This report, authored by Tiger Research, explores how Pendle is revolutionizing DeFi derivatives by transforming volatile funding fees into stable, predictable returns for institutional investors through Boros.

TL;DR

Institutions seek stable returns and pursue a delta-neutral strategy, but the constraints of funding fee volatility carry significant risks.

Pendle, a leader in DeFi derivatives, aims to minimize this volatility by launching Boros, which turns funding fees into DeFi derivatives.

In the future, we plan to expand from cryptocurrency to traditional finance (bonds, stocks) and lead the on-chain derivatives market.

1. The Untapped Areas Behind DeFi's Success

While numerous narratives have emerged in the cryptocurrency market thus far, decentralized finance (DeFi) and derivatives trading have demonstrated the strongest product-market fit.

Among these, DeFi first gained traction. Starting with lending protocols like Aave and Compound and decentralized exchanges like Uniswap, it has since expanded to include yield farming mechanisms. While DeFi projects share similar features to those offered by traditional finance, the lack of a centralized entity has led to a surge in participants utilizing the DeFi ecosystem.

As the DeFi market fully entered the mainstream, it naturally moved into the next phase: the expansion into the derivatives market. This is a similar path to that taken by traditional financial markets. Even in traditional financial markets, derivatives generated significantly greater trading volume and liquidity than spot trading. The same phenomenon is now occurring in the cryptocurrency market. Derivatives, accessible to everyone, are becoming a new growth engine.

Be the first to discover insights from the Asian Web3 market, read by over 16,000 Web3 market leaders.

2. Pendle, a leading player in DeFi financial engineering

Pendle was an early adopter of this shift. Since its launch in 2021, Pendle has been a leading project in bringing structured derivatives to DeFi.

