Note on our methodology: To fully document activity in the MENA region, we used our regular web-based geography methodology for the bulk of the analysis. However, Iran is not available in those data. For the Iran sub-section, we plot cryptocurrency activity related to specific Iranian services. Because these data are estimated using a different methodology, Iran is not included in the various high level regional charts in the beginning of this chapter.

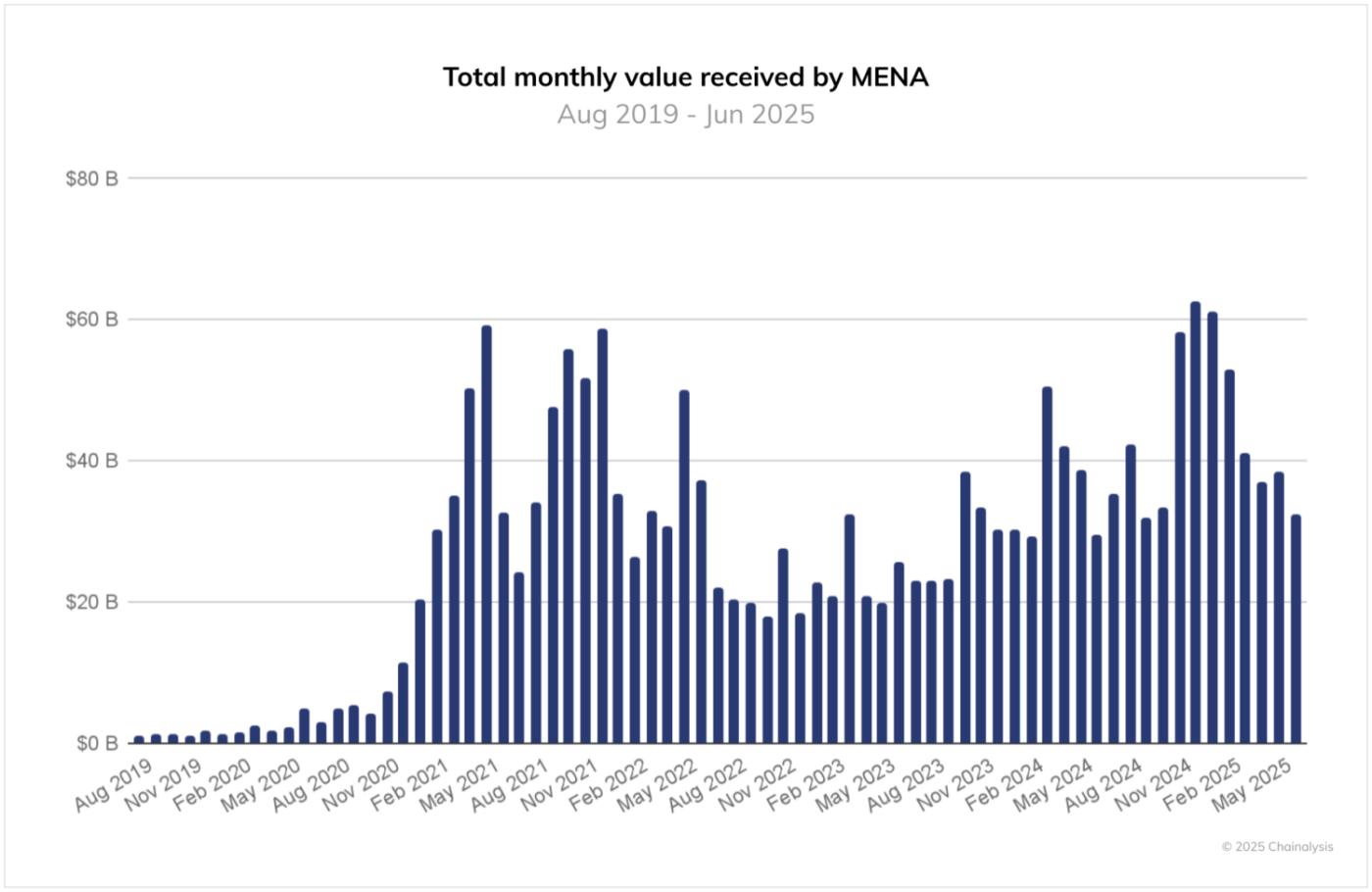

The MENA region has emerged as a compelling case study in cryptocurrency adoption, with transaction volumes reaching a pinnacle of over $60 billion in December 2024. Despite moderate cooling in 2025, year-over-year growth remains robust, with record monthly flows in late 2024. This sustained growth, despite a backdrop of regional geopolitical tensions and varied economic pressures, points to the durability of cryptocurrency in the MENA financial landscape.

