Now we try to answer the question about the future of DAT.

Part 5: The Fog of Risk

5.1 The Sword of Damocles of the Old World Order

Of all the risks facing digital asset treasuries (DATs), legal and regulatory risk is the most fundamental, unpredictable, and devastating. Like a "Sword of Damocles" hanging over the heads of all adopters, it can not only lead to asset freezes and hefty fines, but is also a force powerful enough to instantly collapse entire business models.

This is why we mentioned in the title of the article that this is a profound paradigm conflict: a new decentralized technological species is engaged in an inevitable violent collision with an old legal world centered on sovereign states.

The first act of this conflict began with a profound "crisis of definition." The root of all regulatory risk lies in the inability of existing legal systems—whether securities or commodities law—to provide a clear identity for this "new species." In the United States, this crisis manifests itself as a chaotic multi-faceted regulatory landscape.

The U.S. Securities and Exchange Commission (SEC) wields the age-old "Howey Howey Test," still adhering to the core elements: investment of money, contribution to a common project, an expectation of profit, and the expectation of profit primarily stemming from the efforts of the promoter or a third party . Attempting to classify most tokens other than Bitcoin and Ethereum as securities exposes any DAT holding Altcoin to charges of unregistered securities trading. The SEC previously determined that tokens issued by the Decentralized Autonomous Organization (DAO) constituted an unregistered securities offering. Even investment activities disguised as decentralization or lending remain within the SEC's regulatory scope as long as they meet the Howey Test(e.g., the penalties/suspending of BlockFi and Coinbase's lending products).

At the same time, the Commodity Futures Trading Commission (CFTC) officially took a position and declared that Bitcoin and other virtual currencies meet the definition of commodities under the Commodity Exchange Act (CEA), resulting in the same asset being caught up in the jurisdictional war between two powerful regulatory agencies at the same time, forcing companies to survive under a dual legal framework.

Even though regulatory, court, and legislative/regulatory developments from 2024-2025 are gradually narrowing uncertainty, coordination among regulators, the gradual clarification of court precedents, and the establishment of regulatory/product approval pathways (such as the discussion and implementation of spot ETFs and trading venue regulations) are all reducing uncertainty and some duplication of compliance burdens. The SEC Chairman's high-profile announcement embracing cryptocurrencies suggests greater coordination and actionable pathways, potentially reducing costs and complexity. However, it's important to note that the aforementioned issues remain and won't completely disappear in the short term.

Faced with this definition crisis, Asian financial centers represented by Hong Kong have tried to take a detour by building a "framework-based regulation" (such as the VASP licensing system and the Stablecoin Ordinance) to proactively give digital assets a clear and functional identity. That is, through the Stablecoin Ordinance, stablecoins are clearly regarded as a payment tool that needs to be strictly regulated , rather than securities or other assets.

However, this clarity does not come without a price. As critics have pointed out, this is the “price of ‘friendliness’” : while providing certainty, the Hong Kong framework also largely sacrifices the innovative spirit of crypto-native “permissionless” technologies by prohibiting stablecoins from being used in DeFi scenarios and imposing strict know-your-customer (KYC) requirements. This places an open technology back within a highly controlled financial regulatory framework.

Meanwhile, security tokens (STOs), if they possess the characteristics of securities (e.g., equivalent to tradable financial instruments with monetary value), must still comply with the relevant provisions of the Hong Kong Securities and Futures Ordinance (SFO). DAT companies that issue or hold assets classified as security tokens will face challenges such as information disclosure, registration, and investor protection under securities laws.

This crisis of definition directly led to a "governance gap" —the beginning of the second act of conflict. Due to the lack of a unified identity, major jurisdictions around the world have diverged significantly on the philosophical approach to governing this new species. The United States has chosen a deterrent approach of "regulation through enforcement," gradually drawing red lines through lawsuits against companies like Coinbase and Ripple over a lengthy legal process. The unpredictability of this model has imposed significant legal costs and persistent market panic . Consequently, Nasdaq has tightened its scrutiny of DATs, focusing on those that purchase and hold crypto assets through financing, fearing potential market manipulation and investor misleading. This is a direct manifestation of this deterrent effect.

In contrast, Hong Kong's "principles-based" regulation, while offering theoretical flexibility, also places the burden of judgment on companies. As DAT strategies evolve from passive Bitcoin holdings to active returns through Ethereum staking or DeFi participation, companies must independently assess whether their increasingly complex operations will trigger new securities or custody regulations. For example, the DAT model is shifting from passive Bitcoin holdings to active value creation (Ethereum staking, DeFi liquidity provision). When DAT companies engage in ETH staking to generate native returns, they must determine whether their staking activities will trigger additional securities or custody regulations.

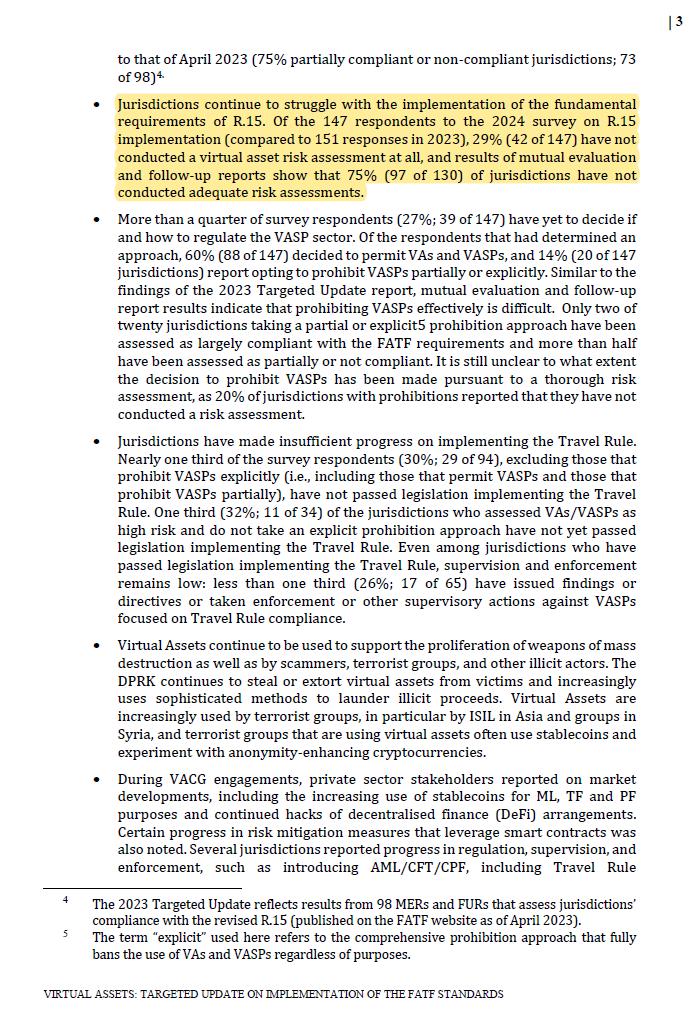

Behind this governance gap lies a profound phenomenon of regulatory convergence and divergence . While international organizations like the Financial Action Task Force (FATF) and the Financial Stability Board (FSB) are pushing for global convergence on bottom-line principles like anti-money laundering and systemic risk prevention, the divergence between specific governance philosophies and implementation approaches between the United States and Hong Kong is becoming increasingly pronounced. This compels multinational DATs to develop a precise compliance map for each business function and in each target jurisdiction.

