As September draws to a close, Bitcoin prices are fluctuating around $109,000, with market sentiment quietly shifting towards anticipation for an “Uptober” rally.

This seasonal phenomenon is not unfounded. Historical data shows that October is often one of Bitcoin's strongest months of the year. However, this year's market environment is complex and intertwined. While September did not experience its traditional "curse," increased intra-month volatility, large-scale ETF fund outflows, and macroeconomic policy uncertainty have cast a shadow over the fourth quarter's performance. This article will deeply analyze Bitcoin's potential trajectory in the fourth quarter from four perspectives: historical patterns, current market dynamics, the interplay between bulls and bears, and future prospects.

1. “Uptober” in History: Data Support and Seasonal Logic

Since 2013, Bitcoin's performance in October has shown a significant regularity: it has closed higher 10 times in the past 12 years, with an average increase of 21.89%. Among them, the increases in bull markets such as 2013 (+60.79%), 2017 (+47.81%) and 2021 (+39.93%) were particularly prominent.

This phenomenon is dubbed "Uptober" by the market, and there are multiple logical reasons behind it.

First, the fourth quarter is usually a window for institutional funds to reallocate . Investors' risk appetite increases at the end of the year and they tend to increase their holdings in high-volatility assets.

Secondly, Bitcoin's halving cycle often resonates with October - for example, the bull markets in 2017 and 2021 both started in October, and the supply contraction effect after the 2024 halving may also be concentrated in the fourth quarter.

In addition, the macro liquidity environment tends to be loose in October : the Federal Reserve has turned dovish many times in September and October in recent years. For example, after the interest rate cut in September 2024, the market's expectations for further interest rate cuts in October rose to 91.9%, which provided fuel for risky assets.

However, history is not an absolute template. Octobers in 2014 and 2018 recorded declines of -12.95% and -3.83%, respectively, indicating that "Uptober" needs to work in tandem with the macroeconomic environment to be effective.

September 2025 ended with a slight increase of 1%. Although it did not trigger a deep decline, it did not accumulate enough momentum. This makes the trend in October more dependent on real-time fundamentals rather than simple seasonal patterns.

2. Current Market State: The Legacy of September's Volatility and Divergence in Funding

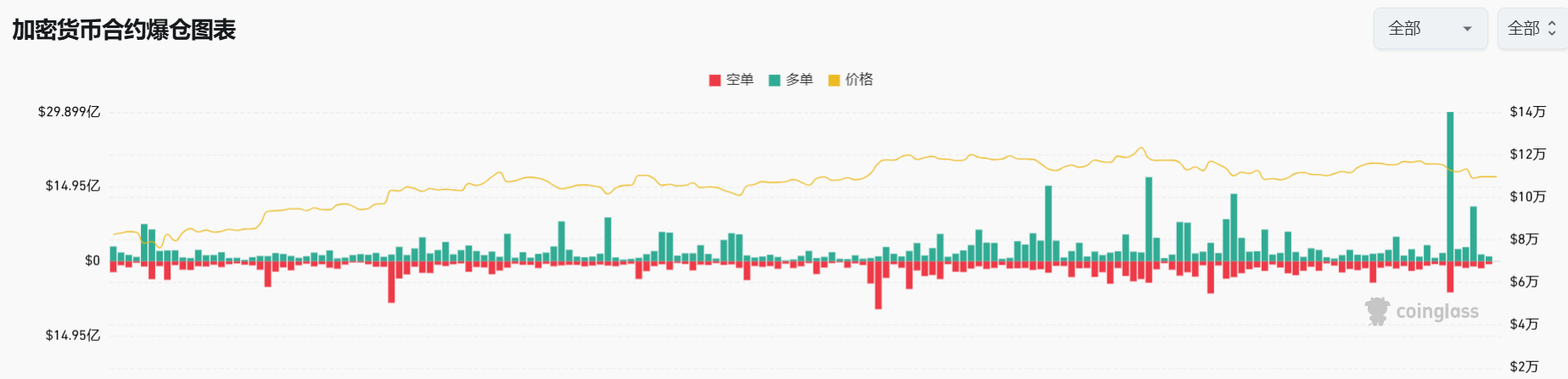

In the last two weeks of September, Bitcoin fell from $117,000 to around $108,000, a drop of nearly 8%. During this period, the total amount of liquidation across the entire network exceeded $3 billion, and long leverage was liquidated on a large scale.

