There’s been a lot of chatter recently about the AI bubble we’re in. I’d say it’s consensus that we’re in a bubble, which probably means we’re not. As someone who has lived through 2-3 crypto cycles there’s one key characteristic about true bubbles: the supply outstrips demand by a large margin eventually.

My core belief is that we are at the verge of the transformation of machines doing magnitudes more work than humans. This will be a structural change in how the world will look in the next decade as a result. Demand is far greater than what anyone can predict accurately.

Internally at RouteMesh (more on this soon!), we’ve gone from 7 people to 2. The results: our shipping speed has increased, burn decreased, ability to move on ideas increased. This has uniquely been enabled by AI. Two skilled operators can outperform a team of 10 or 20 massively.

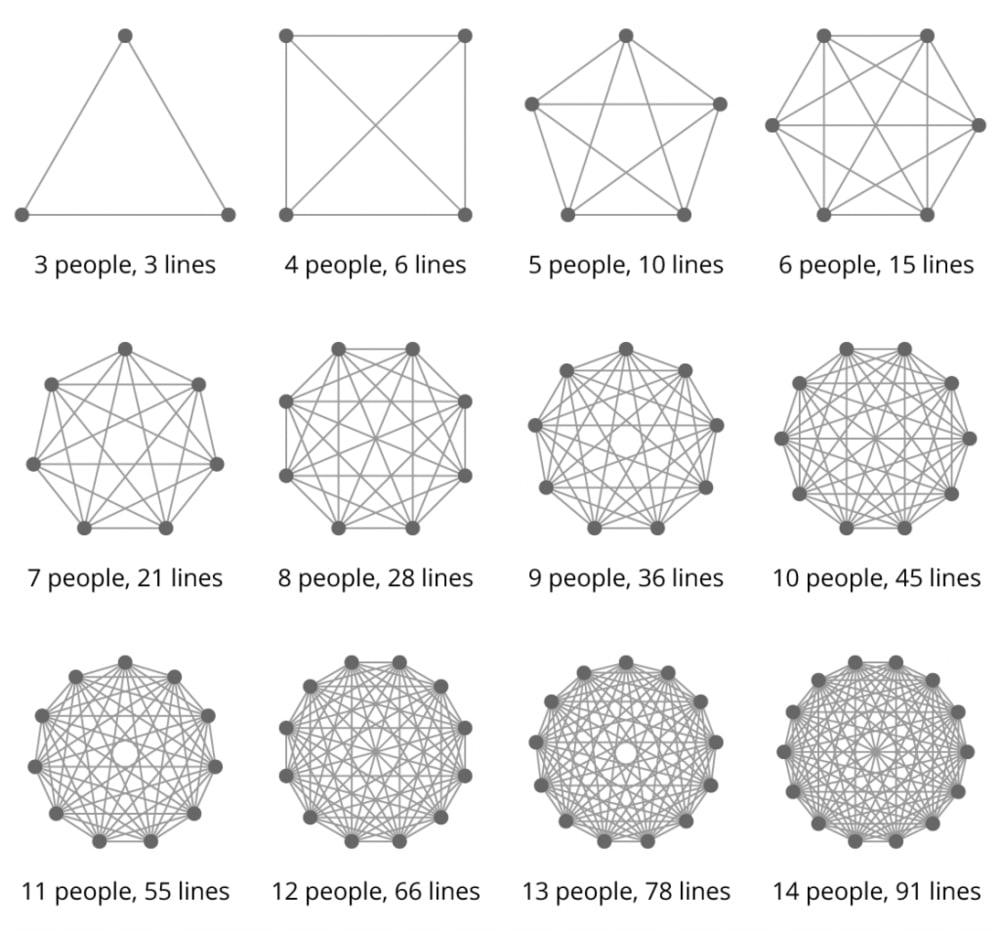

Hiring people has an extraordinarily high cost (outside of time) and is non-linear in output relative to cost. Doubling head count does not lead to a double in output. However with agents you can scale the labour a person or team can do by at least one magnitude — today. Future models will increase this even more. These are not hypothetical numbers, these are the realities that me and other founders are experiencing firsthand.

