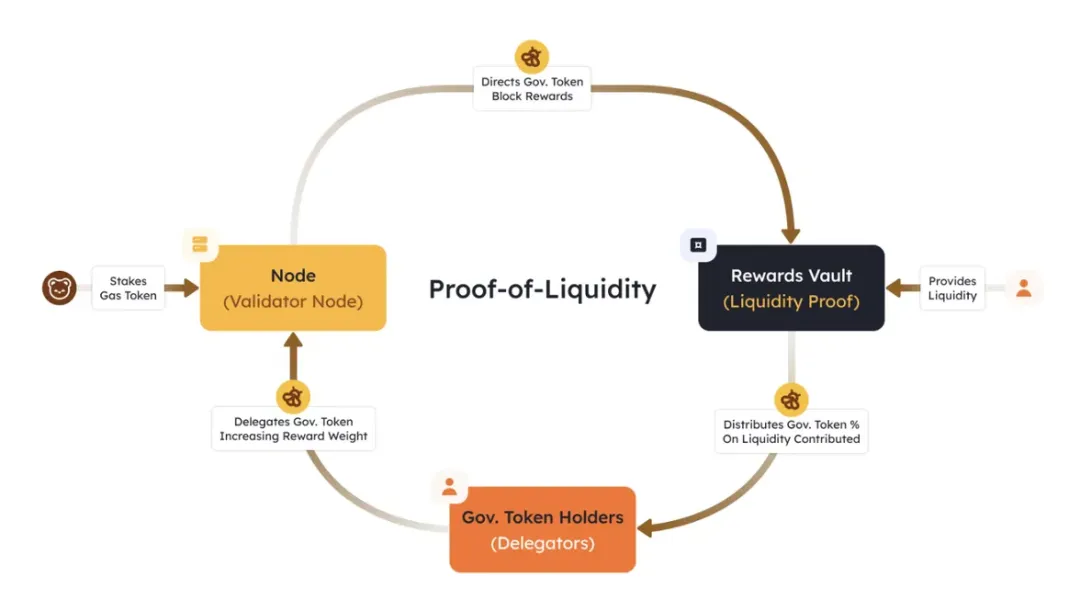

The Berachain ecosystem offers users diverse and composable revenue paths. Through methods like LP, LSD, and Restaking, users can not only earn substantial farming returns but also receive governance token rewards from the PoL mechanism. This compound incentive structure enables Berachain to offer more stable and sustainable returns than other public chain ecosystems.

While Berachain's revenue paths offer highly composable functionality, they often present significant operational barriers to entry for average users. For example, the need to repeatedly compare yields across different pools, constantly adjust portfolios to optimize, and frequently switch between protocols poses significant challenges for most investors.

In contrast, you can also choose to stake your tokens to BeraFarm with one click, and easily obtain equally impressive compound returns without any complicated operations.

BeraFarm: One-click access to optimal returns

BeraFarm is a native yield-generating protocol on Berachain. Its unique design allows it to truly leverage its advantages within Berachain's PoL ecosystem. Unlike most protocols that simply "participate in PoL emissions," BeraFarm fundamentally optimizes its mechanisms, improving both yield generation and user experience.

Maximizing liquidity efficiency

BeraFarm itself is similar to a yield aggregator with execution functions, which will allocate the funds deposited by users to the most rewarding PoL qualified pool to significantly improve liquidity efficiency.

The BeraFarm protocol itself uses dynamic rebalancing across multiple strategies to continuously track the performance of different pools and automatically switch between them based on the situation to maximize overall returns and emission efficiency. By integrating decentralized funds, it not only brings scale advantages, but also allows the protocol to accumulate more $BGT with the same deposit, further amplifying overall returns.

