Source: Token Dispatch

By Prathik Desai

Compiled and compiled by: BitpushNews

Seven years ago, Apple pulled off a financial operation that dwarfed even its greatest products.

In April 2017, Apple opened its $5 billion Apple Park campus in Cupertino, California. A year later, in May 2018, it announced a $100 billion stock buyback program—a sum equivalent to 20 times the cost of its 360-acre headquarters, nicknamed "the spaceship." This move was Apple's undeniable declaration to the world: it had another "product" as important as, or perhaps even more important than, the iPhone.

It was the largest buyback program ever announced at the time and part of a decade-long spree in which Apple spent more than $725 billion buying back its own stock. Just six years later, in May 2024, the iPhone maker broke its own record by announcing a $110 billion buyback program. It showcased how to create scarcity not only in devices but also in the equity itself.

The crypto industry is employing a similar strategy, but on a larger scale and at a faster pace.

Two major revenue engines — perpetual futures exchange Hyperliquid and memecoin startup Pump.fun — are reinvesting nearly all of their fee income back into buying back their own tokens .

"True Repurchase"

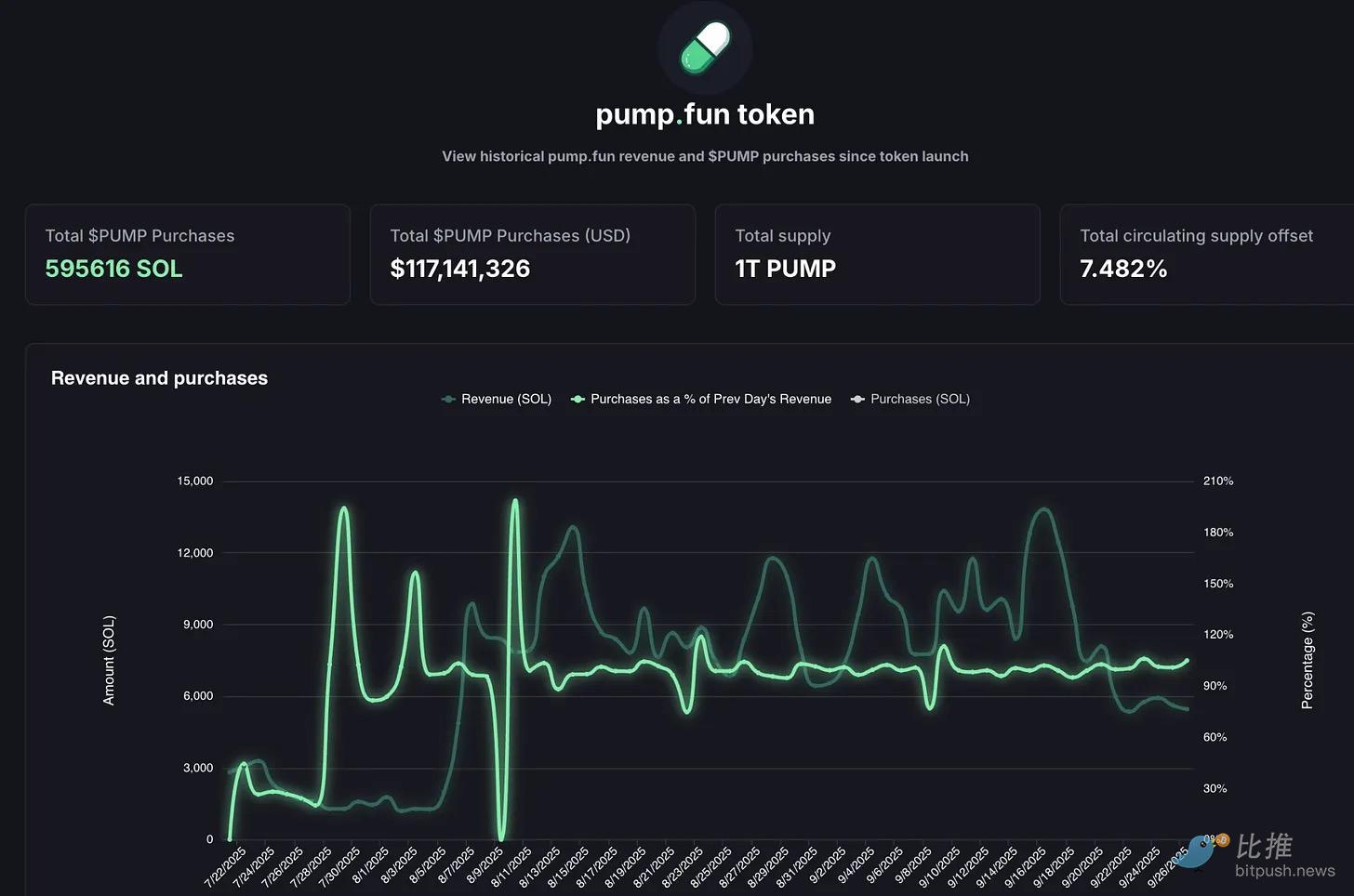

Of the record-breaking $10.6 million in transaction fees generated by Hyperliquid in August, over 90% was used to repurchase HYPE tokens on the open market. Meanwhile, on a single day in September, pump.fun briefly surpassed Hyperliquid in revenue with $3.38 million. Where did this massive revenue go? The platform consistently uses 100% of its revenue to repurchase PUMP tokens—in fact, this repurchase mechanism has been operating stably for over two months.

