Original author: Wuyi

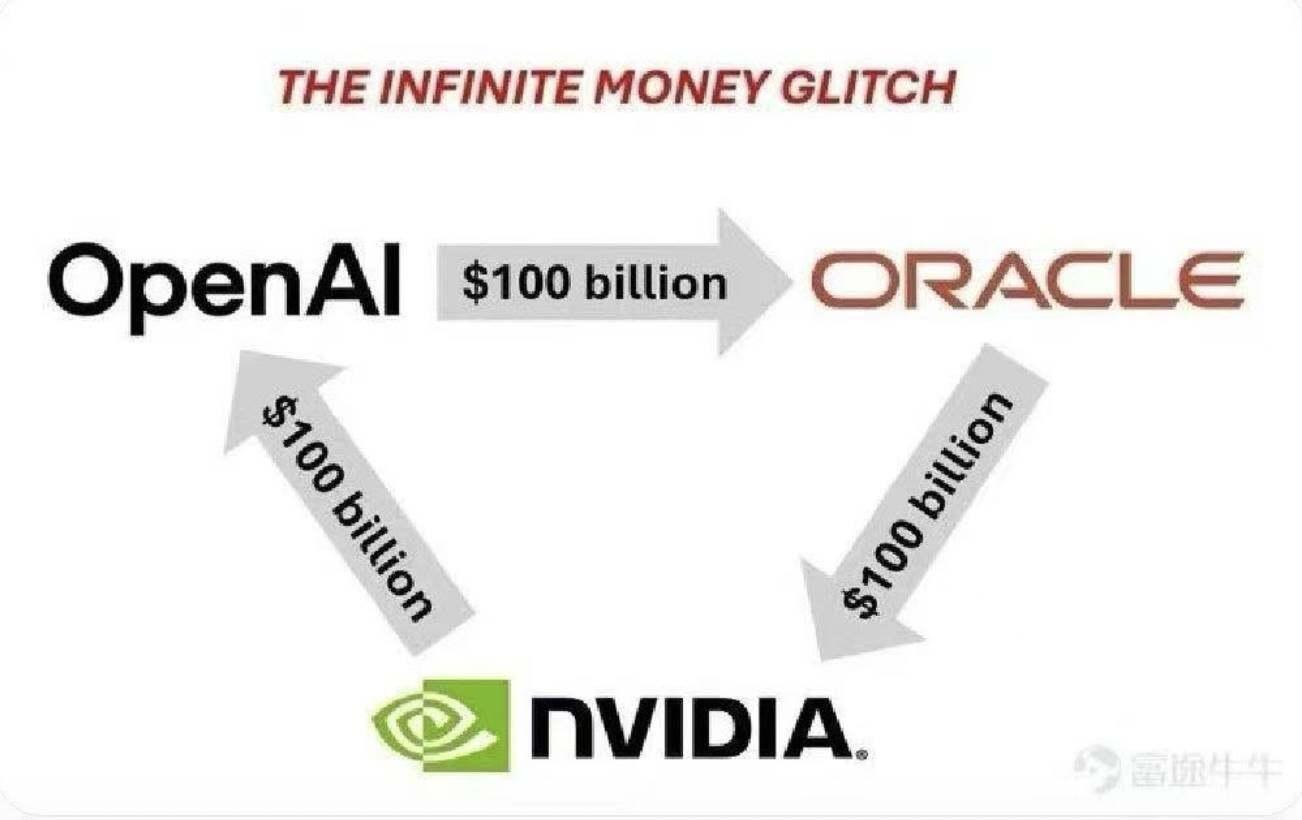

There is a joke circulating in the US stock market recently:

"OpenAI invested $100 billion in Oracle for cloud computing services; Oracle invested $100 billion in Nvidia for graphics cards; and Nvidia invested another $100 billion in OpenAI to develop AI systems. So, who actually paid for the $100 billion?"

Of course, the above is just a joke, and the amount is quite different from the facts. It is not that the three companies are making a profit with the same money, but it does reflect a closed loop of a new type of capital narrative .

In this closed loop, each link is a real contract or investment, and each action will be amplified by the capital market, thereby bringing trillions of dollars in market value increases.

On September 11, Oracle's stock price soared 36%, its largest single-day gain since 1992. Overnight, the company's market capitalization soared to $933 billion, and founder Larry Ellison even briefly surpassed Musk to become the world's richest man.

On September 22, Nvidia and OpenAI announced a strategic partnership. Nvidia plans to invest up to $100 billion in OpenAI. Nvidia's stock price rose nearly 4%, and its market value exceeded $4.46 trillion, igniting the entire technology stock market. The three major U.S. stock indexes all hit new highs.

$100 billion may seem like a lot, but it drove the U.S. stock market up by trillions overnight, definitely a big deal with a small fortune.

The U.S. stock market is playing a new kind of AI roulette game.

Triangular circulation: How does money circulate?

In the real-life investment maze, three names form a perfect capital closed loop: OpenAI, Oracle, and Nvidia.

Ring 1: OpenAI’s hunger for computing power

The central protagonist of this story is OpenAI. As the creator of ChatGPT, OpenAI processes requests from 700 million users daily. AI operations at this scale require massive computing power.

