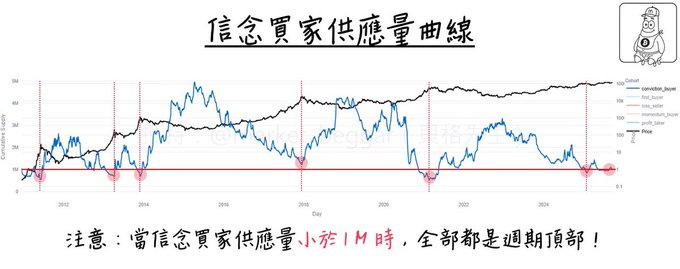

A Conviction Buyer's Perspective on BTC Bull and Bear Cycles 🔬 Previously, I introduced the "Five Major Buyer Groups Heatmap" (x.com/market_beggar/status/192...…), and among these, there's a group known as "Conviction Buyers"—those who scoop up BTC during dips 💎. Usually, the heatmap tracks their mid-to-short term moves, but zooming out to a broader timeframe reveals some intriguing patterns 👇: Since BTC’s inception, factoring out volatility, its trajectory has been an unstoppable bull run. So, Conviction Buyers—those catching falling knives—have consistently shown remarkable foresight. That’s why I always keep a close eye on their activity 👀. When we’re tracking the Five Buyer Groups Heatmap, the stats are calculated similar to an RSI indicator, so the focus is skewed toward mid-to-short terms (7 days, 14 days, etc.). ⚡️Here’s where it gets interesting: If we isolate Conviction Buyers and ditch the time parameters, directly charting the historical "BTC holdings (supply)" of Conviction Buyers, we get this chart: 🔸 I marked the supply = 1M BTC with a red horizontal line 🔸 Every time Conviction Buyer supply < 1M, it’s marked with a vertical line What stands out: 1️⃣ Almost every time Conviction Buyer supply drops below 1M, it’s at a cycle top. 2️⃣ The only exception was the sharp 2017 top—supply bottomed at around 1.2M. 3️⃣ The second top in 2021 saw supply dip to about 1.03M. 4️⃣ The early 2025 top showed the same pattern, with supply falling to around 0.82M. 5️⃣ A drop in supply basically means fewer Conviction Buyers—aka, they're selling. I’ve been saying it: this cycle is wildly different from the previous ones. Right now, Conviction Buyer supply is behaving unusually. Since around July this year, supply has hovered near the 1M mark, with the curve going flat for an extended period—something never seen before‼️ A similar anomaly popped up in the "1y~3y Holder Group" I covered earlier. If you’re curious, check out this post: x.com/market_beggar/status/192...… Bottom line: My stance hasn’t changed since the start of the year. Whether you look at long/short-term holders, the 1y-3y group ratio, or today’s Conviction Buyer supply, they all point to us being closer to the top—not the bottom‼️ From a cyclical trading POV, I don’t think now is the time to DCA or catch the spot bottom. Still, let’s not ignore the unique nature of this cycle—a lot of stuff is happening that’s never played out in BTC history. I wrote a deep-dive on this before, linked at the end. History doesn’t repeat, but it sure rhymes. How it’ll rhyme this time? Only time will tell... ⏳ // 📚 Further Reading Who’s buying now? The Five Major Buyer Groups Heatmap by address x.com/market_beggar/status/192...… 1y-3y Group Ratio: The second top luring smart long-term holders to sell x.com/market_beggar/status/192...… BTC’s fading cycles from an on-chain data perspective x.com/market_beggar/status/191...… Zombie Rally: On-chain analysis of the bizarre double top in 2021 x.com/market_beggar/status/188...… Revisiting 2021’s double top: What is “future data leakage”? x.com/market_beggar/status/189...… Research Thread: Studies & Analysis on Cyclical Tops x.com/market_beggar/status/196...…

This article is machine translated

Show original

貝格先生

@market_beggar

09-19

五大買方族群熱力圖:新買家依然旺盛、信念買家開始減少📊

有很長一段時間沒有和各位更新這組數據了,

今天就再來和各位分享一下「五大買方族群熱力圖」的最新狀況👇

如果你是新朋友,不知道這組數據的原理,可以參考以下帖子:

https://x.com/market_beggar/status/1927539239903764555…

而我也會在本文的前段簡單幫各位溫習一次✏️

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content