cryptocurrencies must be held on an exchange registered as a VASP with the National Securities Commission (CNV) and a formal declaration must be submitted. The new system drove crypto asset deposits to a record high in September 2024, with Bitcoin deposits reaching three times the annual monthly average.

CEDEARs for Bitcoin and Ethereum ETFs. The Securities and Futures Commission's Resolution No. 1030/2024 paves the way for the issuance of Argentine Depositary Receipts (CEDEARs) linked to Bitcoin and Ethereum ETFs in the Argentine capital market. CEDEARs allow investors to gain exposure to cryptocurrency prices without the need for direct custody of the crypto assets. Like the underlying ETFs, these CEDEARs must be purchased through CNV-authorized broker-dealers and do not involve actual custody or direct access to the underlying assets.

Regulatory Outlook 2025

As the crypto ecosystem becomes increasingly connected with traditional sectors such as capital markets and the banking system, there is an urgent need for regulatory rules to promote this integration and drive wider adoption and use. Any excessive regulation of virtual assets or their service providers is unnecessary. To achieve this integration, the following aspects should be focused on:

Tax treatment of virtual assets. Argentina's tax treatment of virtual assets remains challenging due to a lack of updated measures (for example, it remains unclear whether virtual assets will be included in the bank lending tax). While Law No. 27,743 is a step in the right direction, incorporating these assets into the asset regulation and externalization regime for the first time, inequalities remain prevalent compared to other investment vehicles.

Tokenization of real-world assets. The tokenization of stocks, financial assets, and real estate requires regulatory updates to leverage the efficiency and security offered by blockchain to issue, trade, and confirm digital forms of ownership. This process, already underway in several countries, allows for more agile, secure, and efficient access to investment opportunities. To advance this issue, the Argentine Fintech Chamber has drafted a reform proposal advocating for tokenized assets to be separated from traditional regulatory frameworks. The document emphasizes that blockchain, through its distributed registry, verifiability, transparency, and immutability, can provide comparable safeguards to traditional mechanisms. It also points to the potential for utilizing smart contracts governed by autonomous rules, including lock-up/vesting clauses and automatic dividends. This approach will bring benefits such as increased liquidity, reduced asset fragmentation, reduced intermediary costs, and truly universal access to investment.

Building a national strategic reserve with Bitcoin or virtual assets. Another key development this year was the submission of a draft bill proposing to allow the Central Bank of Argentina (BCRA) to purchase, store, and mine Bitcoin, and to allocate a portion of its reserves to this cryptocurrency. Currently, the BCRA's charter does not explicitly address cryptocurrency mining; as for the purchase of crypto assets, current regulations allow for the trading of "financial assets" but do not specify whether this definition includes cryptocurrencies.

Buenos Aires Crypto Economic Zone. In 2024, Argentina further solidified its position as Latin America's crypto capital, attracting hundreds of startups, companies, and global developers to the Aleph Tech Hub in Buenos Aires, known as the "Ciudad de Crecimiento" ("City of Growth"). This was achieved through a tailored regulatory framework encompassing specialized tax, labor, and social security systems, as well as infrastructure benefits, legal certainty, and investment incentives for this inherently transnational technology.

F. Challenges and Opportunities

With the rise of Javier Mille to power, Argentina's crypto ecosystem stands at a crossroads. Mille has publicly championed cryptocurrencies and proposed a first-of-its-kind asset legalization plan, allowing taxpayers to declare crypto assets without additional documentation. If he implements a bold and progressive regulatory framework, it will both protect consumers and position Argentina as a regional leader. However, macroeconomic indicators remain volatile, and economic uncertainty is keeping investors cautious. If policies successfully mitigate risks, capital confidence and inflows are expected to rebound rapidly. The robust demand for DeFi and asset tokenization, coupled with Argentina's inherent entrepreneurial spirit, could spawn a new wave of market disruptors.

G. Future Outlook

During Mille's tenure, Argentina's crypto landscape is poised for a rollercoaster ride. If regulations become clearer and more user-friendly, international capital is likely to flock to the country, solidifying its position as the "crypto capital of Latin America." By overcoming both regulatory and macroeconomic challenges, Argentina is poised to occupy a key position in the global crypto landscape, becoming a trendsetter and a focal point in the Spanish-speaking world.

4.2 Brazil

Blockchain technology is penetrating Brazil at an astonishing pace—from the beaches of Rio de Janeiro to the most digital favelas, cryptocurrencies are now ubiquitous. Economic factors such as inflation and financial exclusion are driving this "quiet revolution": what was once a niche market has become an unstoppable, universal movement.

