Written by 1912212.eth, Foresight News

On the morning of September 22nd, BTC remained above $115,000. However, just hours later, at around 2:00 AM, BTC fell below $115,000 and then plummeted, losing several round-number barriers, reaching as low as $111,800 before recovering to $112,800. ETH, meanwhile, dipped from around $4,500 to $4,077 before recovering to above $4,100. Solver (SOL) briefly dipped to $214.5, and many Altcoin also experienced widespread declines.

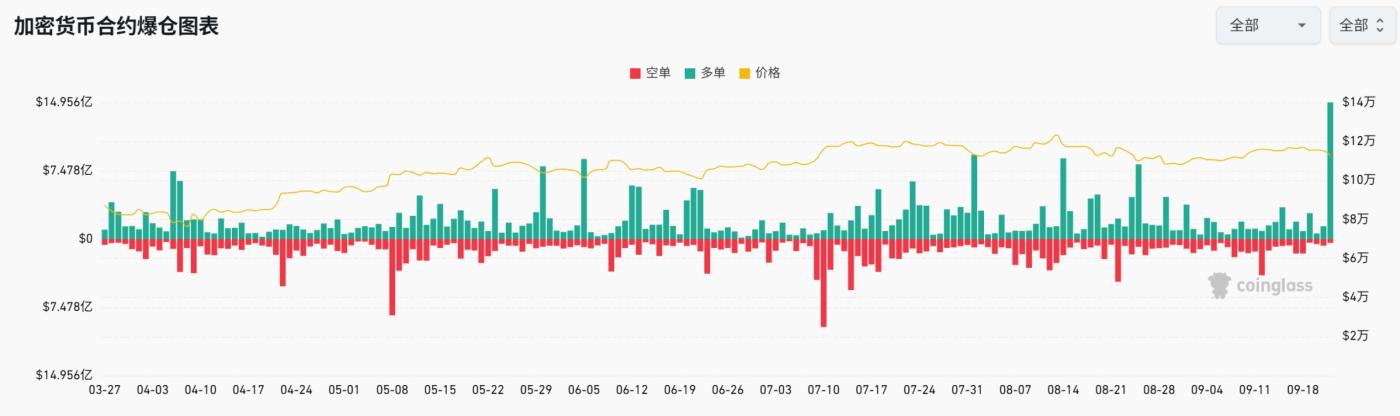

Coinglass data shows that the total open interest in the entire network was liquidated by US$1.7 billion in 24 hours, setting a new high for the year. Among them, long positions were liquidated by US$1.617 billion. The largest single liquidation occurred in BTC-USDT on OKX, worth US$12.74 million.

Just a few days after Fed Chairman Powell announced a 25 basis point interest rate cut, the market has seen such a drop. Is this a pause in the bull market, or has the market quietly turned?

ETH whales sell off sharply as the market digests the Fed's interest rate cut

Smart whales consistently take profits during periods of high market sentiment and peaks. Data analyst Murphy, citing a glassnode chart, shows that on September 18th, whales holding 1,000 to 10,000 ETH cashed out $1.5 billion in a single day. Adding in whales holding 10,000 to 100,000 ETH and those holding over 100,000 ETH, the total cash out reached $2.15 billion.

In July this year, when ETH broke through $3,500, huge cash outs occurred. However, the price did not fall because some US treasury companies actively bought.

It is worth mentioning that the treasury company Bitmine now holds 2.151 million ETH (US$9 billion) at a cost price of US$3,949. Although the company has previously stated that it will not sell its holdings in the short term, the market is concerned about its stock price performance and subsequent ability to increase holdings if ETH falls below the cost.

ETH's performance was weak, and the performance of Altcoin was predictable. Except for some BNB Chain ecosystems and DEX derivatives, all of them saw significant declines.

Furthermore, since early September, the market has generally anticipated a 25 basis point interest rate cut by the Federal Reserve. Consequently, BTC has fluctuated upward from $107,000, reaching $117,900 after the Fed's decision. When positive news runs out, a market correction often follows.