These are unprecedented economics in terms of scaling economic output without an increase in human labour. Revenue per team member is the gold standard for how efficient your organisation is and we’re starting to see some unprecedented numbers. Five million dollars per person is normal reality for the top decile of companies. Crypto companies can take this to a whole new level.

Economic output has been tied closely to employment since the industrial revolution. Hiring people has been a necessity in order to scale output.

However, this link is now altered significantly. The co-efficient of output per person can be scaled up massively with machine resources. Our entire economy is around the coordination of resources between capital, labour and resources. Machines take this coordination to a new level. My thesis boils down to the following:

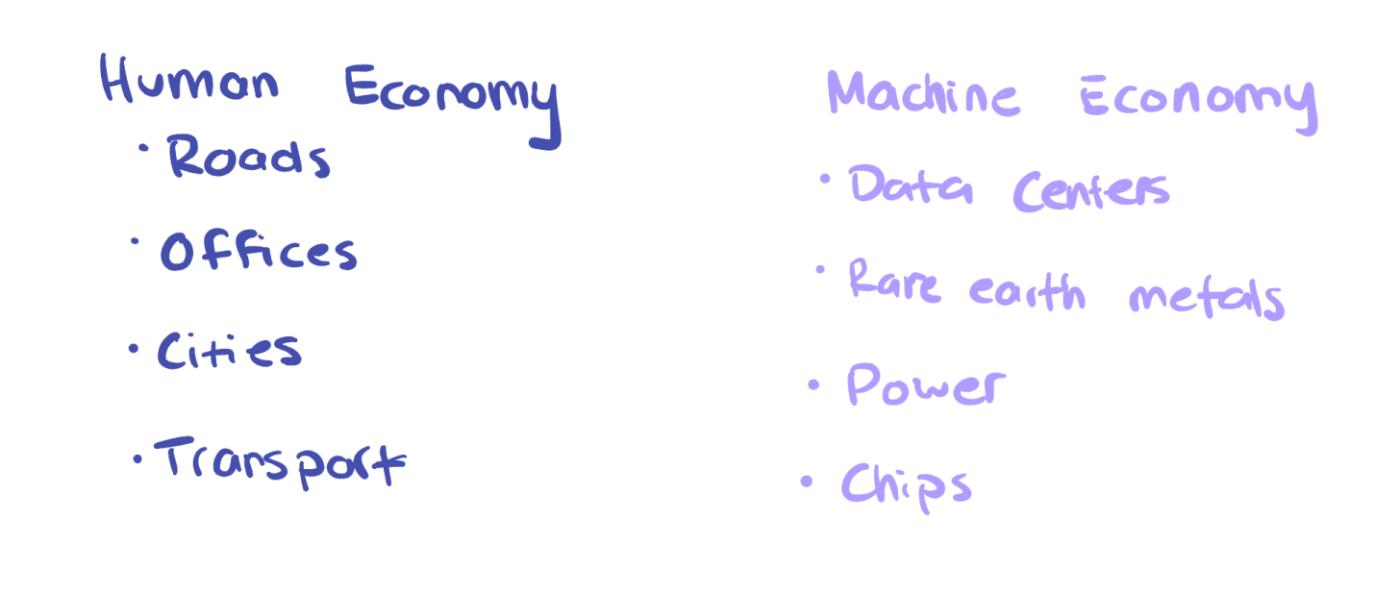

The future of work will be centred around a machine-first economy and anything that assists the machines has a large inflow of demand due to the always on, constant value adding property they have.

In the machine-first economy of work, the following things will be needed: data centres, energy, GPUs, CPUs, memory, renewable infrastructure, batteries, security, power storage, rare metals, transmission, real estate etc.

