Crypto.com CEO calls for investigation into exchanges after record $20 billion liquidation. Photo: Happycoin

Crypto.com CEO calls for investigation into exchanges after record $20 billion liquidation. Photo: Happycoin

Calls for investigation of major exchanges

- An “earthquake” swept through the crypto market over the weekend. More than $20 billion in positions were liquidated in just 24 hours, a loss that far exceeded any previous crash, including the FTX scandal that rocked the industry.

- The root cause stems from US-China geopolitical tensions. President Donald Trump announced a 100% tariff on all imports from China from November 1, in response to Beijing's recent rare earth export control policy. China currently supplies about 70% of the world's rare earth resources - a group of essential materials for high technology, chips, AI and Mining infrastructure. The export restriction has caused investors to panic and withdraw Capital from risky assets, leading to the largest sell-off in crypto history.

- In the midst of the storm, Crypto.com CEO Kris Marszalek has sounded the alarm, calling on global regulators to launch an investigation into the exchanges with the largest liquidation volumes .

Regulators should look into the exchanges that had most liquidations in the last 24h and conduct a thorough review of fairness of practices. Any of them slowing down to a halt, effectively not allowing people to trade? Were all trades priced correctly and in line with indexes?… pic.twitter.com/UCD6iKuKFQ

— Kris | Crypto.com (@kris) October 11, 2025

- In an October 11 post, Kris questioned the fairness and transparency in how these platforms operate:

Is there any floor that has "frozen" itself, making it impossible for investors to make transactions at crucial moments?

Are transactions priced accurately and closely follow market indices?

Are transaction monitoring and anti-money laundering (AML) systems operating properly?

And have the exchange's internal trading teams maintained the “Chinese wall” – the barrier that prevents conflicts of interest between departments – or has it been breached?

- Marszalek emphasized that $20 billion was liquidated, millions of users lost, the Vai of the regulator is to protect investors and ensure the integrity of the market.

Allegations of manipulation, freezing of user assets

- Immediately after the crash, a storm of criticism from the trader community erupted. A series of accusations were aimed at Binance - the world's largest exchange: harsh, lacking transparency and showing signs of abuse of power.

Since we're all taking about how exchanges functioned during yesterday's nuke, let me tell you how I got liquidated on Binance.

— CoinMamba (@coinmamba) October 11, 2025

I was running a pair trade, one Longing and one Short position. As the prices started nuking, my margin got low and changed from partially liquidating my…

- A user nicknamed “Cowboy” called Binance “the biggest scammer in the crypto industry”, accusing the exchange of arbitrarily locking users’ accounts, leaving them unable to access their assets or, more painfully, having their positions closed during the market turmoil. Limit order and stop-loss functions were also paralyzed during the critical moment, so that Binance “maximized profits from the largest liquidation event in history”, Cowboy said bitterly.

Binance has proven again why they are the biggest scammers in crypto

— Cowboy (@CryptoCowboy_AU) October 11, 2025

During the recent market crash, they froze user accounts across the board, preventing traders from accessing their funds at critical moments. Limit orders and stop-loss functions were convenient… https://t.co/2KACQ9Ns6B pic.twitter.com/BA08yzezwT

- Cowboy also said that Binance CEO Richard Teng could face jail time if the manipulation and misconduct allegations are confirmed.

Vulnerability leading to depeg crash

- Another user ElonTrades also published a scary accusation. Binance was hacked through an internal pricing vulnerability , causing the stablecoin USDe to be massively Peg and hundreds of millions of dollars to be forced liquidated.

The Oct 11 Crypto Crash — What Really Happened

— ElonTrades (@ElonTrades) October 12, 2025

TL;DR:

Roughly $60–90M of $USDe was dumped on Binance, along with$wBETH and$BNSOL , exploiting a pricing flaw that valued collateral using Binance's own order-book data instead of external Oracles.

That localized depeg triggered…

- According to ElonTrades, instead of using price data from an external oracle - which is a commonly used objective source to determine asset values - Binance relies on its own internal order book to calculate prices for USDe, BNSOL and WBETH.

- When the attacker then Dump about 60 million USDe on Binance, pushing the price of this stablecoin to fall below 1 USD right on the exchange. This caused users who used USDe as collateral to have their positions automatically liquidated, causing huge losses.

- ElonTrades concluded: “What appeared to be chaos was actually an organized attack, exploiting weaknesses in Binance's internal pricing system and the damage was exacerbated by leverage and macro market shocks.”

