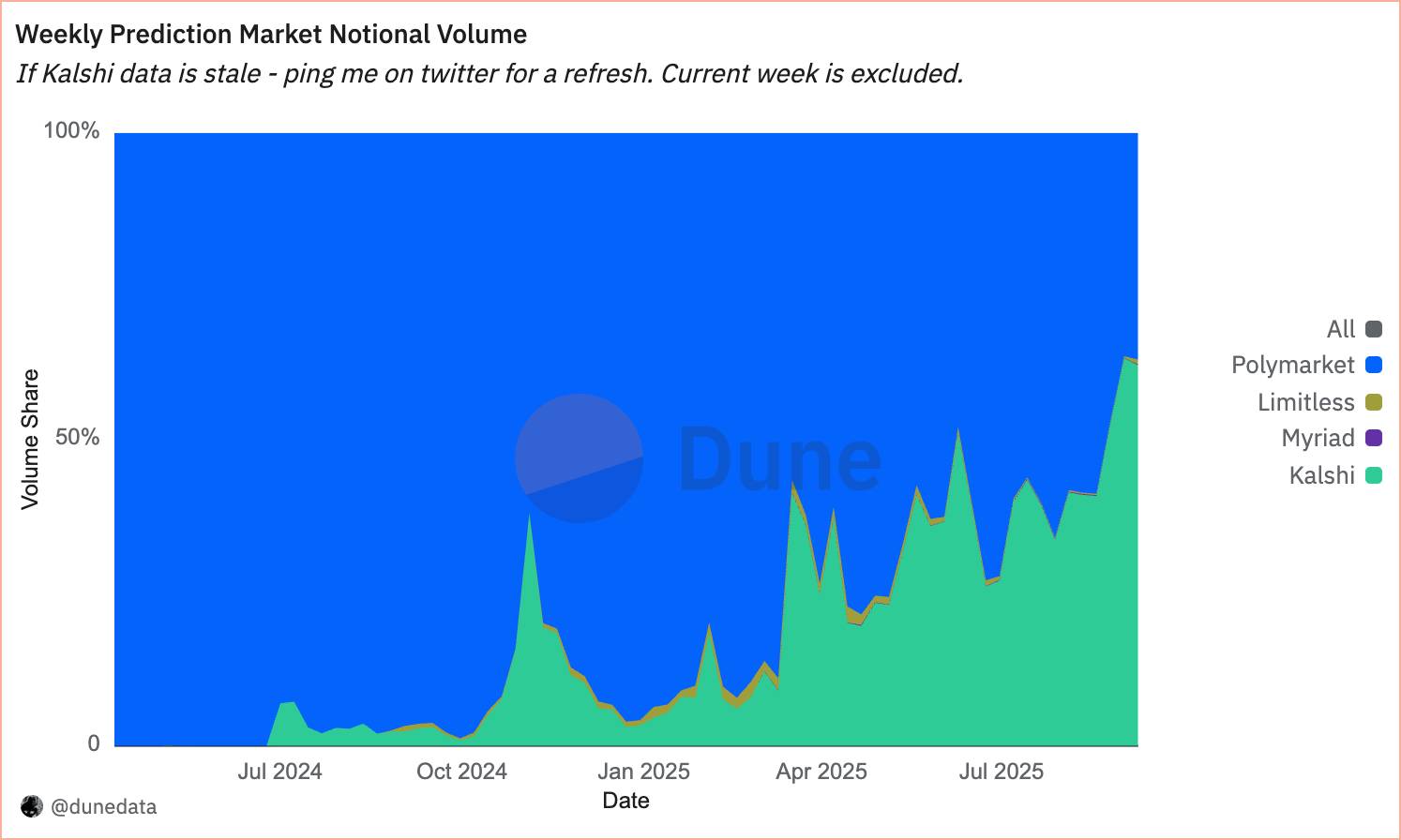

Kalshi surpassed the $1 billion Volume mark in just the first half of September, capturing 62.2% of global prediction markets, up sharply from 3.1% in the same period last year.

