Written by VelvetMilkman, Crypto KOL

Compiled by Felix, PANews

When Facebook launched, it seemed insignificant: a digital college yearbook with no discernible business model. Older generations viewed it as a toy, unable to foresee how the company would monetize attention on a global scale. Twitter faced similar skepticism. Once dismissed as a platform for people to announce what they were having for lunch, it evolved into the nervous system of global politics and media. Even Roblox, viewed by many as little more than a children's video game, has proven itself to be a laboratory for virtual economies and user-generated worlds. Time and again, platforms that initially seemed like quirks have evolved into global cultural infrastructure and sources of immense wealth.

Pump.fun is at a similar turning point. To many, the team's foray into livestreaming seemed quixotic, even absurd. Pump has been dismissed as a short-lived "memecoin" farce. But viewing it in this light overlooks its enduring vitality and the fact that it has repeatedly outperformed competitors in mere weeks. Pump is laying the foundation for a new generation of lifelong online internet economy. It's a world where culture and speculation aren't separate but intertwined. With streaming back in their portfolio, they now set their sights on becoming an entertainment gateway for viewers to participate in financial activities.

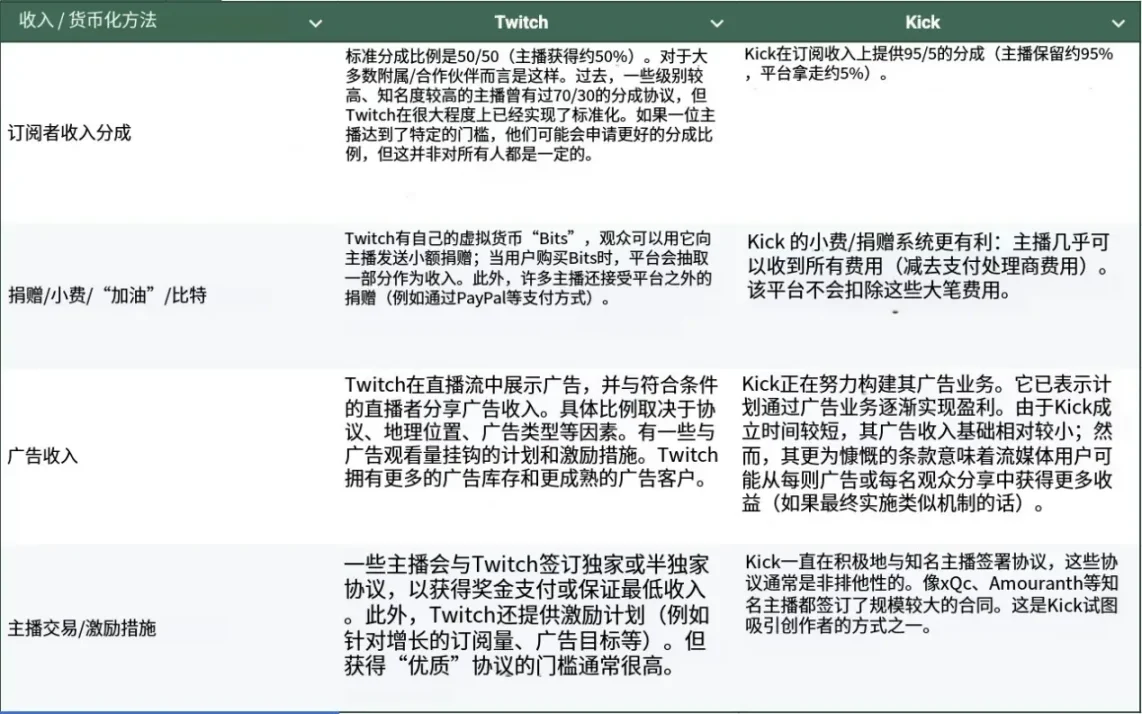

The streaming economy highlights the limitations of existing models and the opportunities for new entrants like Twitch and Kick to disrupt these incumbents. Twitch, a wholly owned subsidiary of Amazon, takes a 50% cut of every subscription, while the average creator with 1,000 concurrent viewers might only earn $600 per month (after accounting for subscription revenue, ads, and tips). Kick, backed by the gambling platform Stake, offers a 95% commission. Kick's generosity is sustained by subsidies. Streamers who qualify for Kick's incentive program can earn over $6,000 per month, even with the same number of viewers, nearly 10 times more than Twitch. However, this economic model is unrealistic. They rely on Stake funding to attract new users to their online casinos. These models are not economically viable on their own.

Revenue sharing model between existing platforms and creators

Pump's incentive model directly addresses these contradictions, providing creators with a way to realize profitability early. Streamers launching tokens no longer rely on subscriptions or advertisers; creators can now directly generate demand through their livestreams. The flywheel is simple: livestreams spark speculation, which drives fee revenue, creators can choose to execute buybacks, which generate narratives that feed back into new livestreams. This is a unique selling point for the next wave of livestreamers seeking to innovate. Revenue is no longer limited solely by audience size, but by their willingness to engage.