A key driver behind this is Brazil's crypto regulatory law. Enacted in December 2022 and effective in June 2023, the law marks a milestone in Latin America: the Central Bank of Brazil (BCB) is authorized to regulate virtual asset service providers, while token projects deemed securities are now regulated by the Securities and Futures Commission (CVM). The new regulations not only protect consumers but also set a regional benchmark, potentially accelerating the development of regulatory frameworks in neighboring countries.

A. Community

The Brazilian crypto community is like a constantly roaring engine, fueled by passion and the desire to change the status quo.

Blockchain Rio: An annual conference that brings together developers, businesses, and enthusiasts, it is the most important blockchain "social magnet" in Latin America.

Ethereum Brasil: Continuing to generate momentum for smart contracts and DApps through hackathons and events.

Praia Bitcoin: Bringing Bitcoin lectures to the beach, allowing encryption to truly become part of daily life.

Other active local nodes: Polygon, Solana, Polkadot and other ecosystems also have Portuguese communities, forming a "samba rhythm" of multi-chain progress.

B. Project

Brazil is a fertile ground for crypto entrepreneurship, where creativity and courage fly together.

Exchange

Mercado Bitcoin: the largest in the country and a benchmark in Latin America, it was the first to achieve asset tokenization and received a US$200 million Series B funding from SoftBank in 2021.

Mynt (BTG Pactual): Owned by an investment banking giant, traditional institutions directly enter the retail market.

Asset Tokenization

Liqi: Real estate, equity, and agricultural startups are “fragmented on the chain”, turning high-threshold assets into tokens that can be purchased for 100 reais.

Amfi: A compliant token issuance platform that has implemented multiple cases including hotel revenue rights and private equity.

Stablecoins

M^0 (M-Zero): A "decentralized crypto dollar" with a multi-issuer model. Qualified collateral can be used to mint coins, reducing single-point risk, and targeting the "on-chain Federal Reserve" in emerging markets.

Financial Solutions and DeFi

Hashdex: The first batch of crypto ETF manufacturers, BITH11 (Bitcoin ETF) and HASH11 (Metaverse ETF) brought 300,000 traditional investors into crypto.

Picnic: A one-stop DeFi portal that aggregates returns, staking, and insurance, with an interface reminiscent of the "Brazilian Alipay."

Infrastructure

Parfin: Crypto-as-a-Service, providing custody, liquidity, and matching APIs to banks and securities firms. Clients include Itaú and BTG.

Cointrader Monitor: Real-time price, depth, arbitrage radar, a must-have market tool for local traders.

Atomic Fund: Market maker, ensuring the depth of local exchanges such as Mercado Bitcoin and Foxbit.

Arthur Mining: Hydropower + solar mining farm, PUE <1.05, and full ESG narrative.

C. Investors

Canary: A $200 million early-stage fund that invested in Hashdex, Liqi, and Picnic.

Monashees: A long-established Latin American VC with heavy investments in DeFi and blockchain infrastructure.

Valor Capital Group: Focusing on cross-border fintech, bringing the "long money" of American LPs into the Brazilian blockchain world.

D. Traditional enterprises enter the market

The active embrace of cryptocurrencies by traditional Brazilian businesses, driven by both strategic considerations and market forces, makes them unique within the region. Cryptocurrencies offer a hedge against the ongoing devaluation of the real and broaden investment options. Furthermore, while the regulatory framework is still evolving, Brazil's openness to financial innovation has significantly reduced compliance risks for businesses. This relaxed environment has enabled traditional companies to expand their services, attract new, tech-savvy customers, and seize opportunities in the digital race. Coupled with the Brazilian business community's long-standing culture of innovation and rapid trial and error, integrating cryptocurrencies is not only feasible but also considered a strategic imperative for enhancing competitiveness.

Typical examples of this trend are as follows:

XP Investimentos: As one of the largest brokerage firms in Brazil, XP has launched cryptocurrency-related services, highlighting the integration of crypto assets by traditional financial institutions.

Nubank: Brazil's largest digital bank has launched cryptocurrency buying and selling functions, marking the official integration of crypto services into the traditional banking system.

Mercado Libre: This Latin American e-commerce giant has integrated cryptocurrency functionality into its payment platform, making the world of crypto accessible to tens of millions of users.

BTG Pactual: One of Brazil's top investment banks, it has launched products such as exchanges and crypto investment funds, highlighting its important position in the local market.

E. Challenges and Opportunities

One of the biggest challenges facing Brazil's crypto ecosystem is the final implementation of its regulatory framework and fiscal and tax regulations . Overly restrictive policies could constrain businesses and dampen investor enthusiasm. However, this presents an opportunity to transform crisis into opportunity: Brazil could establish a mature regulatory framework that encourages innovation while protecting consumers. The most intriguing initiative is the central bank digital currency (CBDC) project, DREX. If successfully launched, it will inject new momentum into the Brazilian economy by reducing transaction costs, improving financial inclusion, and enhancing system efficiency. It will also make Brazil the first country in Latin America to establish a benchmark CBDC, providing a replicable "Brazilian model" for neighboring countries.