This adjustment is considered a "healthy correction" by some analysts because it clears out excessive leverage and lays the foundation for a subsequent rebound. However, the signals from the capital market are contradictory:

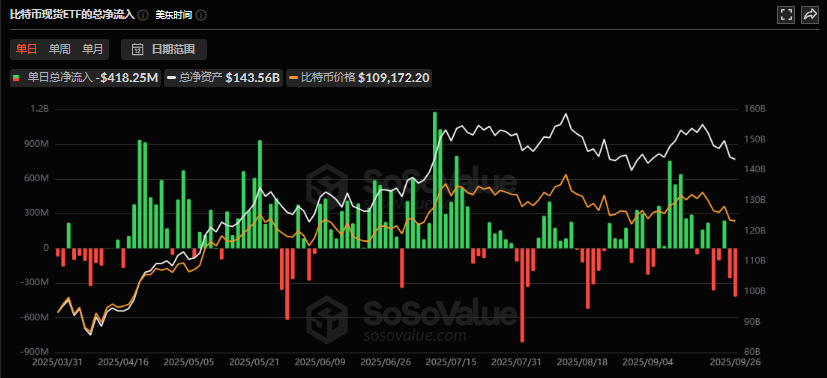

- ETF outflows intensified: Bitcoin spot ETFs experienced net outflows for several consecutive days, reaching $902.5 million in a single week. Both BlackRock IBIT and Fidelity FBTC experienced significant redemptions.

- The Ethereum ETF also struggled, with weekly outflows of nearly $800 million, its worst week since its launch. This temporary cooling of institutional demand reflects the market's cautious attitude toward highly valued assets.

- On-chain data shows resilience: Despite price pressure, long-term Bitcoin holders (HODLers) have not panicked. Net realized profit and loss (NRPL) remains positive, and buying activity around the key support level of $109,500 indicates that core investors remain confident in the long-term logic.

This divergence reveals the core contradiction in the market: short-term capital flows are constrained by macroeconomic uncertainties (such as differences in Federal Reserve policies and disturbances in the US election), while Bitcoin's scarcity narrative (institutional buying and halving supply contraction) remains a long-term support.

3. Drivers of the Fourth Quarter: A Game of Bulls and Bears

1. Bullish Catalysts

- Macro liquidity shift: If the Federal Reserve cuts interest rates as scheduled at the FOMC meeting on October 29, it will push the US dollar to weaken. Historical data shows that the negative correlation between Bitcoin and the US dollar index has reached -0.25 (a two-year low). During the interest rate cut cycle, funds are more likely to flow into the crypto market.

- Institutional Behavior Deepens: By August 2025, over 290 companies will hold $163 billion worth of Bitcoin, with corporate demand growing at approximately 4.3 times the rate of Bitcoin production. Furthermore, the Ethereum fork upgrade, scheduled for April 2026, could reignite market interest in smart contract platforms if the technical upgrade goes smoothly.

- Defending key technical levels: If Bitcoin holds the support level of $109,500 and breaks through the resistance level of $117,700, it may trigger a trend reversal. Technical analysts believe that the current trend is highly similar to the shock wash before the start of the bull market in 2017.

2. Risks and Suppression Factors

- Regulatory uncertainty: The U.S. SEC’s increased compliance scrutiny of crypto exchage and its investigation into the digital asset treasury (DAT) model may dampen institutional market entry.

- Market sentiment is fragile: The negative feedback loop of ETF fund outflows may amplify selling pressure, especially when prices fall below key support levels. Panic selling may lead to a test of the low of $98,000.

- Potential impact of black swan events: Recently, projects such as UXLINK and GriffinAI have been attacked by hackers, causing local panic. If the security incidents spread, it may undermine overall confidence.

Four. Future Path Deduction: Market Trends under Three Scenarios

Based on current variables, the fourth quarter could present three scenarios:

Optimistic Scenario (30% probability): The Federal Reserve sends a clear dovish signal, leading to Bitcoin's rapid recapture of $115,000 and a potential challenge to its all-time high. Institutional funds flowing back into ETFs, coupled with the growing "Uptober" sentiment, push prices towards the $165,000 target.

Neutral Scenario (50% probability): A tug-of-war between bullish and bearish factors sees Bitcoin fluctuate widely between $100,000 and $120,000. Volatility remains elevated, but a clear trend is lacking as the market awaits clear signals, such as the outcome of a US interest rate cut.

Cautious Scenario (20% probability): A systemic sell-off triggered by worsening macroeconomic data, geopolitical factors, or tightening regulations could push Bitcoin towards $100,000. A break below this level could lead to a test of $98,000 (52-week moving average), but long-term investors may accelerate accumulation in this area.

Conclusion: Striving for a Balance Between Seasonality and Real-Time Fundamentals

"Uptober" isn't some kind of calendar magic trick, but rather a combination of historical probability and market psychology. In the fourth quarter of 2025, Bitcoin faces both short-term pressure from institutional capital outflows and long-term support from interest rate cuts and a scarcity narrative. For investors, a rational understanding of seasonal patterns and a close monitoring of Federal Reserve policy and ETF fund flows are crucial for navigating volatility and seizing opportunities.