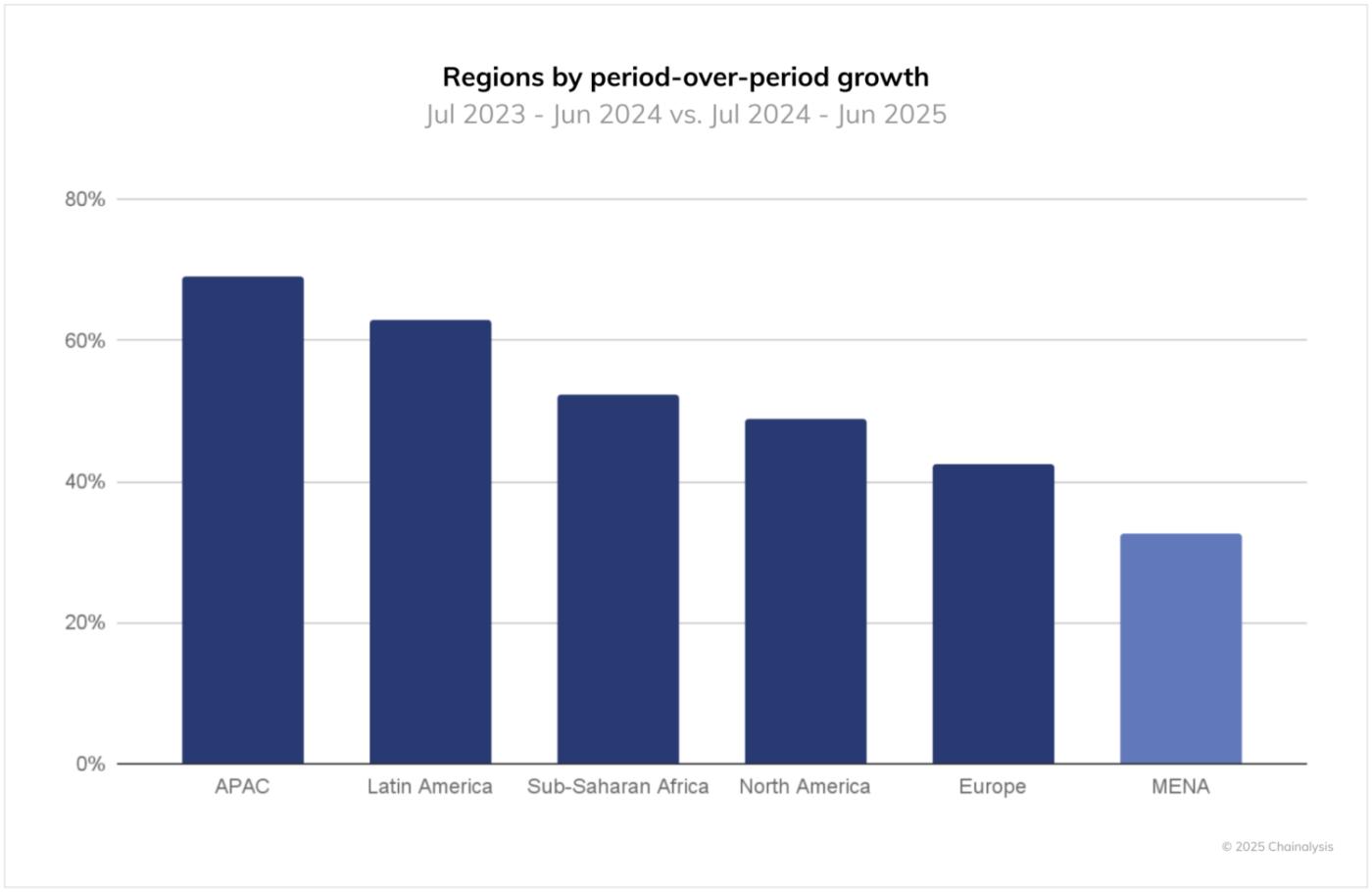

While MENA’s 33% period-over-period growth pales next to the growth rates we have seen in other developing markets such as APAC (69%) and Latin America (63%), complex dynamics in individual markets reflect how cryptocurrency can serve many different purposes, depending on unique local challenges and opportunities.

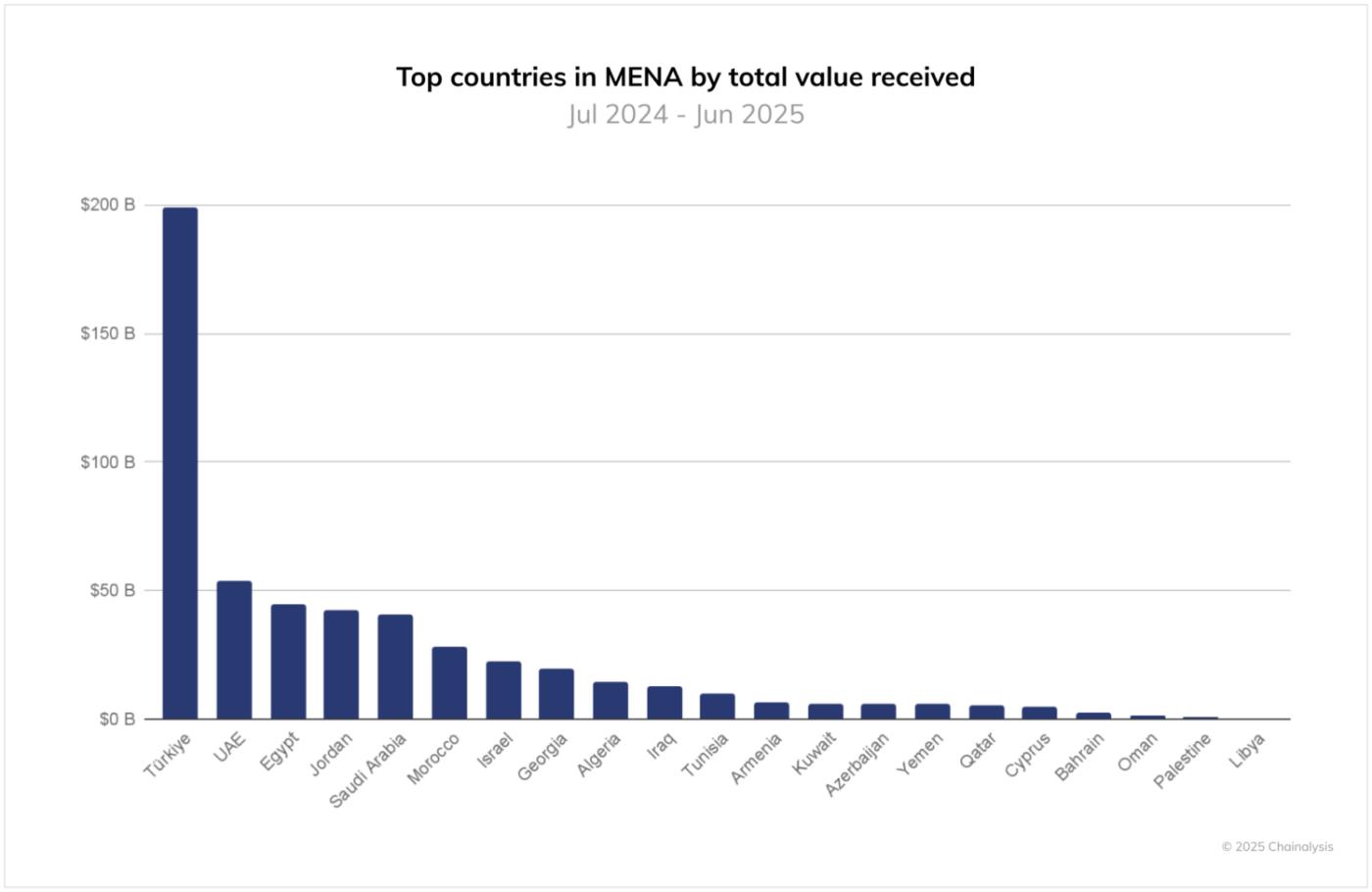

Nowhere is this more evident than in Türkiye, which occupies the top position in the regional index. Türkiye also dominates regional volume with nearly $200 billion in annual transactions, almost four times that of the UAE, which follows as the second largest market ($53 billion), while Israel’s volumes ($22 billion) reflect dramatic shifts in usage patterns following geopolitical upheaval. Iran, despite — or potentially because of — its isolation from global financial systems, maintains significant crypto activity through an increasingly self-contained ecosystem adapted to international sanctions.

Türkiye: Massive crypto inflows amid economic headwinds

Türkiye presents one of MENA’s most compelling cryptocurrency stories — its large volumes may be explained by increasingly speculative behavior rather than sustainable adoption. The country’s challenging economic circumstances seem to have driven substantial adoption of crypto for economic necessity, as an alternative financial infrastructure, and as a form of investment to escape financial hardship.

