When a joke is worth more than $500 million, it's no longer a joke.

On the evening of October 4th, Binance co-founder He Yi reply on X (X)—"Wishing you a Binance life"—was like a spark thrown into a haystack, instantly igniting a firestorm that engulfed the Chinese crypto world. Within 96 hours, a meme coin coined from this meme skyrocketed from zero to over $500 million in market capitalization. This wasn't an isolated get-rich-quick scheme; rather, it was a textbook narrative blitz orchestrated by market sentiment, high-level interaction, and community power. It accurately exposed the core contradiction of the current market: while the institutionally-driven "value coin" narrative is exhausting, a grassroots cultural force is reshaping the rules of the game in an almost brutal manner.

In recent months, those "king-tier" projects, boasting star-studded halos and valuations exceeding tens of billions, have become relentless "retail investor harvesters" upon launch. Their "high FDV (fully diluted value) and low liquidity" model means ordinary investors are burdened from the outset with heavy selling pressure, which will continue to unlock value over the next few years. The community has exhausted patience and confidence amidst the endless decline, and complaints are widespread. As veteran KOL Jason Chen (@jason_chen998) put it, "From the rush to high-cap VC coins to the continuous selling and decline, retail investors are furious..." This accumulated sentiment has created the perfect breeding ground for a market reversal. When the mainstream narrative dies, exchanges need new excitement to stimulate trading volume, while retail investors desperately need a VC-free, fair-stakes asset class to realize their dreams of wealth. Meme, the purest consensus game, has become the unanimous choice for both parties.

He He Yi's reply was the perfect moment that ignited everything. It wasn't a whimsical concept, but rather a precise capture and amplification of the pre-existing crypto dream within the Chinese-speaking community—a collective desire to navigate both bull and bear markets and achieve social mobility. Keen developers and influencers grasped the message, completing the entire process from contract deployment to community building in a matter of minutes. The community's power, from the bottom up, completed the initial cold start.

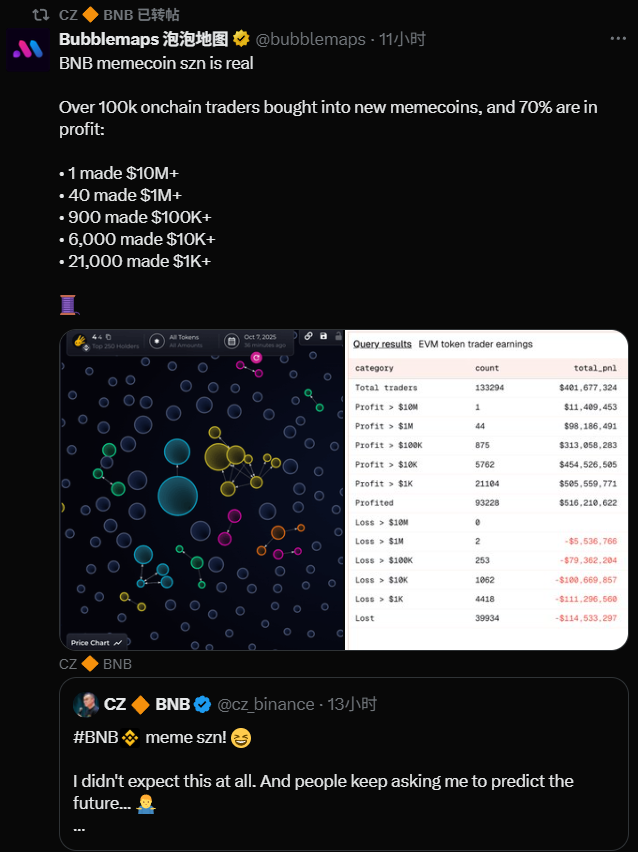

CZ (CZ) personally added the most crucial fuel to the fire. He retweeted a post from the on-chain data platform Bubblemaps and commented, "#BNB meme szn! 😅 I didn't see that coming at all." This seemingly unexpected comment was actually an imperial coronation, sending a clear signal: the authorities not only saw it, but also welcomed it.

