By AltSeason CoPilot

Compiled by: Vernacular Blockchain

President Trump's sudden announcement of an additional 100% tariff on all Chinese imports, effective November 1, 2025, sent shockwaves through global markets, leading to one of the worst single-day sell-offs of the year in stocks, cryptocurrencies, and commodities.

This is not a policy tweak but a global reset in progress.

DOGE price plummets 65%

Tariffs that crush markets

Trump's new tariffs double existing import duties , bringing the total tariffs on Chinese goods to about 130% .

The escalation came after Beijing imposed export controls on rare earth minerals and new port fees on U.S. ships, both seen as strategic countermeasures in an intensifying economic standoff.

Trump responded not only with tariffs but also with export controls on all critical software and a hint of canceling a planned meeting with President Xi Jinping.

The timing? Extremely cruel. The impact? Immediate.

Market crash: $1.6 trillion wiped out of stocks

- Dow Jones Industrial Average : -1.05% (-878 points)

- S&P 500 : -2.7%

- Nasdaq: -3.5% — worst day since April 2025

About $1.65 trillion in market value was wiped out in a matter of hours as traders rushed for the exits.

Tech stocks bore the brunt of the impact: AMD fell 5.7% and Nvidia tumbled , sending sentiment in the semiconductor sector tumbling amid fears that supply chains between the world's two largest economies would freeze.

Bitcoin and other cryptocurrencies fall

Cryptocurrencies have not been immune.

In the hours following the announcement:

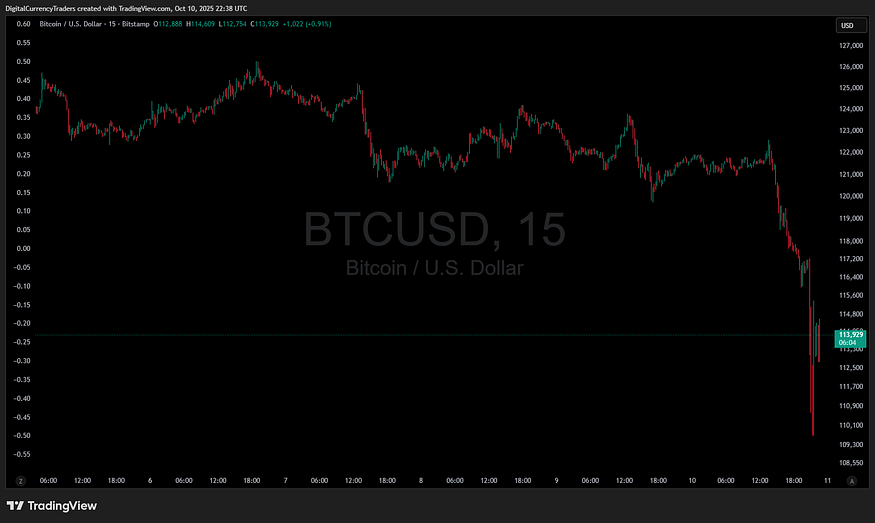

- Bitcoin drops 10% from $122,000 to $107,000

- Ethereum, XRP, and BNB fell more than 15%

- About $200 billion in crypto market value evaporated

The sell-off highlights how digital assets remain highly correlated with broader risk sentiment, and how macro shocks can trigger synchronized liquidations in both traditional and crypto markets.

The broader context: The return of fear

The context for this escalation was already very fragile:

- The specter of a US government shutdown continues to loom.

- Inflation anxiety remains high as commodity and transportation costs rise .

- Global supply chains are at risk again – a repeat of the chaos of 2018, but on a larger scale.

Analysts warn that if China retaliates with further restrictions on rare earths, semiconductors or dollar-based trade, markets could face a prolonged “stagflation shock” — slower economic growth, higher prices and continued volatility.

What this means for investors

This is a macro turning point . Here are some strategic considerations:

Short-term : Expect a sharp rise in volatility – both stocks and cryptocurrencies could see multi-day pullbacks.

Medium term : Watch for safe-haven flows – demand for gold, cash and US Treasuries could surge.

Long-term : If this trade standoff persists, supply chain inflation could reignite favor for “hard assets” like gold and Bitcoin.

Ironically, tariffs intended to bolster U.S. competitiveness may end up increasing the appeal of decentralized store-of-value assets.

Last window of opportunity

The message from the markets is clear : the trade war is back—and this time, it’s all-out.

Gold is soaring. Bitcoin is bleeding. The stock market is crashing.

As capital scrambles for safe havens, one thing is certain - the next phase of global finance will no longer be about growth, but about survival, positioning and timing .

The question every investor faces is: Are you reacting to headlines, or are you preparing for the ripple effects?

Link to this article: https://www.hellobtc.com/kp/du/10/6074.html

Source: https://digitalcurrencytraders.com/flash-crash-trumps-100-tariff-shock-401f453da462