Tokenize is moving from experiment to reality. The World Economic Forum predicts that the private Capital and venture capital market could grow to around $700 billion, and it is expected to be Tokenize. This potential scale could yet reshape global finance.

The APAC region has been ahead. Hong Kong’s spot ETFs attracted $400 million on their first day. Japan is preparing an ETF backed by SBI and Franklin Templeton. Singapore is establishing Tokenize frameworks. These ETF milestones are important both individually and as stepping stones toward broader Tokenize .

Japan promotes ETFs: Retail investors first, institutions later

In an exclusive interview with BeInCrypto, Max Gokhman, Deputy Chief Investment Officer at Franklin Templeton Investment Solutions (FTIS), explained why retail investor flows, representative bets, and national adoption could fuel the next phase.

His comments highlight both opportunities and risks. While ETFs mark the first entry points, the bigger story is how Tokenize can expand across asset classes and reshape market structures. However, history shows that markets rarely move in a straight line.

Japan’s Financial Services Agency (FSA) is updating its fund guidelines in 2025, making room for new ETFs with partners like SBI Holdings. Gokhman believes retail investors will provide liquidation first, with institutions following as the secondary market matures, he argues.

While he sees retail investors as a catalyst, history shows that the initial influx can fade without strong demand from pension funds and hedge funds. The story of Japan’s ETF illustrates how short-term retail demand can lay the groundwork for Tokenize markets that institutions may eventually adopt.

Gokhman stressed that institutions are less interested in fractional LP funds. Instead, they want vehicles to manage volatility and increase liquidation —necessary conditions for large-scale adoption.

“It starts more at the retail investor level… Retail investors may need more liquidation , but they also provide liquidation to institutions when retail investors get big enough that the secondary market really starts to develop.”

Proxy Bets and the $2.7 Billion Solana Supply

Before ETFs, investors pursued representative bets. MetaPlanet disclosed that it had accumulated more than 15,000 BTC. Remix Point also attracted speculative flows. Hong Kong regulators warned about leverage and counterparty risk when spot ETFs launched.

Gokhman notes that Solana ’s lending market already holds $2.7 billion in commitments. This reduces supply and pushes up prices, indicating appetite but also increasing systemic risk. These proxy bets suggest that demand is growing and explain why regulated Tokenize vehicles may be necessary for stability.

“Representative products can be leveraged and have more counterparty risk. For example, many Solana debt instruments are buying more supply — about $2.7 billion has been committed. That drives up the price, as more demand meets limited supply. With an ETF, most traditional crypto ETFs are one-to-one — buying one share means it holds the underlying asset on chain, like a gold ETF.”

The Tokenization Advantage of APAC

APAC markets are moving ahead, but also deeper. At Token2049 in Singapore, Franklin Templeton executives met with family offices and OCIO clients. They were not asking for simple exposure, but structured strategies.

Singapore's MAS has expanded Project Guardian and finalized a framework for Tokenize funds, with the goal of reaching retail investors by 2027. The WEF report estimates that the PE/VC market could reach ~$7 trillion by 2030, with ~10% Tokenize (~$0.7 trillion).

ETF progress shows appetite, but deeper involvement from APAC institutions shows Tokenize is a larger transformation underway. Europe, by contrast, is focused on compliance. The US remains mired in uncertainty.

Gokhman notes that while the US will remain Franklin Templeton’s number one source of revenue, APAC clients show greater maturity in digital assets. This Chia illustrates how global strategies must balance scale in the US with innovation in Asia.

“There is greater sophistication in APAC than in the West, especially with family offices and OCIO clients. They are not just saying, ‘I want some exposure,’ but asking us to structure it in a particular way, or guide them through Layer 2 research. APAC is definitely a key driver for us.”

Geopolitics and de-dollarization

The BIS has noted a slow decline in the dollar’s dominance. Gokhman argues that Trump-era policies have made the dollar less attractive, boosting demand for digital assets.

The backdrop, he said, is geopolitical. When the US is in conflict even with its allies, demand for the dollar weakens. For cross-border payments, avoiding SWIFT makes blockchain the obvious alternative. That dynamic cements digital assets as neutral rails for global transactions. Dedollarization could Vai a geopolitical role, making Tokenize rails more urgent than simply adopting ETFs.

“The Trump administration has actually been beneficial in creating more demand for digital assets because the dollar is becoming less attractive. National treasuries are de-dollarizing. As big players get involved in DeFi and start buying at scale, they will centralize that asset class, which will reduce volatility. An asset class with 30% annual volatility is much easier to integrate than one with 70%.”

Token sleepless activity

Unlike traditional assets, which pause on weekends, Tokenize assets operate 24/7. Gokhman summed it up in one sentence: “Money never sleeps, but Token do not.”

For investors, this means that tokenization will not only expand product portfolios. It will change the pace of finance. Portfolios will have to adapt to a world where markets never stop.