Regional dominance against economic headwinds

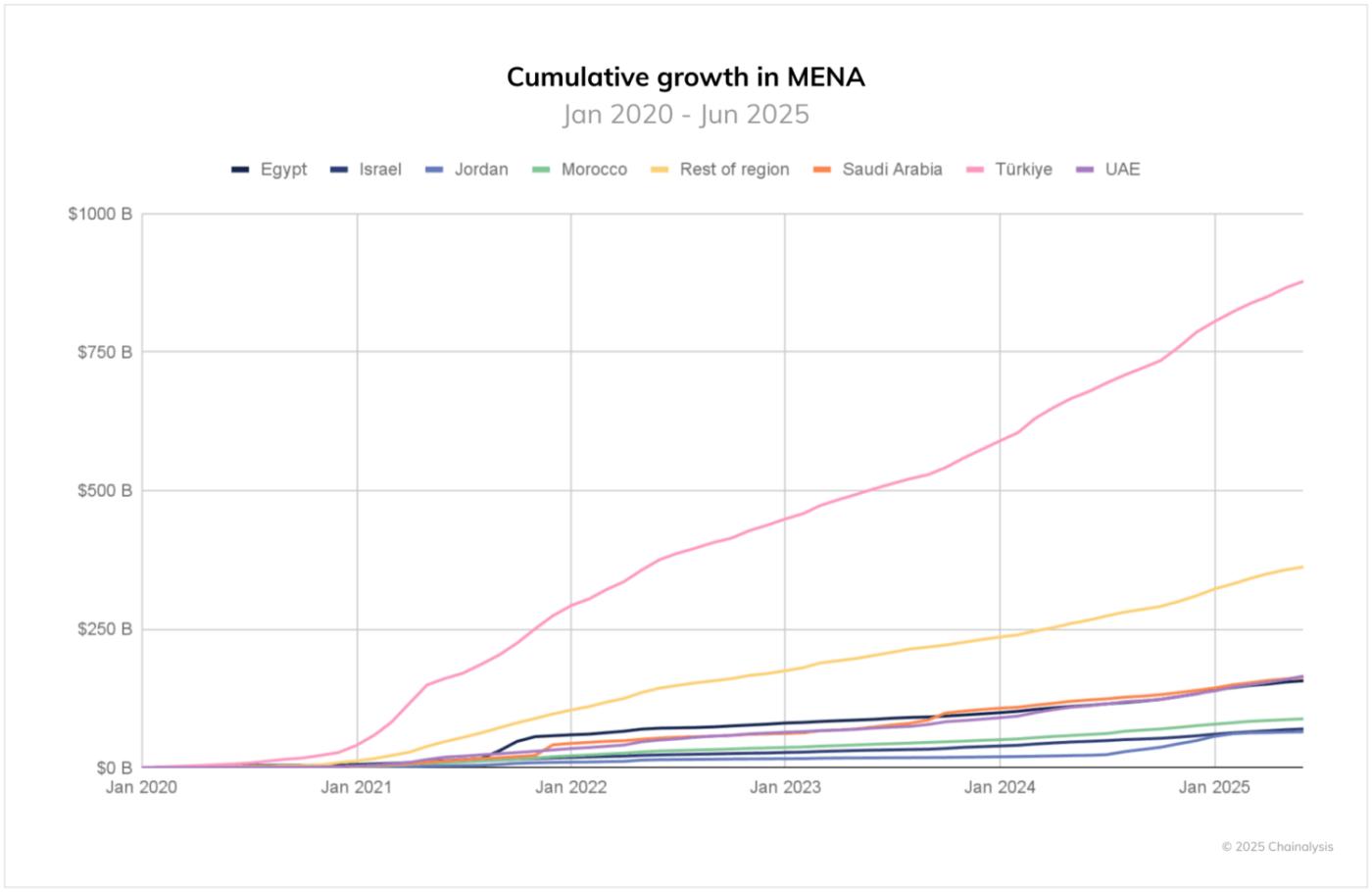

Since early 2021, Türkiye has experienced unparalleled expansion in gross cryptocurrency inflows, reaching approximately $878 billion by mid-2025, a scale that outpaces all other regional markets, despite the country’s persistent currency devaluation and inflationary pressures.

This remarkable growth curve began its steep ascent in Q1 2021, coinciding with a period of accelerating economic challenges for the Turkish lira. What’s particularly striking is how Türkiye’s crypto adoption has maintained consistent upward momentum throughout successive waves of currency volatility and double-digit inflation rates. While these economic headwinds have created significant hardships for Turkish citizens, they appear to have catalyzed crypto adoption at an institutional scale rarely seen in emerging markets facing similar pressures.

Retail contraction

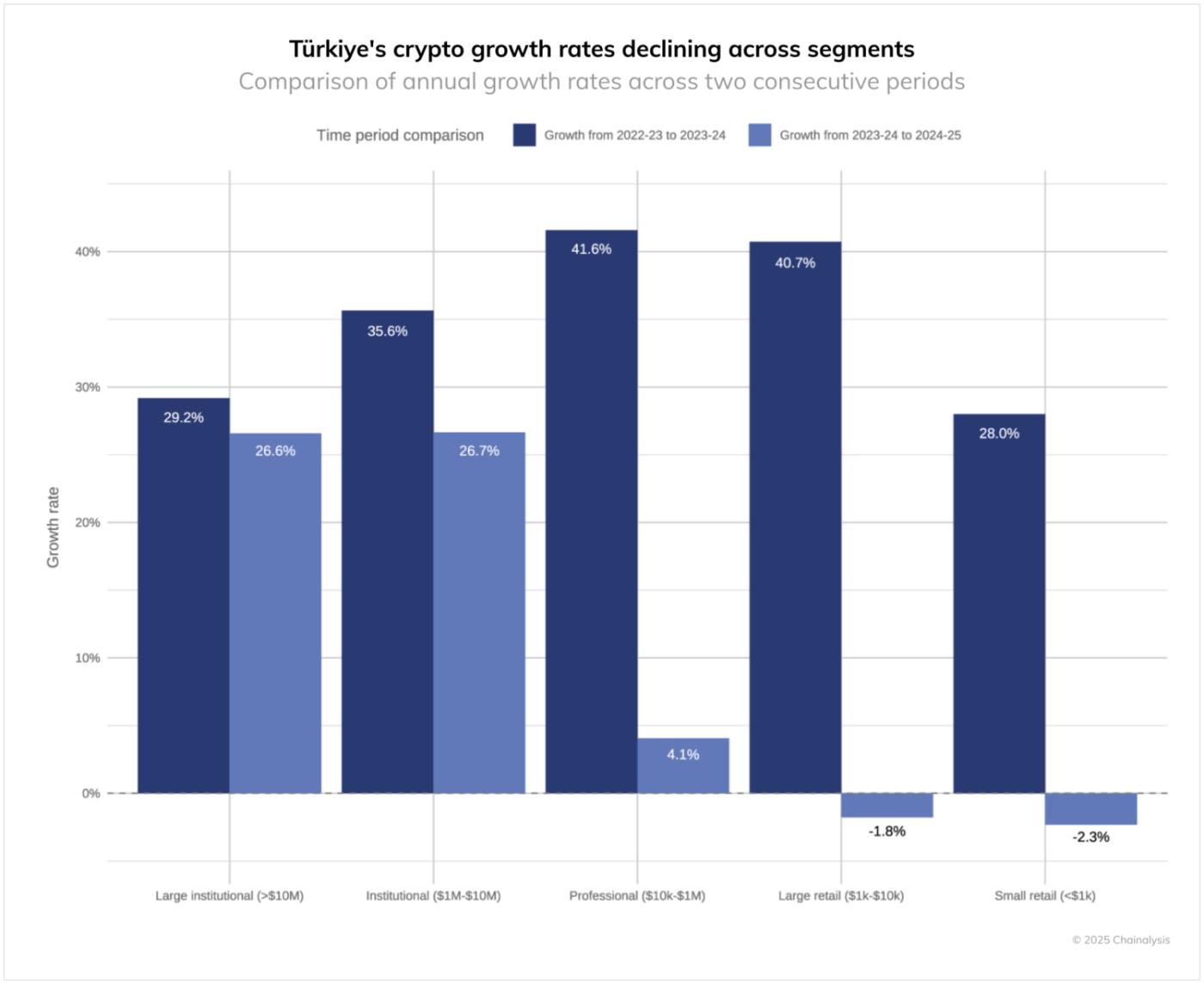

While Türkiye’s cumulative crypto volumes remain impressive, breaking down the year-over-year growth rates by transfer size reveals a broad-based deceleration across all participant categories, with retail segments experiencing a particularly significant reversal.