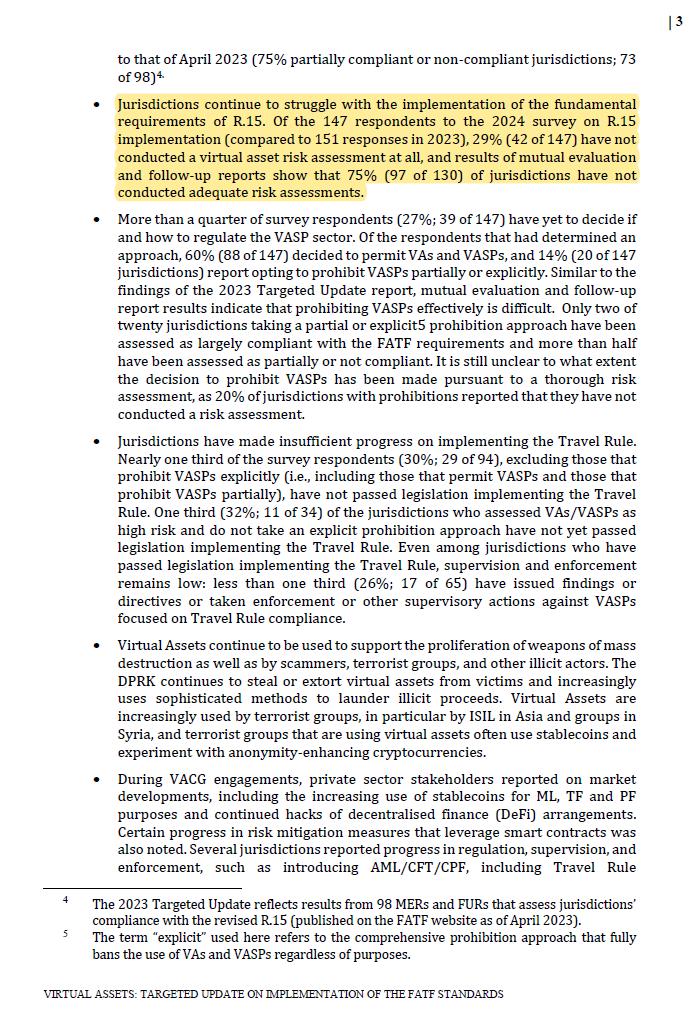

Regardless of the divergence of local governance philosophies, the third act of the conflict has brought all participants into a unified, inescapable "iron cage of control" —global anti-money laundering/countering the financing of terrorism (AML/CFT) standards. Once involved in digital assets, companies must establish compliance systems no less stringent than those of financial institutions, investing heavily in Know Your Customer ( KYC ) , Customer Due Diligence ( CDD ) , and Know Your Transaction (KYT) processes. This includes real-time screening of sanctions lists (such as OFAC), devoting resources to building AML/KYC systems, and integrating third-party tools like Chainalysis to enable KYT screening for cross-chain transactions. Leading stablecoin issuers like Tether and USDC have also switched to publishing reserve reports at least monthly and have established on-chain address blacklisting systems to freeze assets of sanctioned addresses. The FATF also requires VASPs to comply with the "Travel Rule," which has restructured the compliance operating costs of exchanges. According to the FATF report "Virtual Assets: Targeted Update on Implementation of the FATF Standards (2024)", as of April 2024, approximately three-quarters of jurisdictions (75%) were only partially compliant or non-compliant with R.15 (requirements for VASPs) . This requires DATs to implement stricter measures to verify customer identities and the source of funds.

The transparency of blockchain technology becomes a double-edged sword, bringing with it the unique risk of "address contamination": criminals are increasingly using anonymity-enhancing technologies (AECs) , such as mixers, to obfuscate the origin of funds. Once a business's wallet interacts with sanctioned entities (such as the North Korean Lazarus Group) or illicit addresses, it can face severe consequences, including asset freezes, law enforcement investigations, and even reputational damage. For example, traditional banks like Santander have announced that they will block real-time payments from UK customers to cryptocurrency exchanges to prevent potential fraud, reflecting a risk-averse attitude towards the crypto ecosystem.

This "iron cage" ultimately reveals the fundamental paradox facing DATs: the dilemma of compliance and innovation . The future of DAT strategy lies in proactive value creation, namely, diving into the permissionless, censorship-resistant world of decentralized finance (DeFi). However, the stringent requirements of AML/CFT compliance are fundamentally at odds with the core spirit of DeFi. To meet compliance requirements, DATs may be forced to avoid interacting with permissionless DeFi protocols, thereby limiting their ability to add value and ultimately degenerating into an inefficient asset class, indistinguishable from traditional finance.

In this paradigm clash between the old and new worlds, the only way for companies to survive is to establish a dynamic, quantitative risk assessment system . Leadership must go beyond simple legal advice and construct a "regulatory risk matrix" that quantifies the "identity risk" and "liquidity risk" faced by each asset in the portfolio under the core jurisdictions. Based on this matrix, they can make clear-headed strategic decisions that will stand the test of time.

5.2 The Illusion of Defense in Depth in Digital Fortresses

If legal risk is the external "Sword of Damocles" hanging over DATs, then technological and operational risks are the existential crises erupting from within, characterized by a zero-tolerance environment. In traditional finance, erroneous transactions can be corrected; in the world of digital assets, a single operational error, a contractual loophole, or the bankruptcy of a custodian institution can mean the permanent loss of assets. The layers of "digital fortress" that companies attempt to construct, under the harsh stress test, reveal that their defense-in-depth defenses may be a fragile illusion.

The first leg of this stress test began with the core of the fortress, the "vault"—the unsolvable dilemma of custody decisions . The crypto world's motto, "Not your keys , not your coins," has thrust companies into an unavoidable strategic dilemma. This isn't a choice between security and risk, but rather a trade-off between two different, equally deadly forms of risk. This is essentially a "transfer" of risk, not its "elimination."

Choosing "self-custody" means placing trust in yourself, but it also opens the door to an internal abyss . Enterprises must navigate an extremely complex technology stack, from separating hot and cold wallets, hardware security modules (HSMs), to multi-signature (Multi-Sig) and multi-party computation (MPC). Cold wallets (offline) and hot wallets (online) are key to protecting assets, with hot wallets used for transactions and cold wallets for storing the majority of assets. Multi-Sig requires multiple authorized signatures to process and approve transactions, thus distributing risk. More advanced technologies, such as multi-party computation (MPC), divide private keys into "key shares" and distribute them across multiple physical devices, aiming to mitigate single points of failure. This requires top-tier professionals and audit-level internal processes.