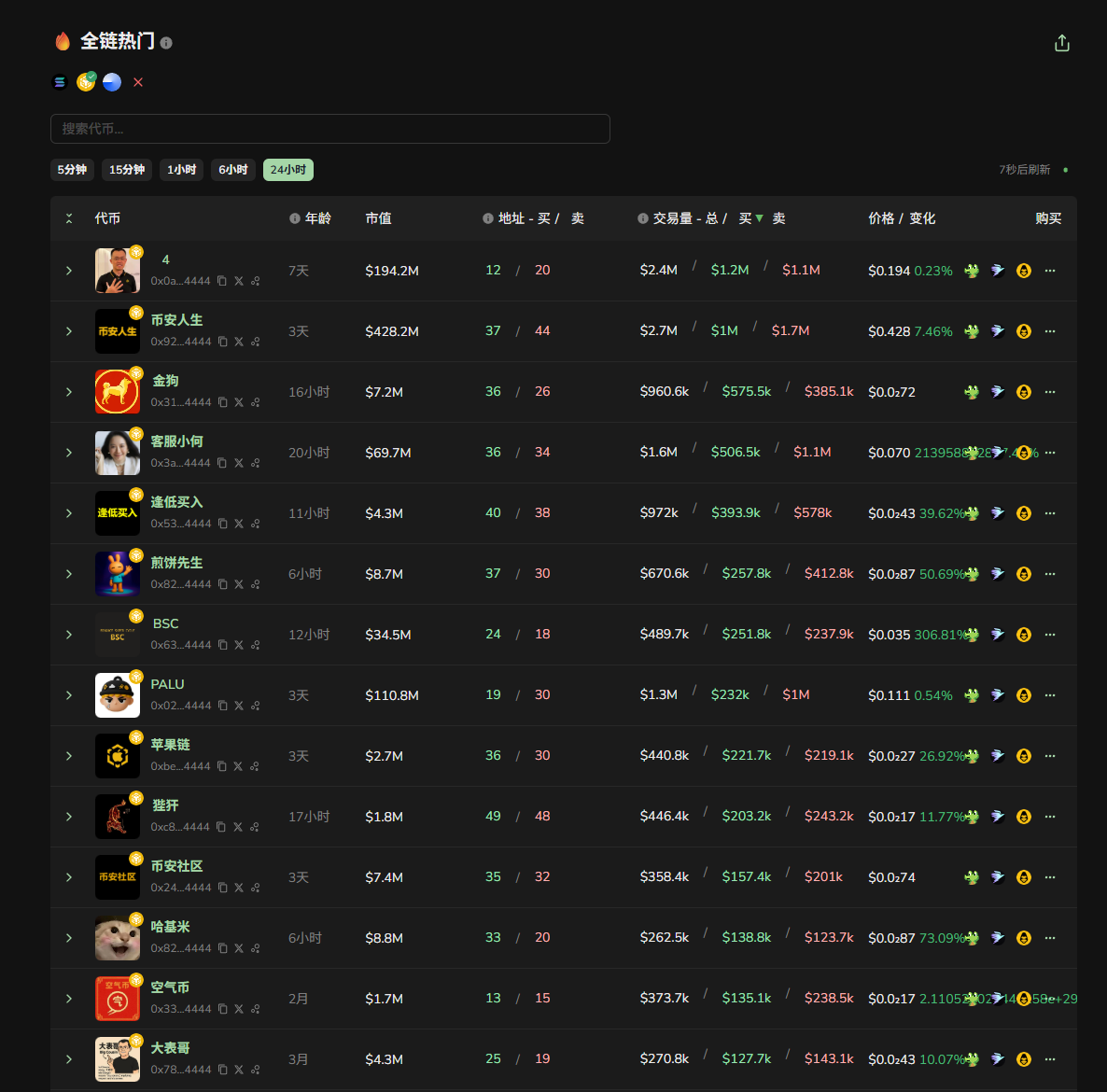

The wealth creation effect of this carnival is astonishing and far from isolated. Bubblemaps data clearly paints a picture of collective wealth creation: over 100,000 on-chain traders participated, 70% of whom achieved profitability, creating over 40 millionaires and nearly 1,000 $100,000 millionaires. This was no longer a gamble for a few, but a collective feast where tens of thousands of people "recovered their losses." This powerful wealth creation effect directly translated into real liquidity. According to deBridge data, over the past week, BNB Chain has been like a "star-sucking" operation, frantically pumping funds from major public chains like Ethereum Mainnet, Solana, Arbitrum, and Base, resulting in a spectacular net inflow of funds. Simultaneously, Coinglass data shows that BNB contract open interest across the entire network has reached a record high of $3.088 billion. The meme craze has ultimately perfectly fed back into the value of BNB itself.

