Get the best data-driven crypto insights and analysis every week:

Ethereum Update: Can Further Scaling Return Value to Ethereum?

By: Cooper Duschang & The Coin Metrics Team

Introduction

Ethereum experienced a major turnaround in sentiment since our Ethereum Asset Analysis in November 2024. In August 2025, ETH returned to over $4,500, driven by Digital Asset Treasuries (DATs) accumulating ETH and supportive stablecoin legislation.

In this report, we break down the forces behind Ethereum’s renewed momentum and the role of scaling in supporting future growth. Are DATs and stablecoin legislation enough to justify Ethereum’s current momentum? Is Ethereum prepared to onboard new users and support higher transaction volumes? In this update, we unpack the impact of DATs on token supply and sustainability, how an influx in mainnet activity affects the user-experience, and continued scaling of Layer-2s (L2s) for Ethereum.

Key Takeaways from the Report:

Hungry Digital Asset Treasuries

DATs are rapidly accumulating ETH and exploring staking and DeFi activities to earn additional rewards. DATs benefit from maintaining a higher multiple-of-net-asset-value (mNAV), a measurement of ETH held to shares outstanding, which enables them to raise funds to continue buying ETH.

Sustainability of Ethereum’s Stablecoin Dominance

Ethereum supports the largest share of stablecoin supply, but network constraints like slower block times and higher fees hinder growth potential. While transaction activity has risen, Ethereum will need to continue improving network capabilities to prevent other networks from siphoning stablecoin adoption.

Layer-2s Expanding Through Blobs

Layer-2s are increasingly posting blob data to Ethereum, which allows them to handle higher transaction volumes without significantly raising fees. Since the Pectra upgrade raised the blob inclusion target, Ethereum blocks are consistently carrying more blobs, expanding throughput and lowering costs across the L2 ecosystem.

Market Data Highlights

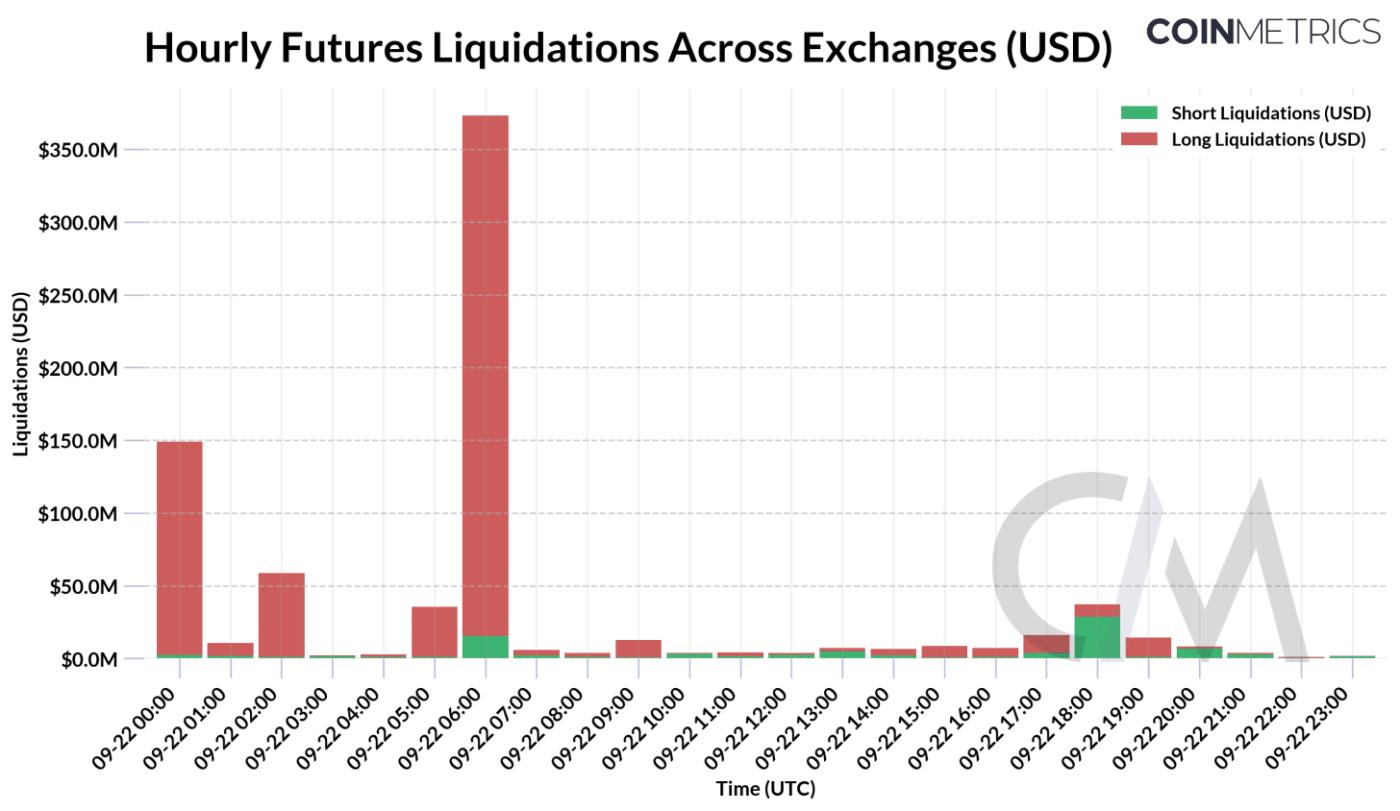

The Federal Reserve’s 0.25% rate cut earlier in the week briefly boosted risk appetite, lifting majors and large-cap altcoins such as SOL, BNB, and DOGE. However, this momentum was short-lived as markets soon faced a wave of liquidations and volatility.