The contrast in growth between 2022 and 2023, and then between 2023 and 2024, is striking. The institutional bracket, which includes both large (exceeding $10 million) and mid-sized transactions ($1 million to $10 million), has seen more modest decelerations in growth. In the retail bracket, professional traders ($10,000 to $1 million) have experienced a decline from 41.6% growth to just 4.1%, a nearly 90% reduction in their growth rate. At the retail end, we have seen an even more dramatic reversal in retail participation, with large retail ($1,000 to $10,000) and small retail (under $1,000) transactions shifting from healthy positive growth to a 1.6% and 2.3% contraction, respectively.

This pattern — institutional resilience alongside retail contraction — suggests that, while Türkiye’s economic challenges drive adoption among larger players seeking inflation hedges and currency alternatives, it is perhaps reducing the capacity of everyday Turkish citizens to participate. The negative growth rates in retail segments are particularly noteworthy given continued lira depreciation and inflation pressures, which theoretically should incentivize greater crypto adoption among individuals.

This counterintuitive pattern indicates growing affordability challenges, reduced disposable income for crypto investment, or a shift in sentiment among smaller participants who have experienced losses in an increasingly speculative market. This pattern may also partially reflect the impact of Türkiye’s crypto regulatory framework introduced in 2024, which targeted illicit financial flows and sought stronger alignment with FATF standards. Enhanced KYC obligations, now rigorously enforced across domestic exchanges, along with new withdrawal controls and restrictions on margin and yield products, have likely curtailed some retail activity and reshaped trading behavior.

Speculative altcoin trading surges

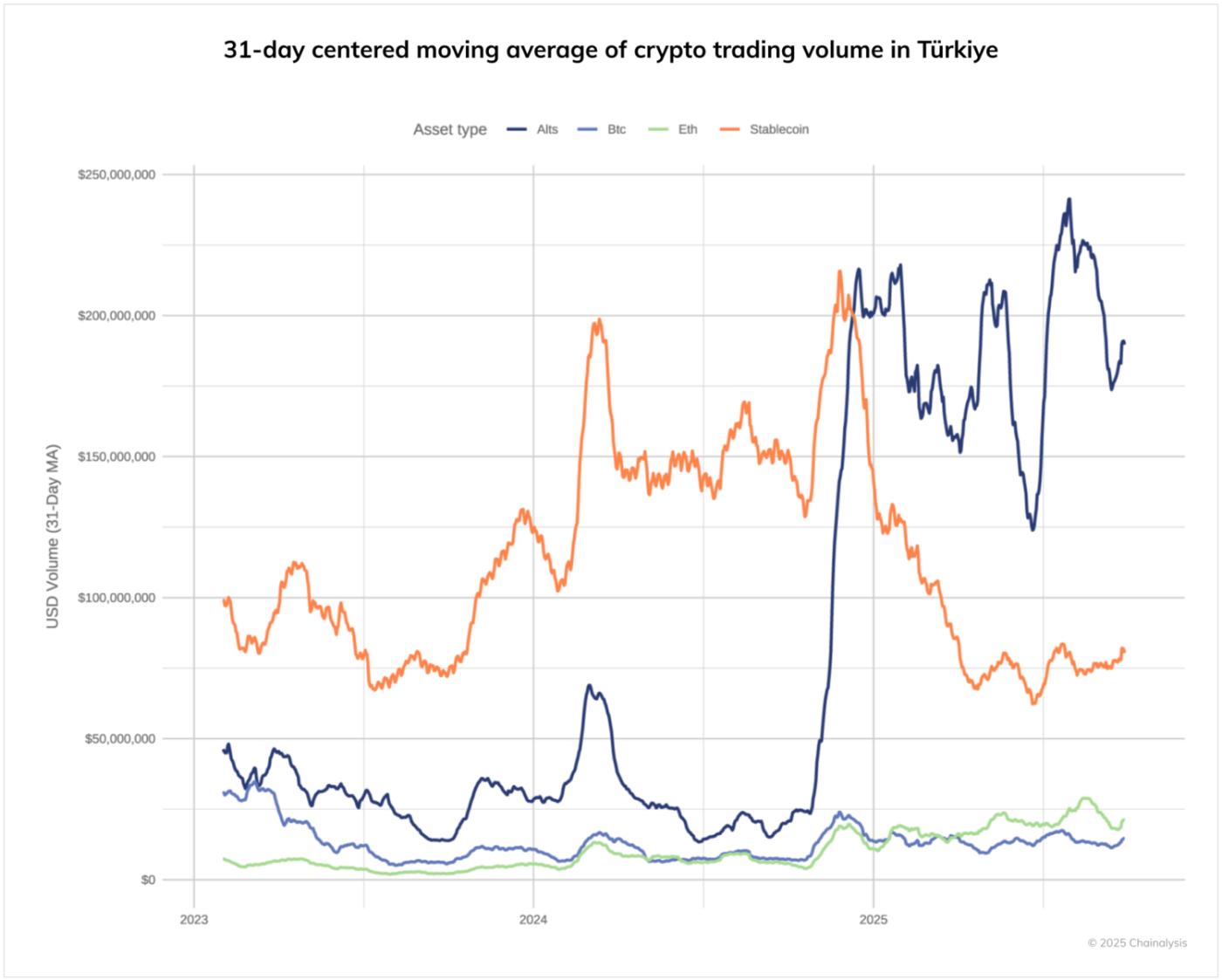

The 31-day moving average of crypto exchange trading volume in Türkiye may explain the apparent paradox in retail participation. While stablecoins (orange line) historically dominated Turkish trading volumes, late 2024 saw a surge in altcoin volumes (dark blue line) from approximately $50 million to peak above $240 million by mid-2025, more than tripling previous volume levels, and eclipsing stablecoin trading.

The timing of this altcoin surge coincides with broader regional economic pressures. It may reflect a desperate yield-seeking behavior among remaining market participants, who, faced with diminishing purchasing power and a more restrictive regulatory regime have embraced greater risk in pursuit of outsized returns. This shift toward speculation rather than preservation presents concerning implications for market stability, particularly for retail investors with limited capacity to absorb losses in increasingly volatile market segments.

Israel: Crypto as a financial refuge during a time of national crisis

Israel has exhibited steady growth in its crypto economy, with 2024 to 2025 experiencing inflows that surpassed $713 billion. However, following the October 7, 2023, attacks, it becomes clear how digital assets can function during periods of acute national crisis.