This isn't a minor shift in creator incentives. Pump redefines what it means to livestream online. A creator earning $10 million annually from sponsorships can simply allocate a relatively small portion of their token buybacks, and the tokens tied to their online personality suddenly behave like an investment, with ongoing demand built into their structure. Instead of being passive, the community chooses to invest financially (and emotionally) in creators.

Younger generations tend to choose new media formats for daily news and current events. Once you delve deeper into these consumption habits, it's easy to imagine them purchasing tokens from their favorite streamers (if not immediately, then once they can afford it or realize the value of owning a token). Under this new incentive model, the token valuations of the most popular creators could surpass those of established tech companies. Investors and traders are buying more than simple cash flow: they're buying access to culture, identity, and community.

The above scenario isn't purely hypothetical. Earlier this year, shortly after winning the election, President Trump launched his $TRUMP memecoin and invited the top 220 holders to a dinner; the top 25 holders also received a special VIP trip to the White House and were feted by the president at a private reception. Collectively, these holders spent nearly $150 million to secure their status. This news alone drove the token's price up by over 50%. While this may sound absurd, it's a reality, demonstrating that token ownership can generate both returns and tangible social opportunities. In other words, Pump's vision of making streaming tokens a cultural norm is already taking shape among celebrities and high-ranking politicians.

What critics overlook is that Pump is professionalizing financial spectacle, just as sports professionalize physical dominance and esports professionalize digital mastery. In the era of hyper-financialization, trading imitates art, just as art imitates trading. A crash is no longer the end of a career; it's the climax of a narrative. Absconding with funds no longer spells the end of someone's career; it's a ritual that cements the legend of the antihero. Risk and loss are no longer flaws in the system but repackaged as something to be created and shared culturally.

Tokens won't remain speculative. They'll continue to evolve into loyalty tools that manage access, commerce, and community. Just as TikTok integrated shopping into entertainment, Pump will embed spectacle into speculation. The line between financial participation and cultural engagement will dissolve. Spectators won't feel like they're watching from the stands, but cheering from the sidelines. Audience identities will evolve into their own micro-economy: organizing treasuries, coordinating buybacks, and managing collective assets.

Humans have always demonstrated their worth through performance. Rome had gladiators, the industrial age had athletes, the digital age had gamers, and the financial age will continue to elevate traders to ever-higher levels. In the latest arena, the line between spectator and participant has blurred. Watch traders in action, and join in with a single click. Highlights are no longer just slam dunks or Oscar-worthy performances; they'll be accompanied by parabolic charts, waves of liquidations, or dramatic buybacks that reshape token prices in real time. Finance is no longer relegated to the background; it's taking the lead.

Absurdity and obscenity are entirely subjective concepts. The longer something exists, the more widely accepted it becomes. History teaches us that seemingly insignificant things early on often contain the seeds of change. Social networks were once considered toys before they became cultural infrastructure, and online dating was once ridiculed, but is now commonplace. To some, creator tokens may seem meaningless, just noise. But skeptics quickly emerge, wondering why they didn't recognize the opportunity sooner.

Pump doesn't simply add speculation to streaming. It has the potential to reshape the relationship between creators, audiences, and capital, forming a system that is both self-sustaining and scalable. Content generates demand. Demand generates buybacks. Buybacks generate culture. Culture generates more content. The cycle is complete. We've created a flywheel.

Money itself is a culture. Pump is the first platform to openly acknowledge this and build a track for its expansion. The highlight of the next decade will be a chart.

It's easy to dismiss Pump's livestreaming as a flash in the pan, something that won't last. But looking at Pump's numbers (revenue, distribution across various streaming categories, growing daily active viewers, etc.), it's hard to argue that it's not worth keeping a close eye on. For those reading this who share this perspective, try to suspend disbelief, set aside your preconceptions, and consider what the future might look like in a few years. CT won't stop talking about over-financialization. They harp on it endlessly, making it seem inevitable.

This is a manifestation of over-financialization. With recent success, public opinion has shifted. It's hard to imagine a future where streamers need to beg platforms like Twitch or Kick for distribution channels. I think it's more likely that the first generation of entrepreneurs will seize the opportunity and merge live streaming and creator tokens into an engine that is both culturally influential and financially profitable. We are currently experiencing a form of accelerated capitalism: one that merges entertainment and investment on the same stage.

The line between audience and stakeholder has begun to blur. What seemed absurd, after just a week in the spotlight, has already achieved astonishing results. Over time, this becomes more natural. Pump didn't invent livestreaming, but it has taken it to its logical extreme. The team's foray into livestreaming has the potential to propel Pump to the cultural forefront.

You may not agree with it, or even participate in it, but Pump is demonstrating an inevitable future. Don't let your discomfort blind you to the fact that the current landscape can change rapidly. It usually happens much faster than anyone anticipates.