This report, authored by Tiger Research, sets a Bitcoin price target of $200,000 for Q4 2025. Despite volatility, institutional buying continues, the Federal Reserve cut interest rates, and the October selloff demonstrates that institutions now dominate the market.

Key Takeaways

Institutional buying continues despite surge in volatility - ETF net inflows remain high in Q3, and MSTR confirms long-term investment commitment with additional purchases of 388 BTC in October alone.

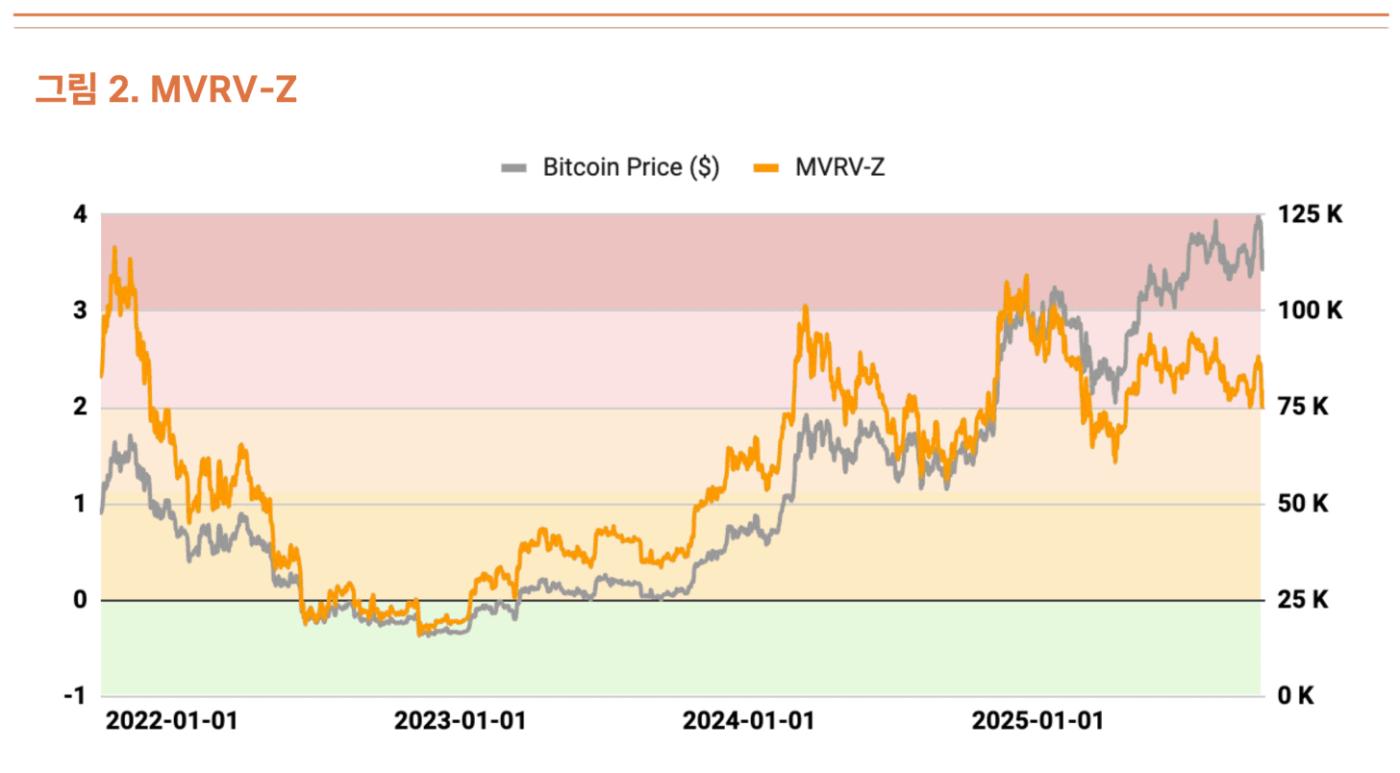

Signs of overheating but a healthy correction phase - MVRV-Z is not overvalued at 2.31, and leverage liquidation has quenched short-term trading demand, securing further upside potential.