This explosive energy struck many veterans as familiar. Indeed, the frenzy was remarkably similar to the "BNB Season" of March, but the tactics had evolved. Back in March, CZ's meme manipulation skills were still those of an intern, progressing through three stages: from inexperienced to proficient. With the initial test coin, $TST, CZ downplayed the hype with a simple "Happy Trading," but underestimated its impact, leading to a rapid debacle after the token's launch on Binance. With the subsequent $Broccoli concept, CZ, while mastering pre-announcements and storytelling to ignite excitement, made a crucial mistake: failing to specify a unique contract address (CA). This directly led to a chaotic on-chain environment, with tens of thousands of identically named coins dispersing funds and allowing for crypto honeypot and insider trading. Ultimately, it devolved into a farce where retail investors were exploited and a failed "stress test."

It wasn't until the emergence of $Mubarak (a Middle Eastern concept) that CZ's trading techniques truly matured. He mastered the art of first releasing memes from his official account to warm up the market, then engaging personally in the market. Crucially, by retweeting specific community members, he cleverly "selected" a leading CA for the market, avoiding capital diversion and confusion. From the unregulated $TST, to the uncontrolled $Broccoli, to the precise guidance of $Mubarak, this was a clear process of learning and evolution.

However, the current "Binance Life" season has seen another iteration, a masterclass in gameplay. If CZ was the protagonist in March's drama, driven from top to bottom, this time, the community is at the center, igniting the situation from the bottom up. He Yi's role is no longer that of a "starter," but rather a "igniter." Rather than inventing a new concept, she precisely captured and amplified the community's pre-existing "crypto dream" meme. Developers and influencers understood her intent, swiftly completing the entire process from deployment to securing the leading position. CZ's subsequent comments, after community consensus had already formed, served as an imperial coronation. This "follow-the-trend" approach is far more sophisticated and explosive than March's "creating something out of nothing." It strips away all pretense of "application" and gets straight to the heart of trading: consensus. This is the ultimate narrative simplification, with a very low barrier to entry, perfectly aligning with the current market's impetuous pursuit of pure, quick wealth.

It's clear this isn't just a simple pump and dump; it's a "cultural renaissance" in the Chinese-speaking world. For a long time, on-chain meme-playing has been largely dominated by Western "zoo" narratives. From DOGE to PEPE to WIF, all have played on a visual humor that resonates globally. Binance Life, however, opens up a new frontier: a deeply resonant experience rooted in a specific language and cultural context. It doesn't need to be universally understood; it just needs to instantly captivate "our own people."

This can be seen as a complete "cultural counterattack" on the blockchain. It proves that Chinese-speaking communities are no longer just purveyors of Western narratives, but can also become powerful engines of narrative. The "Sun Wukong" scenario on the Solana chain has already been previewed, and "Binance Life" has brought this drama to a climax within Binance, the world's largest traffic pool. It demonstrates to the world, with real money, that Eastern liquidity and storytelling power are a force capable of upending the game.

Of course, meme bubbles will eventually have their own cycles. When the frenzy subsides, the value of Binance Life will ultimately return to the resilience of its community consensus. But regardless of where its K-line chart ultimately leads, the fire it ignited has already spread to the vast crypto landscape. The "Chinese Meme Era" may have just begun.

In the future blockchain world, we may see the rise of more meme narratives based on diverse cultures and languages, collectively forming a more diverse and exciting crypto-cultural casino. The story of "Binance Life" will be long remembered because it demonstrates, in the most extreme and dramatic way, that in the Web3 world, the most powerful code is sometimes the slogan written in people's hearts. Which Chinese character combination will be the next to set the community on fire? This question is left to everyone who still plays the game.