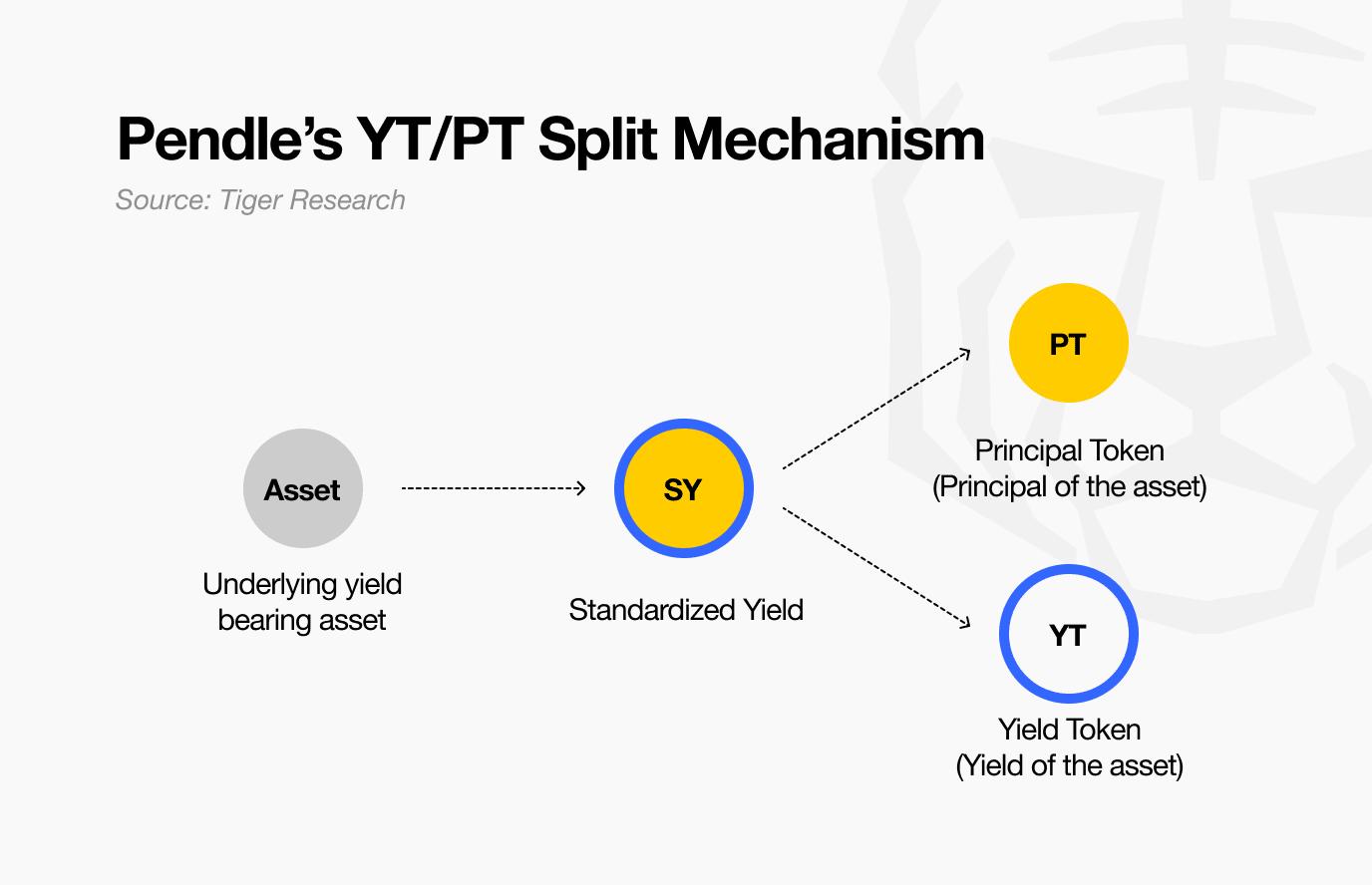

Pendle was the first to launch a product that separates the principal and yield from yield-bearing tokens. The timing was perfect. Staking was becoming widespread, and by 2023, staking and airdrop expectations had become major topics in the cryptocurrency market, leading to interest in Pendle. These days, new projects are taking Pendle as a fundamental partner when developing yield strategies.

While the mechanism itself appears simple, it actually creates two completely different assets: a right to purchase future value at a discount (PT) and an asset that bets solely on interest rate fluctuations (YT).

You'll understand how significant this change is when you try it yourself. In the past, assets like stETH and rETH were simply tokens used for staking. But now, they've transformed into the building blocks of much more complex and sophisticated investment strategies.

For example, investors who believe staking interest rates will rise in the future can purchase YT. This can leverage up to six times, depending on market conditions. Conversely, those seeking stable returns can purchase PT equivalent to the discounted principal, potentially at a double-digit discount to the future value.

The key point is that Pendle's first foray into derivatives in DeFi has laid the foundation for full-scale financial engineering in the blockchain market. Tools previously reserved for institutional investors have become accessible to everyone.

