In industry parlance, this phenomenon is called “circularity.”

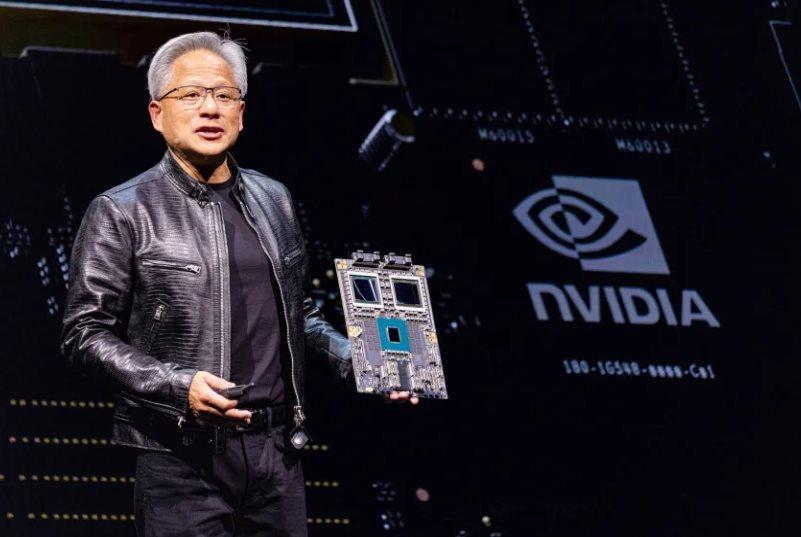

On Monday, Nvidia announced a $100 billion investment in OpenAI, the private company behind ChatGPT, sending shockwaves through the tech world. The idea is that Nvidia gives OpenAI cash to build data centers, and in return, OpenAI buys Nvidia chips (at a discount) to run those centers. In short: OpenAI gets the money it needs, and Nvidia gets the chips it needs.

“OpenAI has now become a ‘too big to fail’ entity in the race to build AI data centers,” Peter Boockvar, chief investment officer at OnePoint BFG Wealth Partners, wrote in a report on Tuesday.

For this massive experiment to run without incurring massive losses, OpenAI and its competitors must generate massive revenues and profits to pay for the commitments they are signing, while still providing a return to investors.”

BLIND SPOTS

There’s still a lot of uncertainty about the Nvidia-OpenAI deal, which exists only as a letter of intent. We don’t know the investment’s timeframe, and it’s unclear how OpenAI— which has never been profitable and only brings in about $13 billion in annual revenue—will pay for it.

Even with Nvidia's money, OpenAI still needs an additional $40 billion for every gigawatt of capacity it plans to build (a total of 10GW, equivalent to the amount of electricity needed to power 8 million homes), according to Reuters.

So where will that huge amount of money come from?

OpenAI, which did not respond to a request for comment, is burning through cash at a furious pace. The Information recently reported that the company expects to burn through as much as $115 billion by 2029—about $80 billion more than it originally projected.

Not to mention, OpenAI is also tied up in billion-dollar deals to buy chips and rent data centers from other companies like Broadcom and Oracle.

Meanwhile, the current AI industry is so chaotic that it requires a flowchart to explain the tangled commitments between just a few companies.

In industry parlance, this phenomenon is called “circularity.” Nvidia gave money to OpenAI; OpenAI used the money to buy chips from Nvidia. Amazon invested $4 billion in Anthropic; Anthropic spent $4 billion to use Amazon’s AWS cloud service.

“Such circular deals are common in the AI world and raise questions about whether new sales truly reflect market demand, or are simply Capital recycled within the industry,” according to the WSJ.

“Without tech-related spending, the US economy would have fallen into recession this year,” wrote George Saravelos, an expert at Deutsche Bank. “Nvidia is now responsible for the majority of US economic growth.”

But he warned: To maintain this Vai , Capital spending must continue to grow at a “parabolic” pace – something unlikely given that infrastructure investment from Microsoft, Amazon and Google appears to have peaked this year.

$800 BILLION FINANCIAL GAP

Now, back to the original question: Where will the money come from? The answer from OpenAI and its investors: From us. They are betting that users will become so dependent on ChatGPT that they will pay to use it.

ChatGPT is now the most popular AI application, with over 700 million weekly users. But OpenAI has to keep attracting users, and then convince some of them to pay for the premium version. The problem is that neither the free nor the paid versions have proven to be widely useful in practice, and sometimes lead users down dangerous spirals of delusion.

For the past three years, OpenAI has been promising ever more “magical” versions of ChatGPT. But the launch of ChatGPT-5 this summer was a disaster: The new bot produced incorrect results, even worse than previous versions, leaving users frustrated and OpenAI confused.

The “give it away for free” strategy thatCapital common in Silicon Valley (like Uber) may work. But the question is: Is ChatGPT really so different that users will be willing to pay for it, instead of using the myriad of free chatbots?

For most individuals, the answer is probably no. For businesses, the answer is also ambiguous. Recent studies from MIT and McKinsey show that most companies that implement AI still see no improvement in revenue.

To pay for their data center plans, AI companies will need $2 trillion in annual revenue by the end of the decade, according to Bain & Company. But even when AI savings are factored in, the real figure will still fall short by about $800 billion.

In other words, the financial landscape of the AI industry – and OpenAI’s future – is still far from sustainable.