The global liquidity environment is favorable: M2 money supply surpasses $96 trillion, reaching a historic high. The Fed cut interest rates, with one or two more cuts expected this year.

Institutional buying remains robust despite uncertainty surrounding the US-China conflict.

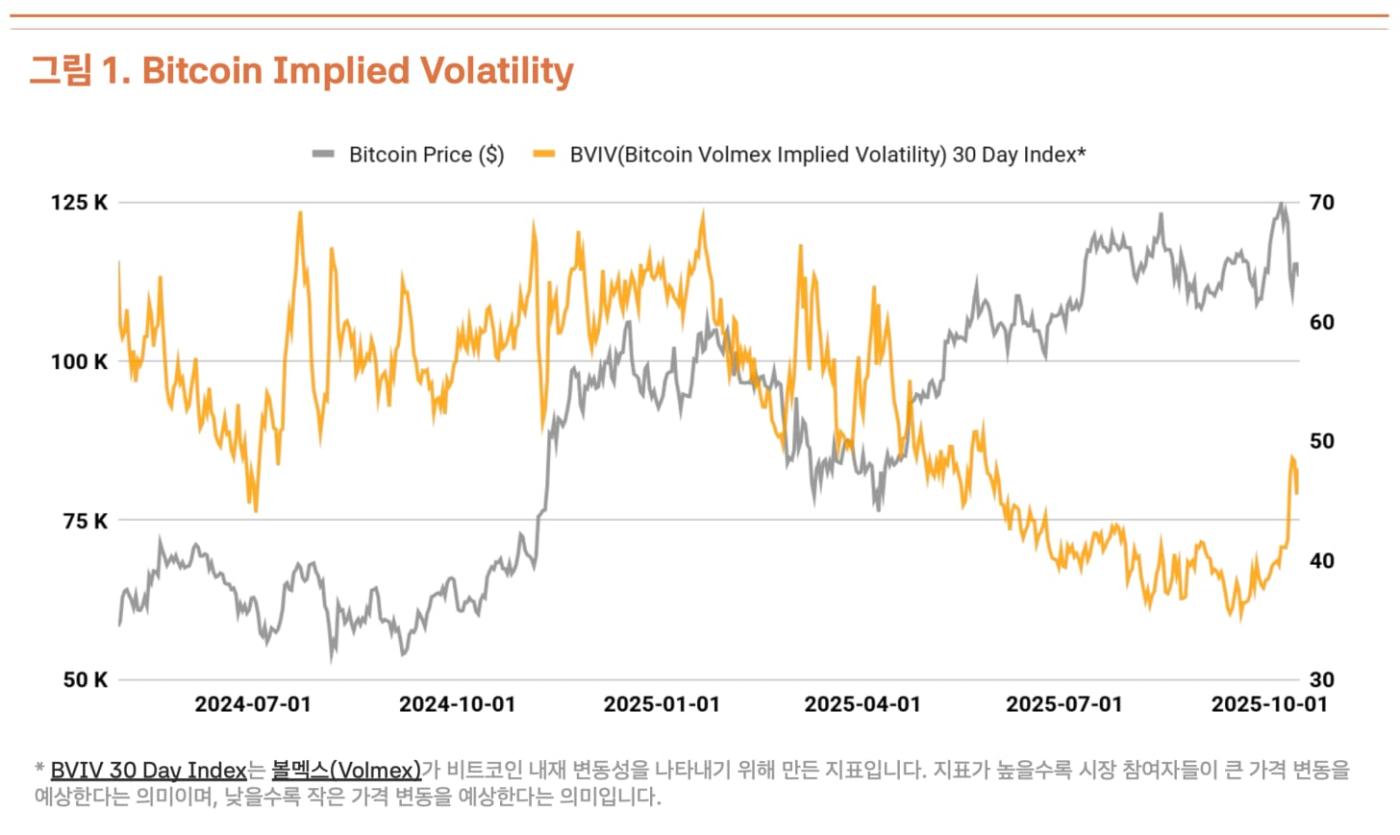

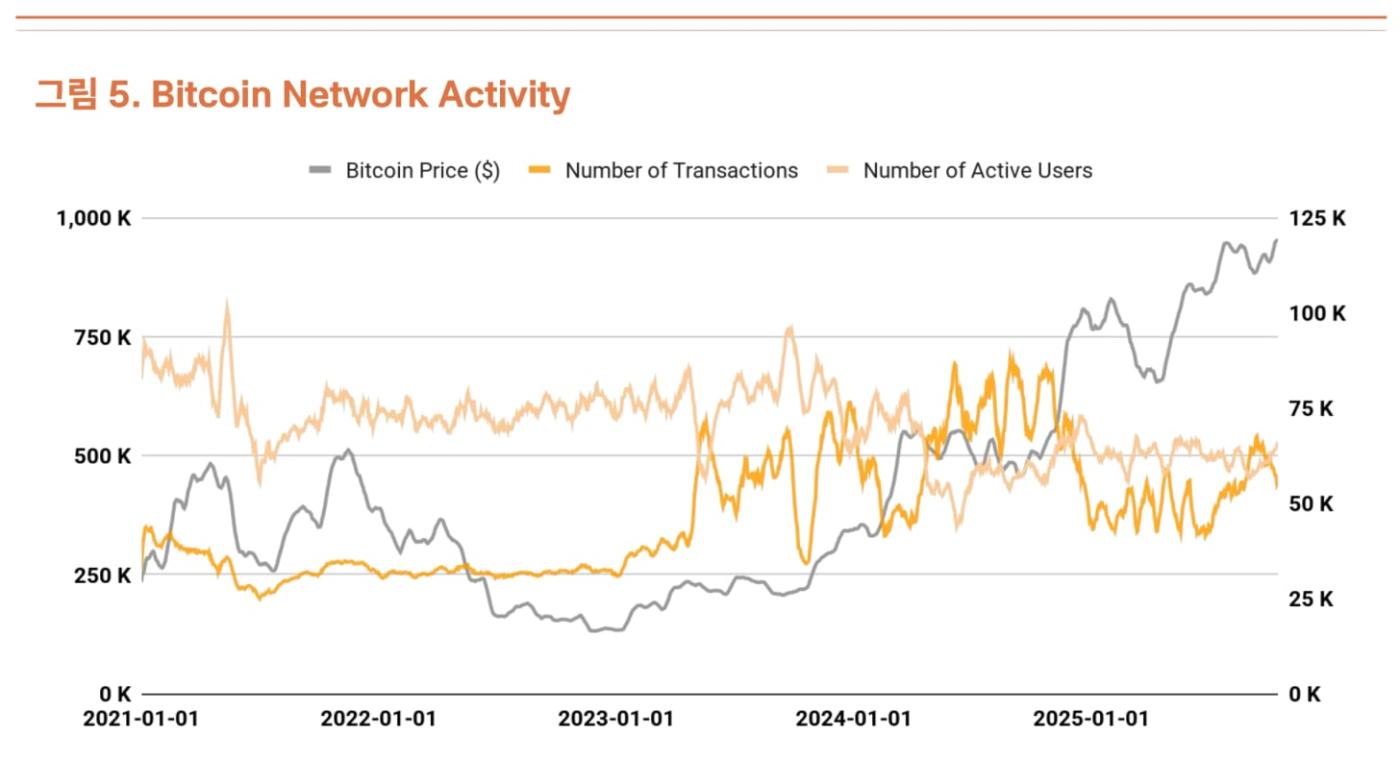

In Q3 2025, the Bitcoin market exhibited a sideways trend amid increased volatility (+1% QoQ), as the strong upward momentum of Q2 (+28% QoQ) slowed. It reached a record high of $126,210 on October 6th, but then fell 18% to $104,000 due to the Trump administration's renewed trade pressure, demonstrating strong volatility. According to Volmex Finance 's Bitcoin Volatility Index (BVIV) , volatility decreased from March to September due to continued accumulation by institutional investors. However, a 41% surge since September has exacerbated market uncertainty (Figure 1).

