This article is machine translated

Show original

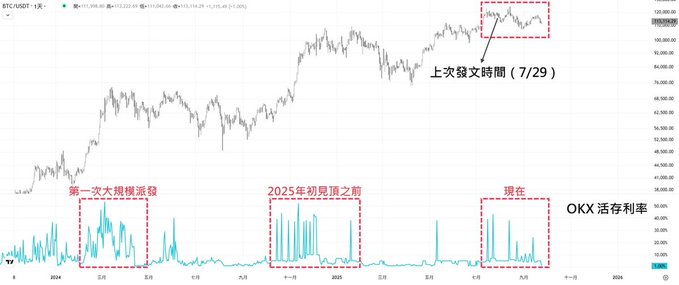

Recap & Alpha Thread: OKX Savings Rate Spike Signals Another Market Top 🌡️

Let’s talk about a “sentiment indicator” we haven’t covered in a while.

Two months ago, I posted about a fresh way to track market vibes:

Using “OKX USDT Savings Rate” as a real-time sentiment gauge.

Fast forward to today, and this OKX rate strategy is proving itself again 👇

Quick refresher on sentiment indicators for both OGs and newcomers:

We all know the classic “be greedy when others are fearful, be fearful when others are greedy,”

but let’s be real—easy to say, tough to nail in practice 🤷♂️

That’s why “quantifying market sentiment” is so crucial.

There are tons of sentiment metrics out there, including:

➡️ Fear & Greed Index

➡️ VIX

➡️ US Money Sentiment Curve (x.com/market_beggar/status/188...…)

➡️ Lending rates (x.com/market_beggar/status/192...…)

➡️ Coinbase App Rankings (x.com/market_beggar/status/194...…)

Also, don’t forget the well-known “Coinbase premium/discount,” which I often mention.

So many indicators, but the goal is always the same: spot overheated market sentiment 🔭

Today’s alpha: “OKX USDT Savings Rate” as a sentiment signal.

Here’s the gist: when the OKX savings rate suddenly spikes (those classic “needle candles”),

visualizing the rate curve helps us track these rapid, clustered spikes.

For details, check the linked post below—won’t repeat all the nitty gritty here.

The chart I’m sharing uses @coinkarma_’s “OKX Savings Rate Monitor.”

Back on July 29, we saw two sharp rate spikes in a short time.

Since then, there have been 4 clear needle spikes, plus a bunch of smaller, dense ones 💉

As I mentioned before:

If USDT savings rates suddenly surge, it means demand to borrow USDT is popping off—

everyone’s trying to borrow U for trades, which is a classic sign of overheated sentiment 🌡️

Check the chart: after July’s cluster of spikes, BTC went into chop mode, then topped out with a new high “stop hunt”:

x.com/market_beggar/status/195...…

After the spike clusters, BTC’s max drawdown hit ~14% 📉

When I posted on 7/29, I had no clue how things would play out;

But this recent dump just adds another W for the OKX savings rate as a top signal.

So next time we see similar clustered spikes in the savings rate,

might be time to stay cautious and watch out for a possible correction... ⚠️

//

That’s all for today—hope you found this useful 🫡

The “OKX Savings Rate Curve” indicator is by @coinkarma_—

check their site for a free 14-day trial!

Also, I scored a special perk for Market Beggar readers:

From now until 10/20, first-time subscribers get the first month for just $10 ✨

(Reg. $69/mo—just enter code “beggar10” at checkout for a $59 discount 💰)

If you vibe with it, use my invite code (in the comments below) when you sign up

for an extra 15% extension on your subscription ✅

貝格先生

@market_beggar

07-29

另類情緒指標:上竄下跳的 OKX 活期利率📊

市場的頂底,往往發生於情緒之極,

因此如何評估市場情緒就成了每位投資者的必修課。

先前我曾介紹過諸多不同類型的情緒指標,

包含美資情緒曲線、借貸利率,

以及下方引文中的 Coinbase App 熱度排行榜。

那,你知道 OKX 的活期利率或許也有跡可循嗎❓ x.com/market_beggar/…

🔗Register here for a free trial. If you like it, keep using it.👇

coinkarma.co/zh-tw/join/821184...…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content