F. Future Outlook

Brazil possesses all the ingredients to become a global crypto hub : a vibrant community, a burgeoning pipeline of innovative projects, and an open and progressive regulatory framework. These factors are converging to position the country as the leader of Latin America's next wave of financial transformation. Local examples like Liqi and M^0 not only demonstrate Brazil's ability to embrace emerging technologies but also demonstrate the global repercussions of its innovations. As regulations take hold and projects mature, Brazil is poised to take a central role in the evolution of decentralized finance, reshaping not only its own economy but also the global crypto landscape.

4.3 Colombia

With a vibrant scene of technological innovation, Colombia is beginning to carve its own path in the crypto world. Despite economic and regulatory challenges, creativity continues to fuel a growing crypto ecosystem. However, a lack of regulatory clarity and a regional technology gap limit its potential to become a true crypto hub in the short term. Fortunately, vibrant communities, innovative projects, and growing investor interest in cities like Bogotá and Medellín are positioning Colombia for a prominent position on the Latin American cryptocurrency landscape.

A. Community

The crypto community is the heart of the Colombian ecosystem, dedicated to education, collaboration, and innovation. Some of the most influential figures include:

ETH Medellín: The most active Ethereum community in the country, based in Medellín, the "Innovation Capital", regularly organizes hackathons and workshops to promote smart contracts and DApp development.

Celo Colombia: Focusing on financial inclusion, Celo promotes the popularity of the Celo blockchain on mobile devices and opens the door to cryptocurrency for groups not covered by traditional banks.

B. Project

Colombia has seen a surge in projects aiming to use blockchain to solve local and global problems. These scalable solutions range from financial inclusion to DeFi adoption:

Littio: It focuses on "digital dollar" savings and payments, connects with local merchants, has a low threshold for use, and has become an entry-level tool for daily crypto consumption.

Wenia (under Bancolombia): Traditional major banks have directly entered the market, allowing users to buy and sell cryptocurrencies with one click within the bank app, breaking through the last barrier between fiat currency and digital assets.

Tropykus: A DeFi platform focused on emerging markets, offering decentralized lending and interest-based deposits, providing the unbanked with a viable alternative to traditional finance.

Kravata is an infrastructure service provider dedicated to simplifying Web3 technology, based in Colombia. Through its Crypto-as-a-Service (CaaS) solution, the company provides compliant, API-based digital asset access to businesses in Latin America, enabling secure, low-cost, and efficient two-way exchange between local fiat currencies and crypto assets. Its technical architecture helps individuals and businesses in Latin America fully unlock the potential of decentralized finance (DeFi) and Web3. In its first year of operation, Kravata processed $215 million. In March 2024, it received backing from international investors including Volt Capital, Framework Ventures, and Circle Ventures, committed to solving transaction infrastructure challenges in Latin America through blockchain technology.

C. Investors

Several venture capital firms have been attracted by the potential of Colombia’s crypto ecosystem:

InQLab: Focuses on local blockchain startups and promotes ecosystem growth through strategic investments.

Magma Partners: A Latin American fund that invests in Colombian fintech innovation and helps local crypto companies accelerate their implementation.

D. Traditional enterprises enter the market

Colombian giants have also begun experimenting with blockchain:

Rappi: The food delivery platform has been internally testing encrypted payment, and users can place orders directly with digital assets, reflecting the seamless integration of traditional services and encryption.

Banco de Bogotá: First to participate in the central bank's sandbox, piloting direct deposits and withdrawals of cryptocurrencies from bank accounts.

Davivienda: We are actively exploring the integration of crypto assets into existing product lines to meet the growing demand for innovative finance.

E. Challenges and Opportunities

Colombia's crypto ecosystem faces numerous obstacles in its bid to become a regional hub. The primary obstacle is regulatory ambiguity : despite repeated government announcements of legislation, progress has been slow and inconsistent, deterring investors and startups from making significant bets. The lack of clear rules to protect consumers and define corporate responsibilities has directly inhibited market expansion. Secondly, a significant technological gap exists: while first-tier cities like Bogotá and Medellín have advanced infrastructure, remote areas suffer from weak connectivity, leaving rural populations, who most need alternative financial services, without access to digital services.

But the opportunities are equally enormous. Colombia's remittances are among the largest in Latin America, and crypto remittances can significantly reduce costs and increase efficiency. The large unbanked population provides a natural breeding ground for crypto adoption. Traditional financial institutions' trials also send positive signals: Banks like Bancolombia and Davivienda have already launched crypto sandboxes. If regulatory guidance becomes clear, access to mainstream financial channels will instantly expand the user base. The key lies in whether the government can strike a balance between encouraging innovation and protecting consumers, and implement clear and user-friendly policies.