This behavior makes the tokens similar to shareholder certificates, which is unusual in the crypto industry, where tokens are often dumped on investors at the first opportunity.

The underlying rationale is to emulate the decades-long shareholder return strategies of Wall Street's " Dividend Aristocrats" (e.g., Apple, Procter & Gamble, and Coca-Cola). These companies consistently reward shareholders through stable cash dividends or share repurchases. Apple spent $104 billion on share repurchases in 2024, returning 3%-4% of its market capitalization to investors at the time. Hyperliquid's repurchases reached 9% of the circulating supply, far exceeding Apple's.

Even by stock market standards, these numbers are insane, and in the cryptocurrency world, they are unheard of.

Hyperliquid's model is actually very straightforward.

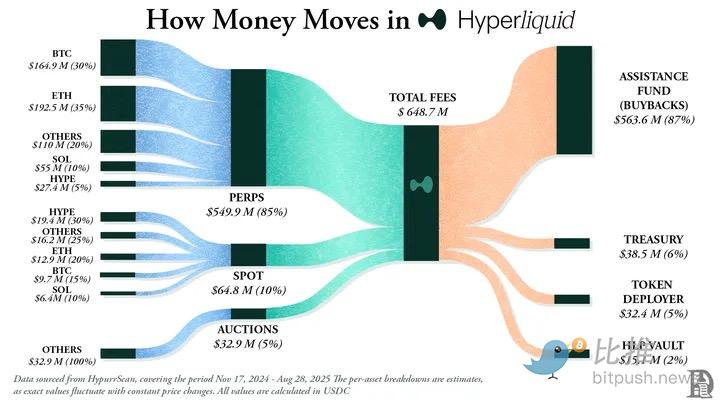

It has created a decentralized perpetual contract exchange, offering an experience comparable to centralized platforms like Binance, but built entirely on-chain. With zero gas fees, high leverage, and a Layer 1 specifically designed for perpetual contracts, by mid-2025, its monthly trading volume had exceeded $400 billion, capturing approximately 70% of the DeFi perpetual contract market.

But what really sets Hyperliquid apart is how it uses its capital.

More than 90% of the platform's daily transaction fees go into a so-called "assistance fund," which directly accesses the open market and continuously purchases HYPE tokens.

