#BTC

- Bitcoin is testing critical support levels with current price near Bollinger Band lower boundary

- Market sentiment is extremely fearful, historically a contrarian bullish indicator for long-term investors

- Mixed technical signals suggest potential for both near-term decline and medium-term recovery toward $118,000

BTC Price Prediction

Technical Analysis: Bitcoin at Critical Juncture

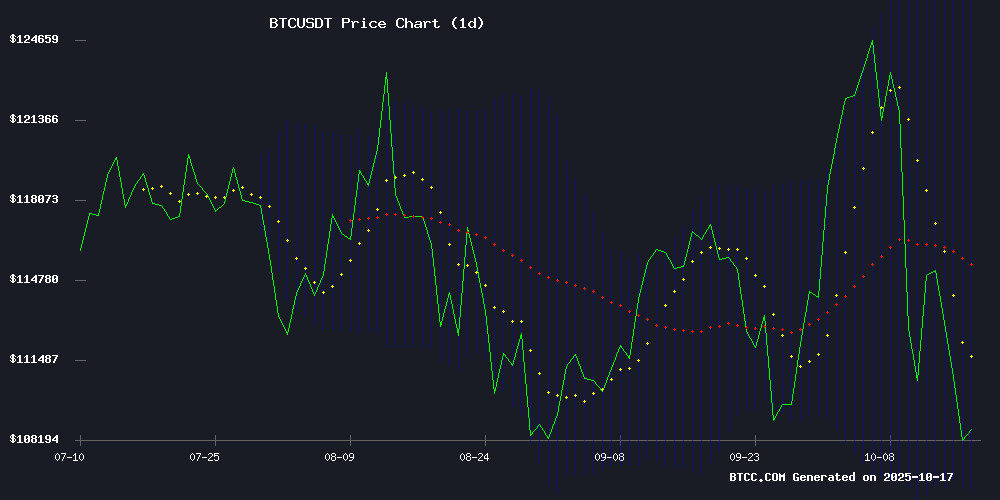

According to BTCC financial analyst Emma, Bitcoin is currently trading at $104,878.93, significantly below its 20-day moving average of $116,456.14, indicating bearish momentum in the short term. The MACD reading of 1,365.04 shows some positive momentum, though the negative histogram value of -1,796.49 suggests underlying selling pressure. Bitcoin is trading near the lower Bollinger Band at $105,224.87, which could serve as immediate support. Emma notes that a break below this level could trigger further declines toward $100,000, while holding above it might lead to a retest of the middle band at $116,456.14.

Market Sentiment: Fear Dominates Amid Multiple Headwinds

BTCC financial analyst Emma observes that current market sentiment is overwhelmingly negative, driven by several factors. The Fear and Greed Index hitting yearly lows suggests potential accumulation opportunities for long-term investors, though short-term pressures remain. Geopolitical tensions and spot ETF outflows have created significant selling pressure, while positive developments like Florida's proposed bitcoin reserve bill provide longer-term structural support. Emma emphasizes that the market is experiencing typical correction behavior after substantial gains, with the current retest of key support levels being technically consistent with previous market cycles.

Factors Influencing BTC's Price

Bitcoin's Decline Against Gold Sparks Debate as Schiff Predicts Collapse

Gold's rally to record highs has reignited Peter Schiff's criticism of Bitcoin, with the economist highlighting a 32% drop in BTC's value against the precious metal since August. Schiff's tweet urging investors to abandon "fake gold" for the real asset coincides with gold reaching $4,318/oz amid geopolitical tensions and central bank demand.

Crypto analysts counter that Bitcoin and gold serve distinct portfolio roles, noting continued institutional adoption through players like BlackRock and Ripple. The debate unfolds as macroeconomic forces drive divergent performances between the two asset classes.

Bitcoin Price Drops Below $108K Amid Extended Selling Pressure

Bitcoin's price trajectory shifted sharply this week as profit-taking accelerated, pushing the cryptocurrency below $108,000. Despite a weekend rebound, BTC failed to sustain momentum, erasing recovery gains and establishing a new weekly low of $107,464. This reversal has unsettled market participants.

Macroeconomic uncertainties—including U.S.-China trade tensions and interest rate volatility—are driving cautious sentiment across crypto markets. Notably, institutional interest persists: Newsmax Inc. unveiled plans to allocate $5 million toward Bitcoin and Trump Coin, signaling continued corporate treasury diversification into digital assets.

