“The major advances in civilization are processes that all but wreck the societies in which they occur.” A.N. Whitehead

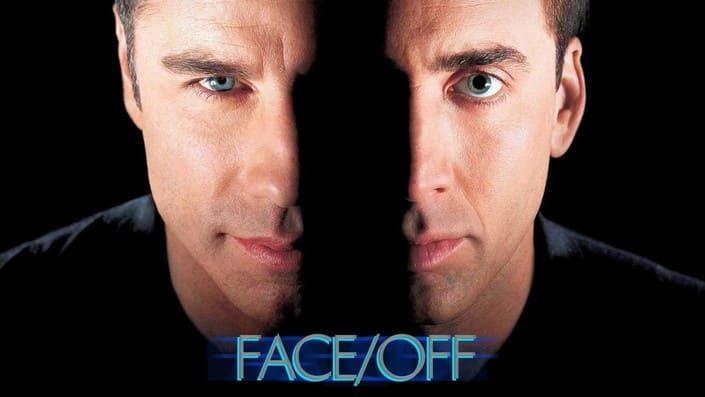

Face/Off is a 90s movie classic that tells a story of an FBI agent, Sean Archer, undergoing an experimental face-swapping procedure to impersonate notorious criminal Castor Troy to thwart a terrorist plot. However, when Castor awakens and assumes Archer’s identity, a high-stakes game of cat-and-mouse ensues, with each man trapped in the other’s body, navigating their rival’s life while racing to reclaim their own.

When Sean Archer and Castor Troy swap faces, and thus lives, they embody the existential dilemma of becoming the “other”. Archer grapples with the chaotic freedom of Troy’s villainy, while Troy revels in the structured facade of Archer’s domesticity.

This inversion suggests that identity is performative, shaped by environment and choice rather than innate essence, blurring the lines between good and evil as each man confronts the shadow self within, ultimately implying that vengeance and redemption are two sides of the same coin.

The swapped faces represent deceptive shadows masking deeper truths; the characters’ journeys force a reckoning with authenticity versus appearance, highlighting how societal roles, personal traumas and ambitions imprison the soul.

All roles, imposed through norms, are a prison which tames the human will. However, they provide stability for society to function. It is always a matter of time until the will breaks free, ushering in chaos, only to rebuild stability anew.

A Vessel: Crypto Identity Crisis

I have come to believe that technology is the substrate on which society plays out. The technology creates a mostly invisible environment, a network, that is like a theatre with its own physical and other, more abstract rules.

When I first engaged with crypto, it was by reading the Ethereum whitepaper in 2016. To me, this was a fundamental change in how human society can govern itself. Then I read Nick Szabo’s thoughts on Social Scalability, reflecting my own scattered thoughts comprehensively.

In today’s discourse, blockchains are reduced to a database solution and trust minimization is considered an ideology. Everybody follows the money, but money, in this case, leads to a dead end. Slowly, we are eroding trust minimization requirements, first for performance, then for a use case, to finally pander to whatever makes the governments and corporations buy more.

If crypto were a character in a movie, it would be a story of a techno-anarchist drug dealer who, through a cocaine-fueled career of being a Wall St. trader turned tech founder, became a JP Morgan board member summering in the Hamptons.

Two main memes sum up the current mood in crypto. One is “believe in something” which essentially reflects crypto’s inability to have a deterministic outlook on what it wants to achieve. “Something” should be understood as “nothing”. Price is all that matters.

The second meme is “pragmatism above all”. Centralized chains, single sequencers, performance optimization, censorship compliance and so on. Pragmatism slowly chips away at what is the actual unique selling point of crypto - trust minimization, enabling social scalability. In other words, the reduction for the trusted third party.

It truly seems that the revolution devours its children. The early revolutionaries became too wealthy to care, and today are reminiscent of the bankers they once revolted against. 2021 was about the future of France on alternative financial rail, 2025 is about wrapping trust minimization machines into trust maximization vehicles and finding a willing buyer for hot air.

Indeed, it is all a game of tradeoffs. One cannot be a decentralization maximalist because that is impractical and almost impossible to commercialize. When the pendulum swings too much towards centralization one should realize the whole point is gone and we’re selling financialized nothing. In other words, financialization of financialization. Yield for the sake of yield.

