Kenya passes comprehensive digital asset management law. Photo: Blockworks

Kenya passes comprehensive digital asset management law. Photo: Blockworks

Africa's “blockchain gateway”

- Kenya has just approved Africa's most comprehensive digital asset management law, clearing the way for stablecoins, exchanges and global investors to enter the continent's hottest market.

Kenya's National Assembly has passed the Virtual Asset Service Providers Bill, 2025, establishing a licensing and oversight framework for crypto and digital asset firms.

— Kenyan Wall Street (@kenyanwalstreet) October 8, 2025

The law empowers regulators like CBK and CMA to supervise operators, enforce AML/CFT rules, and ensure… https://t.co/Jyyfw3mpmU pic.twitter.com/L8ZowbQYDh

- Specifically, the country's National Assembly passed the Virtual Asset Service Providers Bill, a historic milestone in efforts to bring the digital asset industry into a legal framework. This move marks a strong transformation of the East African economy, aiming to attract investment and become the continent's new financial and technology center.

- According to Mr. Kuria Kimani, Chairman of the Kenyan Parliamentary Finance Committee, the new law aims to address the long-standing lack of clear Capital in the crypto industry. Kenya aims to establish a comprehensive regulatory framework for digital assets, including cryptocurrencies, stablecoins and related services.

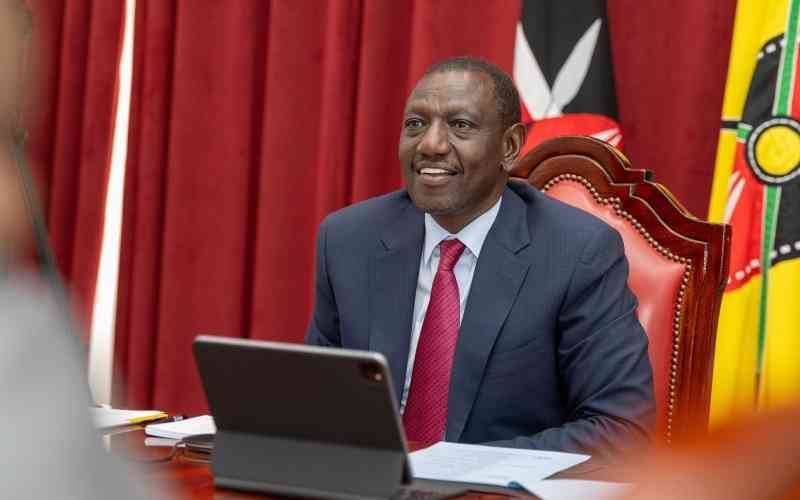

- The bill will only come into effect after it is formally signed by President William Ruto, making Kenya one of the few African countries – along with South Africa – to have a comprehensive legal framework to regulate the digital asset industry.

Clear management and licensing structure

- The new law sets out two focal points in managing the digital asset industry, namely:

Central Bank of Kenya (CBK): responsible for licensing the issuance of stablecoins and other virtual assets.

The Capital Markets Authority of Kenya will license and supervise crypto exchange and digital asset trading platforms.

- In addition, the law adds many new strict regulations to ensure transparency and protect users:

Digital asset businesses must have a physical presence in Kenya, a minimum of three natural person directors and a local bank account to segregate client assets.

Require independent IT audits, AML/KYC reporting, user data protection, and compliance with international standards of transparency.

Companies currently operating will have a transition period to complete their licensing applications.

- In its initial draft, the bill proposed allowing the Virtual Asset Chamber of Commerce (VACC) – an organization believed to be related to Binance – to participate in the new regulatory body. However, this provision was removed in the final passage.

- “We hope Kenya can become the gateway to Africa,” Mr. Kimani Chia . He said that young Kenyans aged 18-35 are actively using digital assets for transactions, payments, investments and startups.

Opportunities & Challenges

- Kenya's move comes as the world prepares for a boom in USD-backed stablecoins. Despite global regulators warning that stablecoins could undermine currencies in developing economies, Kenya has taken the initiative to get in on the game.

- In particular, as Vai of COMESA (Common Market for Eastern and Southern Africa), Kenya can take advantage of this law to link regional digital payment systems, reduce dependence on the USD and promote intra-bloc trade in local currencies or digital assets.

- According to Mr. Kimani, legal clarity will be key to attracting international investment Capital , especially from major exchanges such as Binance and Coinbase, which have had preliminary discussions with the Kenyan government.

- The new law could also reopen the door for the banking system, which has been wary or refused to serve crypto businesses due to legal risks. Moreover, Kenya's legal framework is referenced and developed based on practices from the US and UK - two markets that have a relatively complete legal foundation for digital assets.

- Kenya is known as the cradle of mobile finance, with the M-Pesa system operated by Safaricom, a platform that has brought money transfer, savings and investment services to tens of millions of people, contributing to the creation of a cashless society in East Africa.

- In recent years, crypto has begun to penetrate the lives of low-income people, especially in the Kibera slum. People here use Bitcoin and stablecoins for payments, savings and cross-border transactions. New laws can protect this vulnerable group of users by requiring exchanges to be transparent, segregate customer assets and be responsible for compensation in case of incidents.

- In addition, Kenya is also turning crypto into a new source of revenue. In the 2023-2024 fiscal year, the country collected more than $77.5 million from 384 crypto dealers, and aims to collect $158.8 billion in the next five years. Previously, in 2022, the government proposedan 8.5% tax on trading profits and required investors to declare ownership of digital assets.

Coin68 synthesis