However, technology cannot eliminate human error : in an environment running on distributed ledger technology (DLT) without a central authority, the consequences of transferring large amounts of funds to the wrong address can be permanent . If the employee responsible for managing the private key shards leaves or dies, and the private key backup or recovery process is flawed, assets may be lost and irreparable. Transferring funds between cold wallets (for example, from cold to warm to hot) can take far longer than the technically feasible second-level settlement time, increasing operational complexity. It also cannot eradicate human greed : For example, a Ponemon study found that 78% of surveyed organizations have experienced data breaches caused by internal negligence or malicious intent. If executives with access to private key shards collude to commit malicious acts, the consequences can be disastrous.

In order to avoid this internal abyss, most companies choose to entrust their assets to a third party for custody, but this is tantamount to throwing themselves into an even more unpredictable "external black hole" - counterparty risk .

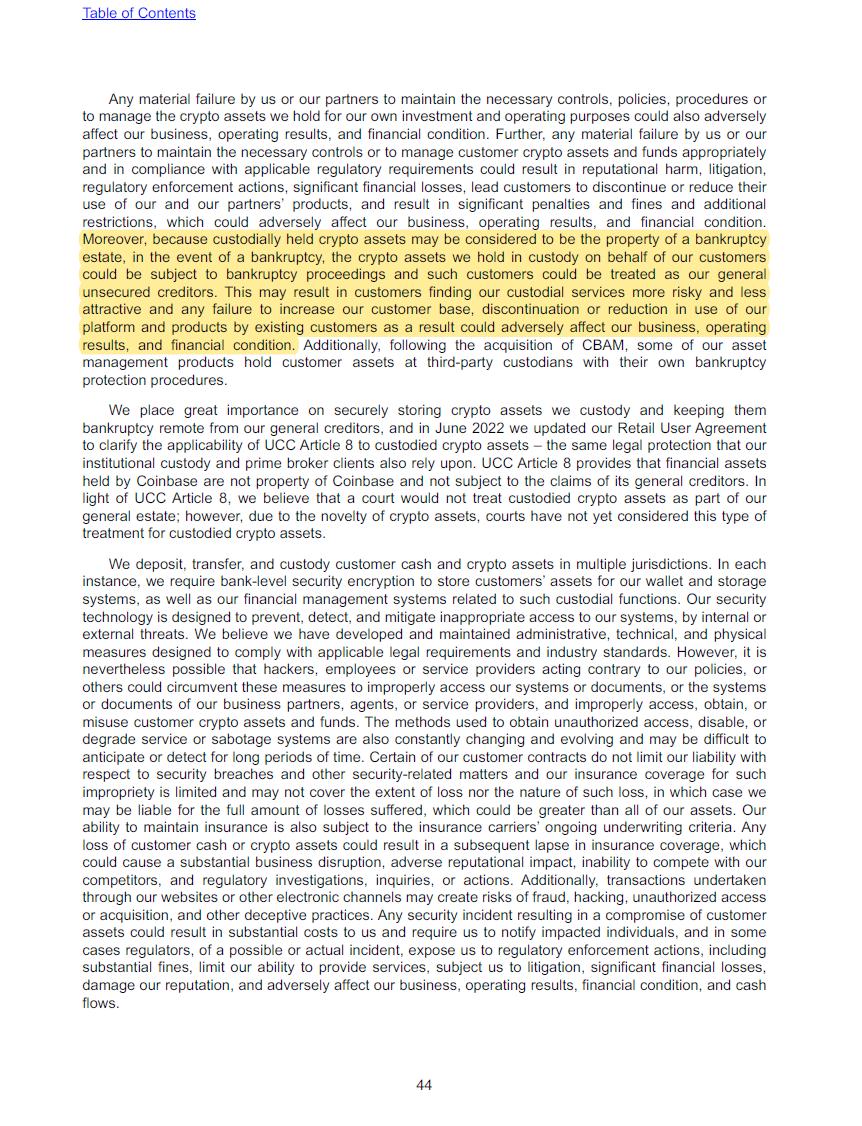

The catastrophic bankruptcies of platforms like FTX, Celsius, and BlockFi have exposed the true nature of this black hole with painful lessons: when a custodian institution fails, the assets deposited by a business may not be truly segregated legally. As Coinbase disclosed in its 2024 Form 10-K, during bankruptcy proceedings, customers may be downgraded to general unsecured creditors , their asset ownership instantly evaporating. This demonstrates that even the most professional custodian institution can become a legal and credit trap that can render a business's assets irretrievable.

However, even if an enterprise manages to survive its core custody decision, the risk of its fortress collapsing is far from over. The second stage of the stress test shifts to the fortress's perimeter— the ubiquitous "secret passages" in daily operations . Attackers don't need to breach impenetrable cold wallets; they can penetrate defenses through more devious means.

A phishing email or social engineering attack targeting the CFO could cause them to tamper with a transaction authorization instruction initiated from a hot wallet , or interfere with any part of the multi-signature approval process, thereby diverting funds to a malicious address.

An API key leaked due to internal oversight (e.g. stored in a public code repository) is enough for an attacker to directly execute unauthorized transactions;

In the DeFi context, oracles are services that connect DLT networks with off-chain data sources, providing real-time external data to smart contracts. If an oracle is manipulated or exploits vulnerabilities (for example, by manipulating the prices of the exchange APIs it queries), it could lead to erroneous liquidations in DeFi protocols that rely on that data. These operational vulnerabilities create secret pathways to bypass core defenses, proving that the fortress's walls are far more porous than imagined.

But the most profound vulnerability lies neither in the fortress's core nor its borders, but in the very foundation of the entire ecosystem upon which it rests. The third leg of the stress test revealed that this foundation—whether centralized or decentralized—is built on quicksand. The risks of centralized exchanges (CEXs), exposed in the case of FTX's misappropriation of customer funds , demonstrate that even industry giants can harbor systemic corruption of trust.

When businesses bravely enter the DeFi world in pursuit of raw returns, they face another risk of collapsing foundations: vulnerabilities in smart contract code that cannot be completely eradicated through audits, and the so-called "decentralization" illusion , where governance tokens are controlled by a small number of whale. For example, decentralized autonomous organizations (DAOs) that make decisions through governance tokens may be controlled by a small number of entities, or their upgrade mechanisms may be flawed.

Governance tokens typically link voting rights and/or parameter modification rights to token holdings—the more tokens you own, the greater your voting power. Many DAO decisions (proposals, upgrades, treasury withdrawals, etc.) rely on token holder voting. Therefore, token holding distribution directly determines who can make decisions.