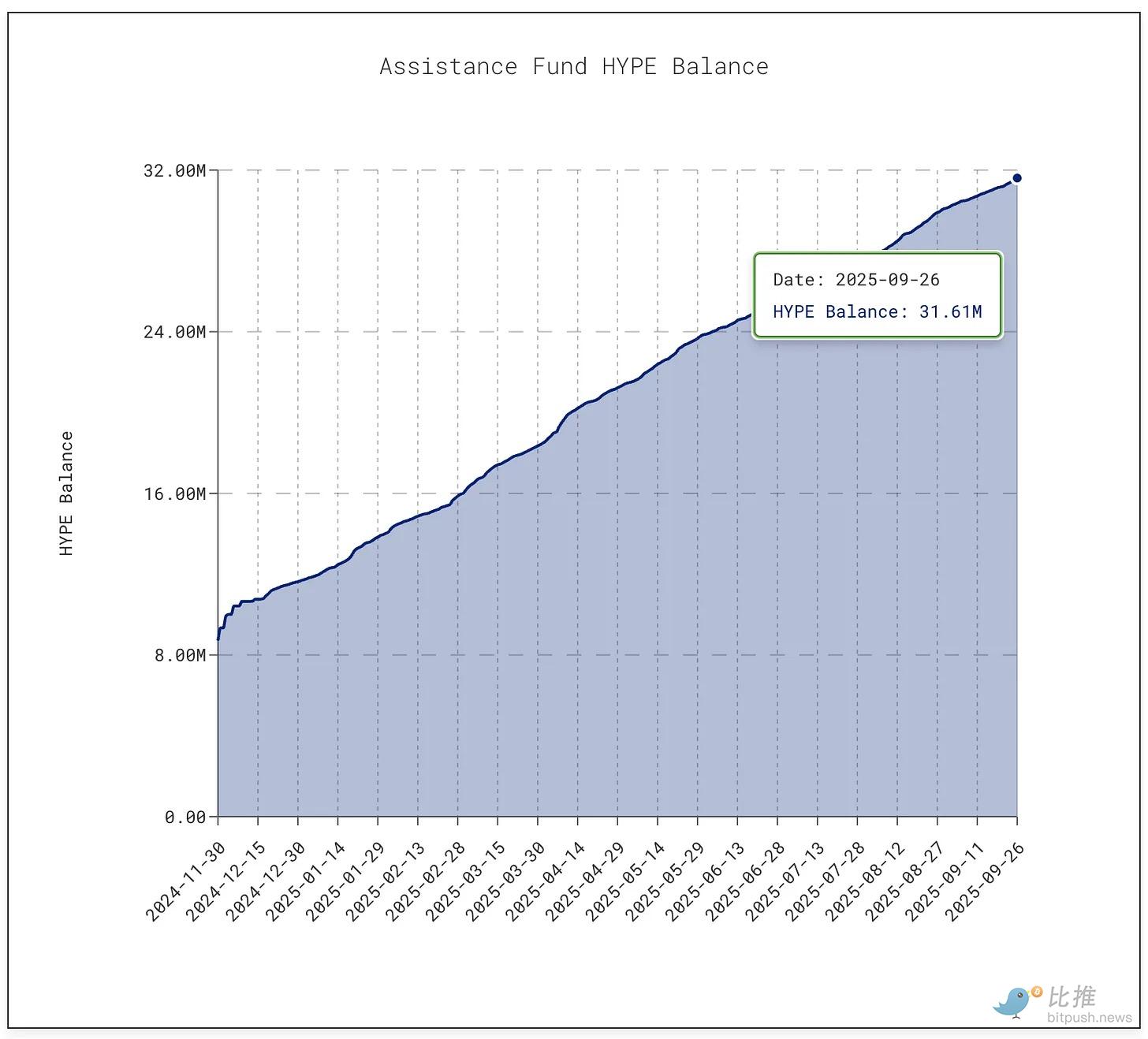

As of this writing, the fund has accumulated over 31.61 million HYPE tokens, valued at approximately $1.4 billion. This represents a tenfold increase from the 3 million tokens it held in January.

This buyback frenzy sucked out about 9% of the circulating supply, pushing the HYPE token price to a peak of $60 in mid-September.