While Bitcoin's dominance remains unchallenged, scalability limitations are redirecting early adopters to layer-2 solutions. The Bitcoin Hyper protocol has attracted $24 million in presale funding, underscoring demand for infrastructure improvements.

Bitcoin Price Crashes Below $106K as Geopolitical Tensions and ETF Outflows Fuel Market Fear

Bitcoin plunged below $106,000 amid escalating geopolitical risks and institutional profit-taking, dragging the Crypto Fear & Greed Index to 22—deep into extreme fear territory. The selloff mirrors last week's drop to $104,000 triggered by trade war anxieties.

Former President Donald Trump's threat of 100% tariffs on Chinese imports—potentially escalating to 500%—ignited risk-off sentiment. Treasury Secretary Scott Bessent noted bipartisan support for the measures, with over 85 senators backing punitive actions against China's energy trade with Russia.

The bleeding accelerated as spot Bitcoin ETFs suffered a historic $531 million single-day exodus on October 16. BlackRock, Grayscale, and other major issuers simultaneously recorded outflows for the first time, signaling institutional retreat from crypto exposure.

Bitcoin Dips Below $110K Amid Spot ETF Outflows and Market Caution

Bitcoin's price fell below $110,000 as spot BTC ETFs recorded $536 million in net outflows, signaling growing investor caution. The cryptocurrency traded at $108,420, down 2.4% over 24 hours and 10% for the week, now 14% below its all-time high of $126,080.

Trading activity surged during the decline, with Bitcoin's 24-hour volume rising 25% to $83.1 billion. Derivatives data showed a 40% increase in futures volume to $127.6 billion, while open interest remained flat at $72.8 billion—a sign of position adjustments rather than new bets.

ARKB and FBTC led the ETF outflows with $275 million and $132 million withdrawn, respectively. Analysts warn that failure to hold the $108,000 support level could trigger a further slide toward $100,000.

Bitcoin Retests Key STH Cost Basis: Support or Breakdown Ahead?

Bitcoin's price action hinges on a critical on-chain metric as it retests the Short-Term Holder (STH) Cost Basis—a level that has oscillated between support and resistance in recent weeks. The current dip follows renewed selling pressure, with market participants closely watching whether this zone will catalyze a rebound or accelerate downward momentum.

Analysis by CryptoQuant contributor Maartunn places BTC at the fourth phase of the STH Realized Price cycle, a juncture historically pivotal for trend reversals. The STH Realized Price, reflecting the average acquisition cost of coins held for under 155 days, serves as a litmus test for investor sentiment. Short-term holders, known for their volatility-driven behavior, often dictate near-term price trajectories when spot prices approach this threshold.

The Realized Price metric broadly signals market profitability. Trading above it indicates widespread unrealized gains; dipping below suggests mounting losses. For BTC, this inflection point could determine whether recent declines are a temporary shakeout or the precursor to deeper correction.

Florida Bitcoin Reserve Bill 2026: Aiming to Invest 10% of State Funds in Crypto

Florida is positioning itself at the forefront of digital asset adoption with the introduction of House Bill 183 by State Representative Webster Barnaby. The proposed legislation, dubbed the "Strategic Bitcoin Reserve," would allocate up to 10% of state funds—including public and pension reserves—into Bitcoin and other approved digital assets like tokenized securities and NFTs. Custody and compliance safeguards are central to the bill, mandating that holdings be managed by the state CFO’s office, licensed custodians, or SEC-registered ETFs.

The move signals a broader shift toward institutional acceptance of cryptocurrencies. By incorporating the Florida Retirement System Trust Fund, the bill provides a regulated pathway for traditional finance to engage with digital assets. Representative Barnaby frames the initiative as a modernization effort, emphasizing transparency and oversight.

Notably, the bill also explores allowing residents to pay taxes in crypto, though details remain pending. If passed, Florida could set a precedent for other states to follow, further bridging the gap between legacy finance and decentralized innovation.

Bitcoin Fear and Greed Index Hits Yearly Low, Signaling Potential Accumulation Phase

Bitcoin's fear and greed index has plummeted to 24, its lowest level since 2023, as geopolitical tensions and futures liquidations trigger a market-wide correction. The sharp decline from last week's reading of 71 reflects growing panic among investors, but analysts see opportunity in the chaos.