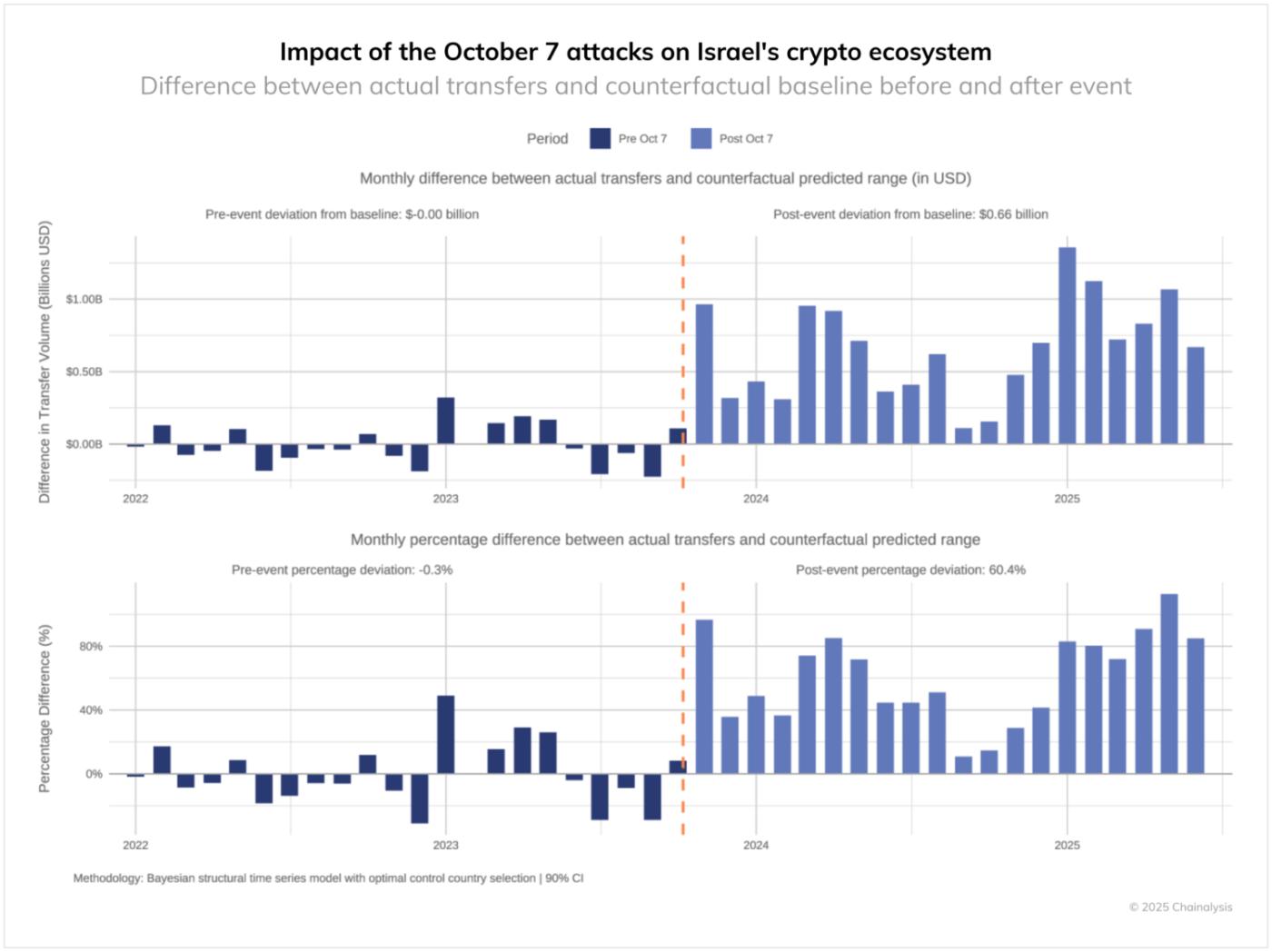

Before the attack, Israel’s crypto transaction volumes closely followed expected patterns, with minimal deviation from typical activity levels (around -0.3% on average). However, there is a distinct departure from this established trend.

The upper panel of our chart quantifies this impact in concrete terms: crypto volumes consistently exceeded expectations by an average of $0.66 billion each month following the attacks. The lower panel shows actual volumes have exceeded predicted levels by an average of 60.4% since October 7.

Instead of returning to normal after an initial crisis response, these heightened volumes have continued through 2024 and into 2025, suggesting a lasting change in financial behavior rather than a temporary trend. The evidence suggests that cryptocurrency has established itself as a significant player in Israel’s economic landscape during this period of uncertainty, serving as a safe-haven asset — a pattern we have previously observed in other crisis-stricken contexts, including Ukraine and Iran.

Retail-led adoption: Individual response to a national crisis

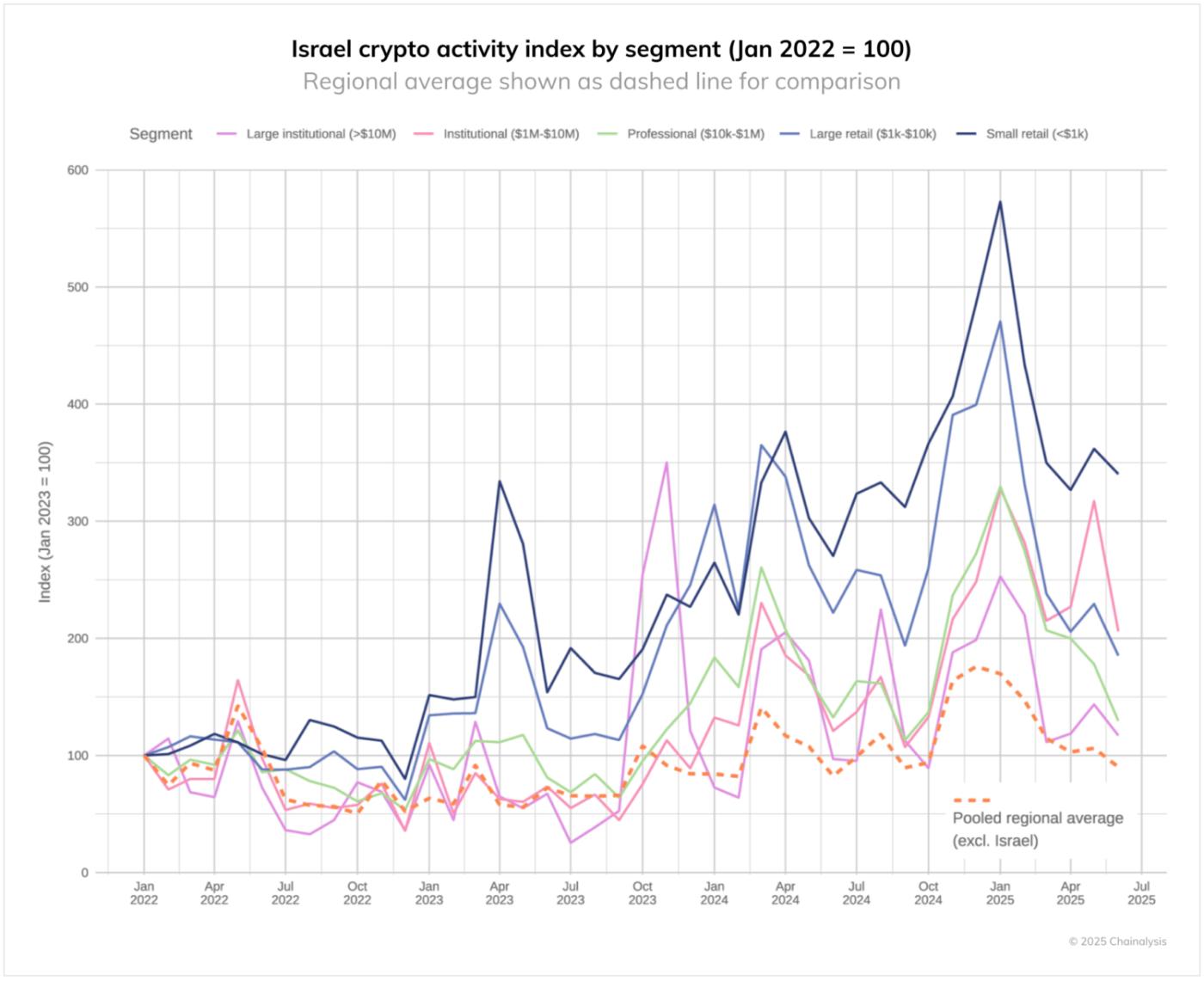

Breaking down growth in the Israeli crypto economy by transfer size provides critical insights into what is driving this change. While all segments show elevated activity compared to the regional average (represented by the dashed line), the character of activity has been different across each type.