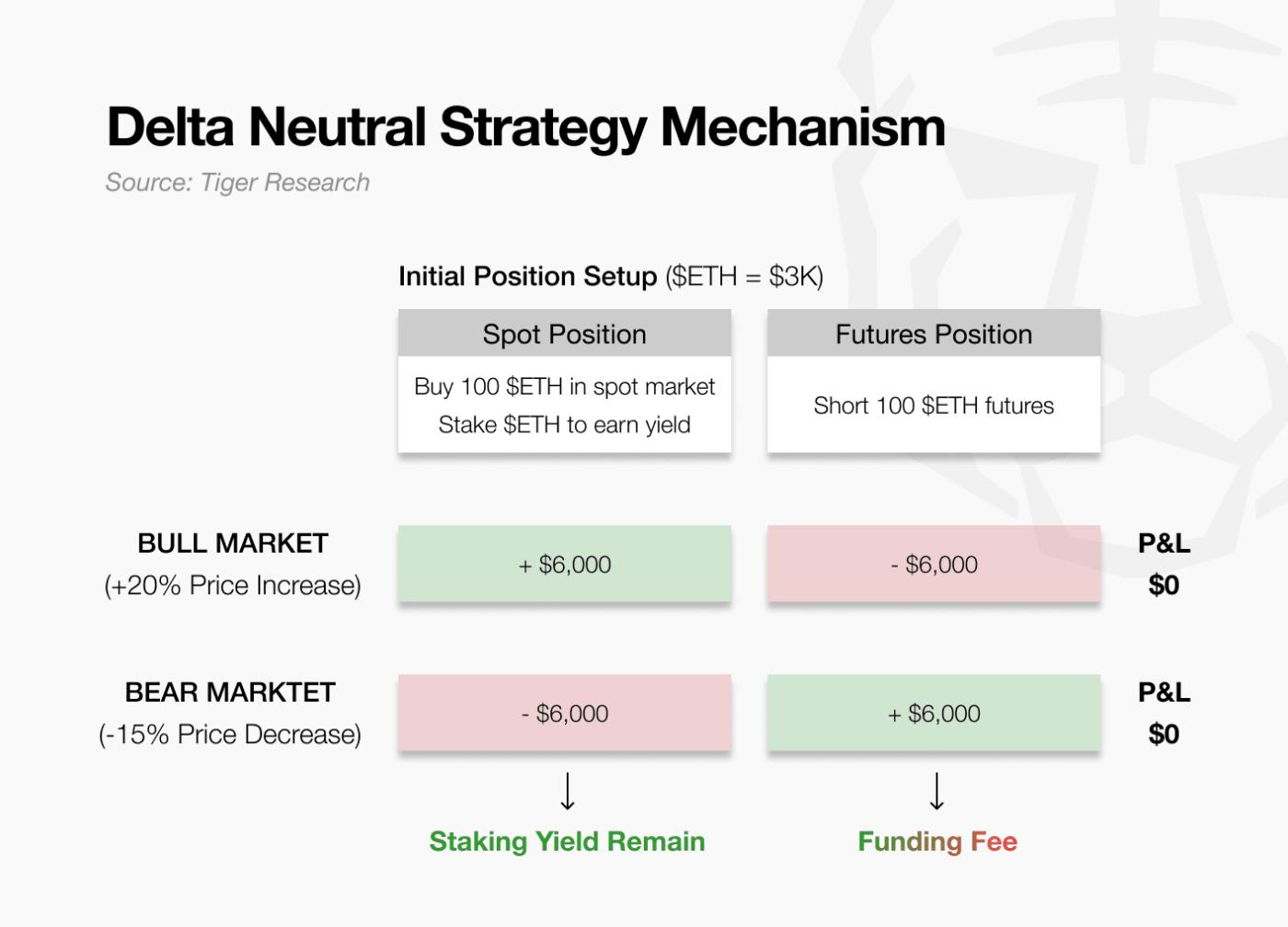

Amidst this trend, as the cryptocurrency market naturally grows, institutional investors are investing more capital into the cryptocurrency market and striving for returns. However, unlike retail investors, their primary goal is stable returns. To achieve this strategy, they typically utilize delta-neutral positions to minimize price risk.

Ethena is a good example. It holds spot ETH while simultaneously shorting the same amount in futures. Profits from one position offset losses from the other, ensuring a stable portfolio regardless of price movements.

However, this isn't always a zero-sum situation. This is due to the funding fee. In a bull market, long position investors pay funding fees to short position investors, thus generating profits for Ethena. However, in a bear market, Ethena must pay the funding fee.

The problem is that funding fee flows are inherently volatile. Sometimes they generate revenue, but other times they require expenditures. This volatility poses a significant burden to protocols like Ethena, which back the stablecoin USDe with a delta-neutral strategy.