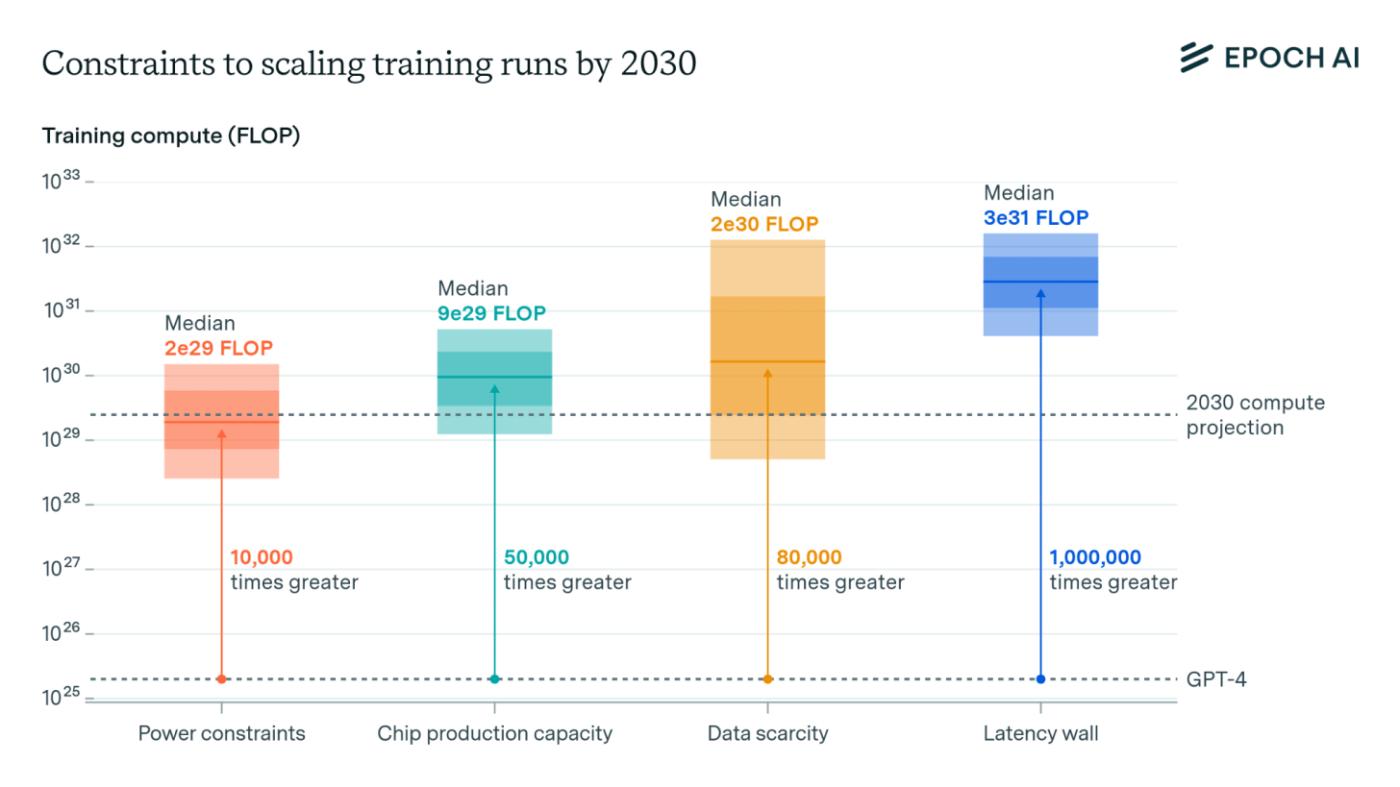

Our future of scaling economic output is our ability to scale the various sub-industries in the machine economy. As of 2025, the largest constraint is power, however I predict this will continue to evolve and change as the machine economy evolves.

Past Calls

One cool thing about this blog is for me to be able to track the calls I’ve made over the years and to see how they’ve panned out! A few that I found interesting to visit looking back on:

Ethereum will be the dominant smart contract platform: Feb 2020. Price: Sub $200.

The future is inevitably multi-chain: Feb 2021.

Most public market tokens don’t work: Nov 2022.

The AI x Crypto overlap will be thing: Aug 2023.

I wanted to write this piece as a way to articulate what I believe is that we’re at the start of a new paradigm for how the future of work will look like with AI and with it lie abundant investment opportunities.