Vulnerabilities in upgrade mechanisms often arise from the fact that some DAOs have no or very short execution timelocks, or have lax thresholds or quorum requirements. This allows malicious proposals to be executed within minutes or blocks, making it virtually impossible for the community to intervene. An adversary can use flash loan to borrow large amounts of tokens in a short period of time, exploit vulnerabilities in snapshot mechanisms or short voting windows, submit and pass malicious governance proposals, and then repay the loan (if voting or execution permits such atomic on-chain manipulation). Research literature lists such practices as typical threat models.

This ultimately leads to a profound irony and paradox of decentralization : while DATs embrace assets centered on decentralization, they are forced to rely on centralized gatekeepers —custodians, exchanges, and compliance providers—to achieve institutional-grade compliance, security, and scalability. This reliance fundamentally undermines the original ideal of crypto assets: to “become your own bank .”

This comprehensive stress test ultimately proved that traditional risk management frameworks are ineffective in the zero-tolerance environment of digital assets, where "errors mean permanent loss . " Boards of directors must clearly recognize that they are approving a strategy with virtually no safety net . This requires companies to establish a technical governance framework that transcends traditional finance, leveraging MPC/multi-signature systems to implement customized approval processes and elevate risk assessment and control to a strategic level that determines the survival of the enterprise.

5.3 The Untamed Cycle of Value Implosion

Even if a company successfully navigates the legal minefields and technological abyss, the DAT strategy itself will inject an untamed financial shockwave directly into the company's core—its financial statements. This is not a single risk, but a deadly chain reaction of extreme volatility, distorted accounting standards, and fragile liquidity. In a market reversal, these three factors will amplify each other, triggering an irreversible, value-destroying implosion cycle.

The first stage of this cycle is the arrival of the "initial shock wave." The price volatility of digital assets, especially Bitcoin, isn't simply a percentage change; it's a force capable of unleashing a financial tsunami. While some might call it "dynamism," this energy can be fatal for companies employing highly leveraged strategies.

Take MicroStrategy, for example. Its strategy of purchasing Bitcoin through issuing equity and debt led to a debt-to-equity ratio that was once estimated to be over 3.0, far exceeding the typical level for similar companies. This leveraged structure magnifies the threat posed by market volatility to the company's solvency many times over. A 30% drop in the Bitcoin price could trigger $5.9 billion in unrealized losses. In 2022, when the Bitcoin price approached $21,000, the company faced the real risk of a margin call . Tesla reported a $204 million loss on its Bitcoin investment in fiscal year 2022. This demonstrates that initial market shocks and sharp fluctuations in asset prices can directly impact balance sheet size and put pressure on key financial ratios in debt covenants, potentially threatening the very survival of a company.

However, this first wave of shockwaves, no matter how violent, was merely the trigger. The true devastation came in the second phase—when it collided with the "panic amplifier " : current accounting standards. Under U.S. Generally Accepted Accounting Principles (US GAAP), digital assets are classified as "indefinite-lived intangible assets," resulting in a disastrous "asymmetric" accounting treatment . When the market price of an asset declines, the company must record an "impairment loss" on the income statement—MicroStrategy reported nearly $1 billion in impairments after the 2022 "Crypto Winter." If the price falls below the historical cost, the loss must be recognized immediately; however, when the market price recovers, the previously recorded loss cannot be reversed or written off . The appreciation of an asset is only recognized as "gain" and recorded in the income statement at the moment the asset is actually sold . For example, Tesla sold 75% of its Bitcoin holdings in 2022, adding $936 million in cash to its balance sheet.

This "only reporting bad news, never good news" rule not only exposes companies to significant downside risk in their reported earnings (EPS), but also distorts and amplifies market volatility into substantial losses on the financial reports, creating a highly contagious panic narrative for the capital market. This is precisely the " CFO 's unsolvable dilemma" : they are forced to present a pessimistic financial reality to investors that is severely disconnected from the true economic value (fair value) of the company's assets. This misalignment fundamentally undermines trust between management and the capital market.

More profoundly, this accounting reality fundamentally negates the original strategic intent of DAT, which was to create a "store of value." The core logic behind companies allocating Bitcoin is to use it as a "store of value" tool to hedge against inflation. However, how can an asset that systematically undermines shareholder confidence due to its accounting treatment during a bear market be defined as a qualified "store of value" tool?