Far ahead of Polymarket, Kalshi surpassed the $1 billion Volume mark in just the first half of September. Photo: News Nation

Far ahead of Polymarket, Kalshi surpassed the $1 billion Volume mark in just the first half of September. Photo: News Nation

Record Volume Puts Kalshi in the Lead in Prediction Markets Race

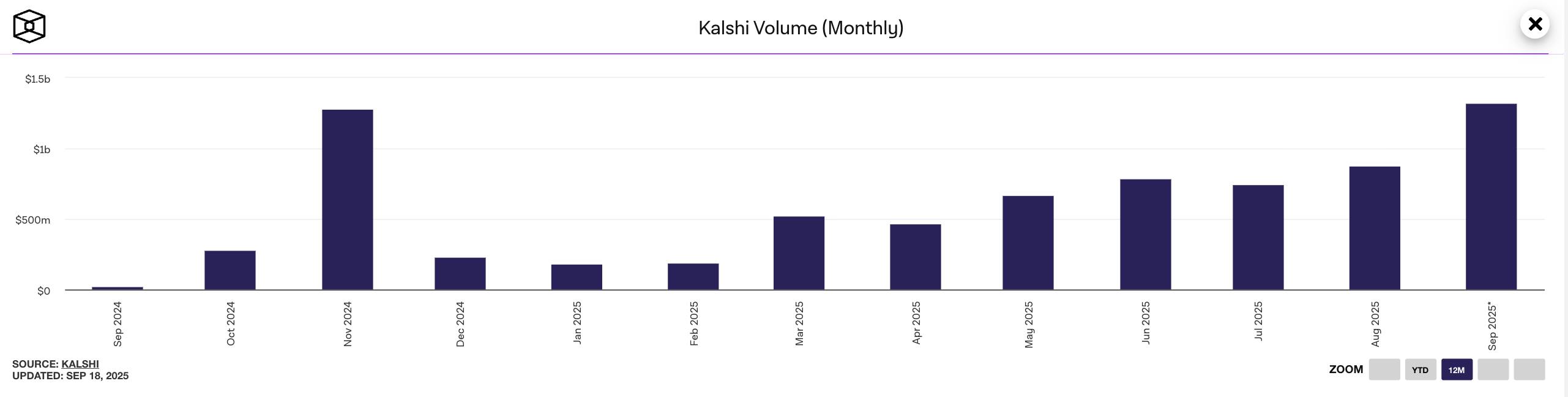

- September 2025 marks a historic milestone for Kalshi as this prediction market platform for the first time since the 2024 US election surpassed the $1 billion mark in monthly volume .

- Specifically, according to data from The Block , Kalshi recorded $1.3 billion in Volume in the first half of September alone, thereby accounting for 62.2% of the global prediction markets market share, a leap compared to only 3.1% market share in the same period last year.

- The number is even more remarkable when Kalshi currently only serves users in the US. Many experts believe that the explosion in volume on the platform comes from the official start of the NFL season, attracting a large number of users to participate in betting.