Subsequent market direction analysis

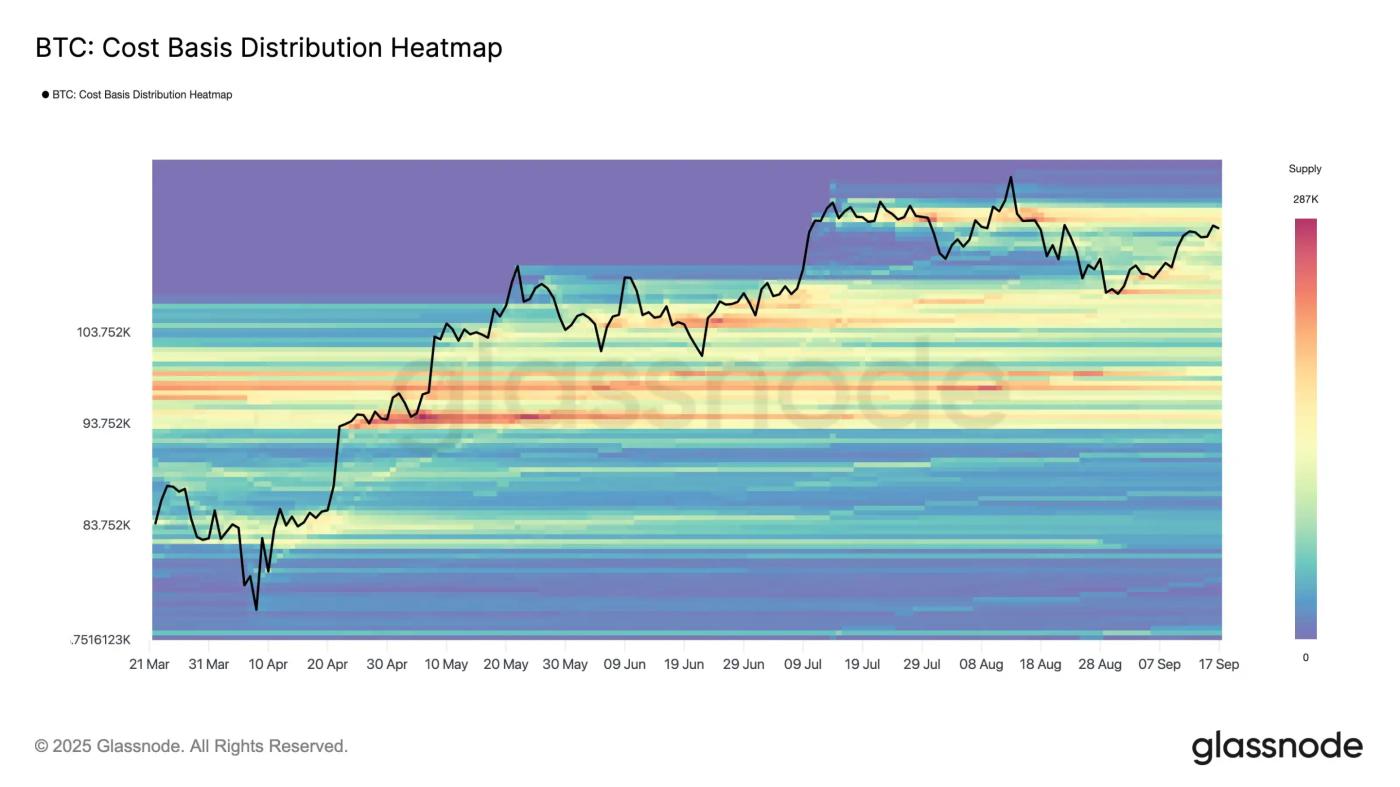

Glassnode previously published an analysis showing that Bitcoin's CBD (Cost Basis Distribution) heat map shows that supply is concentrated around $117,000, forming a key resistance area. A break above this level could trigger further supply reductions, while failure to break through could extend consolidation or trigger a pullback.