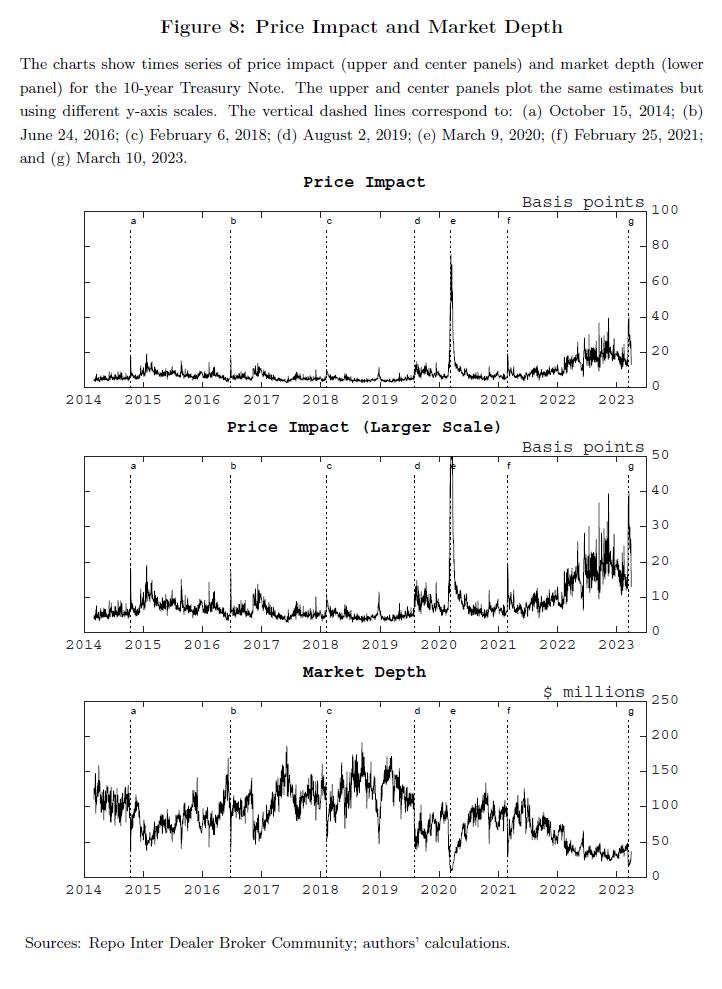

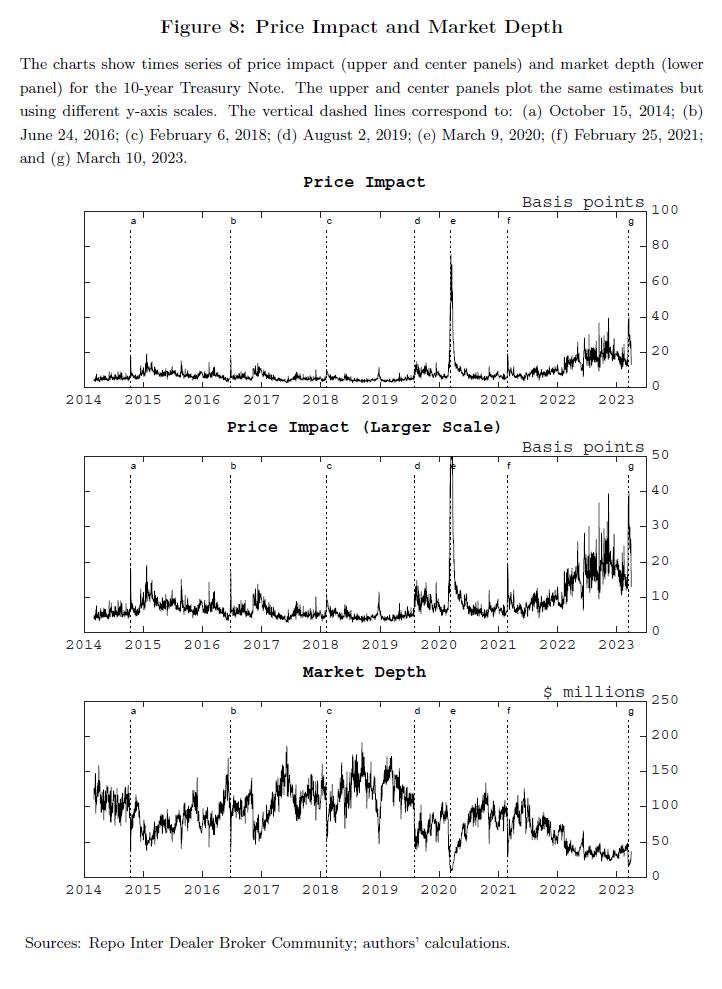

In this panic, orchestrated by both volatility and accounting, companies naturally feel the urge to sell assets to protect themselves. However, it is here that the cycle enters its third stage: the "liquidity trap," which completely closes all escape hatches . The DAT strategy creates a core illusion: a massive "theoretical market capitalization" (such as Bitcoin's total market capitalization) equates to "readily available liquidity." Despite Bitcoin's significant market capitalization, when measuring the depth of immediate order-book transactions at a specific point in time , BTC typically only offers depth in the millions of dollars at narrow spreads (e.g., 10–100 bps) (Amberdata). Traditional markets like US Treasuries often offer depth in the tens to hundreds of millions of dollars using the same metric (Fed), resulting in a significant difference in executable market depth. Furthermore, the premium (premium to NAV) assigned to DAT shares is based on investor confidence in the management team's ability to continuously increase holdings. This high valuation does not translate into immediate, high liquidity in the underlying assets.

However, for "whale" like MicroStrategy, which hold over 100,000 Bitcoins, the sheer size of their holdings creates a self-imposed liquidity trap. If a company like MicroStrategy needs to sell hundreds of millions of dollars worth of Bitcoin in a short period of time due to debt repayment or a sudden crisis, or if any attempt is made to sell large quantities in a short period of time, the massive sell orders will quickly overwhelm the order book , triggering significant slippage losses and potentially causing a market crash. Even in the relatively liquid Ethereum market, if 20%–30% of the ETH vault holdings are sold off in a concentrated manner over a period of several weeks, the price of ETH could plummet to $2,500–3,000. In extreme cases, if over 50% of holdings are forced to liquidate, the price could plummet to $1,800–2,200 . This demonstrates that so-called "vaults" may not be liquidated at their intended value in times of crisis, acting as a procyclical risk amplifier for the market.

This is the desperate dilemma of the "elephant that cannot turn around" : due to its huge success, the company is forced to become a "permanent prisoner" of its own assets, unable to exit without destroying its own value.

This deadly, implosive cycle of "shock waves," "amplifiers," and "traps" presents a serious governance challenge to all boards. Under current regulations, the only rational path forward is to proactively establish an internal communication and governance framework that goes beyond GAAP and is more aligned with economic realities. Boards should immediately promote the research and adoption of a set of "adjusted accounting metrics" to simulate the company's true financial performance under fair value measurement. While this won't change external regulations, it is the only beacon of clarity and rationality that companies can illuminate as they navigate this untamed financial shockwave.

Part 6: DAT, please answer

6.1 Fundamental Challenges of DAT to Corporate Governance

Our analysis concludes here. This isn't a pronouncement of conclusion, but rather a series of fundamental questions about the cornerstones of modern corporate governance. The emergence of digital asset treasuries (DATs) is far more than a simple asset allocation decision; rather, it serves as a prism, reflecting the profound dilemmas facing boards of directors regarding strategic insight, prudence, and ultimate purpose . The following three interrelated challenges compel leadership teams to re-examine their core responsibilities before all shareholders.

The first challenge directly addresses the board's most sacred fiduciary duty : the very definition of "prudence" is being torn apart in the current macroeconomic environment. Boards face a profound paradox: if they choose to "prudently" hold cash to hedge against the extreme volatility of digital assets, the result could be the systemic erosion of shareholder capital amidst persistent inflation —as Ray Dalio has pointed out, cash is one of the worst long-term investments. In this context, does "inaction" itself constitute a new form of "dereliction of duty"? Conversely, if the board chooses to allocate DATs to hedge this risk, it risks being accused of exposing shareholder capital to an "irresponsible gamble." Especially when leveraging strategies, volatile market fluctuations could directly threaten the company's solvency.

This paradox is further complicated by the issue of "cognitive boundaries." The core value logic of DATs is rooted in cryptography, network theory, and consensus algorithms, which largely transcend the collective "circle of competence" of traditional boards of directors. When the underlying logic of an asset is so complex, is the board's approval decision based on thoughtful insight or blind faith in the future of technology? As CZ(CZ) explained at the Hong Kong 2025 Bitcoin Conference:

The DATs we currently support lean toward the simplest, first type. We prefer companies focused on a single asset—especially BNB—because evaluation is straightforward and day-to-day involvement is minimal. In bull markets, listed companies generally benefit; in bear markets, especially in the US, litigation risk rises. If the strategy is clear and simple, litigation risk is lower and legal costs fall—lawsuits are very expensive.

Our goal is to minimize operating costs and promote long-term holding. We don't want companies to allocate into side investments; we hope they engage more deeply by supporting ecosystem development.