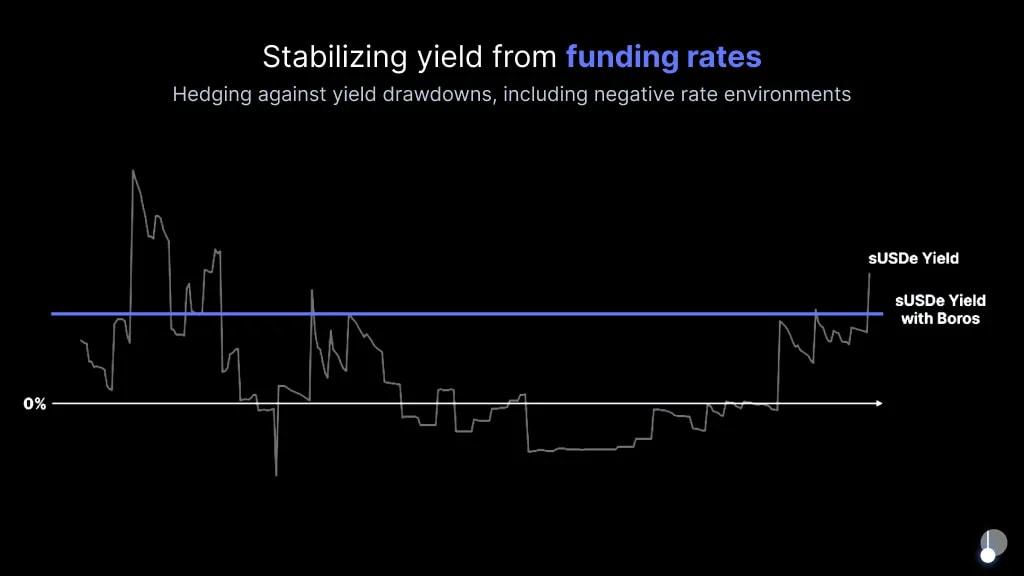

Boros solves this problem by converting volatile funding fee flows into fixed, predictable returns. This provides institutional investors with the consistency they need to expand their capital in the cryptocurrency market.

4. How does Boros move?

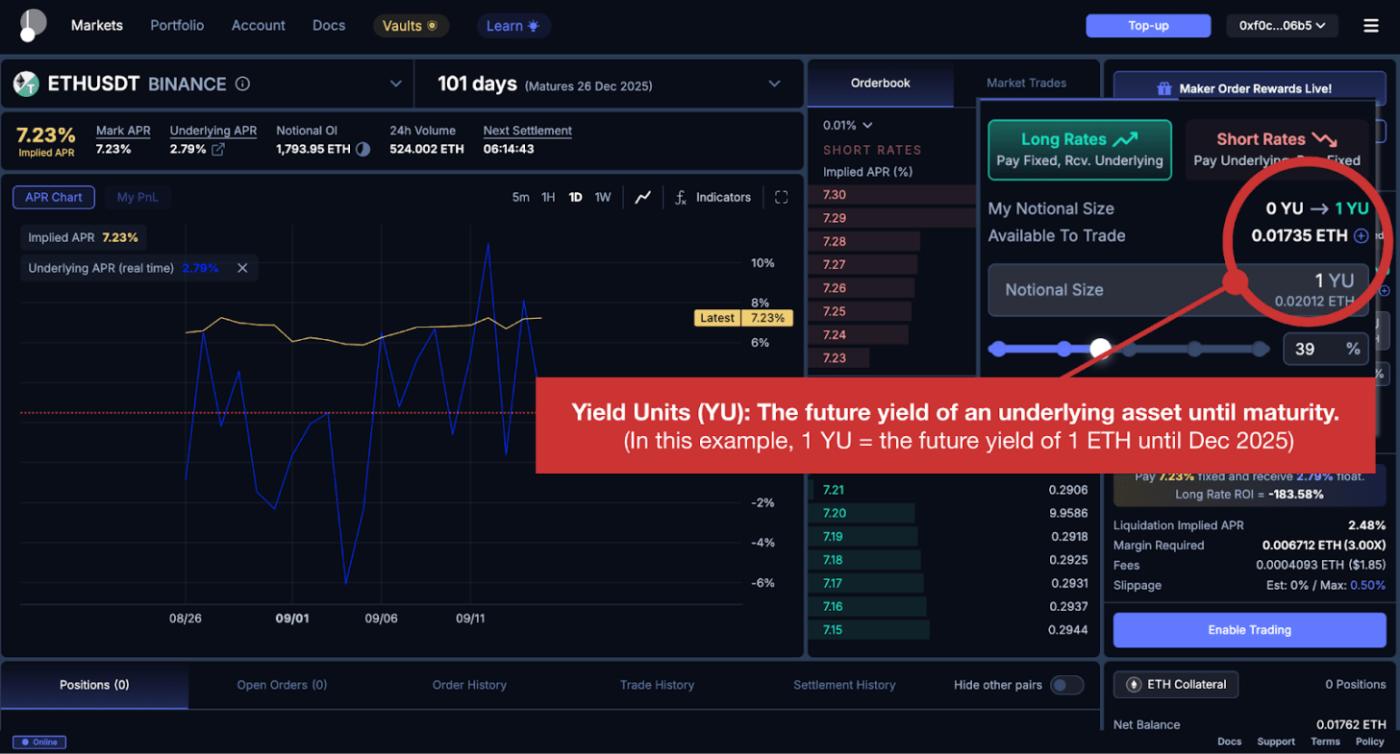

Boros introduced a derivative based on yield units (YU). This product separates funding volatility from the underlying asset price. YU enables two things simultaneously: directional betting on funding and transforming volatile funding flows into a predictable source of income.