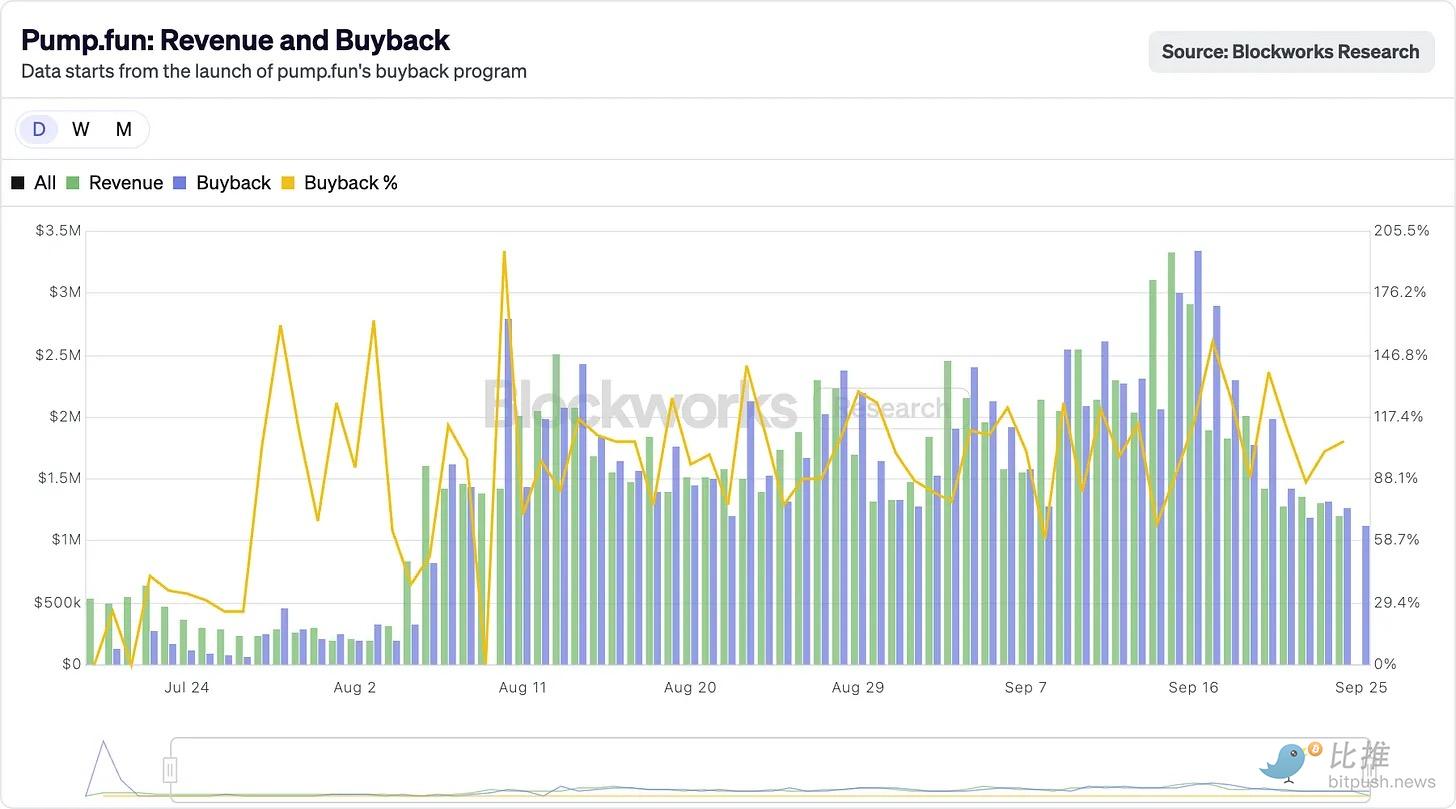

Meanwhile, Pump.fun reduced its supply by approximately 7.5% through buybacks.

The platform transformed the memecoin craze into a business model with extremely low fees. Anyone can launch a token, set up a bonding curve, and let the public participate. What started as a joke tool has now become a speculative asset factory.

But instability remains.