Deep Dive $BGT The Value of Assets

Under the traditional PoL mechanism, $BGT is a soul-bound token. While redeemable 1:1 for $BERA, it cannot be freely circulated in the market, limiting its use cases and flexibility. Users must manually participate in the governance process to receive governance benefits. BeraFarm's design breaks this gap: it converts these soul-bound $BGT into a tradable asset with the same 1:1 backing: $fBGT.

With this mechanism, users can retain governance rights and exposure to base income, while being able to freely use $fBGT in the broader DeFi ecosystem, such as participating in lending, joining liquidity pools, or other income opportunities.

At the same time, users can deposit their $fBGT holdings into the $fBGT treasury. BeraFarm will also automatically route the optimal return path across various external protocols (Dolomite, Infrared, Kodiak, etc.) to further obtain automated governance rewards and delegation returns, without any tedious operation. As a result, $fBGT not only unlocks previously locked-up potential value but also effectively connects Berachain's governance mechanism with the DeFi world, giving governance tokens unprecedented liquidity and composability.

Significantly lower the user income threshold

BeraFarm itself further simplifies the complex process for users to participate in PoL. As mentioned above, in the past, investors often had to repeatedly switch between multiple positions, laboriously compare yields, and face technical challenges such as governance participation and validator delegation. BeraFarm encapsulates all of this within the protocol. Users only need to make a single deposit to automatically receive the full PoL benefits, eliminating the need to worry about complex operations.

Through this comprehensive logic of optimizing efficiency, unlocking value, and streamlining the user experience, BeraFarm allows users to seamlessly enjoy the full benefits of Berachain PoL. For professional players, this means a higher profit ceiling, while for ordinary users, it means a low barrier to entry for capturing reliable compound returns.

BeraFarm's profit logic

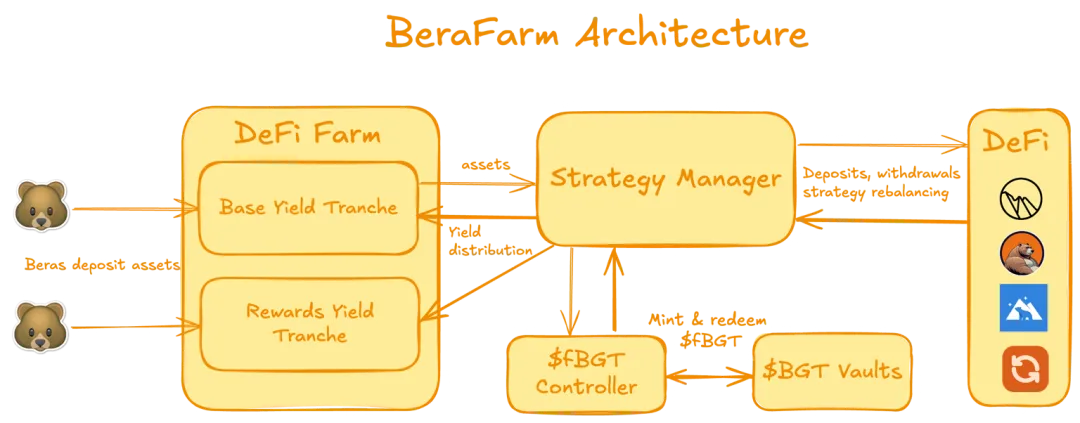

Multi-strategy vault

In BeraFarm's architecture, each vault serves as the core entry point for user deposits and withdrawals. Once funds enter the vault, they are automatically forwarded to the Strategy Manager, which intelligently allocates the assets to multiple efficient strategies based on pre-defined allocation plans. This allows a single user deposit to be split across different profit scenarios, achieving more stable returns.

Taking the HONEY Vault as an example, when a user deposits 1,000 $HONEY, the strategy manager will allocate approximately 500 $HONEY to the BEX liquidity pool, 300 $HONEY to the Dolomite lending market, and the remaining 200 $HONEY to other optimization strategies.

As market conditions change, the Strategy Rebalancer continuously monitors the performance of each position and automatically adjusts the allocation ratio. For example, when lending rates rise, the system will flow more funds to Dolomite to capture higher returns.