4.1. Revenue Unit (YU): Structure and Purpose

Consider an investor who wants a fixed 8% annual return for three months, regardless of whether the Bitcoin funding fee fluctuates. Conversely, another investor prefers direct exposure to funding fee fluctuations, even if it means paying a fixed return.

YU connects these two aspects, allowing you to trade solely on the volatility of the funding fee, regardless of the underlying asset's price movements.

For example, the "1 YU-ETHUSDT-Binance" product represents the funding fee return for a notional 1 ETH position on Binance perpetual futures until expiration. By purchasing this product, investors can profit or lose based on changes in the funding fee associated with the position without actually holding ETH. In this way, YU transforms the funding fee of a specific exchange-asset pair into an independent, tradable instrument.

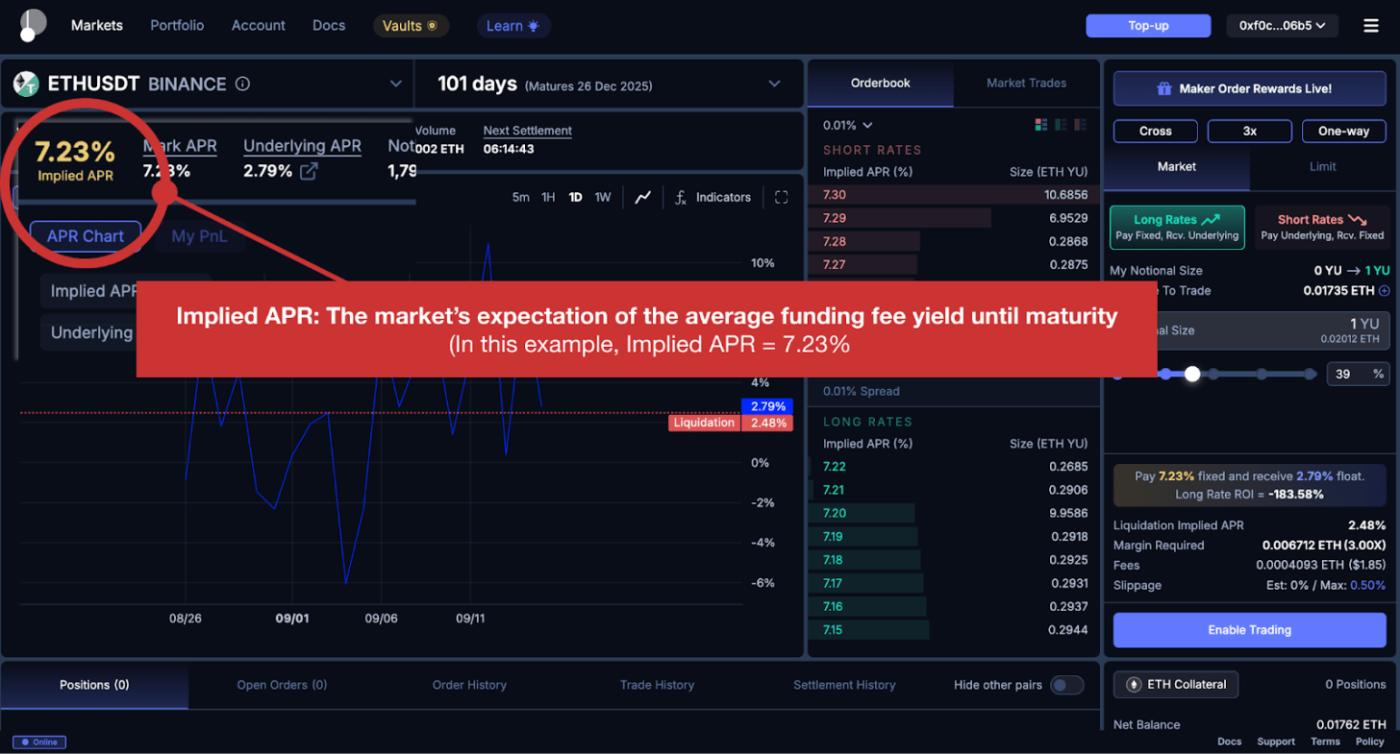

A key concept in YU trading is the implied APR. This represents the market's expectation of the average funding rate yield until maturity and is currently reflected in the YU price.