This year, OpenAI signed the largest technology contract in history with Oracle, a five-year, $300 billion cloud computing agreement. Under this contract, OpenAI will pay Oracle approximately $60 billion annually, equivalent to six times the company's current annual revenue.

What will this money buy? 4.5 gigawatts of data center capacity, equivalent to the electricity consumption of 4 million American households. Oracle will build data center campuses for OpenAI across five states, including Wyoming, Pennsylvania, and Texas.

For OpenAI, this ensures that there is space and computing power to run models; for Oracle, this is revenue certainty for the next five years.

Second Ring: Oracle Needs Chips

After receiving the huge order from OpenAI, Oracle faced a problem: how to build these data centers?

The answer is chips. Lots of them. Oracle plans to invest tens of billions of dollars in Nvidia GPUs for the Stargate project. According to industry estimates, 4.5 gigawatts of computing power will require more than 2 million high-end GPUs.

Oracle CEO Safra Catz puts it bluntly: "The vast majority of our capital expenditure investments are going toward purchasing revenue-generating equipment that goes into the data center."

These "revenue-generating devices" are mainly Nvidia's H100, H200 and the latest Blackwell chips.

Oracle became one of Nvidia's largest customers.

The third ring: Nvidia’s return of support

While Oracle was frantically purchasing chips, Nvidia announced a surprising decision: to invest $100 billion to support OpenAI in building a 10-gigawatt AI data center.

The investment will be made in phases, with Nvidia contributing funds each time OpenAI deploys 1 gigawatt of computing power. The first phase is scheduled to launch in the second half of 2026, using Nvidia's Vera Rubin platform.

Nvidia CEO Jensen Huang said in an interview: "10 gigawatts of data center capacity is equivalent to 4 million to 5 million GPUs, which is about our full-year shipments this year."

At this point, a perfect capital cycle is formed:

OpenAI pays Oracle to buy computing power, Oracle uses the money to buy chips from Nvidia, and Nvidia then invests the profits into OpenAI.

A wealth amplifier between the virtual and the real

A $300 billion long-term contract resulted in Oracle's market value increasing by more than $250 billion in a single day, and a $100 billion investment resulted in Nvidia's market value increasing by $170 billion in a single day.

The three companies support each other and endorse each other, creating a resonance in stock prices .

There is rationality behind the rise in stock prices.

For the capital market, the most scarce thing is certainty about the future.

Oracle's contract with OpenAI means that part of its cloud revenue for the next five years is locked in, and investors will naturally give it a higher valuation.

Furthermore, Nvidia is using "GW" (gigawatt) as its unit of measurement. One GW is roughly equivalent to the size of a super data center. Ten GW signifies that Nvidia and OpenAI are building a next-generation AI factory. This new narrative is more imaginative than simply "how many GPUs were purchased," and it's likely to drive the market.

Nvidia's investment in OpenAI is equivalent to saying "I recognize it as a future super customer"; OpenAI signing a contract with Oracle is equivalent to saying "Oracle has the ability to support my future cloud computing needs", and OpenAI can obtain more financing; Oracle purchasing Nvidia GPUs is equivalent to saying "Nvidia's chips are in short supply."

This is a stable and prosperous industrial chain.

This cycle looks perfect, but a closer look reveals the secret.

OpenAI currently has annual revenue of approximately $10 billion, but has pledged to pay Oracle $60 billion annually. How will this huge gap be filled?

The answer lies in rounds of financing. In April, OpenAI completed $40 billion in financing and is expected to continue raising funds.

In effect, OpenAI uses investors' money to pay Oracle, Oracle uses that money to buy Nvidia chips, and Nvidia reinvests some of the revenue back into OpenAI. It's a circular system driven by external capital.

In addition, most of these astronomical contracts are based on "commitments" rather than immediate delivery and can be delayed, renegotiated, or even canceled under certain conditions. The market sees the promised figures rather than the actual cash flow.

This is the magic of modern financial markets: expectations and promises can create exponential wealth effects.

Who will pay the bill?

Let’s go back to the original question of the joke: “Who actually paid for the 100 billion?”

The answer is investors and debt markets.

Investment institutions like SoftBank, Microsoft, and Thrive Capital are the direct payers in this game. They have poured tens of billions of dollars into OpenAI, propping up the entire capital cycle. Furthermore, banks and bond investors have also provided financial support for Oracle's expansion. Ordinary people who hold related stocks and ETFs are the "silent payers" at the end of the chain.

This AI capital rotation game is essentially a form of financial engineering in the AI era. It leverages the market's optimistic expectations for the future of AI to create a self-reinforcing investment cycle.

In this cycle, everyone wins: OpenAI gains computing power, Oracle secures orders, and Nvidia gains sales and investment opportunities. Shareholders, watching their paper wealth grow, are all happy.

But this joy is built on a premise: that the future commercialization of AI can support these astronomical investments. Once this premise is shaken, the beautiful cycle may turn into a dangerous spiral.

Ultimately, the one who pays for this game is every investor who believes in the future of AI, using today's money to bet on tomorrow's AI era.

I hope the music never stops.

Dispute: The author holds shares in Nvidia and AMD.