Historically , Bitcoin’s price has peaked approximately 20 months after a Bitcoin halving. The last Bitcoin halving occurred in April 2024, meaning we could see the top of the cycle in December of this year.

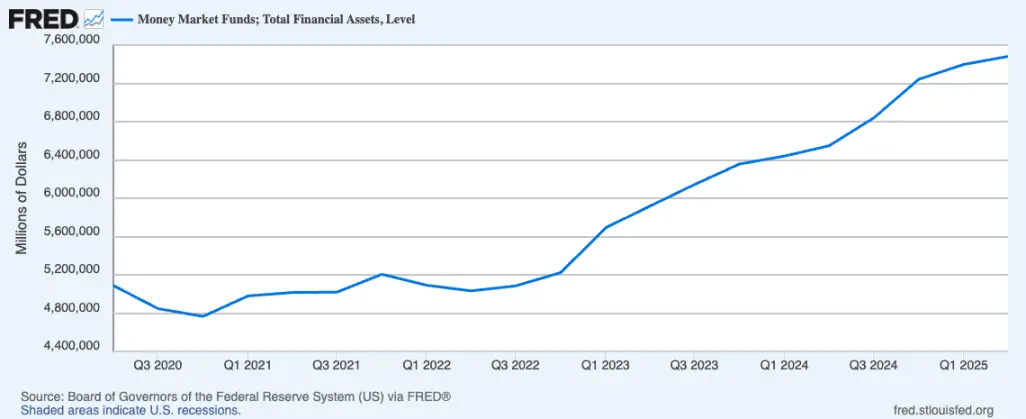

This scenario is becoming increasingly likely after Federal Reserve Chairman Jerome Powell’s 25 basis point rate cut this week gave the roughly $7.4 trillion in money market funds reason to come off the sidelines and flow into assets like Bitcoin, especially now that Bitcoin exposure is more accessible through proxy vehicles like spot Bitcoin ETFs and Bitcoin Treasury Bonds.

Powell also said two more rate cuts are possible before the end of the year, which would further reduce the returns of money market funds and could push investors toward inflation-resistant assets such as Bitcoin and gold, as well as riskier assets such as technology and artificial intelligence-related stocks.

This could catalyze the final stage of a "melt-up," similar to the performance of technology stocks in late 1999 before the dot-com bubble burst.

Furthermore, similar to the views of Henrik Zeberg and David Hunter, I believe that the bull market that began in late 2022 is entering its final parabolic rise.

Using traditional financial indices as a reference, Henrik Zeberg believes the S&P 500 will break through 7,000 before the end of the year, while David Hunter believes it will rise to 8,000 (or higher) within the same timeframe.

More importantly, according to macro strategist Octavio (Tavi) Costa, we may be witnessing a breakdown of the 14-year support level for the US dollar, which means we may see a significant weakening of the US dollar in the coming months, which would also support the bullish thesis for anti-inflation assets and risk assets.

What will happen in 2026?

Starting early next year, we may see the largest crash in all markets since the collapse of US financial markets in October 1929, which triggered the Great Depression.

Henrik Zeberg's reasons include a stagnation in the real economy, evidenced in part by the number of homes on the market.

David Hunter believes we are at the end of a half-century long debt-driven cycle that will end with a deleveraging unprecedented in modern history, as he shares on Coin Stories.

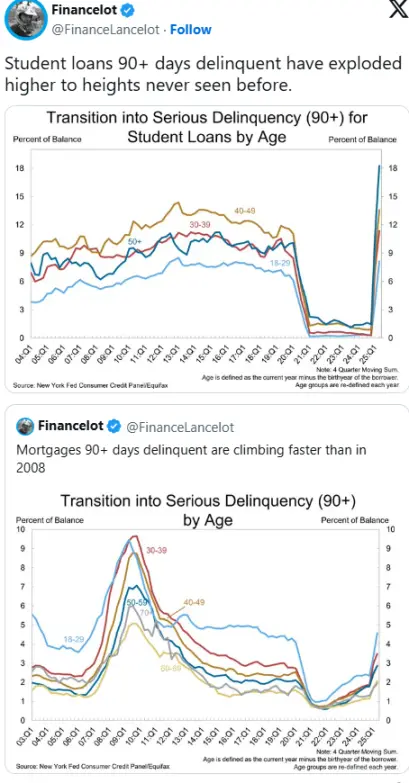

Other signals, such as loan payment defaults, also suggest that the real economy is stagnating sharply, which will inevitably have an impact on the financial economy.

A Bitcoin decline isn't inevitable, but it's highly likely

Even if we don’t head for a global macro crash, if history repeats itself, Bitcoin’s price will experience historic selling pressure in 2026.

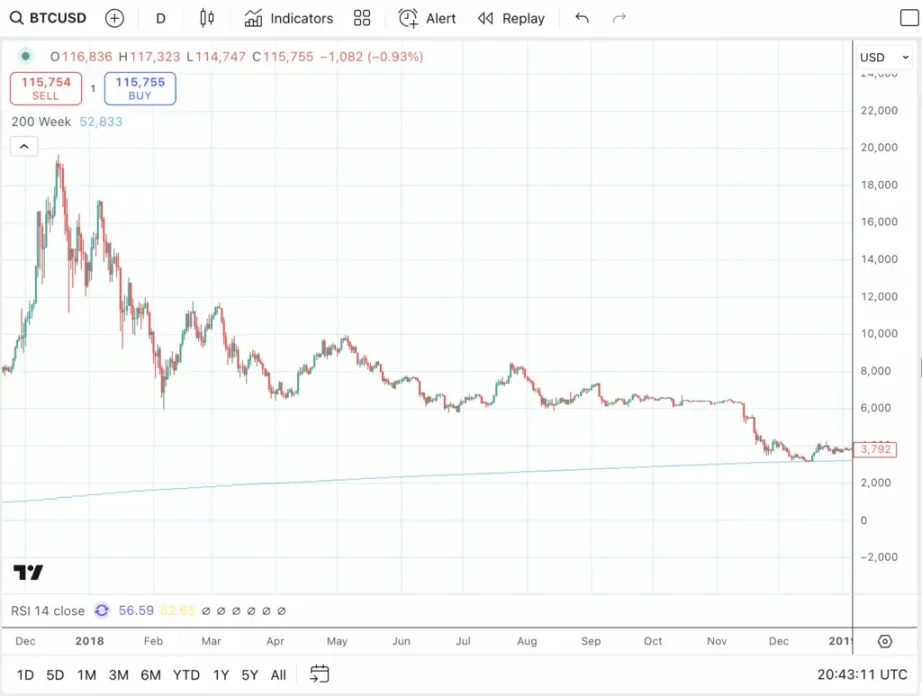

That is, the price of Bitcoin fell from nearly $69,000 at the end of 2021 to about $15,500 at the end of 2022, and from nearly $20,000 at the end of 2017 to just over $3,000 at the end of 2018.

In both instances, Bitcoin’s price touched or fell below its 200-week standard moving average (SMA), the light blue line in the chart below.

Currently, Bitcoin’s 200-week standard moving average sits at approximately $52,000. If the price of Bitcoin experiences a parabolic rally over the coming months, it could rise to as high as $65,000 before falling to that price point or lower sometime in 2026.

If we do see the kind of crash predicted, the price of Bitcoin could also fall well below that threshold. Still, no one knows what the future will hold, and it might be helpful to remember that history doesn’t necessarily repeat itself, but it often does.