However, this adjustment is seen as a temporary phenomenon due to the resurgence of the US-China trade conflict and President Trump's hardline rhetoric. Strategic accumulation by institutional investors, led by Strategy Inc. (MSTR), is actually accelerating. The macroeconomic environment is also favorable. The global M2 money supply has surpassed $96 trillion, reaching a historic high. On September 17th, the Federal Reserve cut interest rates by 25 basis points, bringing the benchmark rate to a range of 4.00%-4.25%. With the Fed hinting at one or two more rate cuts this year, the combination of a stable labor market and economic recovery is creating a favorable environment for risky assets.

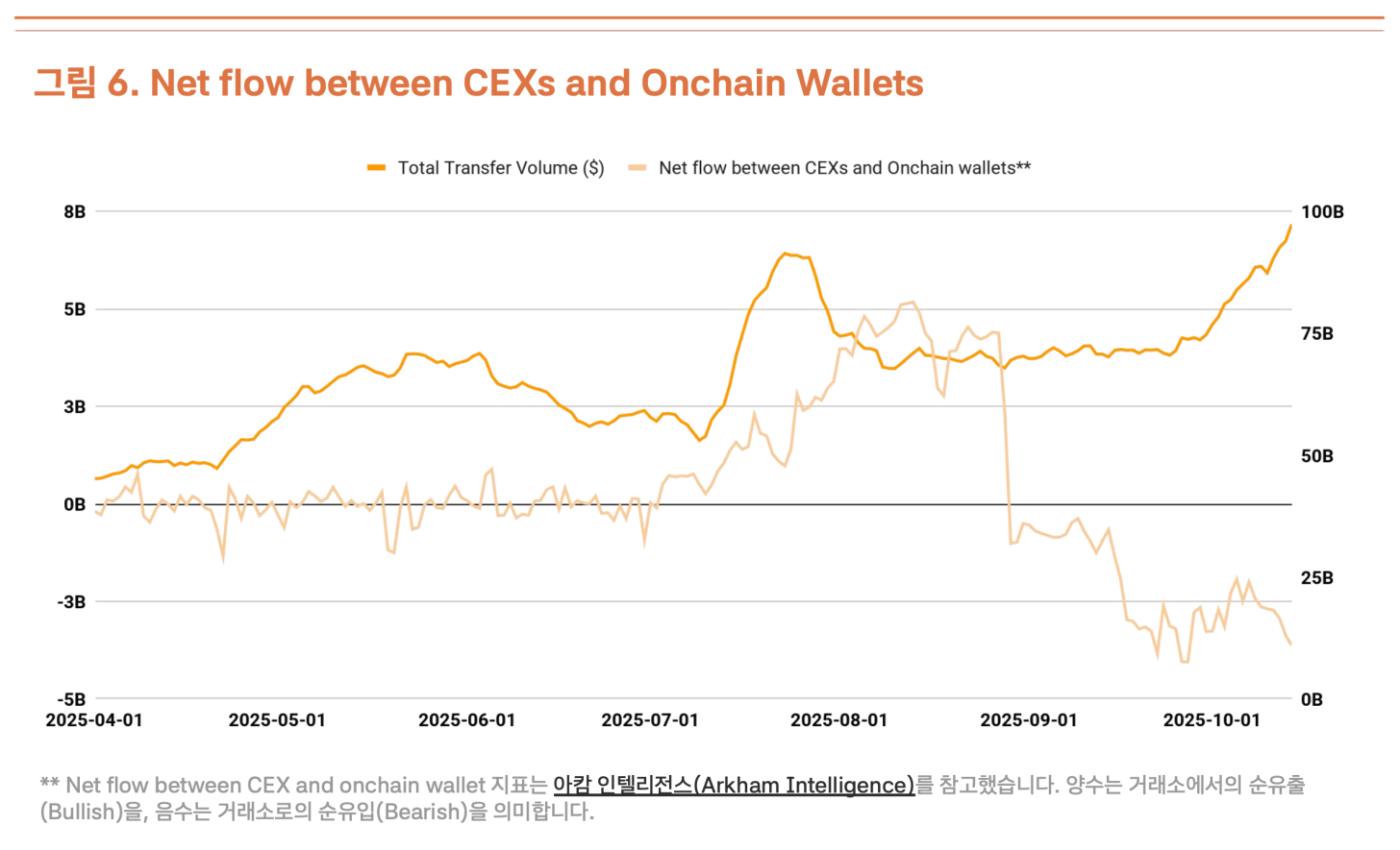

Institutional fund inflows remained robust. Bitcoin spot ETFs recorded net inflows of $7.8 billion in the third quarter. Although this was a decrease from the $12.4 billion in the second quarter, the sustained net inflow throughout the third quarter demonstrates the steady buying power of institutions. This momentum continued into the fourth quarter, with $3.2 billion inflows in the first week of October alone, the largest weekly inflow in 2025. This demonstrates the sophisticated investment behavior of institutions that utilize price corrections as strategic buying opportunities. Despite the market correction, MSTR acquired an additional 220 BTC on October 13th and 168 BTC on October 20th, for a total of 388 BTC over a one-week period. This demonstrates the unwavering commitment of institutions to long-term value, regardless of short-term volatility.

Be the first to discover insights from the Asian Web3 market, read by over 18,000 Web3 market leaders.