Something that crypto has taught me has just because you know something, doesn’t mean the market prices it in the same. In fact, it takes months or years for the market to catch up. Information and context have a delay.

Investing in the AI Stack

Okay so you have to break this down, when people think AI: what do they think of? GPUs. Specifically, NVIDIA. Almost everyone owns NVIDIA now. I think they’ll be the first $10T company but that’s not what high alpha looks like. We’re here to reason about second and third order effects.

So the next question becomes, well what else can we invest in? So NVIDIA doesn’t make chips, they simply design them and have infrastructure around it. So who makes the chips? A company called Taiwan Semiconductor Manufacturing Company (TSMC).

But guess what, TSMC needs machines to make very precise circuits so they have to buy machines from a company called ASML. Each machine costs $200m and ASML is the only company in the world that can produce these very specialised machines. They also only have 5 or so customers, albeit the largest companies in the world. Without ASML the entire AI supply chain is disrupted.

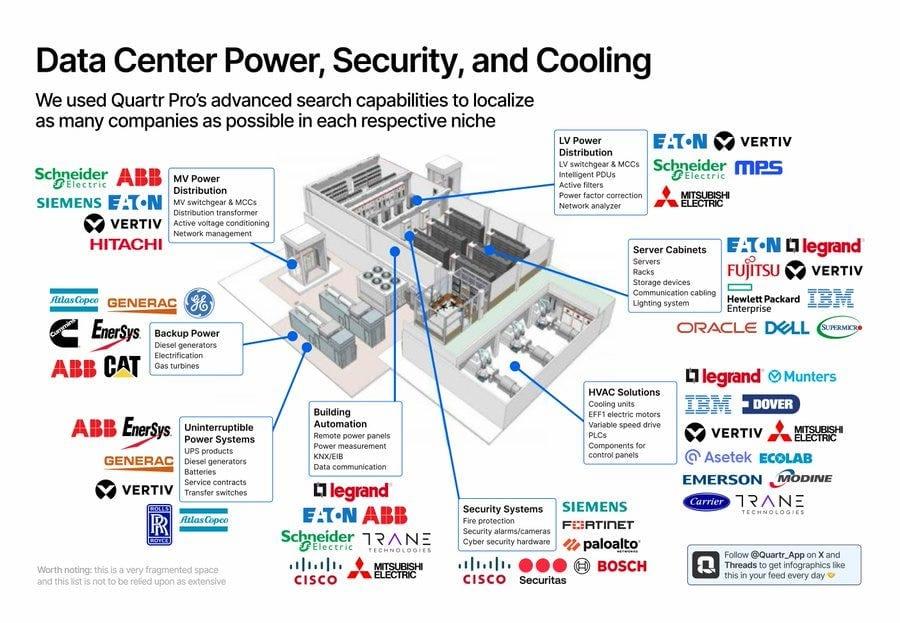

Okay so great, you have your chips but how do you put them to work? Well you need them in some sort of data center. To power this data center you need energy. Either you get this from the grid, or you can get it from off-grid solutions. Both have their place but if you’ve been following social media, US citizens are getting increasingly vocal with DC build outs as the increased electricity is socialised.

Bloom Energy produces Solid Oxide Fuel Cells that can use electricity to convert hydrogen into power to spin up data centers in less than 90 days. But SOFC (Solid Oxide Fuel Cells) require a special metal called Scandium that is available in China, Canada and Australia. There’s a company called Scandium International Mining on the Canadian stock exchange that specialises in Scandium. They’re up 445% YTD.

So once you have your Scandium for your SOFC cells to power your DCs with NVIDIA GPUs you need good cooling infrastructure. In comes Vertiv: they’re market leaders in liquid cooling infrastructure for GPUs. This means DCs need less water to cool their chips. But of course, all of this needs to be wired up together so you need companies that specialise in DC cabling infrastructure: in comes Flextronics. DC build out infra is their speciality.