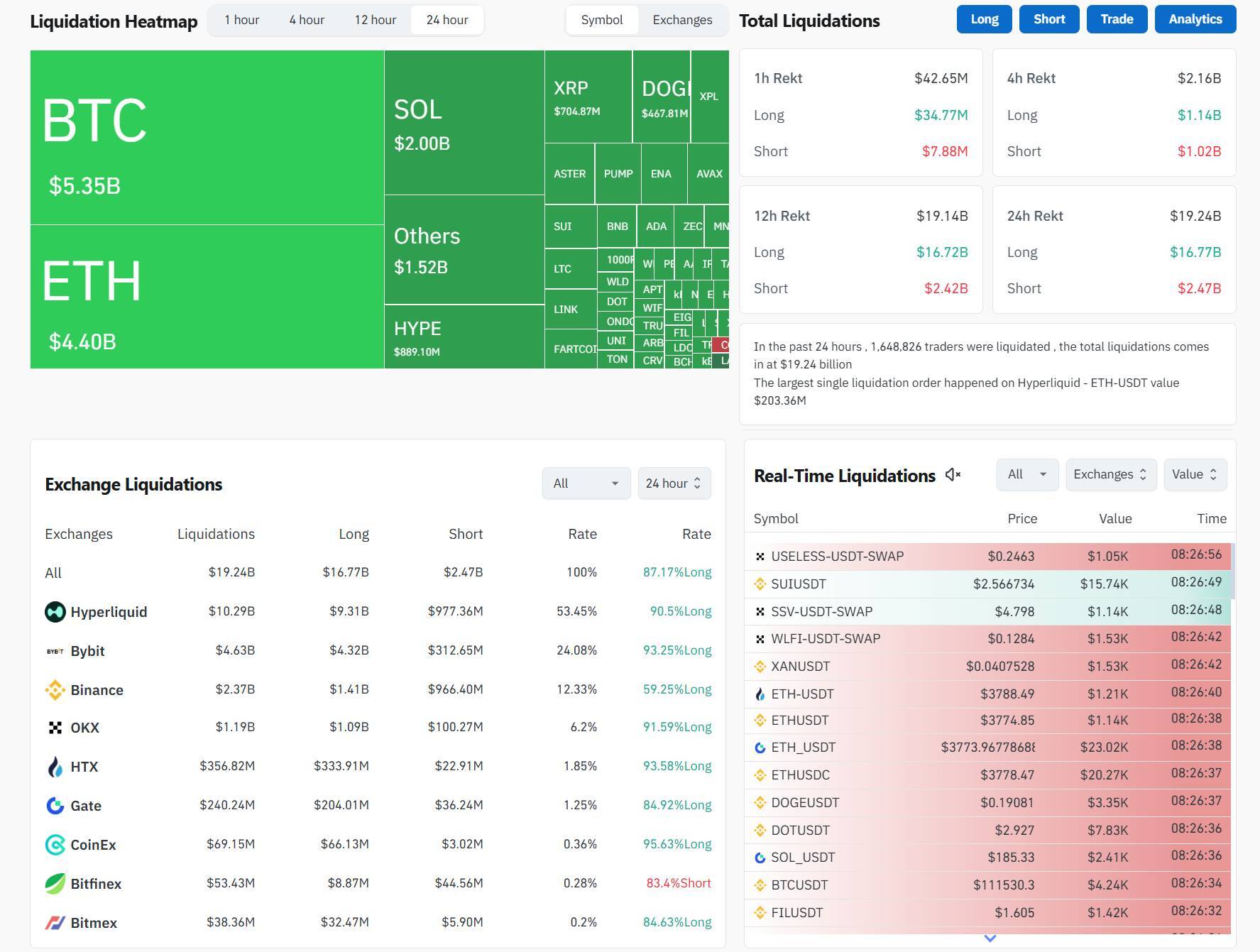

Hyperliquid leads the liquidation

- According to data from CoinGlass , Hyperliquid leads the disaster table with $10.29 billion in positions wiped out, followed by Bybit ($4.63 billion) and Binance ($2.37 billion). OKX ($1.19 billion), HTX ($356.8 million) and Gate ($240.2 million) were also not spared from the liquidation wave.

Liquidation data on the Derivative market immediately after the crash on the morning of October 11. Source: CoinGlass

Liquidation data on the Derivative market immediately after the crash on the morning of October 11. Source: CoinGlass

- Binance has finally acknowledged the depeg incident involving USDe, BNSOL and WBETH. The exchange is currently reviewing the affected accounts and will proceed with appropriate compensation.

- However, that promise has not yet appeased the entire trader community. Many people continue to accuse Binance of closing positions incorrectly. One person said the exchange automatically closed all Short positions but kept Longing positions intact, causing them to lose all their assets, while similar orders on other exchanges still existed.

Binance apologizes, promises compensation

- On the evening of October 11, Co-founder Yi He publicly apologized, admitting that the incident occurred amid intense fluctuations and a sudden increase in users.

- Binance will spend $283 million to compensate for cases that are verified to be due to system errors, and will say no to market volatility or unrealized profits.

- According to data from analyst Quinten François, this crash is far greater than any previous crisis. Let's make a comparison to help you visualize:

$19.31 billion liquidated in 24 hours;

More than 10 times higher than the COVID-19 crash ($1.2 billion) in February 2020;

And more than 12 times the FTX disaster ($1.6 billion) by the end of 2022.

Covid crash: $1.2B in liquidations

— Quinten | 048. ETH (@QuintenFrancois) October 11, 2025

FTX crash: $1.6B in liquidations

Today: $19.31B in liquidations

You wished you bought during the COVID crash.

This is your COVID crash. pic.twitter.com/OnmNY7e86s

Coin68 synthesis