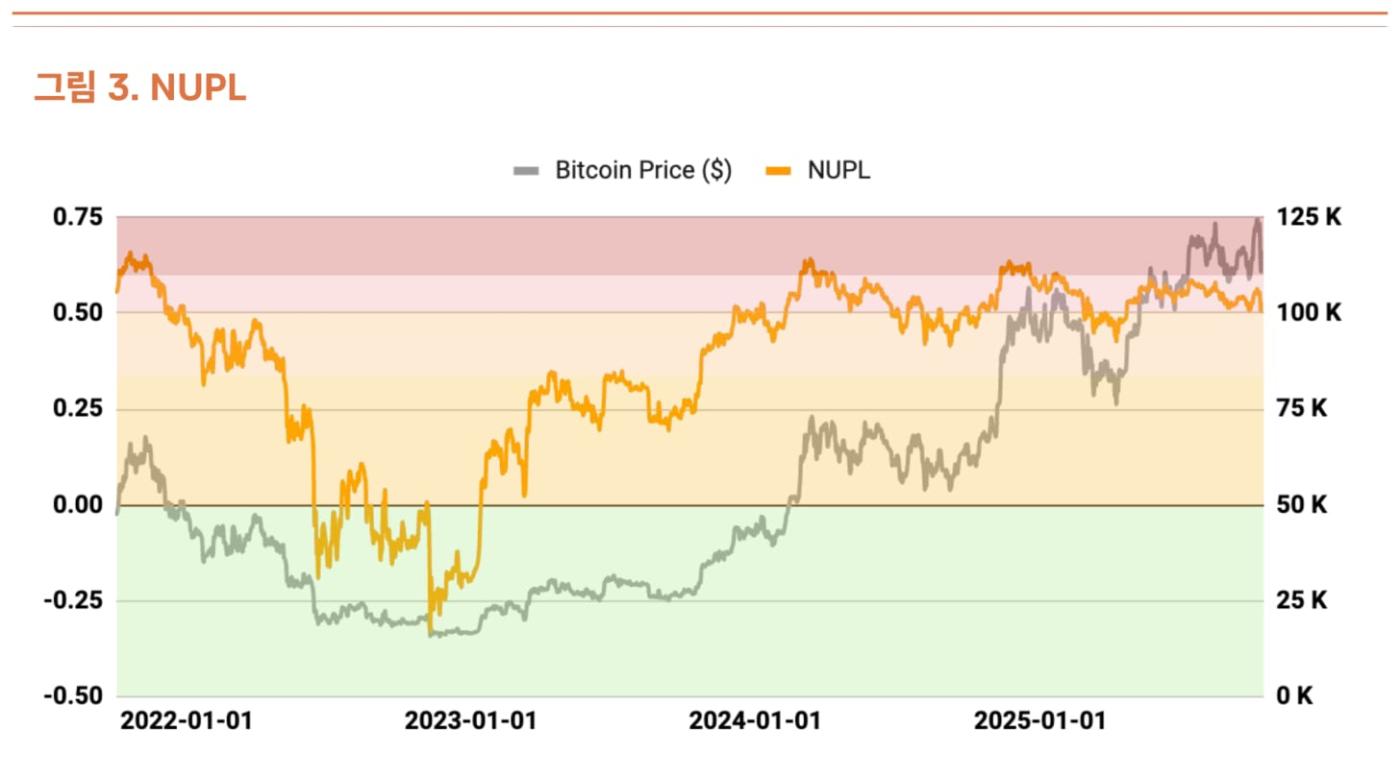

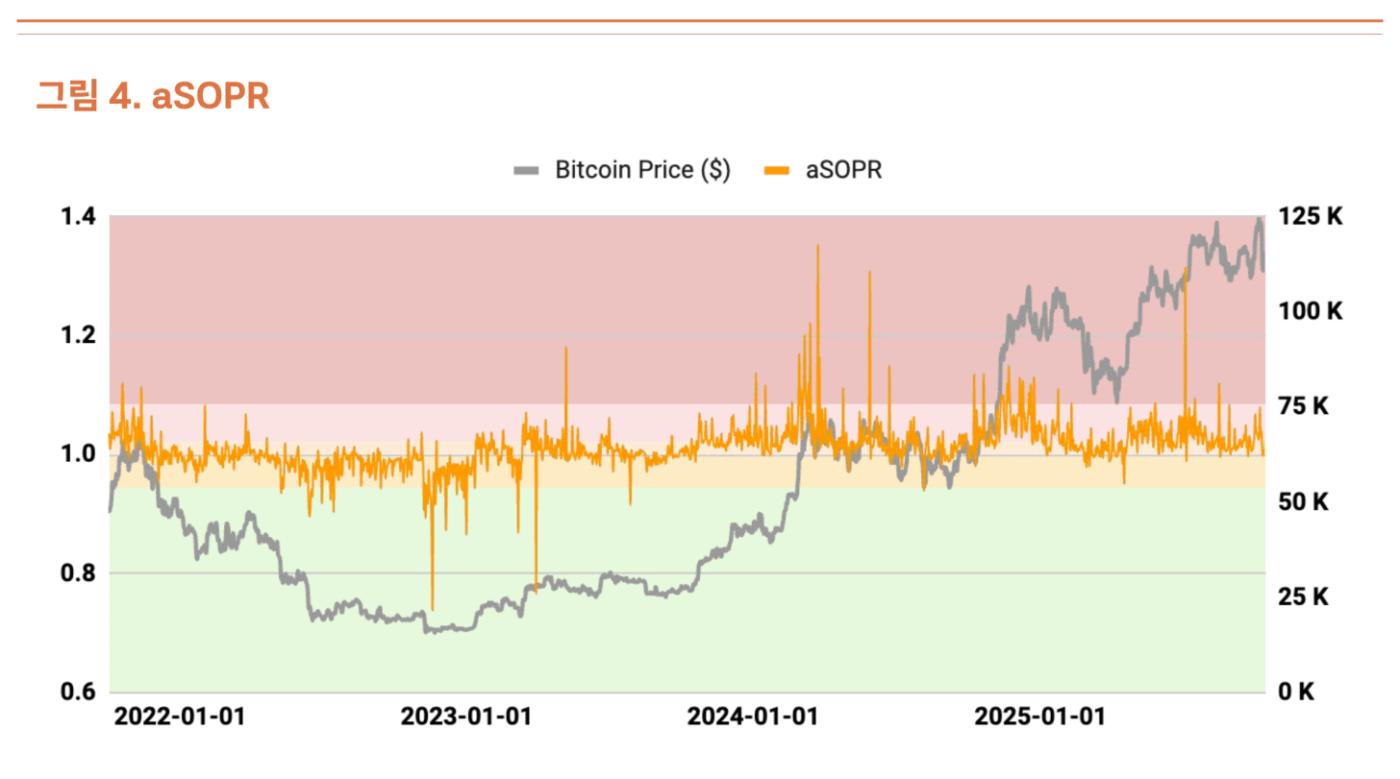

On-chain indicators show signs of overheating, while fundamentals show sideways movement.

