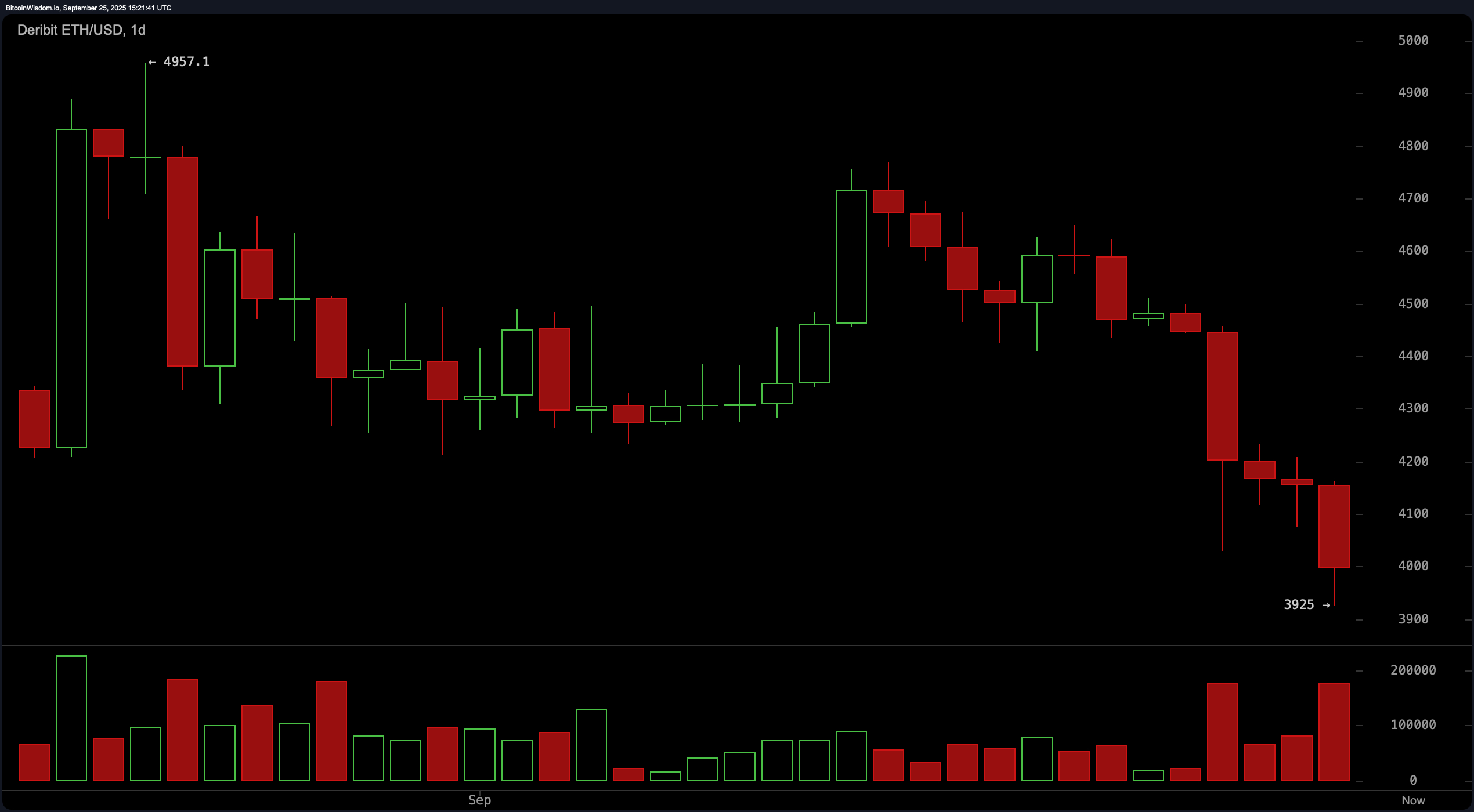

Ether spent the week clinging to the $4,000 mark, bobbing between cooling ETF flows, bargain-bin gas fees, and macro tremors that kept traders second-guessing every move.

From Flush to Balance: Ether Needs to Clear $4,200

Ethereum (ETH) slipped toward the round number after a midweek flush knocked leverage out of the market. Seven-day performance sits in the −4% to −5% pocket, with intraday quotes circling $3,950 to $4,050 and brief breaks below that line as dip-buyers tested their nerve.

Flows didn’t help. Spot ether exchange-traded funds (ETFs) cooled big time from August’s spree to roughly $110 million of net creations this month, while mixed flows across multi-asset funds dulled momentum. Without steadier primary-market demand, price discovery has leaned on spot liquidity and tactical futures, both prone to whipsaw.

As far as onchain is concerned, staking holds near 29% to 31% of supply—about 35 million to 37 million ETH—keeping float tight even as validator rewards drip new coins into circulation. Meanwhile, base-layer gas printed sub-1 gwei at times, great for users but thin gruel for validator revenue, a dynamic to watch if quiet blocks linger.

At the protocol level, the post-Pectra lull shifted attention to incremental UX and efficiency tweaks. Nothing imminent rewires issuance or supply-demand math, but upgrades that nudge activity or fees can tilt revenue and usage at the margins.

Ethereum’s Fusaka upgrade has a date with mainnet on Dec. 3, promising to beef up rollup data capacity while still keeping its decentralization-and-security badge polished.

What matters next is mostly macro and flows. A cooler inflation print would open the door for risk to breathe; a hot one could extend chop. For cleaner trend confirmation, watch ether reclaim and hold $4,150 to $4,200 on rising spot volumes.

Derivatives tell the tale in real time. After the cleanup, funding should rebuild without overheating, and open interest (OI) should climb steadily rather than spike. Fast funding flips and vertical OI usually mean fragile rallies and quick give-backs.

Playbook: respect the range around $4,000 until data or flows budge it. Bull odds improve if ETF creations turn consistently positive, gas lifts from abnormally low levels alongside rising activity, and spot volumes expand on green days. Bears gain traction on repeated failures at $4,200 and a decisive slip through $3,900 that drags funding negative and OI lower.