Source: Coin Metrics Market Data Pro

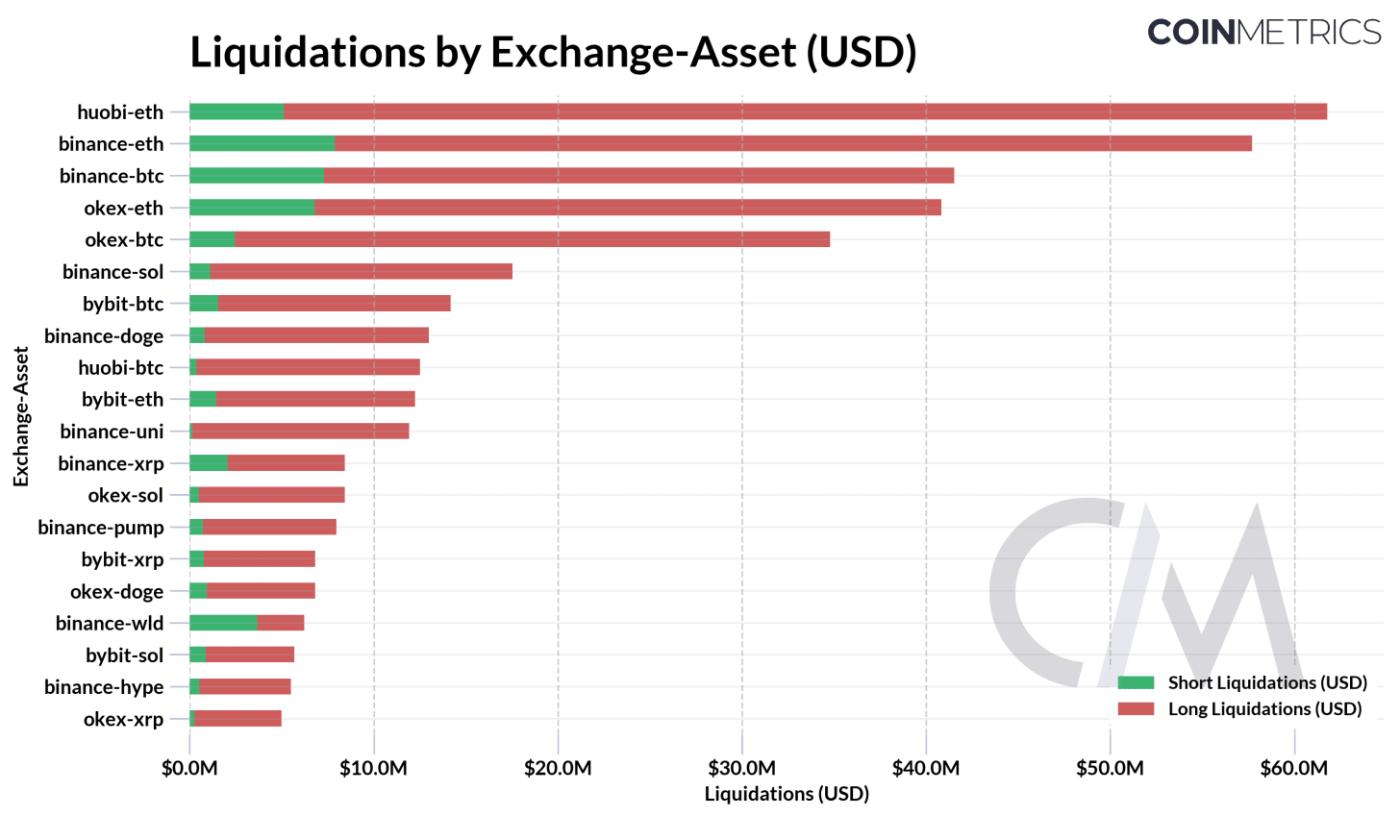

On September 22nd, futures markets experienced a sharp unwinding of leverage. In just 24 hours, more than $680M in long positions were liquidated, resulting in forced selling across exchanges. Liquidations were led by ETH futures on Huobi and Binance, while BTC and other large-cap assets also saw heavy liquidations.

Source: Coin Metrics Market Data Pro

Despite drawdowns across major tokens, the flush cleared excess leverage from futures markets, leaving a healthier foundation for the leg ahead.

Coin Metrics Updates

This week’s updates from the Coin Metrics team:

Follow Coin Metrics’ State of the Market newsletter which contextualizes the week’s crypto market movements with concise commentary, rich visuals, and timely data.

As always, if you have any feedback or requests please let us know here.

Subscribe and Past Issues

Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data.

If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here.