Small (<$1,000) and large ($1,000 to $10,000) retail activity demonstrates the most pronounced reaction, with small retail activity levels peaking at nearly six times their January 2022 baseline in early 2025 and relatively more modest four to five times growth in large retail transfers. This contrasts with large institutional and professional segments, which, while elevated, show more restrained increases.

This retail-led adoption is in line with patterns observed during other regional conflicts, including Ukraine following the Russian invasion in 2022 and Iran during periods of heightened tensions in 2024. In each case, we have found that individual citizens are more likely than institutions to seek out crypto exposure.

Iran: Resilient growth amid increasing isolation

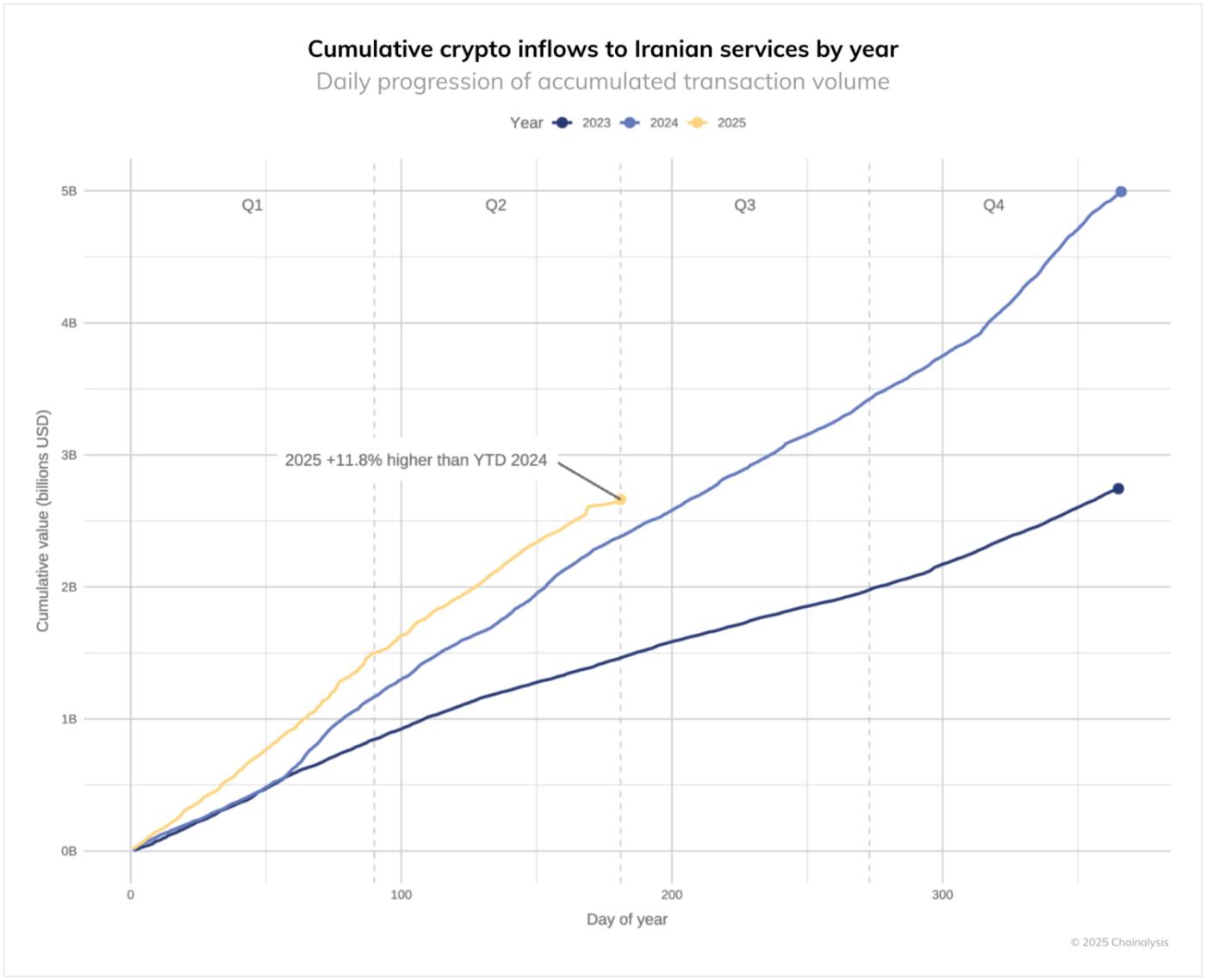

Despite sustained sanctions, domestic economic pressures, and increasing isolation from global financial networks, Iran’s cryptocurrency ecosystem has displayed persistent growth and adaptation, even as its separation from legitimate global exchanges continues to deepen. As of mid-2025, Iranian services have received 11.8% more volume than during the same period in 2024.

This resilience is notable given the challenging circumstances faced by Iranian crypto users and services. The country has been subject to intensified sanctions, regulatory uncertainties, infrastructure limitations, and a significant security breach impacting its most dominant exchange. In early 2025, Nobitex suffered a major hack resulting in losses estimated at $90 million, an event that might have derailed a less established market. Yet the cumulative volume data show minimal disruption to the overall growth trajectory, suggesting Iranian crypto users have developed a high tolerance for operational risks.