Profits generated by all strategies ultimately flow back into the treasury and are distributed differently based on user choices within BeraFarm, such as whether to pursue base or bonus returns. This fully automated process not only maximizes capital efficiency and returns, but also allows users to easily enjoy optimized DeFi returns without complex operations.

Dynamic income layer

The dynamic yield layer is one of BeraFarm's biggest innovations. It separates base yield (Farming yield) from governance yield (governance rewards obtained based on the PoL mechanism, such as $BGT and other ecosystem tokens, such as $KDK and $BURR) and distributes them into two different pools. The former is injected into the Base Yield and the latter is injected into the Rewards Yield.

When staking, users can choose to deposit their assets into either the Base Yield pool or the Rewards Yield pool. When the returns are distributed, users of the Base Yield pool will receive all base returns, while users of the Rewards Yield pool will receive all governance returns (primarily in the form of governance tokens).

Therefore, users who prefer to earn interest in the form of currency can choose Base Yield, while users who prefer to hold some governance tokens can choose Rewards Yield.

For example, if BeraFarm has $10,000 in HONEY assets in its vault, $6,000 (60%) comes from the Base Yield pool and the remaining $4,000 (40%) comes from the Rewards Yield pool.

Then when distributing the income, if the vault is in operation:

- Generate 8% HONEY base interest rate

- 15% annualized return on reward tokens,

Then the distribution of income will show differences:

For users who participate in the basic income portion, since they only need to share the returns brought by the $10,000 scale in the $6,000 fund pool, the final annualized rate of return will be magnified to approximately: 8% × (10,000/6,000) = 13.33%

As for the users who receive the rewards, since they only have $4,000 to distribute all the rewards, the annualized rate of return can be as high as 15% × (10,000/4,000) = 37.5% (they receive governance tokens here).

The key to this design is that it forms a dynamic self-balancing mechanism:

When more users choose the basic income part, the APR of the bonus income part will be further pushed up, and vice versa.

As a result, the vault can automatically adjust the flow of funds based on user preferences, achieve a balance between different types of income, and allow each participant to capture the returns that best suit their own strategy.