The DATs we currently support tend to fall into the simplest, first category. We prefer companies focused on a single asset (particularly BNB) because valuation is simple and day-to-day involvement is minimal. In bull markets , publicly listed companies generally benefit; in bear markets , especially in the US, litigation risk increases. Clear and simple strategies reduce litigation risk and legal costs, which are very expensive.

Our goal is to minimize operating costs and promote long-term holding. We don't want companies to allocate to sideline investments; we want them to participate more deeply by supporting ecosystem development.

This implies complex strategies that lack professional understanding, which will directly translate into legal risks and costs.

Even if a board resolves to bridge this cognitive gap, a second challenge arises: how to chart a rational course in a deep, uncharted ocean? This is precisely the failure of "measurement." In a land devoid of mature valuation models (such as DCF), historical precedent, and rating agencies, any decision regarding allocation ratios loses its traditional rational anchor. Where is the line between a prudent allocation as a hedge (e.g., 1%) and a radical gamble that could alter the company's fortunes (e.g., Boyaa Interactive's once-high 75%)? When the driving force behind decisions shifts from sober risk-return analysis to the founder's unshakable personal convictions, where does the line between "rationality" and "speculation" lie?

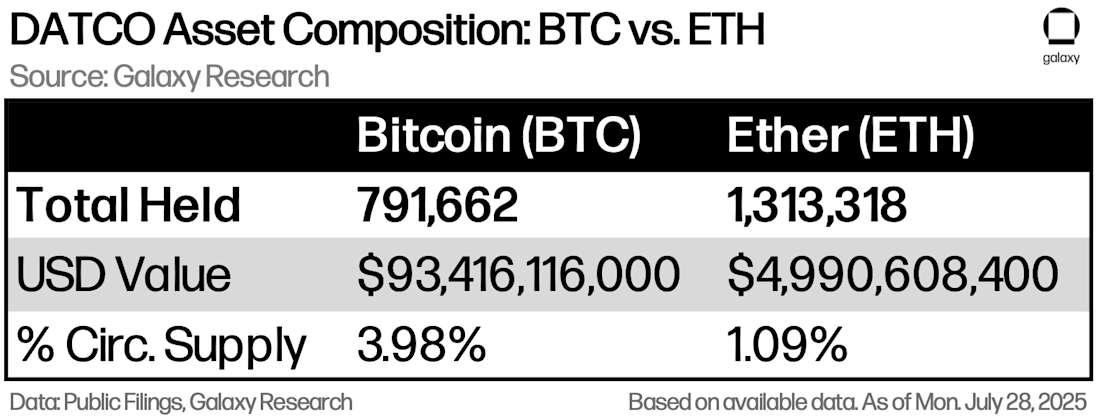

This problem is taken to an extreme in the "financial flywheel" model. The valuation of DAT companies is highly dependent on the premium of their market capitalization relative to their net asset value (mNAV). Investors are buying not only existing assets but also confidence in management's ability to expand in the future. This pro-cyclical model amplifies both returns and risks. Because executive compensation is linked to stock price, it can induce pro-cyclical behavior by management to sell assets to protect their own interests during market reversals, further undermining the stability of long-term strategies. How can boards of directors prove to shareholders that their chosen allocations (for example, BitMine's holdings of over 1.52 million ETH, representing 1.3% of the circulating supply) are scientifically calculated to maintain a strategic hedge with manageable risk, rather than a gamble based on founder Michael Saylor's personal convictions and the pursuit of excess returns?

This failure in measurement ultimately forces us to confront our third and most profound challenge: questioning the "ultimate purpose" of business . For centuries, commercial civilization has been built on a self-evident premise: the value of an asset ultimately derives from its future cash flow productivity. However, the value of DATs, and particularly Bitcoin, is anchored in mathematical scarcity and unpredictable network consensus, not productivity.

When the foundations of value undergo a fundamental shift, do traditional risk models (such as VaR) based on historical data and normal distribution assumptions become a joke ? When a "non-productive" asset can be more effective in preserving capital than a company's core "productive" operations, does this mean that the purpose of the business is being alienated? Strategies like those exemplified by MicroStrategy essentially shift the company's focus from serving social needs to financial engineering in the capital market. Is this a betrayal of the "social contract" signed between business and society?

Ultimately, adopting a DAT strategy is tantamount to signing a Faustian pact with a powerful but capricious future. This pact may allow a company to survive the monetary deluge of the old world, but the price is accepting a completely new value logic, enduring its volatile volatility that traditional risk models can't capture, and ultimately potentially completely transforming its identity, from an industrial company to a highly leveraged , pure macro hedge fund.

Therefore, before making this decision, the board must stare into the abyss and answer one ultimate question: Is your company really ready to sign this contract with the unknown?

6.2 Where is the DAT ecosystem headed?

DAT has become a key bridge connecting the liquidity of traditional equity markets and crypto asset markets, with its total global holdings valued at over US$100 billion (Galaxy Research, "The Rise of Digital Asset Treasury Companies (DATCOs)" 2025-07-30).