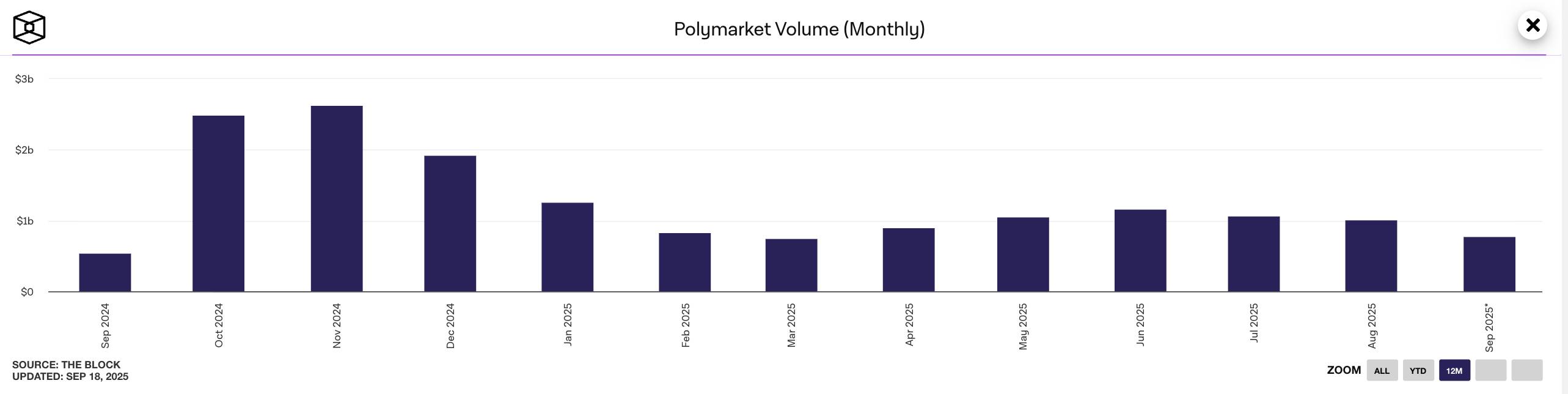

- Compared to its direct competitor Polymarket , Kalshi has created a clear gap. Polymarket only reached about 773 million USD in Volume in September (as of the time of writing), which is nearly 40% lower than Kalshi.

- According to Bernstein, prediction markets are gradually becoming a new type of information portal, where blockchain technology, artificial intelligence and news converge on this platform. Big players like Coinbase and Robinhood also want to jump into this game, especially in the sports betting segment, a huge market worth tens of billions of dollars per year in the US.

Kalshi and Polymarket: Two “giants” shaping prediction markets

- Currently, Kalshi and Polymarket are still the two most prominent platforms in the global prediction markets sector, but the approach of these two projects is completely different.

- Kalshi is a centralized platform, operating as a Designated Contract Market (DCM) licensed by the US Commodity Futures Trading Commission (CFTC).

- Thanks to this license, Kalshi is considered legal at the federal level, allowing Americans to freely participate in trading on the platform.

- In August 2025, Kalshi announced a $185 million Capital raise , bringing the total amount successfully raised to $415 million and a valuation exceeding $2 billion.

- This is a key advantage that will help Kalshi expand rapidly in 2025. The company argues that the DCM license from the CFTC is enough to “override” all state regulations, including those states that are trying to treat prediction markets as a form of gambling.

- Polymarket, on the other hand, is a decentralized platform running on blockchain, which has become popular in the global crypto community since the 2024 US election.

- Previously, due to a CFTC fine in 2022, Polymarket had to block US users to avoid violating federal law.

- However, the platform has officially returned to the US through the acquisition of Derivative exchange QCEX for $112 million.

- Multiple sources say Polymarket is close to completing a $200 million Capital round valued at more than $1 billion, led by Peter Thiel's Founders Fund.

Legal troubles come to Kalshi in the states

- The Kalshi boom has also brought with it growing legal pressure, especially from the state level.

Maryland, Nevada, and New Jersey: These three states have issued cease-and-desist orders, claiming that the “event contracts” on Kalshi are actually a disguised and unlicensed form of sports betting. The cases have been brought to federal court, but are currently at the preliminary hearings, with no final decisions yet.

Massachusetts is the toughest state: In September 2025, the Massachusetts Attorney General filed a 43-page lawsuit seeking to permanently ban Kalshi from operating in the state. In the lawsuit, the government called Kalshi’s sports contracts “illegal and dangerous” and raised the issue of age: Kalshi allows people 18 and older to participate, while Massachusetts law requires a minimum age of 21 to bet online.

- In response, Kalshi asserted that its platform is legally licensed at the federal level through a Designated Contract Market (DCM) license administered by the US Commodity Futures Trading Commission (CFTC). According to Kalshi's argument, federal law overrides state law, so its operations are legal throughout the United States.

- Kalshi said he offers a fair, transparent, federally regulated marketplace, and criticized Massachusetts for “hindering innovation with outdated laws.”

Evidence

Monthly volume statistics on Kalshi. Source: The Block (September 19, 2025)

Monthly volume statistics on Kalshi. Source: The Block (September 19, 2025)

Monthly volume statistics on Polymarket. Source: The Block (September 19, 2025)

Monthly volume statistics on Polymarket. Source: The Block (September 19, 2025)

Kalshi's volume market share statistics in the Prediction Markets sector. Source: Dune - @dunedata (September 19, 2025)

Kalshi's volume market share statistics in the Prediction Markets sector. Source: Dune - @dunedata (September 19, 2025)

Coin68 synthesis