F. Future Outlook

Whether Colombia can secure a place in Latin America's crypto landscape depends on the pace of regulatory oversight and the evolution of its digital infrastructure. If it can establish transparent regulations and address shortcomings in rural internet connectivity, Colombia has the potential to leapfrog its competitors in remittances and financial inclusion, becoming a formidable regional player. Otherwise, it will remain a "potential market" and watch other countries surge ahead. The outcome remains to be seen in the government's actions.

4.4 Mexico

Mexico is emerging as a key player in Latin America's crypto landscape. Leveraging its vast population and regional economic influence, the country is significantly accelerating crypto adoption and blockchain innovation. Its burgeoning fintech sector, vibrant entrepreneurial culture, and growing acceptance are all contributing to its emergence as a hotbed for crypto growth.

A. Community

The Mexican crypto community is the backbone of the ecosystem, providing a space for collaboration, education, and networking. Through events, hackathons, and workshops, they not only educate but also inspire innovation. The most vocal groups include:

ETH Mexico: Focusing on Ethereum and decentralized applications, it hosts large-scale hackathons and summits, bringing together developers, investors, and enthusiasts to boost the growth of local projects.

Frutero Club: Focusing on social interaction and education, it uses relaxed scenarios to lower the threshold for crypto awareness and allow novices to learn how to use wallets during chats.

HER DAO Mexico: Dedicated to increasing women's participation in the crypto space, HER DAO teams up with women to work on projects through internal hackathons and workshops, and selects outstanding results for participation on a larger stage.

B. Project

Mexico also has a number of platforms and programs that are reshaping the digital economy:

Bitso, a leading cryptocurrency exchange in Latin America, was founded in 2014 and is headquartered in Mexico. Its business covers eight countries, including Mexico, Argentina, Brazil, Chile, and Colombia. It is known as the "Coinbase of Latin America." By 2025, it had over 9 million users, serving both individual and corporate clients. It is Latin America's first crypto unicorn (valued at $2.2 billion). The company's mission is to promote financial inclusion and build a borderless financial ecosystem through blockchain technology.

The C-end supports 100+ cryptocurrency transactions, and fiat currencies such as MXN, BRL, ARS, and USD can be deposited and withdrawn in seconds via SPEI/PIX/ACH.

Bitso Business, a B2B platform, provides stablecoin payments, batch payroll, and API settlement services to 1,900 businesses. It can access Latin America without requiring a local license. Its flagship product, Bitso Transfer, uses the Ripple network and stablecoins for cross-border remittances, with instant deposits and fees 50% lower than SWIFT.

Launched the Mexican Peso stablecoin MXNB and the Brazilian Renard stablecoin BRL1 to solve the local fiat currency exchange problem;

The Pay with Bitso system supports cryptocurrency payments and integrates offline POS machines, e-commerce platforms, digital entertainment platforms, subscription companies, etc.

In 2021, it raised $250 million in Series C funding from Tiger Global, Coatue, Paradigm, and others, valuing the company at $2.2 billion. With dual regulatory licenses in Gibraltar and Mexico and a 500-person team spanning 35 countries, it serves as both a gateway for retail investors to buy cryptocurrencies and a foundation for multinational corporations to connect stablecoin payments in Latin America.

Bando: An emerging protocol that focuses on on-chain payments and uses decentralized financial solutions to lower the barrier to entry for the general public.

The Ethereans: An NFT art team that issues limited-edition digital collectibles on Ethereum, attracting attention from both the art and technology circles.

KardashevBTC: A large-scale mining company, focusing on sustainability and energy efficiency, is building a green computing power base in Mexico.

C. Investors

As demand for fintech and blockchain surges, local and international venture capital firms are betting on Mexico:

Angel Ventures Mexico: Focuses on high-growth technology/fintech startups, actively deploys in the crypto sector, and helps companies seize opportunities in the digital market.

Cometa: Adhering to long-termism, investing in crypto teams that build the next generation of financial infrastructure, and promoting the upgrading of national financial infrastructure.

D. Challenges and Opportunities

Despite rapid growth, Mexico still faces significant challenges. A lack of regulation is the biggest obstacle: while relatively relaxed compared to neighboring countries, policy uncertainty still makes entrepreneurs and investors hesitant. Authorities' cautious, "wait-and-see" approach to crypto assets has deterred traditional institutions from entering the market, slowing innovation and undermining the willingness of international players to enter the market. Furthermore, institutional investors' high risk premiums continue to constrain capital access for new projects.

But the opportunities are equally enormous. A booming digital economy, a youthful population, and a vibrant fintech ecosystem have created fertile ground for the w