Pump.fun's revenue is cyclical, as it's tied to the flow of memecoin issuance. In July, revenue plummeted to $17.11 million, the lowest point since April 2024. Consequently, buybacks also declined. By August, monthly revenue had jumped back to over $41.05 million.

Yet, sustainability concerns linger. When the memecoin craze cools (as it has and will continue to do), so too will the token burns. On the horizon sits a $5.5 billion lawsuit claiming the entire project resembles unlicensed gambling.

Giving back to the community: dividends happening every day

What's driving both Hyperliquid and Pump.fun right now is their willingness to give back to the community.

Apple has returned nearly 90% of its profits to shareholders through buybacks and dividends in some years. But these are sporadic, centrally announced decisions. Hyperliquid and Pump.fun, on the other hand, are returning nearly 100% of their revenue to token holders on a daily basis, on an ongoing basis.

Of course, they're not identical. Dividends are cash in hand, taxable but reliable. Buybacks, on the other hand, are at best a form of price support, useless if revenue declines or unlocking overwhelms liquidity. Hyperliquid faces an imminent lock-up cliff. Pump.fun faces the possibility of meme users switching sides at any moment. Compared to Johnson & Johnson's 63 years of steady dividend increases or Apple's consistent buybacks, these are high-wire acts.

But maybe that’s okay.

Cryptocurrency is still maturing and has yet to find consistency. But it has, for now, found speed. Buybacks have the ingredients to drive that speed: they're flexible, tax-efficient, and deflationary. They fit in a market primarily motivated by speculation. So far, they've transformed two very different projects into top-tier revenue generators.

We have yet to determine whether this is sustainable in the long term, but it’s clear that this approach, for the first time in the cryptocurrency world, allows tokens to behave less like casino chips and more like company shares that return value at a rate that even Apple can’t match.

I see a larger lesson. Apple figured this out long before cryptocurrencies: It doesn't just sell iPhones; it sells its stock. Since 2012, it has spent nearly $1 trillion on buybacks—more than the GDP of most countries—and reduced its outstanding shares by more than 40%.

The company's market capitalization remains over $3.8 trillion, in part because Apple treats its equity as a product that must be marketed, polished, and manufactured to be scarce. It doesn't need to issue more shares to raise capital; its balance sheet is incredibly strong. This is where the stock becomes the product and shareholders become customers.

The same language is extending to the cryptocurrency space.

Both Hyperliquid and Pump.fun have successfully implemented this strategy by taking the cash generated by their businesses, not reinvesting it back into the business or hoarding it, but converting it back into purchasing pressure on their own equity.

This also changes the way investors think about the asset.

iPhone sales are important, but Apple bulls know the stock has another engine: scarcity. Traders are beginning to view these tokens in the same way for HYPE and PUMP. They see an asset with a promise: every spend or trade in the token has a greater than 95% chance of being repurchased and burned in the market.

Apple also shows the other side of the coin.

Buybacks are only as strong as the cash flow behind them. What happens when revenue declines? If iPhone and MacBook sales slow, Apple, with its balance sheet, can issue debt and fulfill its buyback arrangements. Hyperliquid and Pump.fun don't have that luxury. If trading volume dries up, buybacks will cease too. Unlike Apple, which can pivot to dividends, services, or new products, these agreements haven't yet found their Plan B.

In the cryptocurrency world, projects also face the risk of token dilution.