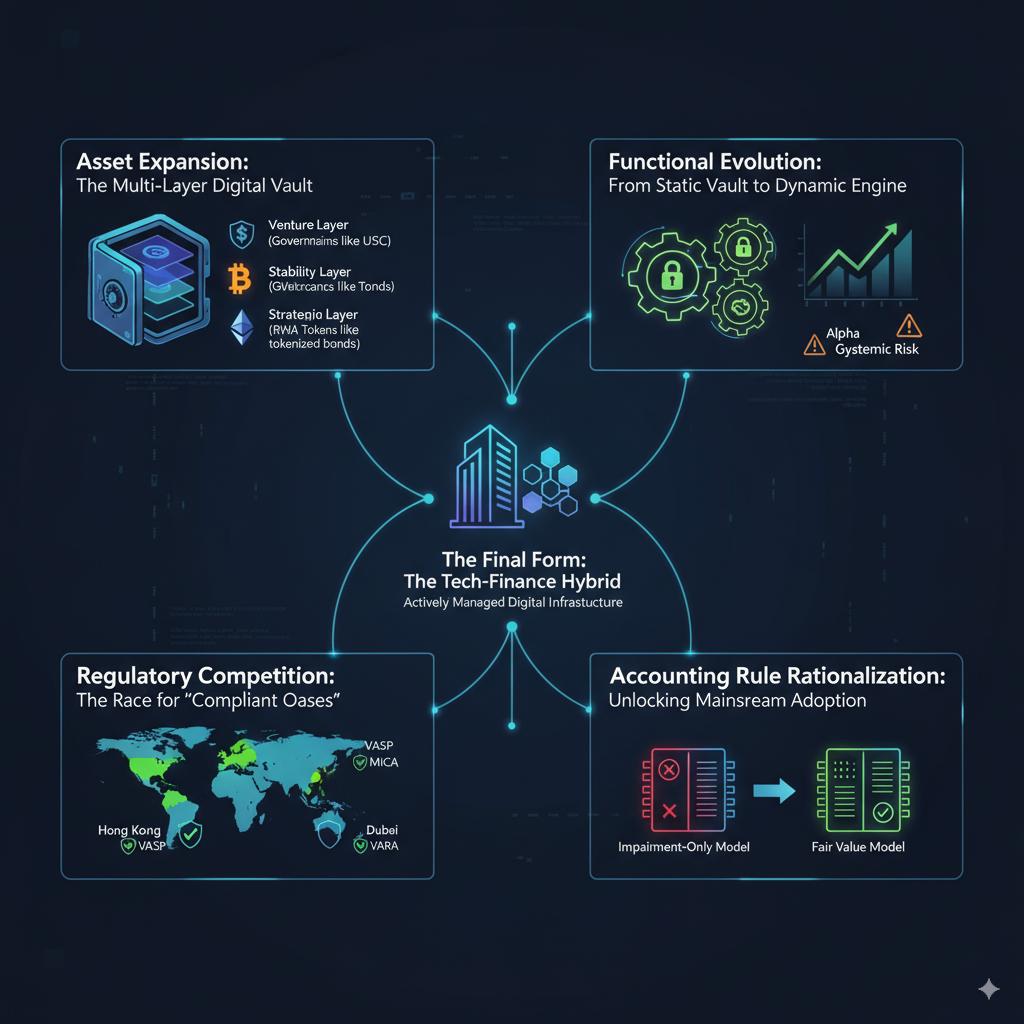

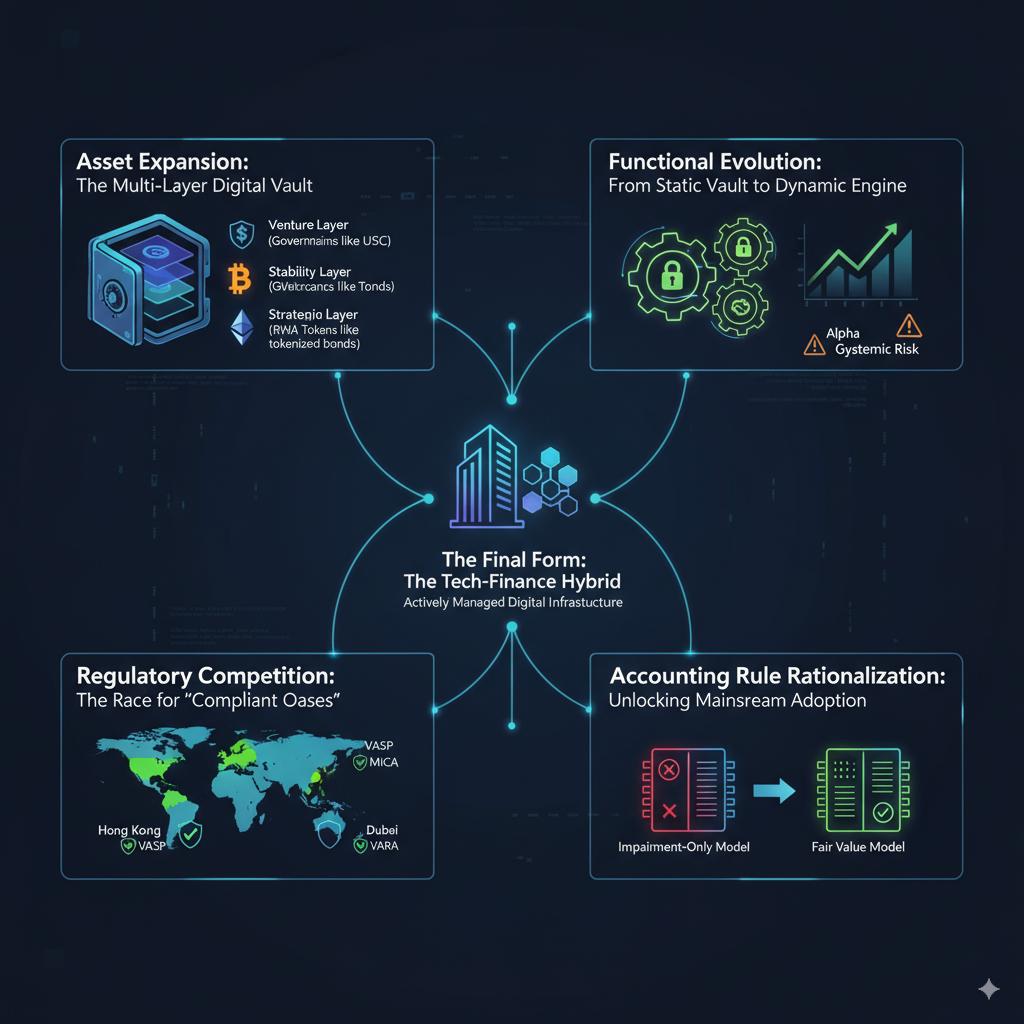

The current model—primarily through equity financing to purchase and hold Bitcoin—is merely the beginning of its evolution. Its true strategic value lies not in a linear progression, but in the dynamic evolution of the ecosystem, driven by four intertwined and mutually catalytic core engines: assets, functionality, environment, and rules .

The first engine is the expansion of the asset base . The "raw material" of DATs is evolving from a single "digital gold" to a multi-layered, functionally complementary "digital treasury." Stablecoins (such as USDC) will constitute the treasury's "cash layer." With their value stability and efficient settlement capabilities, they will become a core tool for businesses in daily operations, such as B2B cross-border trade. Real-world asset tokens (RWA tokens), such as tokenized bonds or fund shares, are expected to become the treasury's "stability layer," balancing the high volatility of crypto-native assets. Yunfeng Financial's pilot program for tokenizing FOF fund shares is an early sign of this trend. According to the Boston Consulting Group, this market is projected to reach $16 trillion to $19 trillion by 2030-2033. Bitcoin and Ethereum will continue to serve as the "core strategic layer," the former as a long-term store of value and the latter as a "digital treasury bond" that generates native yields. Ultimately, governance tokens will form the treasury's "venture capital layer," enabling DATs to move from being passive users of the protocol to leveraging their token holdings to participate in on-chain governance and protocol decision-making . Governance tokens allow users to become partial owners and decision-makers of decentralized finance protocols. By holding governance tokens of key DeFi protocols, DATs effectively gain strategic control and influence over Web3 infrastructure.

