#ETH

- Technical Consolidation: ETH trading below 20-day MA but showing potential reversal signals near Bollinger Band support

- Institutional Strength: Major acquisitions and ETF developments signaling strong institutional confidence

- Long-term Bullish Thesis: High-profile $10K predictions and scaling solutions supporting multi-year growth trajectory

ETH Price Prediction

Technical Analysis: ETH Shows Mixed Signals Amid Consolidation

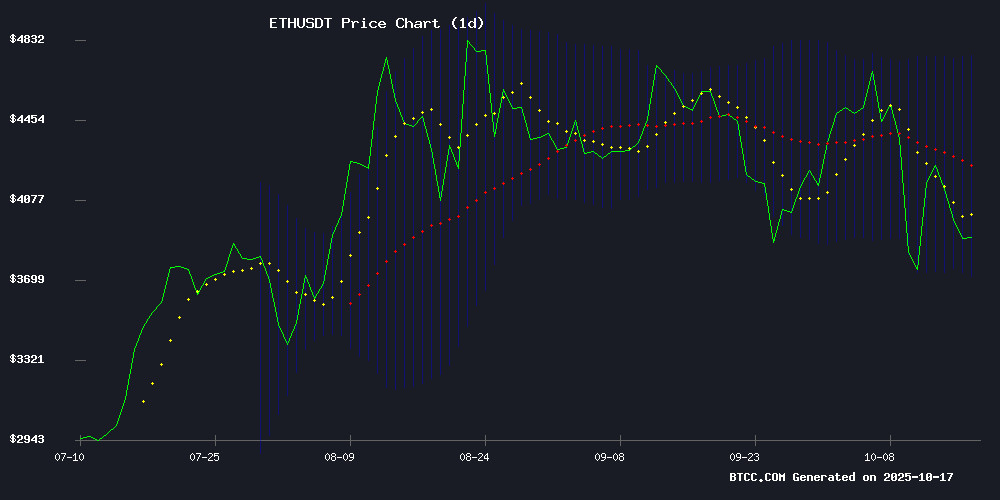

According to BTCC financial analyst Sophia, Ethereum's current technical picture presents conflicting signals. The price of $3,779.47 sits below the 20-day moving average of $4,231.44, indicating short-term bearish pressure. However, the MACD reading of 109.1891 versus the signal line at 7.0602 shows positive momentum, while the Bollinger Bands position suggests ETH is trading NEAR the lower band at $3,689.80, potentially indicating an oversold condition.

Sophia notes that 'the technical indicators suggest ethereum is in a consolidation phase, with the $3,700 level providing crucial support. A break above the 20-day MA could signal renewed bullish momentum toward the $4,200 resistance zone.'

Market Sentiment: Institutional Accumulation Offsets Technical Concerns

BTCC financial analyst Sophia observes that current market sentiment reflects a tug-of-war between institutional Optimism and technical concerns. 'While the MACD turning negative has raised short-term bearish concerns, we're seeing significant institutional accumulation during this dip,' Sophia states. 'The $417 million ETH acquisition by BitMine and VanEck's staked ETH ETF filing demonstrate strong institutional conviction.'

Sophia adds that 'despite scalability criticisms from figures like Kevin O'Leary, the underlying institutional demand and high-profile predictions of $10,000 targets from Tom Lee and Arthur Hayes provide substantial fundamental support for Ethereum's long-term trajectory.'

Factors Influencing ETH's Price

Ethereum Price Consolidates as Traders Eye Breakout Potential

Ethereum's price has been range-bound between $3,900 and $4,100, creating tension among traders. A decisive breakout above $4,100 with strong volume could trigger a new upward leg, potentially dragging altcoins and DeFi projects higher. Standard Chartered's bullish $7,500 year-end target adds weight to ETH's low-risk, high-reward narrative if resistance at $4,580 is reclaimed.

However, weakening buying volume and lower highs suggest fading momentum. Failure to break resistance may prolong consolidation. Meanwhile, projects like Remittix are gaining attention as traders diversify into cross-chain DeFi solutions during ETH's indecision.

Kevin O’Leary Criticizes Ethereum Network Scalability Amid Market Correction

Ethereum (ETH) traded around $3,870 on October 17, 2025, marking a 3.92% decline from the previous close. The cryptocurrency briefly touched an intraday high of $4,076.22 before dipping to $3,835.35, as the broader market shed over $100 billion in three hours.

Canadian investor Kevin O’Leary likened Ethereum’s scalability issues to "paying a thousand-dollar toll to drive on a one-lane highway," citing network congestion and high gas fees. His comments sparked debate, with Ethereum proponents noting actual transaction fees for simple swaps average $22—far below O’Leary’s hyperbolic comparison.

Adriano Feria, a prominent Ethereum advocate, defended the network’s design: "Criticizing Ethereum’s gas fees misunderstands its purpose as a secure settlement layer rather than a retail payment rail." The discourse highlights ongoing tensions between scalability expectations and Ethereum’s security-first architecture.

BitMine Acquires $417M in Ethereum to Strengthen Market Position

BitMine Immersion Technologies has secured 104,336 ETH, valued at approximately $417 million, in a strategic push to expand its Ethereum holdings. The move signals strong institutional confidence in Ethereum's long-term value proposition amid fluctuating market conditions.

Tom Lee, a prominent figure at BitMine, projects Ethereum could reach $10,000 by 2025 despite recent price volatility. "Ethereum's foundational role in decentralized finance positions it for exponential growth," Lee stated, contrasting current market skepticism with bullish institutional sentiment.

