Kucoin hit with record $14 million fine in Canada. Photo: Decrypt

Kucoin hit with record $14 million fine in Canada. Photo: Decrypt

Canada strikes back hard

- In the context of governments tightening control of cryptocurrencies, Kucoin - one of the world's largest crypto exchange - is facing a record fine of ~14 million USD from Canada's anti-money laundering agency.

- The Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) accused Kucoin - operated by Seychelles-based Peken Global Limited - of failing to register as a Foreign Money Services Business and failing to comply with anti-money laundering and counter-terrorism financing measures.

- FINTRAC determined that, from June 2021 to May 2024, Kucoin :

2,952 times of failure to report large crypto transactions (≥ 10,000 CAD).

33 times failed to report suspicious transactions despite reasonable grounds to suspect they were related to money laundering or terrorist financing.

- The agency emphasized that the fine of more than 19.55 million CAD is an unusually large number, demonstrating the determination in the strategy of tightening AML/CTF.

Kucoin 's response

- Kucoin said it has filed an appeal with the Federal Court of Canada, based on both substantive and procedural aspects.

- In a statement on September 25, the exchange asserted: “While Kucoin respects the decision-making process and is committed to compliance and transparency, we disagree with the finding that Kucoin is a Foreign Money Services Business, as well as with the fine, which we believe is excessive and punitive.”

- One of the key points that Kucoin focused on refuting was the concept of FMSB. According to them, the exchange's global operating model does not necessarily fit the traditional definition of a money service business. If the court agrees with this argument, it could create a new legal precedent for the entire crypto industry.

- This is not the first time Kucoin has been in legal trouble. In early 2025, Kucoin pleaded guilty in the US, agreed to pay nearly $300 million in fines , and pledged to withdraw from the US market for at least two years. The US Department of Justice and the Commodity Futures Trading Commission (CFTC) accused the exchange of helping launder up to $9 billion in dirty money by failing to impose know-your-customer (KYC) and anti-money laundering (AML) requirements.

- Kucoin also encountered legal trouble in New York state in 2023, resulting in the exchange having to pay a fine of $22 million for operating without a license and listing cryptocurrencies XEM securities.

- According to FINTRAC, in the 2024-2025 fiscal year alone, the agency issued 23 notices of violation, with a total fine of more than CAD 25 million - the highest ever. Kucoin , with the fine accounting for the majority of this figure, became a prime example of how Canada is determined to deter crypto businesses.

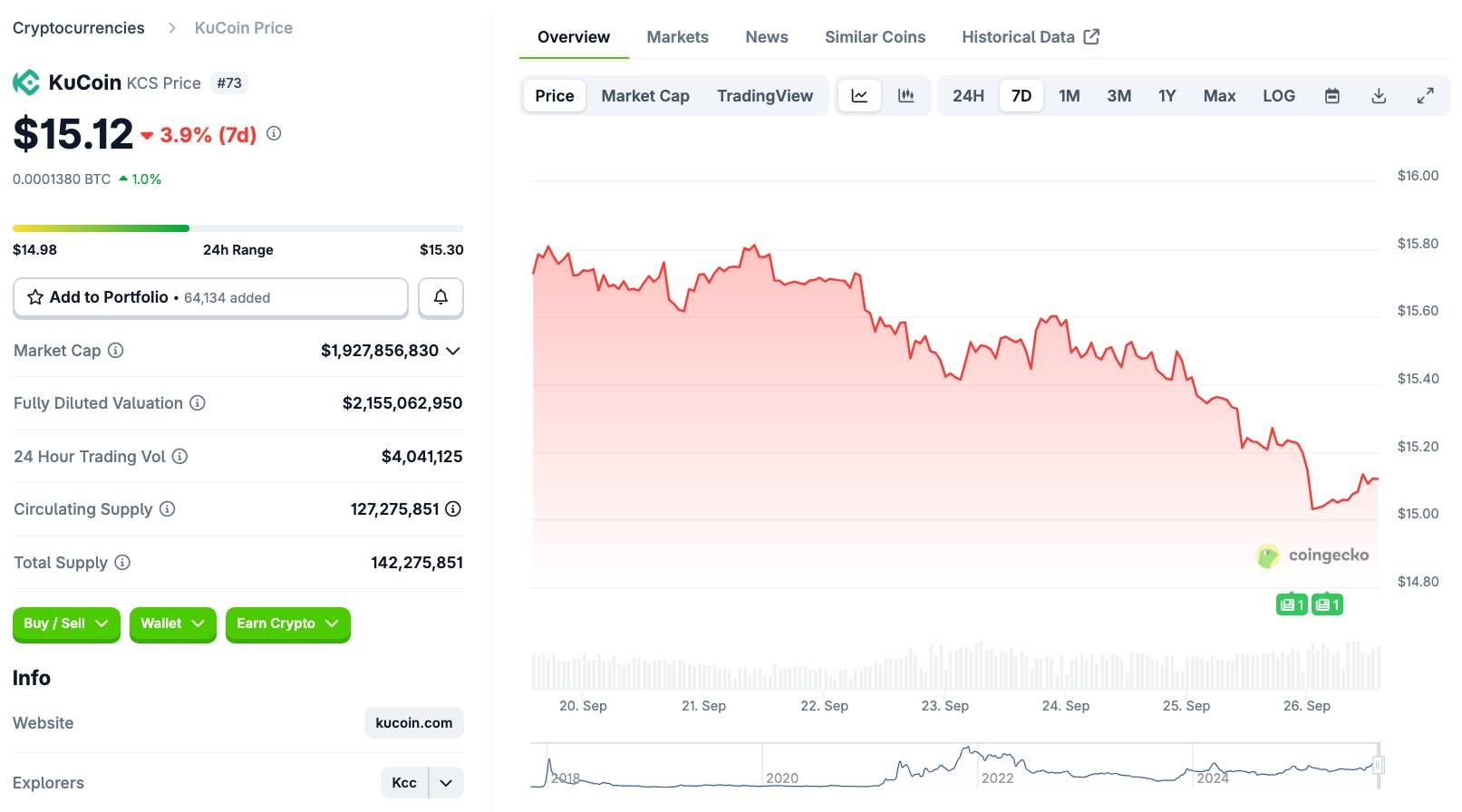

- Kucoin 's KCS price is down 4% for the week and is trading around $15.12. And it seems that tensions with the Canadian government have not had a negative impact on the price path yet.

KCS Token price movement in the last 7 days, CoinGecko screenshot at 01:25 PM on 09/26/2025

KCS Token price movement in the last 7 days, CoinGecko screenshot at 01:25 PM on 09/26/2025

Coin68 synthesis