I could go on and on about this but as you can see, there is an entire supply chain of companies that will power the upcoming Machine Economy revolution. Investing in it requires intellectual rigour that can prove to be valuable. Most of the tickers mentioned above are up at least 100% YTD and some up 500% - 1000%. Now this makes the rational investor ask the following question?

Are we in a bubble?

No.

If there’s one thing I’ve learned about the past 5-10 years, you can’t just blindly pattern match and blindly say things are the same. When the COVID 2020 crash happened, people who were astute in monetary theory knew that the flood of stimulus would actually result in the greatest bull run the world has seen. It was 2021 where a high interest rate regime caused things to “crash”… only to be back to ATHs in 2024. Crypto cycles are meant to make all time highs every 4 years until they don’t. Nothing is guaranteed, you have to evaluate each situation on its own merits.

We’re at cross-roads right now where Wall St thinks we’re in a bubble and all this data center financing is over extended and over provisioned. Their favourite analogy is that the telecom companies invested in all this infrastructure in the year 2000 and then it took 10-20 years before it was properly utilised. What I hate about this is that this is reasoning through analogy, not reasoning through first principles.

AI is a completely different beast for a few key reasons that I want to lay out below.

A bubble here is defined by the provisioning of all this DC build out. For it to “pop”, it means the demand has to dry up and no one is using/paying for this stuff. However, my question is at what point in the future do we wake up and say:

“You know what, all this AI usage is great for my business, I think I’ll use less of it”

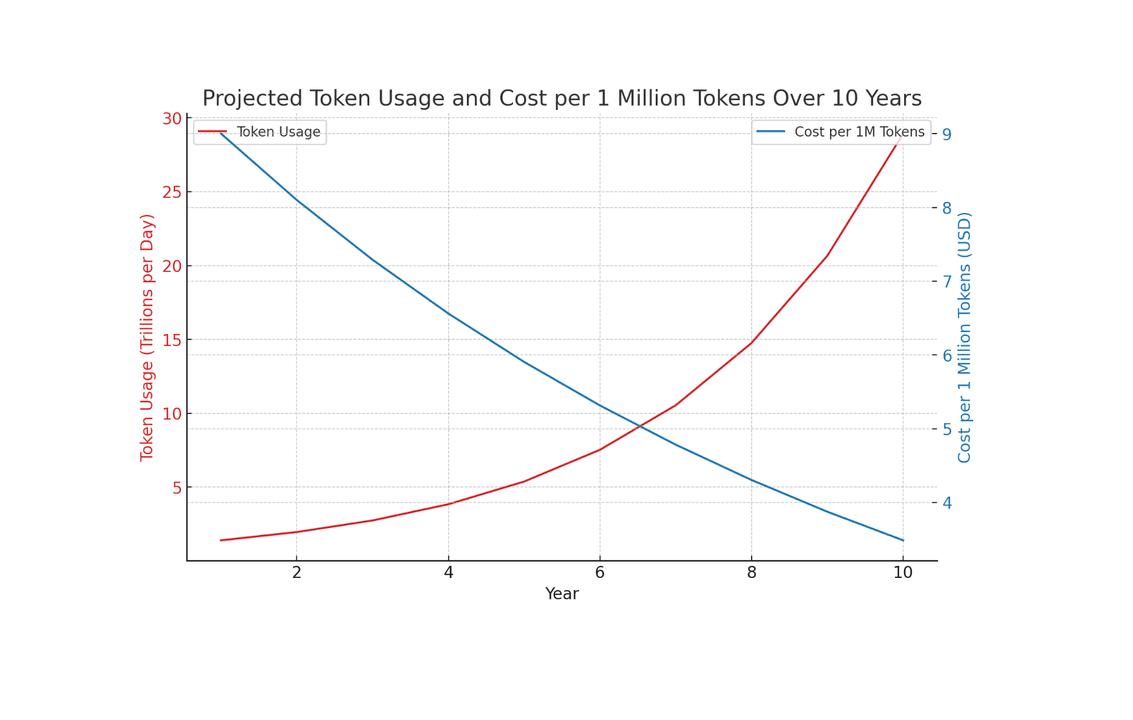

That’s nonsensical. Consumers are becoming increasingly more demanding of the compute workflows they want done. Context windows grow larger and scale quadratically, agents spend more time running every year.

