As sentiment in the broader crypto market cools, top altcoin Ethereum has fallen below the key support level of $4,426.

With bullish momentum slowing across the market, ETH could slide below the $4,000 mark, further testing traders’ confidence.

Smart money goes cold on Ethereum

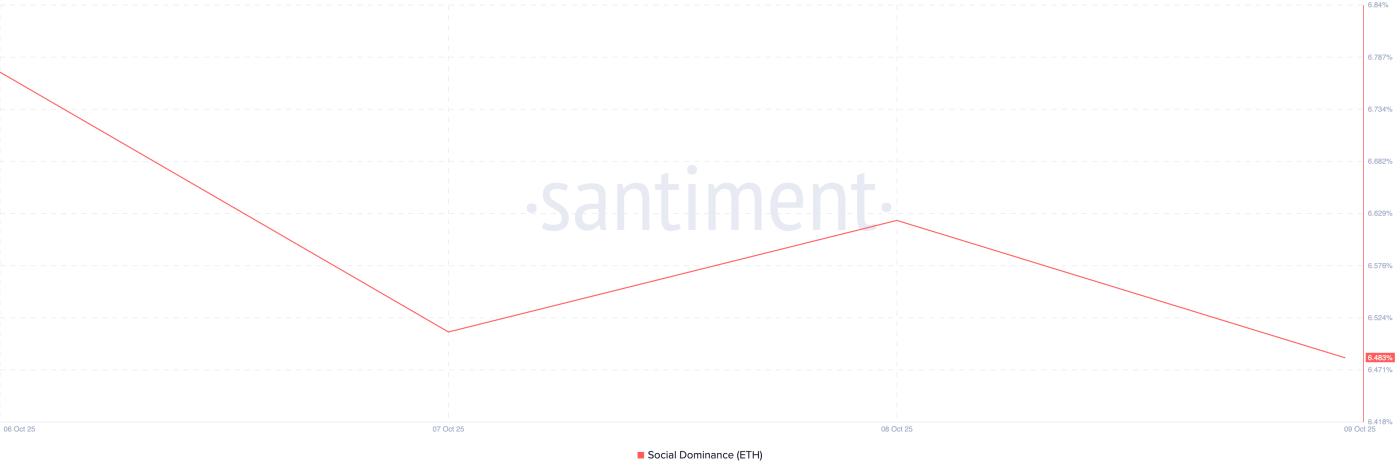

ETH price drop since the start of the week has led to investors becoming indifferent to it, which is reflected in its decline in social dominance since then. According to Santiment, the index is currently at 6.48%, down 5% over the past five days.

To stay updated on TA and the Token market: Want more Token insights like this? Sign up for Editor Harsh Notariya's daily Crypto Newsletter here .

ETH Social Dominance. Source: Santiment

ETH Social Dominance. Source: SantimentAn asset's social dominance measures its share of online discussions relative to the total conversation surrounding the top 100 cryptocurrencies by market Capital .

As it rose, discussions about that asset suddenly became a much more important part of the overall crypto market conversation than they had been before.

However, when it falls and is accompanied by a price drop like this, it signals that trader interest is fading and speculative attention is shifting elsewhere. A decline in visibility often leads to a decrease in demand, further affecting ETH's price performance.

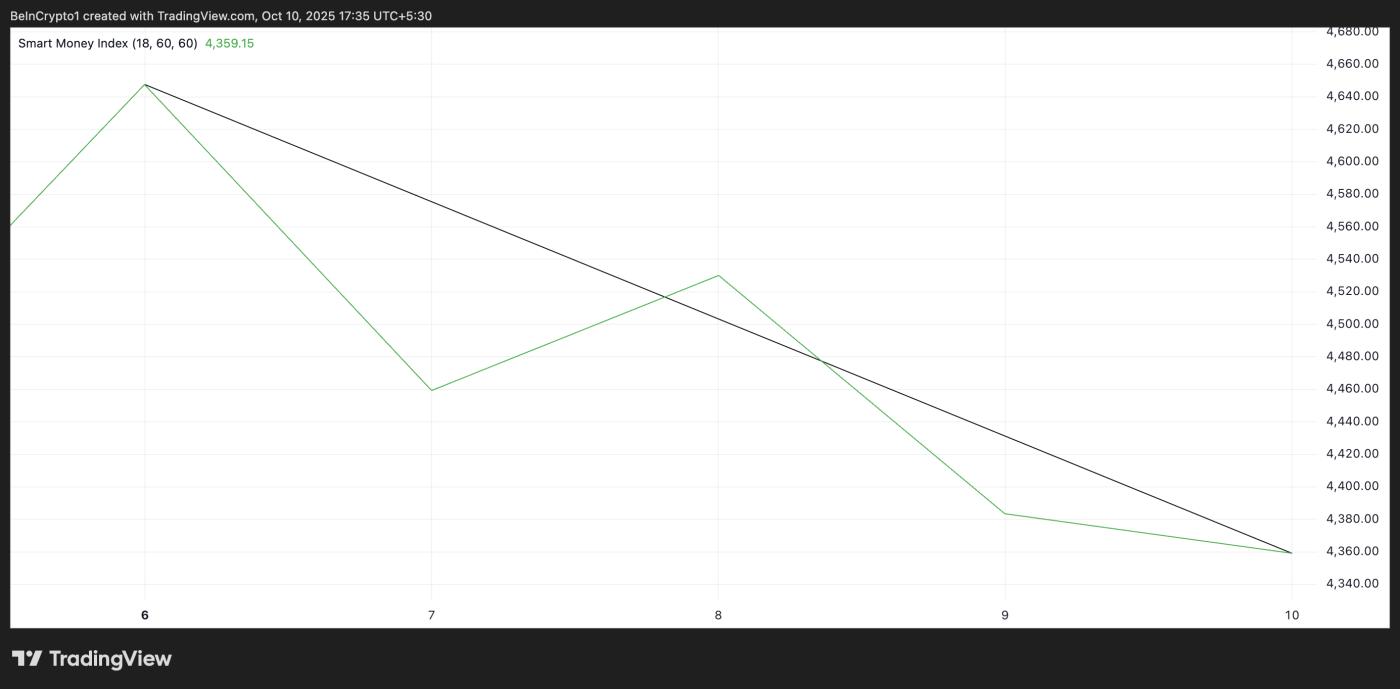

Furthermore, indicators from the ETH/USD one-day chart confirm the decline in the coin’s Smart Money Index (SMI) since Monday. At the time of writing, the index is down 6% to 4,359.

ETH Smart Money Index. Source: TradingView

ETH Smart Money Index. Source: TradingViewSmart money refers to Capital controlled by institutional investors or experienced traders who have a deeper understanding of market trends and timing. SMI tracks the behavior of these investors by analyzing intraday price movements. A rising SMI indicates smart money is accumulating an asset, often before large price moves.

Conversely, when it drops like this, these important investors are taking profits, which could predict a short-term correction. If this trend continues, it could exacerbate the downward pressure on ETH, especially as retail investor sentiment and social activity also weaken.

Can demand save it from a $3,800 drop?

When smart money leaves the market and broader coin demand declines, it usually signals a period of consolidation or decline. This means ETH could establish a sideways trend or decline towards $4,211.

If this support level fails to hold, the altcoin risks dropping below $4,000 to trade at $3,875.

ETH Price Analysis. Source: TradingView

ETH Price Analysis. Source: TradingViewHowever, if demand returns to the market, it could push ETH price back above $4,426 towards $4,742.