Bitwise researchers argue this fear phase may represent the start of a strategic accumulation cycle rather than a crisis. Retail investors appear to agree—on-chain data shows small BTC holders are increasing purchases despite the bearish sentiment.

The current market conditions echo historical patterns where extreme fear precedes major rallies. While leveraged positions continue to unwind, long-term investors view the dip as a buying opportunity before the next halving event.

Florida Proposes Bitcoin and Crypto ETF Inclusion in State Pension Funds

Florida lawmakers are advancing a proposal that could reshape the state's investment strategy. The bill would permit pension funds and public investment pools to allocate up to 10% of their assets into Bitcoin and cryptocurrency exchange-traded funds. This marks a significant departure from traditional investment approaches, signaling growing institutional acceptance of digital assets.

State CFO Jimmy Patronis is spearheading the initiative, characterizing Bitcoin as 'digital gold' capable of hedging against market volatility. His formal request to the State Board of Administration—which oversees $205 billion in assets including the Florida Retirement System—could set a precedent for other states considering crypto exposure.

The move comes as institutional investors increasingly view cryptocurrency ETFs as legitimate portfolio components. While the proposal focuses primarily on Bitcoin, its passage could open doors for broader crypto adoption in public fund management.

BTC Price Prediction: Bitcoin Eyes $118,000 Recovery Despite Bearish Momentum

Bitcoin's price action has entered a critical phase, with technical indicators painting a mixed picture for the world's largest cryptocurrency. Currently trading at $108,908, BTC shows bearish momentum but retains potential for an 8.3% rebound toward $118,000. The $123,000 resistance level looms as a decisive battleground—a breakout could signal renewed bullish conviction, while rejection may confirm deeper corrections.

Analyst forecasts diverge sharply. CoinCodex projects a 12% surge to $127,264 by October 19, while CryptoQuant's AI model anticipates range-bound consolidation between $108,000-$123,000. Market Price Predictions strikes a middle ground, identifying $118,000 as a plausible recovery target amid what may be a bottoming process. The $102,000 support zone remains crucial—a breach there would invalidate most bullish scenarios.

Bitcoin Drops 3.5% Amid Short-Selling Frenzy Despite Spot Market Support

Bitcoin tumbled to $107,500 as aggressive short selling overpowered spot market demand, triggering $724 million in liquidations. The derivatives-driven selloff saw 74% of wiped positions being long contracts, while Coinbase spot buyers accumulated at lower levels.

Open interest surged by $1.03 billion during the decline, with perpetual futures on Binance and Bybit showing pronounced selling pressure. 'Short traders dominate perpetual markets while on-chain data shows spot demand contraction,' noted CryptoQuant's Julio Moreno.

A notable divergence emerged as spot cumulative volume delta held steady against falling perpetual futures CVD—a sign of institutional accumulation amidst retail-driven derivatives volatility.

MSTR Stock Slides as Bitcoin Stalls: Is the Market Losing Faith?

MicroStrategy's stock (MSTR) continues to mirror Bitcoin's volatile trajectory, slipping 1% to $296.76 amid sideways trading for both assets. The stock remains below key technical levels—$342.84 (50-day SMA) and $349.86 (200-day SMA)—as BTC swings between $126,000 and $109,000.

The correlation underscores MicroStrategy's dual identity: a tech firm with Bitcoin-heavy treasury strategy and a leveraged crypto proxy. Recent underperformance reflects broader market tensions—geopolitical risks, inflationary pressures, and crypto's institutional growing pains.

Is BTC a good investment?

Based on current technical and fundamental analysis from BTCC financial analyst Emma, Bitcoin presents a complex investment case. The technical indicators show Bitcoin trading below key moving averages but approaching important support levels, suggesting potential for both further decline and recovery.

| Metric | Current Value | Interpretation |

|---|---|---|

| Current Price | $104,878.93 | Below 20-day MA, bearish short-term |

| 20-day MA | $116,456.14 | Key resistance level |

| Bollinger Lower Band | $105,224.87 | Immediate support level |

| MACD | 1,365.04 | Mixed signals with positive momentum |

| Fear & Greed Index | Yearly Low | Potential accumulation opportunity |

Emma suggests that while short-term volatility may continue, the long-term fundamentals remain strong. The current fear-dominated market sentiment often presents buying opportunities for patient investors, though proper risk management and position sizing are crucial given the elevated volatility.