This frames crypto as a vessel that is to be bought or sold, a means of hyperfinancialization. But crypto is not merely a vessel and is largely misunderstood that way. Crypto is an environment.

Going back to the first paragraph of this section, the substrate on which society plays out has been altered, and there’s no way back.

An Environment: The Electric Drama

Crypto will inevitably swallow everything that we perceive enables it to exist today. It is not a vessel - “a stock, but onchain”. It is totally and absolutely a whole new environment. An extension and transformation of markets, the invisible environment in which we participate. I’ll be relying on McLuhan to get this point across:

“The interplay between the old and the new environments creates many problems and confusions. The main obstacle to a clear understanding of the effects of the new media is our deeply embedded habit of regarding all phenomena from a fixed point of view.”

McLuhan saw already in the 1960s that print technology created the public, and the electric technology created the mass. He knew that the invisible environments were changing and so would society, but noted that the official culture was striving to force the new media to do the work of the old.

We cannot expect that individuals and authorities whose survival is tied to the old processes comfortably chugging along can either see the substance of the new environment or understand its nature.

“The poet, the artist, the sleuth-whoever sharpens our perception tends to be antisocial; rarely “well-adjusted,” he cannot go along with currents and trends. A strange bond often exists among antisocial types in their power to see environments as they really are.

This need to interface, to confront environments with a certain antisocial power, is manifest in the famous story, “The Emperor’s New Clothes.” “Well-adjusted” courtiers, having vested interests, saw the emperor as beautifully appointed. The “antisocial” brat, unaccustomed to the old environment, clearly saw that the Emperor “ain’t got nothin’ on.” The new environment was clearly visible to him.”

Hence, crypto finds itself in a conscious futile attempt to fit in, while unconsciously it has enabled a new world into which people, slowly but surely, opt in. While the industry rushes to fund the conformity machines, a minority of users silently dissents, living by the rules of new media.

“Youth instinctively understands the present environment – the electric drama. It lives mythically and in depth. This is the reason for the great alienation between generations. Wars, revolutions, civil uprisings are interfaces within the new environments created by electronic informational media.”

The genuine adoption of crypto does not come from optimization. It stems from the desire to participate. Anybody could become a banker, and we can argue about the line that separates a bank and rug, a banker and a dev that rugged.

The internet arena and crypto even more so, switch the educational process from package to discovery. Instructions are no longer relevant; the manual has expired. McLuhan alluded that people reject goals and want roles. They crave involvement. If that was already true in the 1960s it is even more so today.

“Our technology forces us to live mythically, but we continue to think fragmentarily, and on single, separate planes. Myth means putting on the audience, putting on one’s environment…”

Face/On

In the spirit of Face/Off, crypto faces its own identity crisis. The true trust-minimized environment of enhanced social scalability is being challenged by a pervasive pragmatism or price action that reduces it to a mere financial vessel.

Just as Sean Archer and Castor Troy were forced to inhabit each other’s worlds, crypto’s pioneers are now grappling with the very systems they sought to disrupt, often adopting the centralized and trust-maximizing tendencies that take away their true substance and USP.

This tension between crypto as an environment and crypto as a vessel mirrors the core themes of the movie: authenticity versus appearance, and the blurring lines between revolution and assimilation. This is the “deceptive shadow” that masks crypto’s deeper truth, much like the swapped faces in Face/Off concealed the true identities beneath.

However, the “electric drama” of crypto, as McLuhan might describe it, continues to unfold beyond the attempts to force it into old paradigms. While official culture, including much of the crypto industry itself, strives to make the new media perform the work of the old, a minority of users unconsciously and silently dissents, opting into a new world built on different rules.

These are the “antisocial brats” who, unaccustomed to the old environment, might have an inkling that the emperor ain’t got nothin’ on. They represent the participation and involvement that drive crypto’s true adoption, rejecting mere optimization in favor of a new mythical engagement with the internet universe that is at people’s disposal.

Ultimately, the choice for crypto, much like the choice for Archer and Troy, is about reckoning with authenticity and embracing its transformative power. It is about understanding that crypto is not just a “stock onchain” or a database solution, but a fundamental alteration of the societal substrate.

A new environment of existing, thinking, creating, and engaging.

Thanks to Lachlan and longsolitude for their feedback.

Thanks for reading Wrong A Lot!