For more on my thinking around this, check out this piece:

Even internally, if tomorrow AI prices were to go down because of the over supply. I will pay more money for these machines because we will happily spend money on compute rather than human resources. I already pay hundreds of dollars, if not thousands, for AI software and will pay more if I can.

My capacity to pay is directly proportional to the value, and I have to say the value is insanely good. I ranked #30 on the Claude Code usage dashboard consuming a few billion tokens in the span of 30 days. Give me as much compute as you possibly can. Every 3 months, my trust in AI increases, the amount of parallel spawned agents increases and my expectations of what these things can do increases. In no world do I wake up tomorrow and say “nah, I’ll go back to what I had before”. Long machine labour.

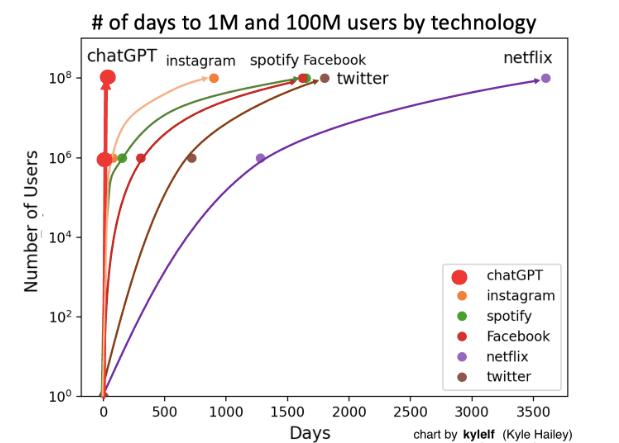

Adding to the point above, ChatGPT has about 800m weekly active users as of 2025. There are 8 billion humans on earth. My mum uses ChatGPT massively too. Do you think we all wake up and say “yeah AI is kinda dumb, I refuse to use it?”. Not at all. If you do you probably have not experienced true productivity gains from AI yourself. Every ChatGPT user is now using reasoning models under the hood, tool usage etc. The demand is very real.

Here’s my next point and one that I think many overlook. There is maybe $20-$50b of spend for AI in terms of revenue and people say how will that grow to $1T of spend.

That’s a limited viewpoint of how to perceive this infrastructure spend. GPUs are accelerated computing platforms. We are going through a seismic shift where there is $1T of existing compute TODAY that is migrating to GPU based workloads. Large matrix multiplication is at the bedrock of most of what we do. Recommendation engines on social media platforms are all GPU dependent and require DCs. Generative AI is one of many use cases for all the CapEx going on right now. Outside of migrating existing workloads and generative AI, there is:

Robotics

Self-driving cars

Drones

Biocomputing

Quantum

Proof of work mining

If you’re short data centers and power, you’re basically short on all of these industries in aggregate. Our demand for intelligence is embedded into every part of our future economy and the demand for compute that comes as a result of being massively behind.

Another very interesting point in all of this is the fact China has already made huge investments into these things 5 years ago. We’re simply playing catch up. The future is whoever can secure the most amount of Gigawatts for their compute needs. If you think we’re over building DCs and energy, then you also must believe that China is wrong too.

So what’s the play?

To buy. While the majority think energy, data centers and GPUs are an overplayed trade that is expensive I argue the opposite: this is the cheapest they will ever be. We are in a huge compute shortage and everything is about to be re-priced in The Machine Economy stack.

The Machine Economy stack is different to the human economy stack due to the geopolitical forces, unit economics, hard physical limits and software stack that it utilises throughout all of it.

While I am still building in crypto 100%, I am actively investing in the machine economy as I view it as being a larger subset of the crypto economy. If this article gets enough traction I’ll write more extensively how I have positioned picks I’ve made for the machine economy and the critical importance they have. There’s a lot of incredibly exciting names, and they’re all public market investable to you and I today. Opportunity is knocking at your door if you know where to look.

Long machine labour, short human labour.

Short machine creativity, long human creativity and ingenuity.