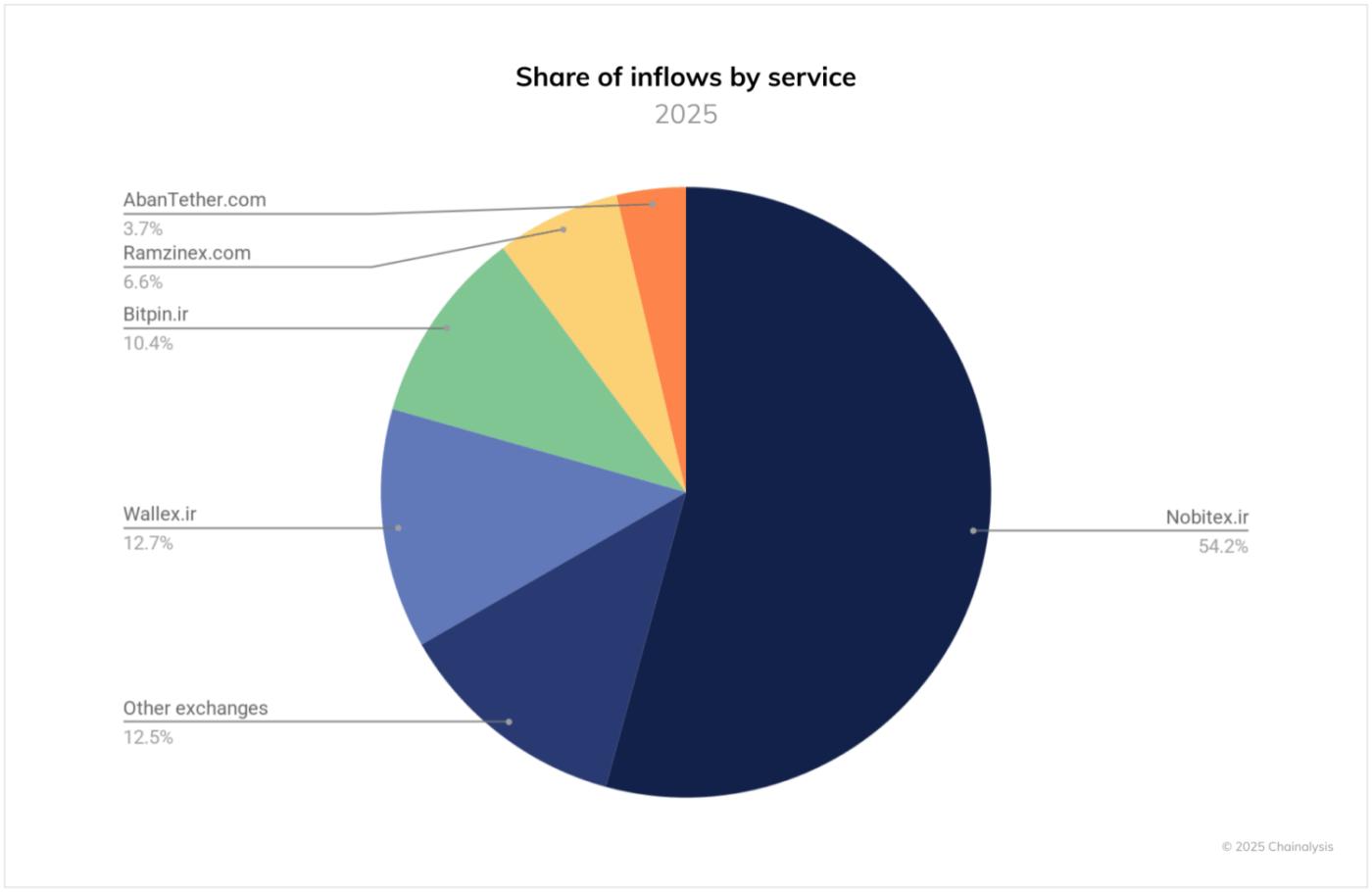

A concentrated ecosystem dominated by local exchanges

Examining the distribution of transaction volume across Iranian services reveals a highly concentrated ecosystem. Nobitex.ir maintains its commanding position despite the previously mentioned security incident, accounting for 54.2% of all inflows to Iranian services in 2025. This continued dominance reflects both the exchange’s entrenchment in the local market and limited alternatives for Iranian users.

The remainder of the market is distributed across a small number of local services, with Wallex.ir (12.7%), Bitpin.ir (10.4%), and Ramzinex.com (6.6%) comprising the next tier of significant players. Together with smaller exchanges categorized under “Other exchanges” (12.5%), these platforms form a relatively self-contained ecosystem that has developed to meet local needs while operating largely independently from global cryptocurrency infrastructure, with a robust crypto mining sector that has ebbed and flowed in 2025 during periods of acute crises.

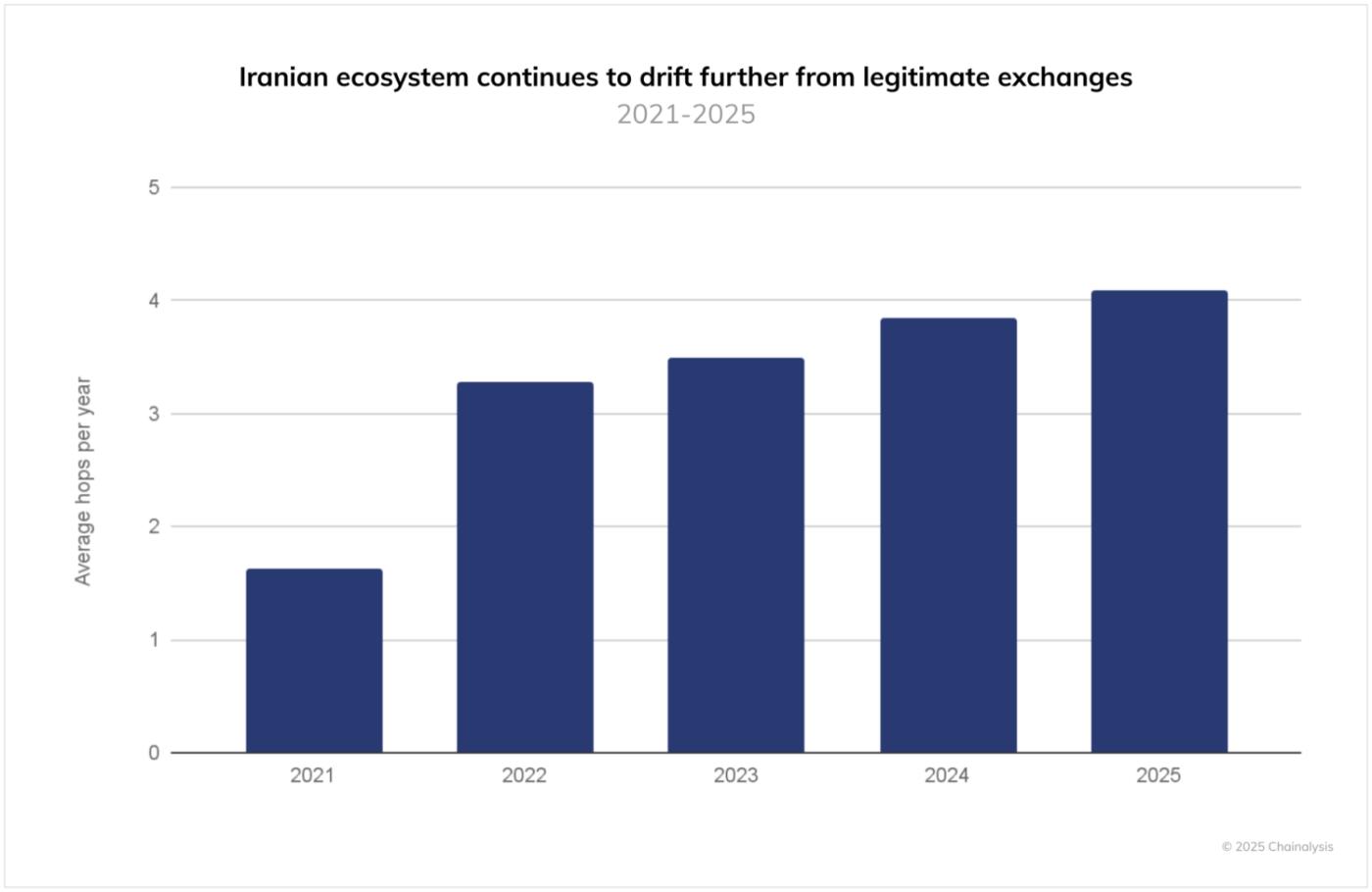

Increasing isolation from global financial system

While Iranian cryptocurrency volumes continue to grow, our analysis reveals increasing isolation from the legitimate global exchange ecosystem. The average number of transactional “hops” required for funds to move between Iranian services and compliant global exchanges has steadily increased from 1.6 in 2021 to 4.1 in 2025, a trend that accelerated notably from 2022 onward. The below data show the distance between Iran’s largest exchange and the rest of the global exchange ecosystem on BTC, ETH, and TRON.