Just as a Bitcoin price of $80,000 reflects the market's assessment of the asset, an implied APR of 8% for YU-BTCUSDT means that participants expect the Bitcoin funding rate to average 8% per year over the period.

Simply put, the implied APR functions similarly to the market price in the futures market. It reflects the market consensus at the current point in time.

YU positions are similar to futures trading, but the motivations for long and short positions are different.

A YU long position reflects the belief that the actual funding fee will be higher than the current market expectation of 8%, for example, 10%. In other words, they pay a funding fee equivalent to the implied APR of 8% and receive a return equivalent to the actual funding fee. This is equivalent to taking a long position by saying, "Bitcoin futures are currently at $50,000, but I expect them to rise to $60,000."

Conversely, a YU short position reflects the belief that the actual funding fee will be lower than the current market expectation of 20%, for example, 15%. In other words, they receive a funding fee equivalent to the implied APR of 20% and pay a fee equivalent to the actual funding fee. This is equivalent to taking a short position by saying, "Bitcoin futures are currently at $50,000, but I expect them to fall to $40,000."

In short, Bitcoin futures are a bet on "current price vs. future price," while YU is a bet on "current market expectations (implied APR) vs. realized funding results (actual APR)." Since the funding rate resets every eight hours, profits are determined by whether the realized funding rate is higher or lower than the market expectations at that point in time.

What practical uses does YU have for institutional investors? Let's examine how Boros addresses Ethena's challenges due to fluctuating funding fees.