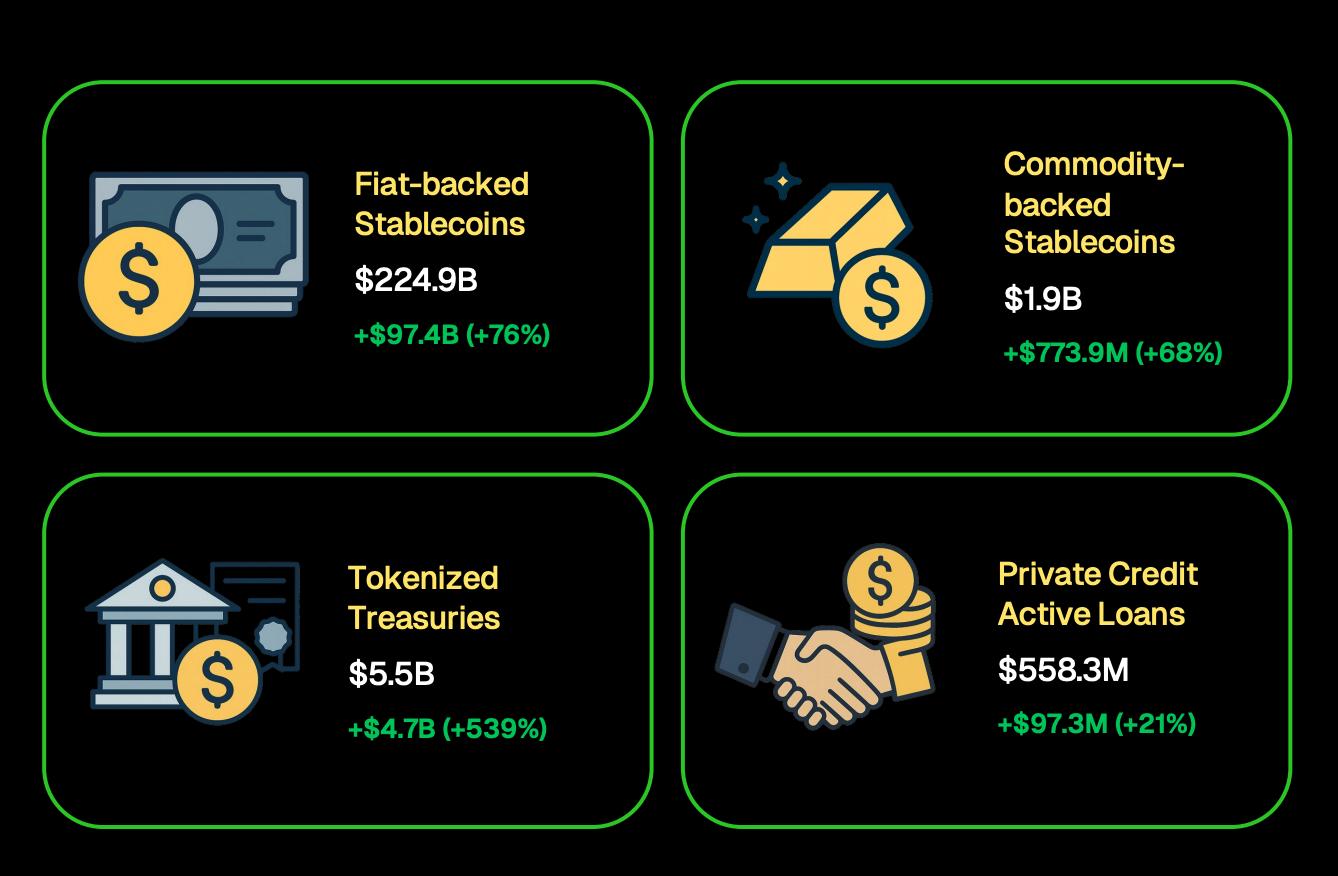

In fact, CoinGecko found that tokenized treasuries have surpassed $5.5 billion, while stablecoins have reached $224.9 billion. ETFs may introduce more investors to cryptocurrencies, but tokenization could redefine how assets are traded, settled, and stored value.

Source: CoinGecko

Source: CoinGeckoThe first wave of crypto is unlikely to encompass every asset class at once. History shows that the market typically starts with instruments that are already liquidation and trusted by institutions. That means money market funds, government bonds, and index-tracking ETFs are likely to be the first candidates.

Once trust is built, encryption could extend to private credit, real estate, or even cultural assets — areas where Gokhman believes blockchain has special potential.

“We believe that the future of all assets is tokenized. Traditional markets have legacy operational risks. To prepare, we are actively creating our own on-chain systems, end-to-end portfolios that combine digital, public and private asset classes, and even exploring categories like cultural assets that can only exist through tokenization.”

Innovation and collaboration

Beyond ETFs, Franklin Templeton is experimenting with new vehicles. Gokhman hinted that while details of the partnership with Binance remain limited, the company is also exploring other strategic partnerships to expand crypto use cases.

For investors, the key takeaway is that asset managers are expanding their experiments to prepare for scale, even as many strategies remain under wraps. The partnerships aren’t just about market share — they signal how incumbent firms are preparing for crypto infrastructure to go mainstream.