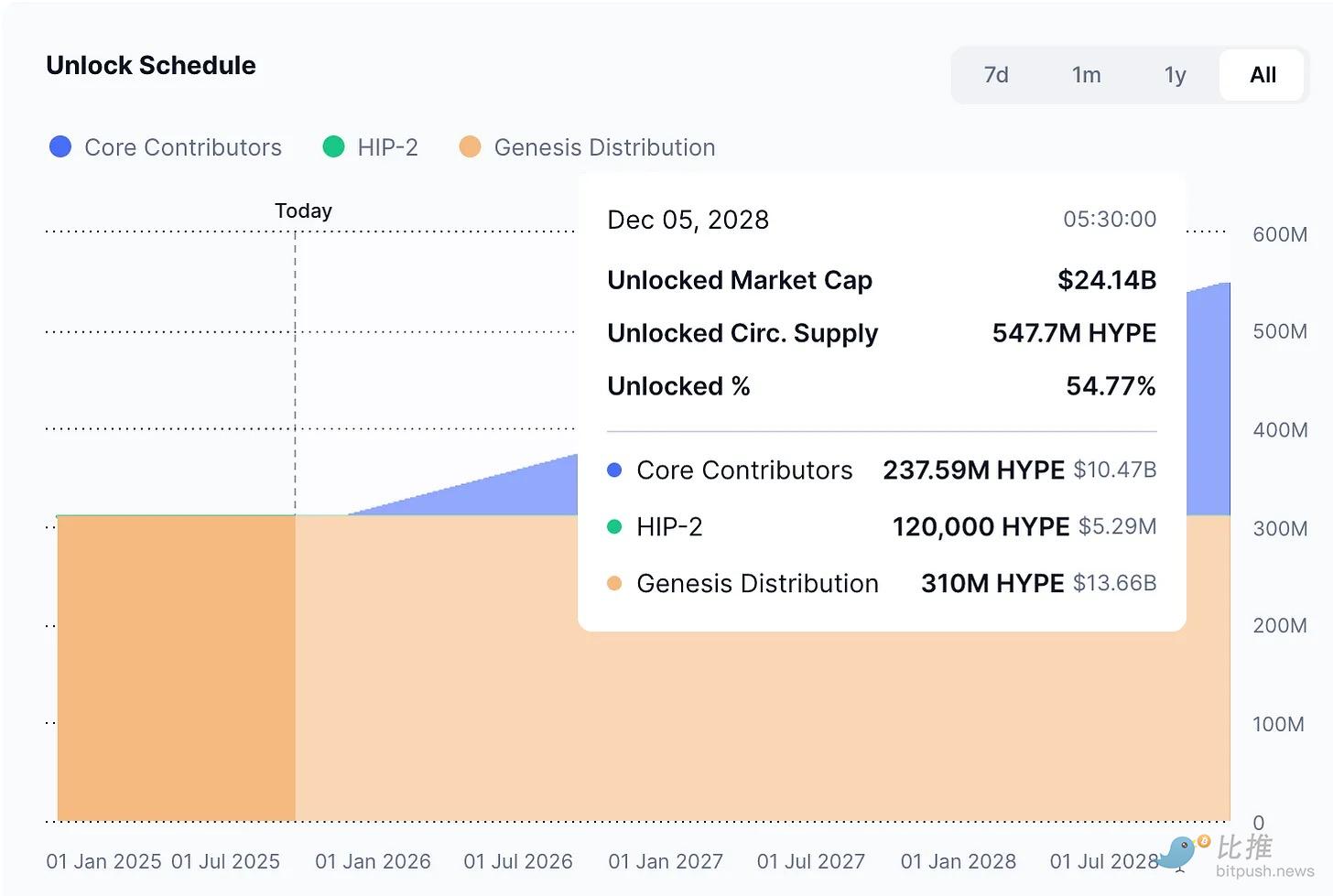

Apple doesn't have to worry about 200 million new shares suddenly flooding the market, but Hyperliquid has to face such a risk. Starting in November of this year, nearly $12 billion worth of HYPE tokens will begin to be unlocked to insiders, a scale that will dwarf the daily buyback volume.

Apple has precise control over the number of outstanding shares, while crypto protocols are struggling with token unlocking plans written down years ago.

Despite this, investors still see echoes of a legendary story and are eager to participate. Apple's operating logic is remarkably familiar, especially to those familiar with its decades-long history. Apple has successfully fostered shareholder loyalty by transforming equity into financial products. Now, Hyperliquid and pump.fun are attempting a similar path for the crypto world, albeit at a faster pace, with greater fanfare and greater risk.

Twitter: https://twitter.com/BitpushNewsCN

BitPush TG discussion group: https://t.me/BitPushCommunity

Bitpush TG subscription: https://t.me/bitpush