The performance of U.S. spot Ethereum ETFs remains mixed, reflecting broader uncertainty in crypto markets. BitMine's substantial accumulation suggests sophisticated investors are positioning for Ethereum's next growth phase while retail traders exhibit caution.

VanEck Files for Lido Staked Ethereum ETF

Investment firm VanEck has submitted an S-1 registration to the U.S. Securities and Exchange Commission for a new exchange-traded fund tied to Lido Staked Ethereum (stETH). The proposed ETF seeks to provide institutional and retail investors with regulated access to stETH, a liquid staking derivative of Ethereum.

Approval would represent a watershed moment for crypto staking products, bridging decentralized finance mechanisms with traditional investment vehicles. The move signals growing institutional demand for exposure to Ethereum's staking yield economy without direct asset custody.

Lido's stETH currently dominates Ethereum's liquid staking sector, with over $30 billion in total value locked. VanEck's filing follows similar staking-related ETF proposals from Ark Invest and Franklin Templeton earlier this year.

Ethereum Flashes Bearish Signal as MACD Turns Negative, Threatening Further Declines

Ethereum's weekly MACD indicator has crossed into bearish territory, a technical pattern that preceded steep declines of 46% to 60% in previous cycles. The last two occurrences—mid-2024 and early 2025—saw ETH lose nearly half its value within weeks.

Crypto Trader Koala flagged the development on X, noting, "The last three times this cross turned red, ETH dropped hard." Market observers are divided on whether the $3,899 support level will hold. A breach could trigger a deeper correction mirroring historical drawdowns.

SharpLink Gaming Secures $76.5M ETH-Backed Equity Deal Amid Stock Decline

SharpLink Gaming Inc. (SBET) shares fell 3.4% to $14.63 despite closing a $76.5 million premium equity deal backed by Ethereum assets. The institutional transaction priced shares at $17.00—a 12% premium to Monday's close—and exceeded the company's ETH-linked net asset value.

The offering, structured under an SEC-effective shelf registration, includes a $78.8 million potential funding boost via a Premium Purchase Contract. Market indifference to the Ethereum-heavy financing suggests skepticism toward tokenization plays despite SharpLink's strategic doubling-down on ETH exposure.

SharpLink Gaming's Strategic Ethereum Accumulation Amid Stock Decline

SharpLink Gaming's shares fell sharply despite a $76.5 million equity sale designed to bolster its Ethereum reserves. The Minneapolis-based company, which transitioned from online gaming to digital asset management, sold 4.5 million shares at a 12% premium to fund further ETH acquisitions. Analysts remain bullish, projecting a 200% upside even as the market reacted negatively to the dilution.

The firm now holds over 830,000 ETH, positioning itself as a major institutional holder—though still trailing BitMine's 3 million ETH stash. Co-CEO Joseph Chalom framed the capital raise as a vote of confidence in SharpLink's long-term crypto strategy. 'This isn't about short-term trading,' he emphasized. 'We're building treasury assets that compound value.'

Competition among institutional ETH accumulators is intensifying. While Ethereum's price remains volatile, large-scale holders like SharpLink appear to be betting on the network's transition to proof-of-stake and growing DeFi adoption. The equity sale's structure—including a 90-day option for additional purchases at $17.50 per share—suggests expectations of further capital inflows.

Tom Lee and Arthur Hayes Reaffirm $10K Ethereum Target Amid Market Volatility

Ethereum trades at $4,129 as prominent analysts Tom Lee and Arthur Hayes double down on their year-end price target of $10,000. The prediction implies a 142% upside from current levels, with both figures emphasizing Ethereum's breakout potential after a four-year consolidation phase.

Historical Q4 performance data shows Ethereum has delivered an average 21.36% return since 2016. The cryptocurrency remains up 57% year-over-year despite recent market turbulence. Hayes, speaking on the Bankless podcast, confirmed his unchanged $10K forecast, while Lee projected an even more ambitious $12,000 range.

The analysts characterize the move as price discovery rather than speculative excess. "Ethereum's basically been basing for four years now," Lee noted, suggesting the asset is poised for significant revaluation. Their bullish stance persists despite weakening sentiment across digital asset markets.

Ethereum Bulls Target $7,000 as Institutions Accumulate During Market Dip

Ethereum has rebounded above $4,000 following a recent correction, now trading near $4,100 with a 7.8% daily gain. The recovery saw ETH breach key resistance levels at $4,000 and $4,120, signaling renewed bullish momentum.

Institutional players including BlackRock and Vanguard reportedly increased their ETH holdings during the sub-$4,000 dip. Market analysts suggest nearly $9.5 billion in short positions could face liquidation if prices rally another 20% from current levels.

Technical indicators show immediate resistance at $4,300-$4,400, with support holding firm at $4,150. Crypto analyst Mike Investing projects a potential $7,000 price target by May 2026, citing institutional accumulation during the recent pullback as a key bullish signal.

ETH Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical analysis and market fundamentals, BTCC financial analyst Sophia provides the following Ethereum price projections:

| Year | Price Range (USD) | Key Drivers |

|---|---|---|

| 2025 | $4,500 - $7,000 | ETF approvals, institutional accumulation, network upgrades |

| 2030 | $8,000 - $15,000 | Mass adoption, DeFi maturity, scalability solutions |

| 2035 | $12,000 - $25,000 | Web3 ecosystem growth, enterprise adoption |

| 2040 | $20,000 - $40,000+ | Global digital infrastructure, mature blockchain economy |

Sophia emphasizes that 'these projections assume continued technological development and regulatory clarity. The current market consolidation represents a healthy correction within a broader bullish trend, with institutional interest providing strong support for long-term price appreciation.'