The October 10th chain liquidation demonstrates the shift toward an institutional-centric market.

Target raised to $200,000

🐯 More from Tiger Research

이번 리서치와 관련된 더 많은 자료를 읽어보세요.Disclaimer

This Bitcoin valuation methodology (hereinafter referred to as "this methodology") was developed for research purposes and does not constitute investment advice, investment recommendations, or trading recommendations of any kind. The fair price presented in this methodology is merely the result of a theoretical analysis based on objective data, and it does not constitute a recommendation or recommendation for any investment action, including buying, selling, or holding, at any specific point in time. This methodology serves as academic research material, providing market participants with a single perspective on Bitcoin valuation, and should not be used for actual investment decision-making.

This methodology has been meticulously reviewed and developed to ensure that it does not constitute unfair trade practices, such as price manipulation or fraudulent trading, as defined in Article 10 of the Act on the Protection of Virtual Asset Users (hereinafter referred to as the "Act on the Protection of Virtual Asset Users"). All analyses utilized only publicly accessible information, such as on-chain data and officially announced macroeconomic indicators, and did not use any undisclosed material or insider information. Furthermore, we declare that the target price calculations used in this methodology were based on reasonable grounds and were prepared transparently, without any misrepresentation or intentional omission of important information.

The author and distributor comply with the obligation to disclose conflicts of interest stipulated in Article 10, Paragraph 4, Subparagraph 2 of the Virtual Asset User Protection Act in relation to this methodology. If the author holds or plans to trade the virtual asset (Bitcoin) at the time of writing or distributing this methodology, he or she will clearly disclose such conflicts of interest.

The calculation methods used in this methodology, including the base price, fundamental indicators, and macro indicators, are based on what the author believes to be reasonable methodologies. However, they are not absolute truths or the only correct answer. The Bitcoin market is extremely difficult to predict due to its extremely high volatility, 24-hour trading, global market characteristics, and regulatory uncertainty. Therefore, there may be a significant discrepancy between the valuation results presented in this methodology and the actual market price, and such discrepancies may persist for an extended period of time.

This methodology is based on historical data and current information and does not guarantee or predict future performance or profits. There is no guarantee that past patterns or correlations will continue to apply in the future, and the predictive power of this methodology may be significantly reduced or rendered meaningless by various factors, including unexpected market shocks, regulatory changes, technological issues, and macroeconomic changes. In particular, it should be noted that the cryptocurrency market has a shorter history and undergoes frequent structural changes compared to traditional financial markets, which fundamentally limits the reliability of past data and its predictive power.

All investment decisions should be made solely at the investor's own discretion and responsibility, and this methodology should not be used as the sole or primary basis for investment decisions. Investors should carefully consider their financial situation, investment objectives, risk tolerance, investment experience, and other factors when making investment decisions. They should also seek independent financial or investment advice when necessary. The author, distributor, or affiliated institutions of this methodology are not responsible for any direct, indirect, consequential, special, or punitive losses or damages resulting from investment decisions made based on this methodology.

Tiger Search Report Usage Guide

Tigersearch supports fair use in its reports. This principle allows for the broad use of content for public interest purposes, provided it does not affect commercial value. Under fair use rules, reports may be used without prior permission. However, when citing Tigersearch reports, 1) "Tigersearch" must be clearly cited as the source, and 2) the Tigersearch logo must be included. Reproducing and publishing materials requires separate agreement. Unauthorized use may result in legal action.