This growing separation reflects both intensified compliance efforts by major global exchanges and the adaptive responses of Iranian users and intermediaries. As legitimate platforms have implemented more sophisticated sanctions screening and blockchain analysis tools, Iranian cryptocurrency flows have rerouted through increasingly complex pathways to maintain connectivity with the broader crypto economy.

This progressive isolation presents a dual challenge: it demonstrates the Iranian ecosystem’s ability to maintain functionality despite obstacles, while also signaling the emergence of an increasingly segregated crypto environment with diminishing connections to global liquidity pools and market infrastructure. The trend suggests that Iran’s crypto economy, while growing in volume, is simultaneously operating with increasing independence from the mainstream crypto landscape.

UAE: Calm in the storm

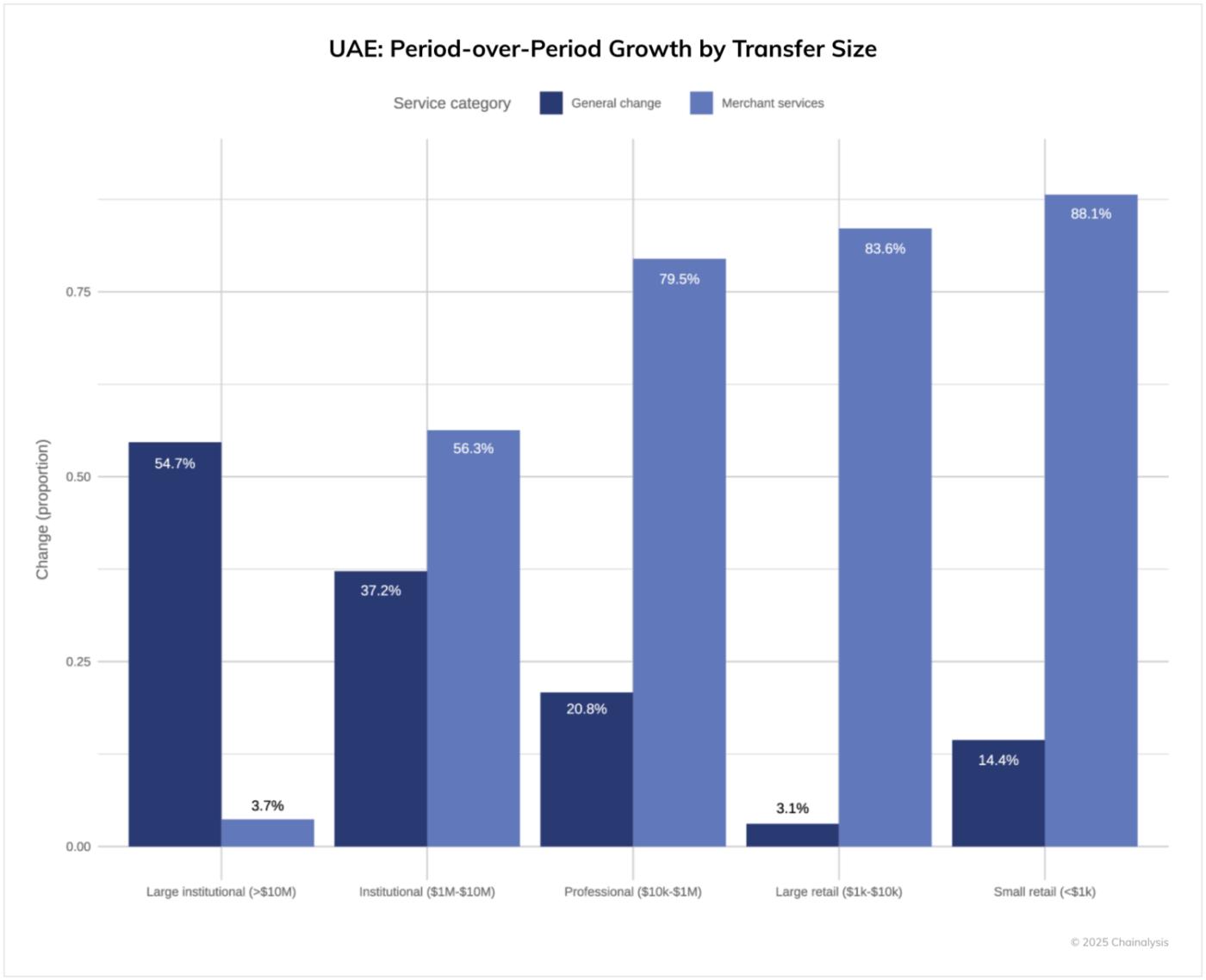

Amid wider regional stresses, the UAE has expanded its crypto economy with the implementation of sound regulation and macroeconomic policy. In the 2024 to 2025 reporting window, the UAE economy received upward of $56 billion in value, growing at 33% period-over-period. And while this rate of growth is slower than the 86.4% growth rate in the previous period-over-period cycle, it still demonstrates steady continuity in the country’s crypto economy.

Additionally, a closer examination of transfer sizes reveals a divergence between general crypto usage and merchant services adoption in the UAE. While overall growth is predominantly driven by large institutional transactions (54.7% growth) and institutional transfers (37.2% growth), merchant services show the opposite trend. The merchant services category demonstrates extraordinary growth across retail segments, with small retail (<$1,000) transactions growing by 88.1%, large retail by 83.6%, and professional transfers by 79.5%.

This countercyclical pattern suggests a fundamental shift in the UAE’s cryptocurrency ecosystem, with everyday commercial use cases gaining momentum even as general transaction growth becomes increasingly concentrated among institutional players. The robust expansion of merchant services across smaller transaction sizes indicates that crypto is transitioning from a primarily speculative or investment vehicle to a practical payment solution with real-world utility for UAE consumers and businesses.

MENA’s four main paths: Adaptation under pressure

The MENA region’s major crypto markets present four distinct narratives of adoption: Türkiye’s massive volume growth increasingly driven by speculative trading; the UAE’s emergence as a regulated crypto hub driving institutional adoption; Israel’s surge in cryptocurrency usage following a national crisis; and Iran’s resilient growth despite increasing isolation from global exchanges. These diverse cases demonstrate cryptocurrency’s remarkable adaptability, showing how digital assets can serve different roles — from speculative vehicle to crisis hedge to regulated financial innovation — depending on local conditions. As the region continues to face economic and geopolitical challenges, these adaptation patterns offer valuable insights into digital assets’ evolving role in the global financial landscape.

This website contains links to third-party sites that are not under the control of Chainalysis, Inc. or its affiliates (collectively “Chainalysis”). Access to such information does not imply association with, endorsement of, approval of, or recommendation by Chainalysis of the site or its operators, and Chainalysis is not responsible for the products, services, or other content hosted therein.

This material is for informational purposes only, and is not intended to provide legal, tax, financial, or investment advice. Recipients should consult their own advisors before making these types of decisions. Chainalysis has no responsibility or liability for any decision made or any other acts or omissions in connection with Recipient’s use of this material.

Chainalysis does not guarantee or warrant the accuracy, completeness, timeliness, suitability or validity of the information in this report and will not be responsible for any claim attributable to errors, omissions, or other inaccuracies of any part of such material.

The post MENA’s Divergent Crypto Paths: From Crisis to Innovation in 2025 appeared first on Chainalysis.