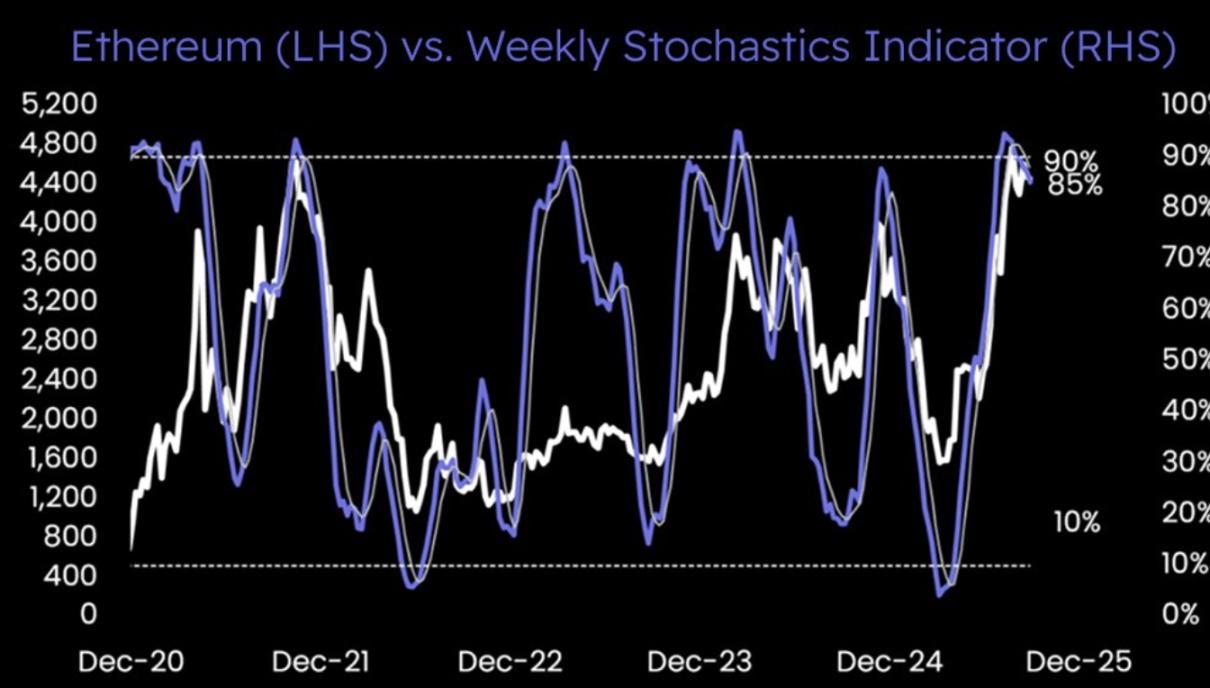

Matrixport released its market opinion, stating, "For some time, the risk-reward ratio of Ethereum long positions has been superior. However, as the market enters a rapid upward phase, technical indicators often become ineffective. Especially when the weekly stochastic indicator reaches an extreme high and reverses, investors' caution often determines whether profits can be locked in. In the past few months, Ethereum Treasury has been the main buyer. As its net assets shrink, its ability to add funds may be limited. In this context, strict risk management appears to be more prudent."

Weiss Crypto tweeted that the full impact of the Fed's rate cut won't be felt until mid-December. Its model suggests that sideways fluctuations may continue for another 30 to 60 days, with a clear bottom likely to appear on October 17th. It's worth noting that Weiss Crypto recently predicted a peak around September 20th.

Historical data shows that BTC often falls in September. Although there was a small plunge today, the BTC monthly line is still in the state of a small green candle. If the "metaphysical" decline of the September monthly line comes true, then in the next week or so, BTC may have a further correction of more than 3%.