The expansion of assets inevitably drives the deepening of the second engine— functional evolution . Corporate treasuries are transforming from "static value containers" to "dynamic work engines." This trend of "DeFiization of treasury management" centers on active value-added. Companies can earn native network returns by staking PoS tokens (such as ETH or SOL, with SOL staking yields of approximately 6%-8%). For example, SharpLink Gaming and BitMine have transformed into Ethereum holding and staking companies, converting ETH's native returns into cash flow. Alternatively, they can invest assets in decentralized exchange (DEX) liquidity pools to earn transaction fees, or even over-collateralize core assets to generate low-risk operating funds. Well-managed DATs can accelerate the growth of their crypto holdings, provide higher shareholder returns, and generate a significant premium effect that exceeds the growth of the underlying assets (such as the MicroStrategy model). Companies can achieve excess returns (alpha) through active management and on-chain operations. However, this shift from a cost center to a profit center does not come without cost. When DAT companies are deeply involved in DeFi lending and liquidity provision, they are essentially evolving into a new type of "shadow banking". Their strong procyclicality may transmit the risks of the crypto world to the real economy through the leverage chain when the market is down , posing new systemic risks.

The third engine is the global regulatory landscape . The expansion and deepening of the aforementioned assets require a robust institutional environment to thrive safely. Consequently, major global financial centers are shifting from early regulatory chaos to a race for "compliance oases" to establish DAT headquarters and RWA business. Hong Kong, for example, offers clear frameworks such as VASP licenses, spot ETFs, and the Stablecoin Regulation, providing compliance assurance for businesses. Similarly, the EU's MiCA regulation categorizes stablecoins as "electronic money tokens" and "asset reference tokens," and Dubai's VARA system opens its services to overseas entities. This provides multinational DATs with opportunities to establish dual hubs in Asia and the Middle East. This, combined with cross-border pilot programs for RWAs, also provides a predictable legal environment. Faced with uncertainties such as tightening scrutiny from Nasdaq, jurisdictions offering clear legal frameworks, robust custody systems, and tax incentives are becoming the preferred choice for DATs to establish global or regional management centers. For example, HashKey positions itself as an "institutional bridge" connecting traditional financial capital and on-chain assets, leveraging Hong Kong's regulatory advantages. These clearly regulated jurisdictions can provide a regulated and convenient investment channel for traditional institutional investors (such as pension funds) that are unable to purchase cryptocurrencies directly.

However, the ultimate catalyst for the next wave of transformation in the entire ecosystem will be the fourth engine: the rationalization of core rules of the game , specifically the evolution of accounting standards. The current asymmetric accounting treatment of "impairment only, no appreciation" is one of the biggest obstacles hindering mainstream companies from adopting DATs. A shift in accounting standards from the "impairment model" to the more equitable "fair value through profit or loss" (FVTPL) model will have far-reaching implications and may even be the key to triggering the next wave of DATs : it will not only eliminate significant financial reporting distortions but also streamline the decision-making process for conservative boards, clearing the final hurdle to the widespread adoption of DAT strategies. Furthermore, a more transparent reporting system that reflects changes in net asset value (NAV) could also reduce the speculative premium currently associated with existing DAT stocks, rewarding those with genuine active management capabilities capable of generating excess returns (alpha).

When these four engines operate in tandem, the ultimate form of DAT will emerge. A company that deeply embraces asset diversification, DeFi-based functionality, and operates within a global compliance framework will no longer be defined by traditional industry labels. It will evolve into a "tech-finance" hybrid , with capital efficiency and returns engineering at its core. This new species challenges traditional corporate governance and valuation models. It is no longer simply an operating company, but an actively managed digital infrastructure. Its on-chain ecological interactions will determine its systemic role in the future economic system.

Conclusion

The rise of digital asset treasuries (DATs) is far from a fleeting phenomenon in the capital markets. It is the inevitable product of the convergence of three forces: macroeconomic structural pressures, the gradual maturation of financial infrastructure, and a shift in corporate cognitive paradigms. Essentially, it represents the first institutionalized coupling between equity capital markets and on-chain assets, marking the birth of a new corporate paradigm.

This new paradigm holds a profound duality. For businesses seeking survival amidst the macroeconomic storm, DATs undoubtedly offer a potentially enormous "value ark." They can generate excess returns through a "financial flywheel" effect. Furthermore, through the DeFiization of assets, they have the potential to transform treasuries from cost centers into profit engines, ultimately becoming a key vehicle for harnessing the wave of tokenization of trillions of real-world assets (RWAs).

However, this ark is navigating a "deep sea of risk" filled with uncharted reefs and extreme storms. Its strong and sensitive procyclicality means that yesterday's growth flywheel can instantly become an engine of accelerated decline when the market reverses. Its irreversible trading characteristics and fragile custody chain mean that any technical or operational error could be fatal. Any decision-maker who only sees the light of the ark and ignores the abyss is taking a gamble.

Therefore, for any rational decision-maker, the key question is never whether to immediately embark on this ark, but whether one has fully understood the full laws of this ocean—including its currents, monsoons, and the deadly dangers lurking in the darkness. The key to success lies not in aggressive asset selection but in a rigorous risk management system. The board of directors must establish a prudent governance framework to clarify the role of the DAT in the company's blueprint: is it a defensive macro hedge tool, an active income generator, or a complete Web3 business transformation?

Ultimately, the only task of every company is to establish a unique "navigation strategy" that fully matches its own risk tolerance and strategic goals, and use it to decide whether to set sail or stay in port.

Author: Zhao Qirui Editor: Zhao Yidan

About RWA Research Institute

The RWA Research Institute was jointly initiated by a number of senior financiers, Web3 practitioners, industry innovators and technical experts, and was officially launched in Hong Kong on June 25, 2024 (full name: RWA Research Institute, abbreviated: RWARI).

As one of the earliest professional RWA research institutions in the world, the RWA Research Institute focuses on the field of real-world assets (RWA) and is committed to promoting the integration of traditional financial assets and blockchain technology. Through in-depth research and practical applications, the Institute provides innovative solutions for investors and businesses, promotes the digitization and tokenization of physical assets, and builds a bridge between traditional finance and digital assets.

The RWA Institute's core mission is to integrate policy research, standard setting, and ecosystem building to help enterprises achieve digital asset transformation and provide technical support and strategic collaboration for global compliance development. Going forward, the Institute will continue to deepen the integration of digital technology and the real economy, collaborate with international organizations to host global industry summits, explore multi-sector application scenarios, and inject new momentum into high-quality global development.

In May 2025, the RWA Research Institute, in collaboration with leading institutions such as China Search and the China Electronics Digital Scene Technology Research Institute, launched the "China RWA Industry Think Tank," focusing on the development of global compliance in the field of asset digitization. The think tank empowers the real economy through three core initiatives: first, spearheading the development of international collaborative standards, such as the "RWA Project Evaluation Standards"; second, building a digital service chain encompassing "asset on-chain, cross-border circulation, and global transactions," integrating blockchain and artificial intelligence technologies; and third, establishing cross-border compliance channels with Hong Kong and Shenzhen as hubs to promote innovation in green finance and cross-border investment and financing. Furthermore, the think tank leverages its "dual-chain integration architecture" (a national-level alliance blockchain and a cross-chain protocol coordination mechanism) to strengthen technological autonomy and data security, and deepen cross-border collaboration and compliance governance.