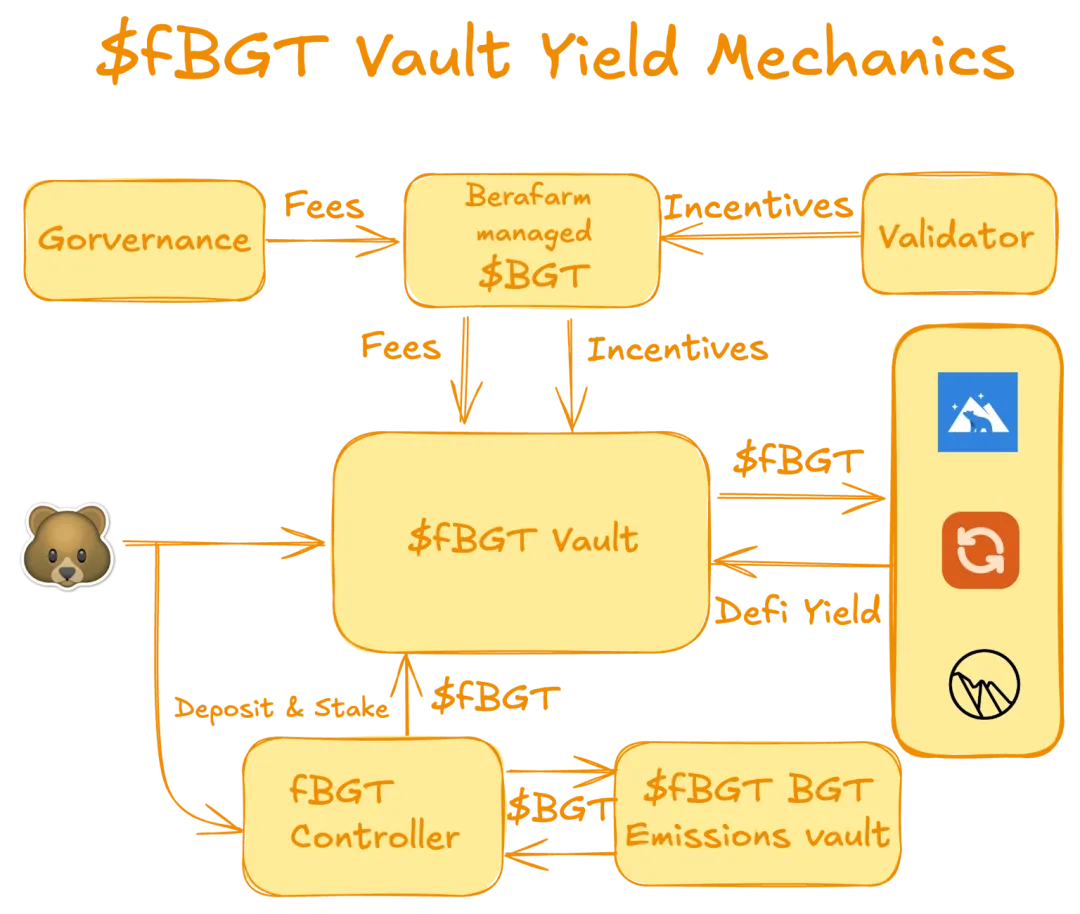

$fBGT Vault

As mentioned above, BeraFarm's $fBGT maximizes user returns by giving $BGT asset liquidity and strategically participating in DeFi, transforming passive governance tokens into active income assets.

The $fBGT vault is mainly for $fBGT assets, that is, $fBGT holders can deposit the assets into the vault to further capture returns.

Unlike traditional staking contracts where assets are fixed, it maximizes user returns by strategically participating in DeFi and transforming passive governance tokens into active income assets.

The vault adopts an advanced profit optimization mechanism:

On the one hand, it will deploy $fBGT to multiple high-performance protocols and continuously capture optimal returns through dynamic rebalancing;

On the other hand, it also ensures that the additional benefits brought by $BGT can be fully captured through validator delegation and governance voting at the protocol level.

At the same time, the overall positioning of the treasury has been strategically designed to enter the whitelist $BGT emission channel, further amplifying the potential for token accumulation and returns. All profits are automatically reinvested, and with the advantage of scale, a return acceleration effect is achieved that is difficult for ordinary users to achieve through individual operations.

This ability to optimize returns is not only reflected in strategy allocation, but also in deep collaboration with validators and governance.

BeraFarm has established strategic partnerships with top-performing validators to boost yields by prioritizing delegation, while optimizing network participation to maximize delegation rewards and ensure returns far exceeding those of individual users. Furthermore, the treasury actively participates in key protocol votes and utilizes data-driven voting strategies to not only maximize bribe rewards but also align governance practices with the long-term health of the protocol.

Through this multi-level and multi-dimensional design, BeraFarm not only helps users capture higher returns, but also strengthens the sustainability, stability and growth momentum of the Berachain governance ecosystem.

Summarize

In summary, BeraFarm not only makes the complex and fragmented revenue paths on Berachain simple and accessible, but also, through its innovative mechanism and automated multi-strategy treasury operations, truly integrates governance and the value of DeFi. For users, this means they can capture higher and more stable returns while also allowing them to participate in the core Berachain ecosystem with a very low barrier to entry. For the entire network, BeraFarm's existence continuously enhances the efficiency of PoL and the depth of governance, providing solid support for the long-term prosperity of Berachain.

As the ecosystem continues to expand, BeraFarm is expected to become a key hub connecting users with Berachain's optimal profit path, leading crypto finance towards a more mature and sustainable future.