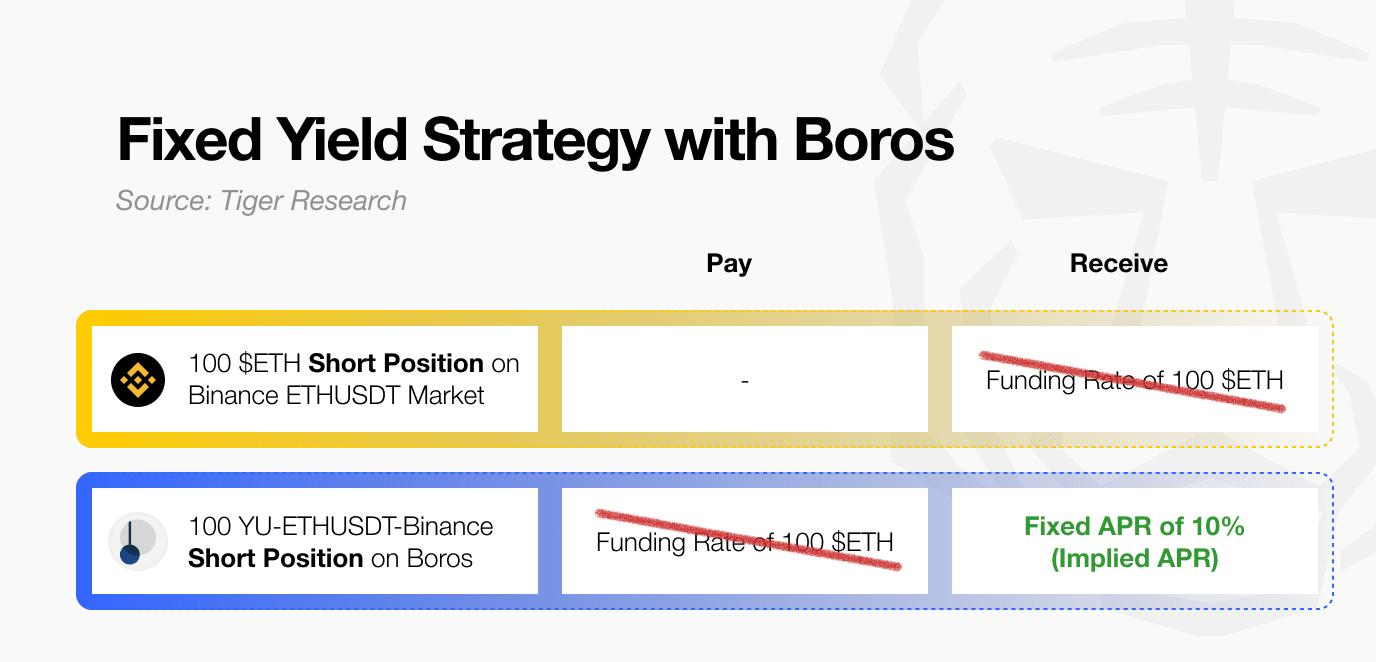

Let's assume Ethena operates a delta-neutral strategy with 100 ETH. It holds 100 ETH in the spot market and shorts 100 ETH in the futures market. The key issue with this structure is funding fee volatility. In a bull market, the short position receives funding, but in a bear market, it must continuously pay funding fees.

To stabilize this exposure, Ethena opens an additional short position of "100 YU-ETHUSDT-Binance" with an implied APR of 10%. To put it another way, this is a contract where Ethena receives a fixed 10% funding fee equivalent to 100 ETH, but agrees to pay the actual funding fee incurred.

As shown in the table, the variable funding fee from futures is offset by the variable funding fee paid by Boros. What remains is a fixed 10% yield from Boros. Even if the funding fee is actually received, the corresponding funding fee must be paid through the Boros contract, so the yield is fixed at 0, resulting in a fixed 10% yield. When combined with the separate staking yield (4%), Ethena achieves a predictable total yield of 14%.

However, this approach has trade-offs. Institutional investors must allocate additional margin to maintain these positions, and rapid price fluctuations can lead to liquidation risks. Therefore, investors like Ethena must use YU within a robust risk management framework.

While Ethena's example shows how YU can be applied in a single delta-neutral strategy, Boros's potential is much greater.

Boros currently operates on Arbitrum and supports Binance's BTC and ETH perpetual markets and Hyperliquid's ETH market. However, institutional investors don't limit their delta-neutral strategies to a single exchange. They diversify their assets and exchanges to manage risk and capture arbitrage opportunities. Therefore, expansion is essential.

Accordingly, Boros plans to add assets like Solana and BNB and integrate with exchanges like Bybit. This will broaden investors' access to the funding market. However, Pendle's ambitions don't stop there.

These strategies are unlikely to be limited to institutional investors. As Boros matures and diversifies, sophisticated individual investors are expected to participate. Even for those who don't directly utilize these strategies, funding fees will serve as a valuable indicator of market sentiment and positioning. Ultimately, they will inevitably influence the trading environment for both institutional and retail investors.

However, Pendle's real goal is to connect with traditional finance. Pendle has announced plans to incorporate benchmarks and products such as LIBOR, mortgage rates, bonds, and stocks. What's interesting is their approach. Contrary to the familiar pattern of traditional finance absorbing cryptocurrencies, Pendle aims to leverage the technological architecture of cryptocurrencies to reimagine traditional financial products on-chain.

The expansion of these funds can be viewed positively. As institutional investor participation increases and demand for more sophisticated strategies grows, the role of these funds in the market will become increasingly important. More significantly, these funds demonstrate the potential to emerge as leaders who not only follow the evolution of traditional finance but also shape the future of the global market. This is a vision worthy of recognition.

이번 리서치와 관련된 더 많은 자료를 읽어보세요.

Disclaimer

This report was partially supported by funding from Pendle, but was prepared through independent research based on reliable sources. However, the conclusions, recommendations, forecasts, estimates, projections, objectives, opinions, and views in this report are based on information current at the time of preparation and are subject to change without notice. Accordingly, we are not responsible for any losses resulting from the use of this report or its contents, and we make no express or implied warranties regarding the accuracy, completeness, or suitability of the information. Furthermore, the opinions of others or organizations may differ from or be inconsistent with those of others. This report is provided for informational purposes only and should not be construed as legal, business, investment, or tax advice. Furthermore, any reference to securities or digital assets is for illustrative purposes only and does not constitute investment advice or an offer to provide investment advisory services. This material is not intended for investors or potential investors.

Terms of Usage

Tigersearch supports fair use in its reports. This principle allows for broad use of content for public interest purposes, as long as it doesn't affect commercial value. Under fair use, reports can be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo ( in black and white ) must be included in accordance with Tigersearch's brand guidelines. Republishing materials requires separate consultation. Unauthorized use may result in legal action.